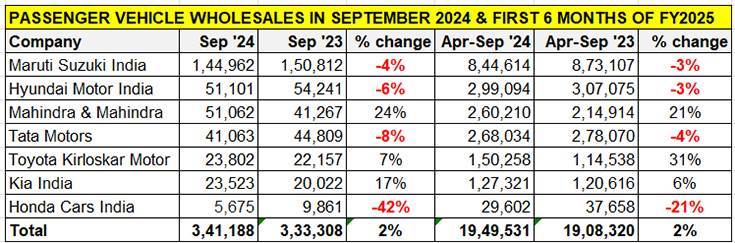

September turned out to be just like August, a tepid month which saw the top three passenger vehicle manufacturers register a year-on-year wholesales decline. While Maruti Suzuki’s dispatches to showrooms were down 4%, Hyundai Motor India posted a 6% reduction in volumes and Tata Motors 8 percent. Tata Motors’ much-reduced volumes meant that M&M, which would have sent out additional units of its in-demand SUVs as well as the recently launched Thar Roxx to its dealers, took third position on the podium in September, displacing the maker of the Nexon and Punch. Of the seven OEMs which have released their wholesales numbers, Mahindra & Mahindra, Toyota Kirloskar Motor and Kia India increased their vehicle dispatches by 24%, 7% and 17% respectively.

The PV industry’s overall performance in September can be attributed to a combination of tepid consumer demand and high levels of inventory at dealers, which OEMs continue to rationalise over the past three-odd months. September also saw the full impact of the Pitru-paksh period (September 17-October 2), which usually sees consumers deferring purchase of new vehicles.

Sales over the past two months have been both hampered by delayed consumer purchase decisions, and disrupted by heavy rains in various parts of India. As it had in August, dealer body FADA, in early September, had red-flagged the high inventory levels in the passenger vehicle industry stating that stock days had stretched to 70-75 days and there was inventory totalling 780,000 vehicles, valued at Rs 77,800 crore. FADA, in its statement, had urged “banks and NBFCs to intervene and immediately control funding to dealers with excessive inventory. Dealers must also act swiftly to stop taking on additional stock to protect their financial health. OEMs, too, must recalibrate their supply strategies without delay, or the industry faces a potential crisis from this inventory overload. If this aggressive push of excess stock continues unchecked, the auto retail ecosystem could face severe disruption.”

A glance at the seven-OEM data table above reveals that four of them – Maruti Suzuki, Hyundai Motor India, Tata Motors and Honda Cars India – are in the red in September as well as in the April-September 2024 or first-half FY2025 period. One can put this down to inventory control measures as also increased competition in the market in certain vehicle segments.

Let’s dive into each of these OEMs’ sales numbers for last month and first-half FY2025.

MARUTI SUZUKI INDIA

MARUTI SUZUKI INDIA

September 2024: 144,962 units, down 4%

April-September 2024: 844,614 units, down 3%

September 2024 was the third straight month of a wholesales decline for Maruti Suzuki, which dispatched 144,962 vehicles to its dealers, down 4% YoY. The percentage of decline would have been higher if it weren’t for the sustained demand the company, which is also the utility vehicle market leader, is witnessing its SUVs and MPV. The UV category, along with the Eeco van, are the only ones to see YoY growth in September and for the first six months of FY2025.

Cumulative first-half FY2025 wholesales at 844,614 units are down 3% (April-September 2023: 873,107 units). At half-way stage into the current fiscal, Maruti Suzuki’s dispatches are 48% of its FY2024 total of 17,59,881 passenger vehicles.

Maruti Suzuki, which is also the largest seller of CNG-powered cars and SUVs, notched a new monthly milestone – it surpassed the 50,000-units mark for a single month for its CNG variants. September 2024’s 53,431 CNG variants constitute 37% of its total PV dispatches of 144,962 units.

Speaking to Autocar Professional recently, Partho Banerjee, Senior Executive Officer of Sales & Marketing, Maruti Suzuki India, said: “Over the past two months, we have considerably reduced the dispatches to our dealers. This has been a conscious call by us and we will be calibrating the dispatches. It is a conscious call because we feel retail and wholesale should match. At the start of September, we had a (Maruti Suzuki) network inventory of only 30 days. We are taking a conscious call not to push wholesales to dealers. We feel the green shoots (of return of demand) will be seen in the festive season. In fact, this is the best time to buy a car.”

HYUNDAI MOTOR INDIA

HYUNDAI MOTOR INDIA

September 2024: 23,523 units, up 17%

April-September 2024: 127,321 units, 6% growth

With dispatches of 51,101 cars and SUVs to its showrooms across the country in September, Hyundai Motor India posted its best monthly figures in the fiscal year to date, albeit this is down 6% on year-ago wholesales of 54,241 units.

There are two key highlights in September. The share of SUVs to total PV sales has risen to its highest ever – at 70%, this would work out to 35,770 units. And, the month also saw the highest monthly contribution of CNG-powered vehicles – at 13.8% or 7,052 units – of total sales.

Commenting on the September numbers, Tarun Garg, wholetime director and chief operating officer, HMIL said, “In September, we introduced the new Alcazar. This, combined with strong performance from the Exter, Venue and Creta, propelled HMIL to its highest ever monthly SUV contribution of 70% to total sales. We also witnessed increased consumer demand for CNG-powered vehicles, backed by the introduction of Dual Cylinder CNG in the Exter and Grand i10 Nios, resulting in highest-ever CNG contribution of 13.8% to September sales. With the festive season kicking in, we have introduced many new models and variants to meet customers aspirations, and our dealer touchpoints are fully geared up to delight customers.”

Hyundai Motor India’s first-half FY2025 sales at 299,094 units are 3% down YoY (April-September 2023: 307,075 units). This is 48.65% of the car and SUV manufacturer’s record FY2024 sales of 6,14,717 units.

MAHINDRA & MAHINDRA

MAHINDRA & MAHINDRA

September 2024: 51,062 units, up 24% YoY

April-September 2024: 260,210 units, up 21% YoY

Mahindra & Mahindra is firing on all cylinders and how! The SUV manufacturer dispatched 51,062 vehicles in September, up 24% YoY. This is the first time that M&M has clocked wholesales of over 50,000 units in a single month. September’s 51,062 units improve upon August’s 43,277 units by 18% and mark the ninth straight month that M&M has dispatched over 40,000 units, clearly indicating the robust market demand it is witnessing for most of its models.

That’s not all. This stellar September wholesales performance means M&M has sold 9,999 more vehicles than Tata Motors, which dispatched 41,063 units (down 4% YoY), for the first time and moves up one rank in the overall PV ladder-board to take No. 3 position on the podium. What’s more, it was only 39 units behind No. 2 OEM, Hyundai Motor India.

M&M’s first-half FY2025 dispatches at 260,210 units are up 21% YoY (April-September 2023: 214,914 units) and already 56% of its record FY2024 sales of 459,877 units. In the highly competitive UV market, M&M, which has eight SUVs (Bolero, Bolero Neo, Scorpio, Scorpio N, Scorpio Classic, Thar, XUV3XO, XUV400 and XUV700), is extremely well placed to capitalise on the surging demand for this vehicle type.

On August 14, M&M launched the new Thar Roxx, the five-door version of the Thar, at prices starting from Rs 12.99 lakh. Bookings for the Thar Roxx open on October 3. August also saw the flagship SUV, the XUV700 drive past the 200,000 sales milestone in the domestic market.

M&M is benefiting from its substantially ramped-up production at its factories. Given the strong demand for its SUVs, it has outlined plans to further increase output. On June 14, M&M confirmed that it plans to further increase production capacity to 64,000 units per annum or 768,000 units per annum by end-FY2025 and 72,000 units a month / 864,000 units per annum by end-2026.

TATA MOTORS

TATA MOTORS

September 2024: 41,313 PVs – down 9% / 4,680 EVs, down 23%

April-September 2024: 269,435 PVs – down 4% / 32,221 EVs, down 15%

September has turned out to be the fourth month in a row that Tata Motors’ overall PV wholesales have seen a sales decline. At 41,313 units, dispatches are down 9% YoY (September 2023: 45,317 units). It’s a similar scenario for its EV wholesales – 4,680 units, down 23% YoY (September 2023: 6,050 units), and both are the lowest monthly numbers in the first half of FY2025.

While it could be that Tata Motors is rationalising inventory levels at its dealers across the country, in pure number terms, the September wholesales have resulted in an aggressive Mahindra & Mahindra, which dispatched a best-ever monthly 51,062 units, to go ahead in the ranking table to take No. 3 rank.

On September 2, Tata Motors expanded its PV stable by venturing into the midsize SUV segment with the Curvv SUV-coupe. With the Curvv, which gets petrol, diesel and electric powertrains, the company is targeting a podium position by aiming to be a disruptor within the midsize SUV category

The prime reason for the continued decline in Tata Motors’ sales is attributed to slow consumer demand and seasonal factors. According to Shailesh Chandra, MD, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, “The PV industry in Q2 FY25 saw more than 5% decline in retails (Vahan registrations) compared to Q2 FY24 driven by slow consumer demand and seasonal factors. In contrast, industry offtake was significantly higher than registrations in anticipation of a strong start to the festive season, resulting in a continued buildup of channel stock. In addition, EV sales in personal segment was affected by the lapse of registration and road tax waivers in key states. Fleet EV sales continued to remain impacted due to lapse of FAME II and non-inclusion of the fleet segment in PM-eDRIVE scheme.”

Tata Motors posted wholesales of 130,753 units in Q2 FY25, a decline of 6% compared to Q2 FY24, as we readjusted wholesales to lower-than-expected retails, to keep channel inventory under control. During the quarter, we launched the Curvv, which has received an excellent response with strong bookings for all its powertrains – petrol, diesel and electric. Initial deliveries of Curvv have commenced, and we will continue to ramp up production in Q3. Our market facing interventions have been well received, generating a strong pipeline. The launch of our higher range Nexon.ev has also generated strong consumer interest.”

“Tata Motors registered wholesales of 130,753 units in Q2 FY25, as we readjusted wholesales to lower-than-expected retails, to keep channel inventory under control. The Curvv has received an excellent response and our market-facing interventions have been well received, generating a strong pipeline,” Chandra added in a statement.

Meanwhile, with the expanding CNG filling infrastructure across the country, Tata Motors, like Maruti Suzuki, is benefiting from growing demand for its CNG models. While the specific launch date remains unknown, Tata Motors has confirmed that it will introduce the Nexon iCNG model this fiscal year.

For the first-half FY2025, Tata Motors’ dispatches at 269,435 units are down 4% YoY. EVs, at 32,221 units (down 15% YoY), have a penetration level of 12 percent in overall PV sales. Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV, and now the Curvv EV.

The company’s share of the ePV market, which was not too long ago upwards of 75%, has been continually reducing, reflecting the growing competition from rival EV OEMs and increased product choice for buyers. Nevertheless, there continues to be a big difference in numbers between Tata Motors and the rest of the competition.

TOYOTA KIRLOSKAR MOTOR

TOYOTA KIRLOSKAR MOTOR

September 2024: 23,802 units, up 7%

April-September 2024: 150,258 units, 31% growth

Toyota Kirloskar Motor (TKM) has continued in the rich vein of growth it has displayed since the opening of the year. In September, the company dispatched 23,802 units, up 7% YoY, albeit its second lowest monthly number in the ongoing fiscal after April 2024’s 18,676 units.

With this, TKM’s wholesales in the first half of FY2025 add up to 150,258 units, an increase of 31% YoY (April-September 2023: 114,538 units). This total is 61% of TKM’s record 244,940 sales in FY2024. With six months left in FY2025, Toyota is well placed to achieve the 300,000 sales milestone for the first time in a fiscal year.

Commenting on the strong sales performance, Sabari Manohar, Vice-President, Sales-Service-Used Car Business, Toyota Kirloskar Motor said: “As the festive fervour picks up, footfalls and enquiries are charged up which makes us positive of a very good festive season. Notably, our SUV, MPV, and small car segments have experienced significant growth nationwide, contributing over 90% to our sales in in September. Key to meeting this rising demand has been our strategic operational improvements, such as the introduction of a third shift. This has significantly optimized our supply chain, particularly for high-demand models where waiting periods have been reduced.”

Along with strong demand for its Toyota models, the company is also benefiting from sustained demand for the quartet of rebadged models – the Glanza, Urban Cruiser Hyryder, Urban Cruiser Taisor and the Rumion. While September model-wise splits are yet to be known, combined sales of these four models for the April-August 2024 period at 67,406 units were up 76% YoY (April-August 2023: 38,280 units). This makes for a 53% share of the rebadged models, up from the 41% a year ago. While the Taisor is already the third best-selling rebadged model for TKM and has sold over 11,000 units in four months, the Hyryder has sold over 90,000 units in two years since its launch.

KIA INDIA

KIA INDIA

September 2024: 23,523 units, up 17%

April-September 2024: 127,321 units, 6% growth

Kia India has improved upon its August 2024 sales by 1,000 units in September to register its best monthly performance in the current fiscal – 23,523 units, up 17% YoY (September 2023: 19,219 units). What is giving Kia strong sales momentum is the continuing demand for the feature-laden and ADAS-equipped new Sonet compact SUV launched in January 2024.

Since its January launch, the Sonet continues to be the best-selling product for Kia. In September with 10,335 units, the Sonet clocked five-figure sales for the third time this year, after January’s 11,530 units and August’s 10,073 units. The Seltos with 6,959 was next, followed by the Carens MPV (6,217 units) and the all-electric EV6 (12 units).

At half-way stage in FY2025, Kia India has achieved 52% of its FY2024 wholesales of 245,634 units. The company’s first-half FY2025 sales at 127,321 units are up 6% YoY. The Sonet, which has outsold the Seltos for nine straight months, accounts for 55,017 units or a 43% share. The Seltos, with 38,618 units, has a 30% share while the Carens MPV (33,575 units) has a 26% share of Kia India’s dispatches. The EV6 has sold 111 units in the same period.

HONDA CARS INDIA

HONDA CARS INDIA

September 2024: 5,675 units, down 42%

April-September 2024: 29,602 units, down 21%

Honda Cars India, which retails the Amaze and City sedans along with the Elevate midsize SUV, dispatched 5,675 units, which is a sharp 42% YoY decline (September 2023: 9,861 units) albeit the highest monthly number in the first six months of FY2025. Cumulative April-September 2024 dispatches at 29,602 units are down 21% year on year.

While the Elevate midsize SUV has been instrumental in bringing Honda Cars India ‘back in the game’, particularly in the booming SUV segment where it was missing on the action big time, sales have slowed down in the past few months.

CAR AND SUV MAKERS BET ON OCTOBER-NOVEMBER TO DELIVER THE GOODS

October has dawned and brings with it the onset of the festive season, starting with Navratri from October 3, followed by Dussehra mid-month and leading up to Diwali, the festival of lights, on November 1.

Typically, this is the time when India goes into full shopping mode and cognisant of this, and also to reduce high inventory levels and clear old stock, car and SUV manufacturers are offering mouth-watering deals and discounts. Autocar India has listed 20 cars available with an over Rs 100,000 discount during the festive season.

ALSO READ: Electric car and SUV sales in September lowest in 19 months: 5,733 units

Electric 2W sales jump 40% in September, Bajaj Chetak outsells TVS iQube, Ola share falls to 27%