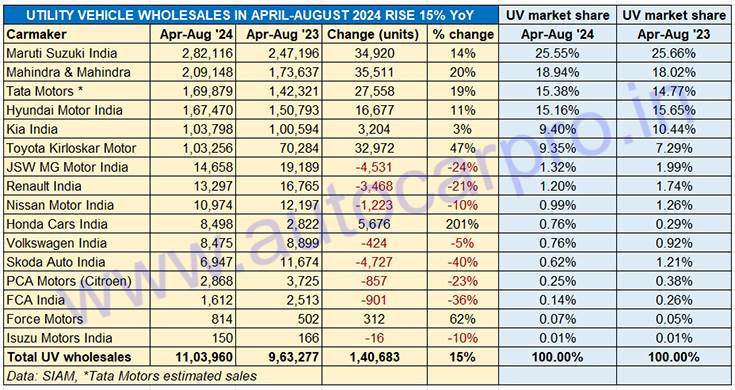

The utility vehicle (UV) segment, with sustained double-digit growth, continues to act as a buffer for declining hatchback and sedan sales. At 1.10 million units, wholesales or OEM vehicle dispatches to showrooms in the April-August 2024 period were up 15% year on year (April-August 2023: 963,277 units). UV dispatches account for 63% of overall passenger vehicle sales of 17,39,044 units in the first five months of FY2025 compared to 57% in April-August 2023.

Of FY2024’s record 4.21 million passenger vehicle sales (up 8.4% YoY), the UV segment had accounted for a 60% share (25,20,691 units, up 26% YoY). After the first five months of FY2025, UV wholesales are already 44% of their FY2024 total. The total would likely have been higher but for the fact that OEM dispatches to showrooms across the country have been lower in July and August as a result of dealer inventories hitting new highs and manufacturers optimising the same.

The top six UV manufacturers, each with six-figure wholesales, together account for 10,35,667 units (up 17% YoY) or an overwhelming 94% of total UV dispatches in the past five months, leaving the balance to the 10 other OEMs. Let’s take a closer look at each of these top six manufacturers.

MARUTI SUZUKI INDIA: 282,116 units, up 14% YoY

April-August ’24 market share: 25.55% vs 25.66% a year ago

Brezza, Ertiga and Fronx sales up. Grand Vitara, XL6, Jimny and Invicto see YoY decline

Passenger vehicle and also UV market leader Maruti Suzuki dispatched 282,116 units between April and August 2024, up 14 percent. Of its seven products in the fray, four products have seen a YoY sales decline. The three UVs in positive territory are the Brezza compact SUV, which remains Maruti Suzuki’s best seller with 78,337 units (up 17%), followed by the Ertiga MPV (77,620 units, up 52%), and the Fronx (59,967 units, up 15%).

Passenger vehicle and also UV market leader Maruti Suzuki dispatched 282,116 units between April and August 2024, up 14 percent. Of its seven products in the fray, four products have seen a YoY sales decline. The three UVs in positive territory are the Brezza compact SUV, which remains Maruti Suzuki’s best seller with 78,337 units (up 17%), followed by the Ertiga MPV (77,620 units, up 52%), and the Fronx (59,967 units, up 15%).

Dispatches for the Grand Vitara midsize SUV at 45,484 units are down 5% as are for the XL6 (15,736 units, down 11%). Jimny wholesales are down sharply by 59% YoY to 4,033 units and the rebadged Invicto premium MPV too is down – by 39% YoY – to 939 units. This performance has meant that the company’s UV market share has remained stagnant at 25.63% versus 25.66% in April-August 2023.

MAHINDRA & MAHINDRA: 209,148 units, up 20% YoY

April-August ’24 market share: 19% vs 18% a year ago

Scorpio remains the best-selling Mahindra SUV, 3XO compact SUV takes second position

Mahindra & Mahindra, which has the largest SUV portfolio in India, is also the OEM with the largest additional volumes over the past five months. The company dispatched 209,148 SUVs, which is 35,211 units more than it did in the year-ago period and 591 units more than Maruti Suzuki. This gives it a UV market share of 19% compared to 18% a year ago.

Mahindra & Mahindra, which has the largest SUV portfolio in India, is also the OEM with the largest additional volumes over the past five months. The company dispatched 209,148 SUVs, which is 35,211 units more than it did in the year-ago period and 591 units more than Maruti Suzuki. This gives it a UV market share of 19% compared to 18% a year ago.

The Scorpio N and Classic are the ones with the highest volume – 66,855 units, up 39% YoY. The No. 2 best-seller is the XUV300/3XO with 41,501 units, up by a strong 67% YoY. The hardy Bolero, with 38,352 units, is next but sales are down 13% YoY. The XUV700 flagship, which currently has a special offer going to accelerate sales, saw 33,846 units sold for a 21% YoY increase. The Thar, which is now also available as a five-door (Thar Roxx) clocked sales of 25,939 units, up 5%. Estimated dispatches of the all-electric XUV400 at 2,584 units are down 33% on year-ago sales of 3,871 units.

TATA MOTORS: 169,879 units, up 19% YoY

April-Aug ’24 market share: 15.38% vs 14.77% a year ago

Punch pumps up the volume, Nexon wholesales decline 4%, Curvv checks in with 3,455 units

Tata Motors, which dispatched an estimated 169,879 SUVs in April-August 2024, (up 19% YoY), has gone ahead of Hyundai Motor India by 2,409 units. With an estimated 60,882 units, the Nexon’s wholesales are down 4% YoY. Its sibling, the Punch compact SUV though continues the rich vein of growth it has exhibited since the past year. The Punch, with 88,109 units, has clocked 48% growth. The Safari sold 8,832 units (up 8%) and the Harrier 8,601 units (down 21%). And the Curvv coupe-SUV has sold 3,455 units in its first month of sale.

Tata Motors, which dispatched an estimated 169,879 SUVs in April-August 2024, (up 19% YoY), has gone ahead of Hyundai Motor India by 2,409 units. With an estimated 60,882 units, the Nexon’s wholesales are down 4% YoY. Its sibling, the Punch compact SUV though continues the rich vein of growth it has exhibited since the past year. The Punch, with 88,109 units, has clocked 48% growth. The Safari sold 8,832 units (up 8%) and the Harrier 8,601 units (down 21%). And the Curvv coupe-SUV has sold 3,455 units in its first month of sale.

HYUNDAI MOTOR INDIA: 167,470 units, up 11% YoY

April-August ’24 market share: 15.16% vs 15.65% a year ago

Hyundai just 1,046 SUVS ahead of Tata Motors, Creta and Exter sole models to see YoY growth

Hyundai Motor India holds onto its No. 3 UV maker position by a slender margin of 1,046 units, ahead of Tata Motors. The Korean automaker dispatched 167,470 units in April-August 2024, an increase of 11% over year-ago figures. Of the six SUVs in the fray, only two have seen YoY growth – the Creta midsize SUV and the Exter compact SUV.

Hyundai Motor India holds onto its No. 3 UV maker position by a slender margin of 1,046 units, ahead of Tata Motors. The Korean automaker dispatched 167,470 units in April-August 2024, an increase of 11% over year-ago figures. Of the six SUVs in the fray, only two have seen YoY growth – the Creta midsize SUV and the Exter compact SUV.

The Creta, which is India’s best-selling midsize SUV, saw dispatches of 80,514 units, up 13%, with strong momentum coming from the launch of the MY2024 model in January this year. The Exter, launched in July 2023, continues to see demand – the 35,030 units are up 143% YoY (July-August 2023: 14,430 units) given that it was launched only in July 2024.

All the other three models see YoY declines – the Venue compact SUV (46,262 units, down 13%), Alcazar (4,735 units, down 50%), Tucson (737 units, down 63%) and the all-electric Ioniq).

KIA INDIA: 103,798 units, up 3% YoY

April-Aug ’24 market share: 9.40% vs 10.44% a year ago

Sonet compact SUV holds the fort for Kia, continues to outsell Seltos

Kia India, with 103,798 units, has sold 3,204 additional UVs in the past five months compared to April-August 2023’s 100,594 units. The Sonet compact SUV, which has outsold the Seltos midsize SUV every month right since January 2024, is the No. 1 seller for the company with 44,682 units, up 31% YoY, and a 43% share of Kia UV sales. All the other three models have posted YoY declines – the Seltos (31,659 units, down 10%), Carens MPV (27,358 units, down 11%) and the EV6 (99 units, down 71%).

Kia India, with 103,798 units, has sold 3,204 additional UVs in the past five months compared to April-August 2023’s 100,594 units. The Sonet compact SUV, which has outsold the Seltos midsize SUV every month right since January 2024, is the No. 1 seller for the company with 44,682 units, up 31% YoY, and a 43% share of Kia UV sales. All the other three models have posted YoY declines – the Seltos (31,659 units, down 10%), Carens MPV (27,358 units, down 11%) and the EV6 (99 units, down 71%).

TOYOTA KIRLOSKAR MOTOR: 103,256 units, up 47% YoY

April-Aug ’24 market share: 9.35% vs 7.29% a year ago

Combined sales of Hyryder, Taisor and Rumion at 44,931 units more than Innova’s 44,662 units

Just 542 UVs behind Kia is a hard-charging Toyota Kirloskar Motor (TKM) with 103,256 units, which constitute handsome 47% YoY growth (April-August 2023: 70,284 units). The company, which is firing on all cylinders, is benefiting strongly from its Maruti-rebadged models like the Urban Cruiser Hyryder midsize SUV, the Rumion MPV and the recently launched Urban Cruiser Taisor compact SUV.

Just 542 UVs behind Kia is a hard-charging Toyota Kirloskar Motor (TKM) with 103,256 units, which constitute handsome 47% YoY growth (April-August 2023: 70,284 units). The company, which is firing on all cylinders, is benefiting strongly from its Maruti-rebadged models like the Urban Cruiser Hyryder midsize SUV, the Rumion MPV and the recently launched Urban Cruiser Taisor compact SUV.

The top Toyota model is the popular Innova Crysta and Hycross – the 44,662 units are up 16% YoY and account for 43% of TKM’s UV sales in the April-August 2024 period. The Hyryder, with 25,386 units (up 58%) is next with a 24% share, followed by the Taisor (11,218 units, 11% share) and the Rumion MPV (8,327 units, 8%). The three rebadged models together – at 44,931 units – account for 43.51% of TKM’s dispatches in the first five months of the year.

Meanwhile, combined sales of the Fortuner midsize SUV, Hilux pickup and the Vellfire luxury MPV at 13,663 units were down 12% YoY.

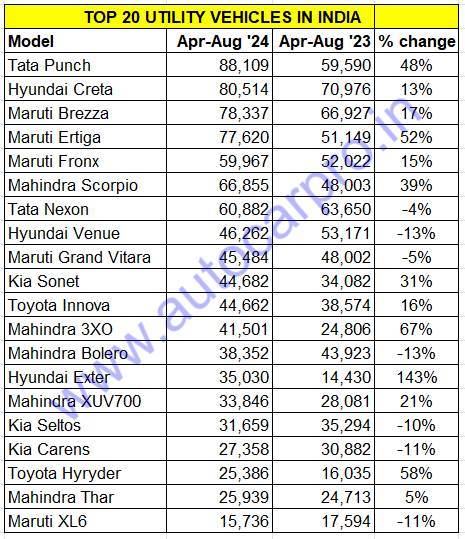

REVEALED: INDIA’S TOP 20 UTILITY VEHICLES

There are an estimated over 100 SUV and MPV models and over 800 variants in the highly competitive and value-conscious Indian market. Which is why achieving market-leading status is a big thing and these Top 20 UVs exemplify just that. In the April-August 2024 period, they cumulatively account for 968,181 units or 88% of the total 1.1 million UVs sold.

The segment-wise model split reveals that both compact SUVs and midsize SUVs have eight models each in the Top 10 listing. The compact SUV lot is led by the Tata Punch, which is currently India’s best-selling SUV. It is followed by the Maruti Brezza and Fronx, Tata Nexon, Hyundai Venue, Kia Sonet, Mahindra 3XO and Hyundai Exter.

The midsize SUVs are led by the Hyundai Creta, which is followed by the Mahindra Scorpio, Maruti Grand Vitara, Mahindra Bolero and XUV700, Kia Seltos, Toyota Hyryder, and the Mahindra Thar.

Four MPVs wrap up the Top 20, led by the Toyota Innova Crysta / Hycross, Maruti Ertiga, Kia Carens and Maruti XL6.