Since the launch of the Faster Adoption and Manufacturing of Electric and Hybrid Vehicles (FAME) subsidies in April 2015, about 3.9 million EVs have been sold in India; 70% of those in just the past two years. Subsidies under Electric Mobility Promotion Scheme (EMPS) 2024, which ends in September, are lower than in FAME II. And yet sales for FY25 till July have so far consistently outpaced sales for FY24. This suggests vehicle electrification is becoming self-sustaining in India.

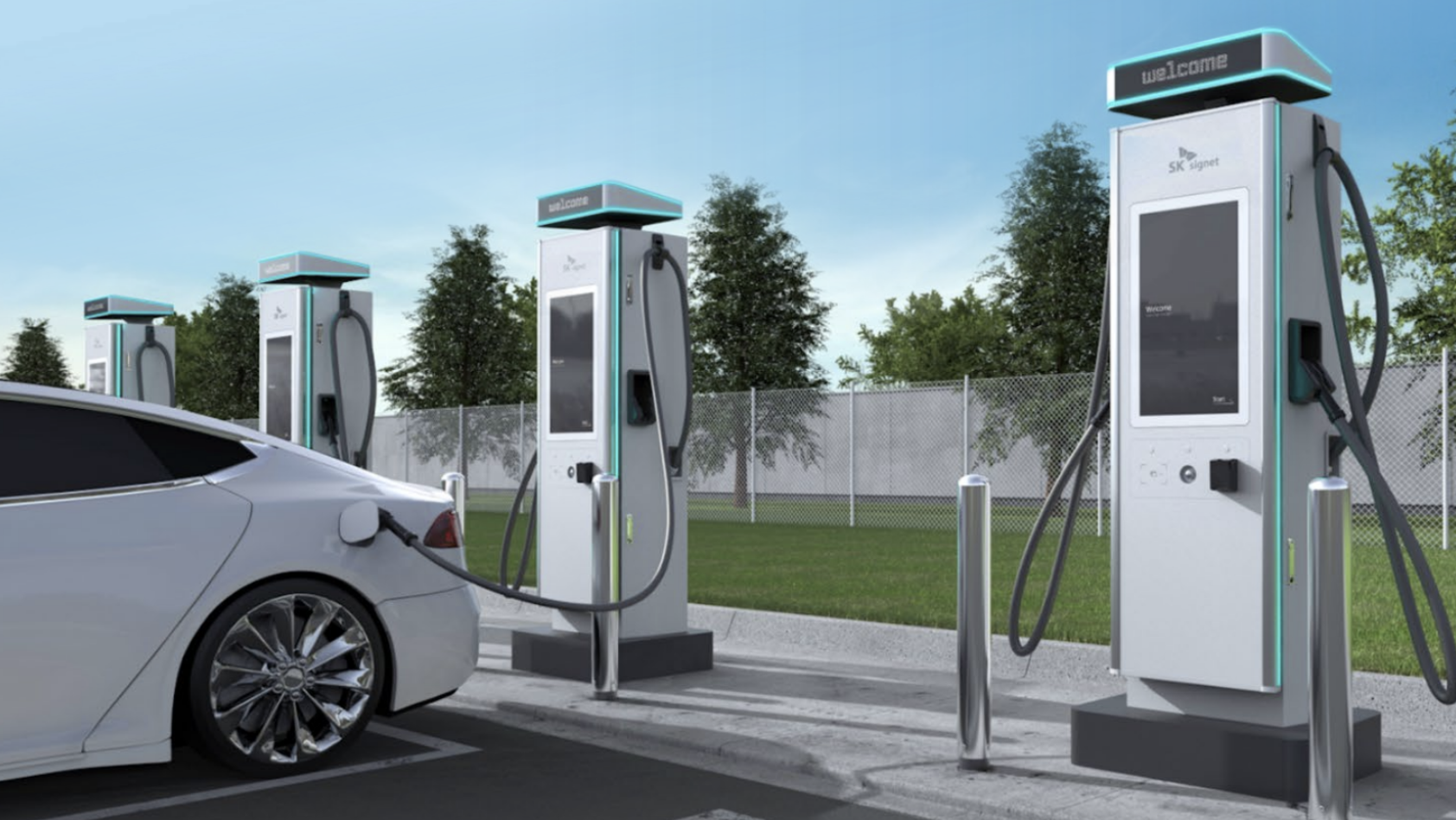

The PM E-Drive Scheme, which offers INR 10,900 crore subsidy over two years, focuses on charging infrastructure and promoting EVs through demand incentives. Among the biggest beneficiaries are public transport buses (14,000-plus e-buses), two- and three-wheelers (2.48 million and 316,000, respectively) and e-trucks to an extent as the INR500 crore subsidy is available to those who have scrapping certificate from vehicle scrapping centres. Part of the outlay, INR2,000 crore, is for installing more than 72,000 fast chargers, mostly for e-two- and three-wheelers in some cities but also for four-wheelers and buses.

Subsidies have been the biggest driver of EVs in India, helping increase sales volumes for incumbents and attracting new entrants. Over a longer period, the volumes and competition can lead to lower costs, more innovation and improved quality, making EVs attractive to consumers even without the subsidy.

While cost plays an important role in adoption and development of the EV ecosystem, subsidies are not sustainable in the long term – the latest scheme is only for two years. The answer lies in operations and technology practices since the biggest obstacles to EV adoption currently are high upfront cost, relatively long recharge times and patchy charging infrastructure, which PM E-Drive also targets. The next growth stage in India will, therefore, depend largely on new or upgraded technology, a far more developed domestic manufacturing and supply base, and collaborations that run deep and wide.

Technology thrust

Till now, subsidies and a positive Total Cost of Ownership (TCO) were driving most of EV adoption. But future-looking OEMs must explore new launches and ways to contain costs. For instance, as lithium-ion cells become cheaper, sub-segments that need larger batteries, such as motorcycles, can be considered. Several e-motorbikes are set to launch soon, featuring swappable multiple battery packs, fast charging, higher top speeds and longer drive range.

Battery and swapping technologies and business models: Globally as well as in India, many organisations are investing in battery technology R&D to improve energy density, charging speed, and durability, all of which can reduce range anxiety. While options such as fast charging can reduce battery size and as a result the vehicle’s price, battery swapping converts upfront capital expenditure into operational expenditure tied to a Battery-as-a-Service (BaaS) model.

Infrastructure to alleviate range anxiety: The government can incentivise companies and municipalities to develop infrastructure, battery swapping networks and even battery leasing or rental services. However, longer-term solutions are needed, such as increased R&D in innovative technologies such as wireless charging and fast charging. Many four-wheeler OEMs are developing new powertrain combinations such as extended range EVs, that have a type of series hybrid powertrain.

Domestic manufacturing

Strong domestic manufacturing and R&D are fundamental for sustaining e-mobility in India. According to some estimates, 60% of an EV in India depends on imports, mostly from China for battery, motor, electronics and components. Several OEMs are investing in the domestic ecosystem, especially in manufacturing cells and motors, to further localization as well as export from India. Under the PLI scheme with an allocated budget of INR3,620 crore, the government had received seven bids for the giga-scale (10-GWh) advanced chemistry cell (ACC) manufacturing that was announced in January 2024. In early September, investment worth INR1.2 trillion from several companies was approved in Maharashtra for manufacturing EVs, hybrid cars, EV batteries, analogue and mixed signal integrated circuits and other semiconductors.

Supply chain development

India imports key raw materials like lithium and cobalt which are used to make batteries. Their supply chains are volatile and not well established and disruptions can affect supply as well as prices. While imports are likely to continue, a broader supplier base and a combination of long-term contracts and short-term spot purchases can dull the impact of short-term price fluctuations.

Recycling is another opportunity in the value chain. India generates about 50,000 tonnes of battery waste (including consumer electronics) per annum and while some companies have invested in recycling technology and capacity for lithium-ion and lead acid batteries, much more is needed, especially to address concerns regarding supply of raw material and costs. It is estimated that with the existing recycling technologies, about 90% of valuable metals can be recovered.

To strengthen supply, some companies are developing motors and battery technologies that are free of rare earth minerals while others are exploring investment in critical mineral mines abroad. Domestic supply and processing facilities are, however, at a nascent stage.

For components as well, a strong domestic supply chain is essential to reduce costs and ensure a reliable supply. Presently, about 45% of an EV’s cost is components apart from the battery and motor.

Public-private collaborations

Be it developing technology, manufacturing or finance products, the role of public-private partnerships (PPP) cannot be emphasised enough. Similar to the infrastructure industry, PPPs in the EV sector can also combine resources and expertise, while sharing risk to finance and develop charging infrastructure. Talks are on in various cities for private vendors to lease government spaces to build, operate and maintain charging stations.

By some estimates, India will be the largest EV market by 2030, growing at a CAGR of more than 60%. To sustain the growth momentum in EVs, sharper focus is needed to address the core challenges than just demand-side direct purchase incentives. A level playing field that encourages the private sector, including start-ups, to invest, innovate and compete will help India achieve long-term benefits of a greener, cleaner, more efficient future for Indian transportation.