As per the latest retail market sales data available on the Vahan website (as of October 7, 2024, 6.30am), Honda Motorcycle & Scooter India (HMSI) has sold more two-wheelers than market leader Hero MotoCorp in September 2024.

Honda has gone ahead of Hero MotoCorp in September 2024. The last time it had done so was two years ago, in September 2022. Hero though remains in the lead on the cumulative sales front.

Honda has gone ahead of Hero MotoCorp in September 2024. The last time it had done so was two years ago, in September 2022. Hero though remains in the lead on the cumulative sales front.

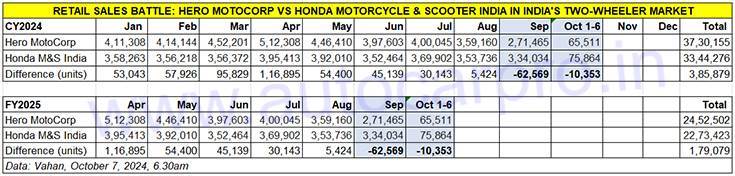

The data reveals that while Hero MotoCorp registered sales of 271,465 units last month, down 23% YoY (September 2023: 352,252 units), HMSI clocked sales of 334,034 units, down 4.50% YoY (September 2023: 349,781 units). This translates into Honda selling 62,569 more two-wheelers than Hero MotoCorp. And Honda is also leading in the first five days of October with 75,864 units – 10,353 more – to Hero’s 65,511 units. In August 2024, Hero had a slender lead of 5,428 units over HMSI.

A deep dive into the last 33 months’ retail sales reveals that Honda had last gone ahead of Hero MotoCorp in monthly retail sales two years ago – in September 2022 with 298,399 units to Hero’s 269,486 units.

Nevertheless, in terms of cumulative retail sales in the current fiscal year FY2025, Hero MotoCorp continues to have a sizeable lead over HMSI. From April 1 through to October 5, 2024, as per the latest Vahan data, Hero MotoCorp has sold 24,52,502 units to HMSI’s 22,73,423 units, which is a lead of 179,079 units.

Hero MotoCorp, which is the unrivalled boss of the volume game since years due to the sustained demand for its fuel-sipping 100cc commuter motorcycles, seems to be under pressure for the first time in decades. In fact, September 2024 retails (271,465 units) are not only its lowest numbers in the current calendar and fiscal year but its lowest in 24 months after September 2022’s 298,399 units. It is also likely that the company was optimising its dealer inventory levels in September.

The retail sales differential between the leading two-wheeler manufacturers in India has been shrinking rather rapidly. In CY2022, the difference in favour of Hero MotoCorp was 1.16 million units, increasing to 1.38 million units in CY2023. Now, after the first nine months of CY204 and the first five days of October 2024, the difference has come down to 385,879 units.

Hero MotoCorp though remains ahead of HMSI on the wholesales (OEM dispatches to dealers across India) front for the current fiscal year FY2025. Between April-August 2024, as per SIAM data for the first five months of FY2025, and the company release for September 2024 wholesales, Hero has dispatched a total of 29,40,666 units compared to HMSI’s 28,81,419 units, and is ahead by 59,247 units at the end of September 2024.

BATTLE BETWEEN MOTORCYCLE BOSS AND SCOOTER KING CONTINUES IN FESTIVE SEASON

BATTLE BETWEEN MOTORCYCLE BOSS AND SCOOTER KING CONTINUES IN FESTIVE SEASON

Hero MotoCorp has a strong stable of motorcycles and its market leadership stems from the mega volumes it generates from the fuel-sipping up to 100-100cc motorcycle category, particularly the 97.2cc HF Deluxe, Splendor+ and Passion brands, and the 113cc Passion XTEC and Super Splendor bikes. In the 125cc category, the Glamour and Super Splendor do duty for Hero. In the 150cc-200cc category, there’s the Xtreme 160R and XPulse 200. Higher up in cubic capacity are the 210cc Karizma and the recently launched Mavrick 440.

In scooters, Hero has the 110cc Pleasure and Xoom, followed by the 125cc Destini. And Hero MotoCorp has the advantage when it comes to electric scooters with the Vida brand, whereas HMSI is yet to introduce an EV. In September, Hero MotoCorp sold 4,313 Vida e-scooters and is ranked fifth in a field of over 200 players with a 5% market share.

Hero MotoCorp has been rapidly expanding its network of premium ‘Hero Premia’ stores across the country, with over 40 Premia stores now operating in nearly 40 cities. This network of stores feature dedicated sections for Hero, Vida and Harley-Davidson products, including the Mavrick 440, Harley-Davidson X440, Karizma XMR, Xpulse 200 4V, Xtreme 160R 4V, and Vida V1 and V1 Pro, along with an array of exclusive merchandise and accessories.

Honda Motorcycle & Scooter India’s product line-up includes four scooter models (Activa and Dio in both 110cc and 125cc avatars) and in nine motorcycles, across 100-110cc (Shine 100, CD 110 Dream Deluxe and Livo), 125cc (Shine 125 and SP125), 160cc (Unicorn and SP160) and 180-200cc (Hornet 2.0 and CB200X) segments.

HMSI’s premium motorcycle retail format is led by the BigWing Topline for entire premium motorcycle range (300cc – 1800cc) in top metros and BigWing, which is exclusively for midsize motorcycle segment (300cc – 500cc). Honda’s range of motorcycles includes the all-new CB350, H’ness CB350, CB350RS, CB300F, CB300R, NX500, XL750 Transalp, Africa Twin and Gold Wing Tour. The Hornet 2.0 and CB200X are now retailed via BigWing showrooms as well.

WILL HERO CLAW BACK SALES IN THE FESTIVE SEASON?

The last word on the battle between these two two-wheeler biggies is not yet written. Expect Hero MotoCorp to claw back sales in the festive months of October and November, with both OEMs stretching their marketing muscle to achieve maximum retail sales traction, even as there is competition from TVS Motor Co and Bajaj Auto, the third- and four-ranked two-wheeler OEMs in India.

In fact, between October 1-5, Hero had sold 53,240 units to Honda’s 67,345 units – a difference of 14,105 units in HMSI’s favour. By the end of October 6, the difference was down to 10,353 units with Hero selling 12,271 units on a single day (October 6) while Honda sold 8,519 units. Clearly, this is a battle India Two-Wheeler Inc will be tracking avidly. We will keep you posted with regular sales updates. Till then, enjoy the action.

ALSO READ: Top 5 two-wheeler OEMs target festive fervour, dispatch 1.85 million units to dealers in September

Electric 2W sales jump 40% in September, Bajaj Chetak outsells TVS iQube, Ola share falls to 27%