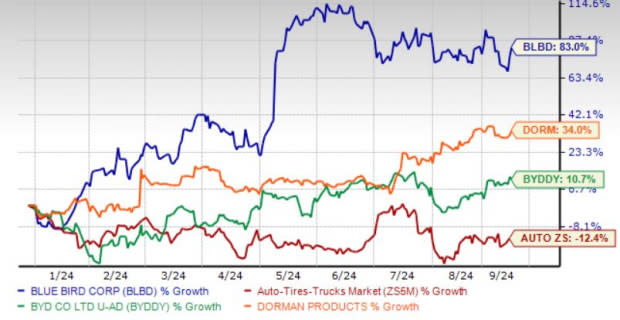

Wall Street is optimistic about a few auto stocks like Blue Bird Corp BLBD, BYD Co Ltd BYDDY and Dorman Products DORM that you may wish to pay attention to. These stocks have garnered favor from brokers and have an attractive average broker recommendation (“ABR”) on a scale of 1 to 5 (Strong Buy to Strong Sell).

Each of these stocks has witnessed growth on the bourses on a year-to-date basis, handily outperforming the broader Zacks auto sector. Let’s see if these stocks are still worth buying at current levels.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

Blue Bird

BLBD is a school bus manufacturer that’s been in business for roughly 100 years. The company has pushed forward into new areas of automotive technology, including alternative fuel and electric vehicle (EV) buses. It is benefiting from the U.S. government’s push to transition more public schools to EV buses and other non-fossil fuel offerings.With roughly 90% of U.S. school buses still diesel-powered, Blue Bird is well-positioned to capitalize on this vast market opportunity.The company exited the last reported quarter with a 5,200-unit backlog, helping it raise its earnings outlook significantly.

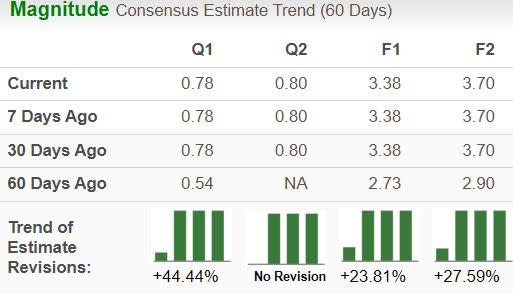

The Zacks Consensus Estimate for Blue Bird’s fiscal 2024 and 2025 sales implies year-over-year growth of 18% and 12%, respectively. The consensus mark for fiscal 2024 and 2025 EPS implies year-over-year growth of 216% and 10%, respectively. BLBD has been witnessing northbound estimate revisions for fiscal 2024 and 2025 over the past 60 days.

Image Source: Zacks Investment Research

Six of the seven brokers covering BLBD stock have Strong Buy recommendations, giving the company an attractive ABR of 1.14.

Image Source: Zacks Investment Research

It’s also noteworthy that the Zacks average target price of $58 a share suggests a 17.55% upside for BLBD stock from current levels. The stock sports a Zacks Rank #1 (Strong Buy) and has a VGM Score of B.

BYDDY

China-based BYD is a prominent electric vehicle (EV) company. With a vertically integrated structure encompassing mines, battery production and chip manufacturing, BYD holds a competitive edge.BYD’s diverse electric vehicle lineup, including models like Seagull, Denza, and Yangwang, has garnered global acclaim. The company is leveraging new technology to produce more affordable and efficient models. In May, BYD launched its DM 5.0 hybrid system, cutting costs and boosting fuel efficiency in new models. Earlier this year, it introduced the e-Platform 3.0, enhancing EV efficiency and charging.

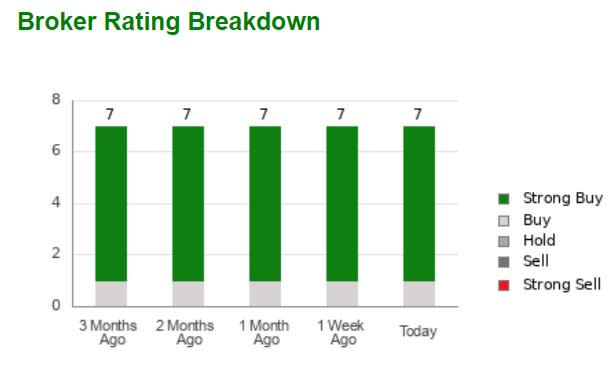

The Zacks Consensus Estimate for BYDDY’s 2024 and 2025 sales implies year-over-year growth of 22% and 21%, respectively. The consensus mark for 2024 and 2025 EPS implies year-over-year growth of 17% and 24%, respectively. BYDDY has witnessed northbound estimate revisions for 2024 and 2025 over the past 60 days.

Image Source: Zacks Investment Research

Of the six brokers covering BYDDY stock, all have Strong Buy rating, with the ABR being 1.

Image Source: Zacks Investment Research

The Zacks average price target of $73 is still 19.32% above the current levels. The stock sports a Zacks Rank #1 and a VGM Score of A.

Dorman Products

The company is a key player in the motor vehicle aftermarket industry, focusing on replacement and upgrade parts. The company is capitalizing on the increasing age of vehicles, boosting the demand for its products. The acquisition of Super ATV has significantly buoyed DORM’s overall prospects. Dorman Products’ dedication to regular product launches and ongoing innovation fuels its sustained growth. With a strong balance sheet, a manageable debt-to-capitalization ratio of 31% (compared to the industry average of 40%) and ample liquidity, DORM is well-poised for success. Investor-friendly moves via share buybacks further instill confidence.

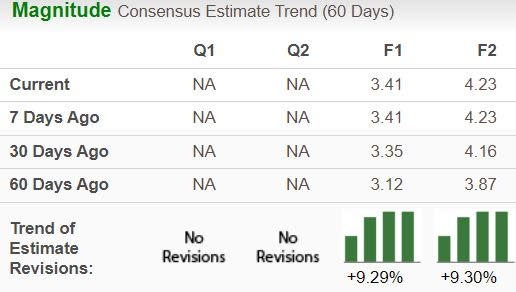

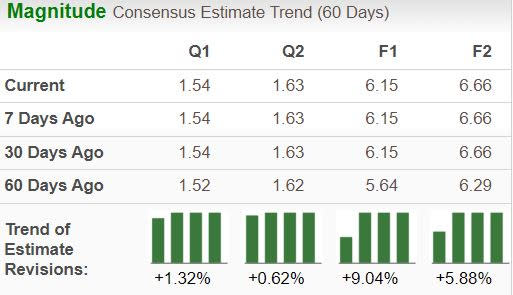

The Zacks Consensus Estimate for DORM’s 2024 and 2025 sales implies year-over-year growth of 4% each. The consensus mark for 2024 and 2025 EPS implies year-over-year growth of 35% and 8%, respectively. Dorman Products has witnessed northbound estimate revisions over the past 60 days.

Image Source: Zacks Investment Research

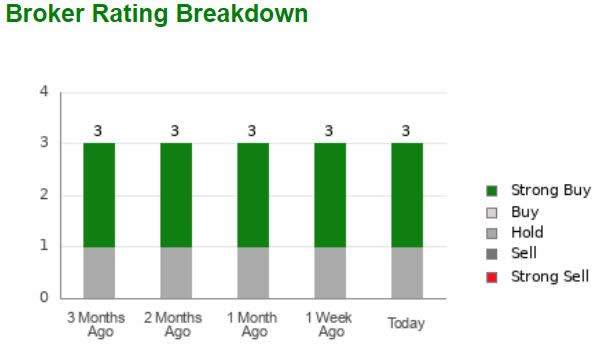

Of the three brokers covering DORM stock, two have a Strong Buy rating, with the ABR being 1.67.

Image Source: Zacks Investment Research

Over the trailing four quarters, Dorman Products has surpassed earnings estimates thrice while missing on the other. The stock sports a Zacks Rank #1 and has a VGM Score of A.

Last Word

Given their robust financial outlook and strong broker endorsements, BYDDY, BLBD, and DORM present compelling investment opportunities. Each company has leveraged innovation and market positioning to achieve growth. It’s no surprise that brokers are bullish on these companies, aligning with the Zacks Rank in considering them top-rated stocks for investors right now.

You can see the complete list of today’s Zacks #1 Rank stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dorman Products, Inc. (DORM) : Free Stock Analysis Report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report