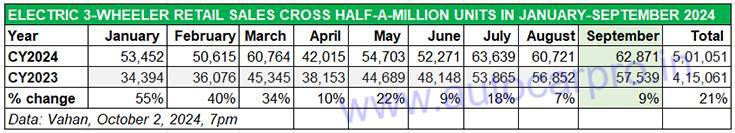

The electric three-wheeler industry in India is on a roll. In September, as per the latest Vahan retail data, this zero-emission vehicle segment clocked over 60,000-unit retail sales for the third straight month. In the process, it surpassed the half-a-million milestone in the first nine months of CY2024. At present, with 501,051 units between January-September, this zero-emission vehicle segment is 82,555 units away from going past CY2023’s record sales of 583,606 units. This gap should be bridged in the first half of November 2024.

With 501,051 units sold in the first nine months of 2024, India e-3W Inc is 82,555 units away from surpassing CY2023’s record sales of 583,606 units. September sales are the second highest YTD.

With 501,051 units sold in the first nine months of 2024, India e-3W Inc is 82,555 units away from surpassing CY2023’s record sales of 583,606 units. September sales are the second highest YTD.

What is fuelling this rally in retail sales is a combination of factors including lower cost of ownership (compared to IC engine, CNG and LPG options), improved financing options, the FAME-EMPS and now the PM E-Drive purchase incentive scheme, increased product choice and as well as growing demand from fleet and last-mile logistics operators.

Demand for electric three-wheelers soared under the FAME II subsidy scheme, when it kept registering strong double-digit growth. Under the four-month EMPS, which ended on September 30, 2024 and had a reduced subsidy compared to FAME II, monthly sales growth has been more muted and in single digits. Now with the new PM E-Drive scheme – which offers the same subsidy as in the EMPS for the first year and half of that in the second – and effective for a two-year period, it remains to be seen if the same momentum is maintained in the second year.

The PM E-Drive scheme will incentivise purchase of 316,000 e-three-wheelers. E-three-wheelers including e-rickshaws, get a subsidy of Rs 25,000 in the first year and Rs 12,500 in the second year. For the L5 category (cargo e-three-wheelers), the incentive is Rs 50,000 per unit in the first year and Rs 25,000 in the second.

Of all vehicle segments, it is the e-three-wheeler industry which is witnessing the fastest transition to electric mobility. Of the total 896,618 units sold between January and September 2024, across petrol, diesel, CNG, LPG and electric powertrains, electric three-wheelers – 501,051 units – account for 56% of the sales, effectively translating into very second three-wheeler sold in India being an EV. CNG-powered three-wheelers, at 262,900 units, are the next highest and have a 29% share of the overall market.

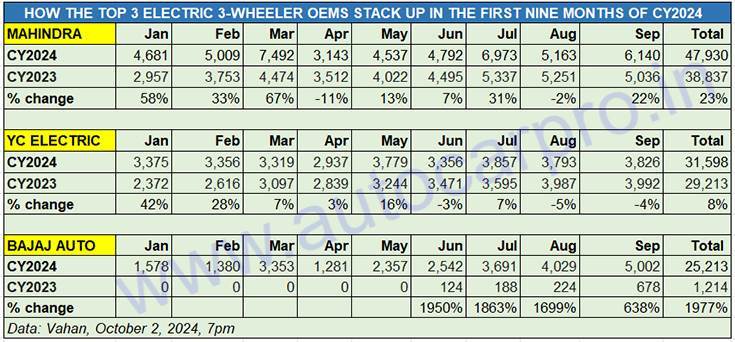

HOW THE TOP 3 PLAYERS ARE FARING in CY2024

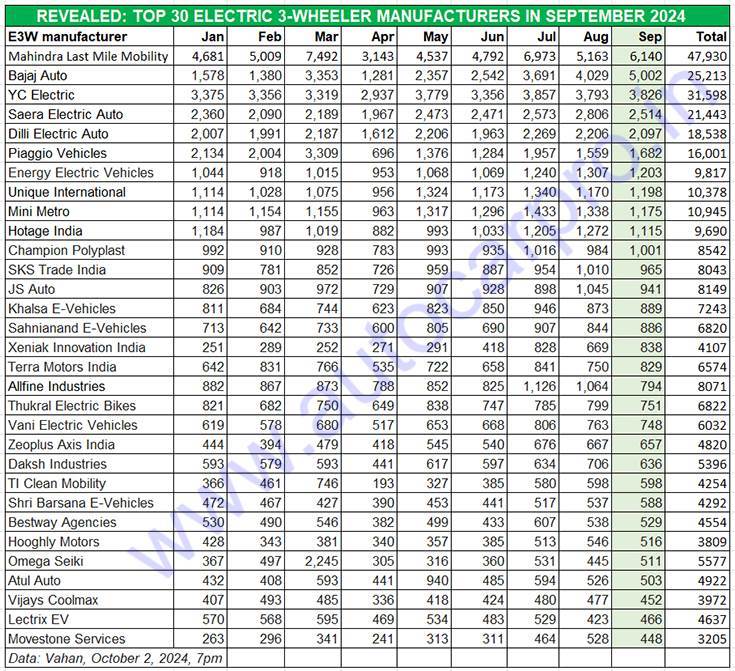

The e-three-wheeler segment, which comprises passenger and cargo-transporting vehicles, has at last count nearly 550 players, all fighting for a slice of the action. Most of the big numbers though are cornered by the Top 10 which accounted for 25,952 units – or 41% of total sales of 62,871 units in September 2024. For the January-September period, these Top 10’s cumulative sales at 201,553 units makes for a 40% share, maintaining the same ratio as last month.

The real battle though is being fought at the podium level – between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric.

Mahindra Last Mile Mobility, which sold 6,140 e3Ws in September, has retailed 47,930 units between January and September 2024, up 23% YoY, and 88% of its entire CY2023 sales.

Mahindra Last Mile Mobility, which sold 6,140 e3Ws in September, has retailed 47,930 units between January and September 2024, up 23% YoY, and 88% of its entire CY2023 sales.

The well-entrenched and longstanding Mahindra Last Mile Mobility sold 6,140 units in September, up 22% YoY (September 2023: 5,036 units) which gives it a 9.76% market share. In the January-September 2024 period, cumulative sales of 47,930 units are a 23% YoY increase and give it a market share of 9.45 percent. This total is already 88% of MLMM’s CY2023 retails of 54,599 units, which means the company could be driving towards record sales in the region of 63,000 to 65,000 units in CY2024. In July, MLMM signed an MoU with Ecofy to offer ease of finance for 10,000 units through leasing and subscription schemes. This should give the company enhanced volumes in the months to come.

MLMM’s EV portfolio comprises the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains. To ensure sustained supplies to meet growing demand, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

While Bajaj Auto ranked No. 2 in August and September, it is third in January-September sales, after YC Electric. The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

While Bajaj Auto ranked No. 2 in August and September, it is third in January-September sales, after YC Electric. The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

Bajaj Auto, which we have consistently predicted as being the dark horse of both the electric two- and three-wheeler segments, recently hit the headlines for having sold more Chetak e-scooters than the longstanding No. 2 product, the TVS iQube in September.

It seems to be attempting something similar in the e-three-wheeler market if the company’s current sales momentum is an indicator. Despite being a late entrant with introduction of its passenger and cargo products only in June 2023, the company has slowly risen up the ladder-board.

Bajaj Auto, which is the IC engine three-wheeler market leader, has two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 in the fray. The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

In CY2023 (six months since its market entry), Bajaj Auto was ranked 28th in the field with 2,428 units. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share with 7,525 units and was ranked No. 13. Sixteen months later, it is hard on the heels of the market leader, Mahindra Last Mile Mobility.

The 3-OEM data table above depicts the monthly growth Bajaj Auto has registered, starting CY2024 with 1,578 units in January and surpassing the 5,000-units monthly sales mark for the first time in September (5,002 units). The resultant increase in monthly market share has gone up from 3% to 8% in September. For the first nine months of this year, cumulative sales of 25,213 units are up 1977% on a low year-ago base of 1,214 units but give it a market share of 5 percent. While Bajaj has been ranked No. 2 both in August and September, it is third on the cumulative sales front, after YC Electric.

With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to achieve higher numbers in the coming months.

YC Electric, the longstanding No. 3 e-three-wheeler OEM, lost its rank to a hard-charging Bajaj Auto in August and September but remains ahead on the cumulative nine-month sales front. In September 2024, YC Electric retailed a total of 3,826 units, down 4% YoY, albeit this was its second best monthly performance in the YTD after July’s 3,857 units. This gives it a market share of 6% for September, below MLMM’s 10% and Bajaj Auto’s 8 percent.

YC’s January-September 2024 total at 31,598 units is up 8% YoY and 77% of its CY2023 sales of 40,789 units. Like MLMM, YC Electric has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations.

TI Green Mobility sold 598 Montra Electric three-wheelers in September.

TI Green Mobility sold 598 Montra Electric three-wheelers in September.

Murugappa Group company TI Green Mobility rising up the ranks

The other eight EV makers which have registered four-figures retail sales in September include Saera Electric Auto (2,514 units), Dilli Electric Auto (2,097 units), Piaggio Vehicles (1,682 units), Mini Metro (1,175 units), Energy EV (1,203 units), Hotage India (1,115 units), Unique International (1,198 units) and Champion Polyplast (1,011 units).

Meanwhile, Murugappa Group company TI Green Mobility (Montra Electric), another recent entrant into the e-three-wheeler market like Bajaj Auto, is slowly climbing up the ranks. On August 21, Montra Electric announced delivery of its 5,000th three-wheeler Passenger Auto (L5M category) within one year of launch and entry into the electric three-wheeler market. Over the past year, Montra Electric has delivered its Super Autos to customers across 74 markets spanning 17 states. In August as well as September, Montra Electric clocked retail sales of 598 units, taking its January-September 2024 total to 4,254 units. This gives it the No. 23 position, which is a creditable performance given that this sub-segment of the EV industry has the highest number of players – 530 companies – all vying for a slice of the zero-emission action.

ALSO READ:

Electric 2W sales jump 40% in September, Bajaj Chetak outsells TVS iQube, Ola share falls to 27%

Electric car and SUV sales in September lowest in 19 months: 5,733 units