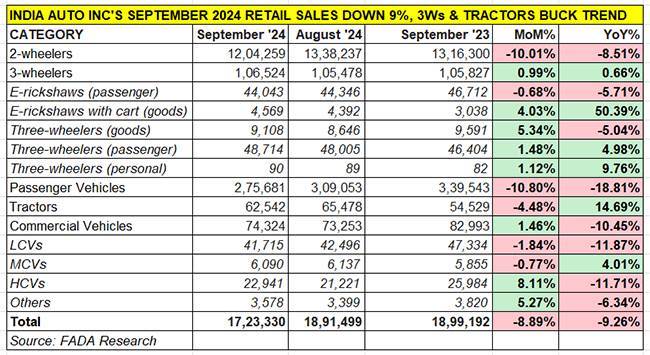

September turned out to be a poor month for India Auto Inc with the lowest retail sales in the first nine months of this year. At a combined 17,23,330 units for two- and three-wheelers, passenger vehicles, commercial vehicles and tractors, September 2024 numbers are a sharp 9.26% year-on-year decline, and an 8.89% decline month on month (August 2024: 18,91,499 units).

Of the five vehicle segments, only tractors (65,542 units, up 14.69% YoY) registered proper growth. While two-wheelers demand was down 8.51% at 1.20 million units, three-wheelers with 106,524 units saw flat sales and a minimal 0.66% uptick. Passenger vehicle sales (275,681 units) witnessed a sharp fall of nearly 19% to 275,681 units as a result of selling 63,862 fewer units than it did in September 2023. And, commercial vehicle retail sales at 74,324 units were down 10.45% YoY.

India Auto Inc’s September sales of 1.72 million units are the lowest in the first nine months of 2024.

India Auto Inc’s September sales of 1.72 million units are the lowest in the first nine months of 2024.

According to C S Vigneshwar, president of apex dealer body, Federation of Dealers Associations of India (FADA), “Despite the onset of festivals such as Ganesh Chaturthi and Onam, dealers have reported that the performance has been largely stagnant. This suggests that overall market sentiment during these festive periods has been underwhelming, with a trend leaning towards flat or negative growth. The Shraddh period further impacted sales negatively, leading to a YoY decline in retail sales across various categories. Discounts and offers have been introduced across segments to stimulate demand, but these have yet to translate into a significant improvement in sales.” 2-WHEELERS: 1.20 million units, down 8.51% YoY, down 10% MoM

2-WHEELERS: 1.20 million units, down 8.51% YoY, down 10% MoM

Honda outsells Hero MotoCorp after 24 months, TVS, Bajaj and Royal Enfield sales down

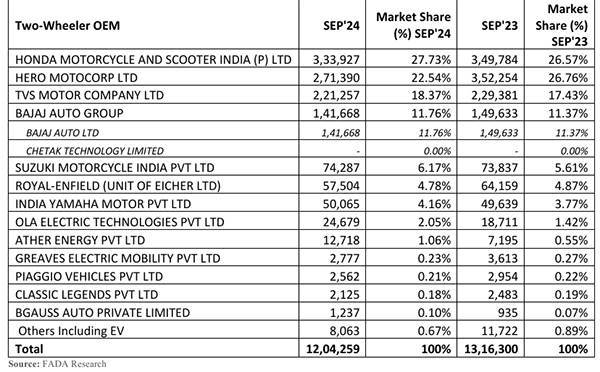

The motorcycle, scooter and moped market witnessed a sizeable 8.51% sales decline to 1.20 million units YoY (September 2024: 1.31 million units) and a 10% decline month on month (August 2024: 1.33 million units).

According to the FADA president, two-wheeler sales were impacted by low consumer sentiment, poor inquiries and reduced walk-ins. Seasonal factors like the Shraddh period, Pitrapaksha, and heavy rains further impacted demand, resulting in delayed purchases and a subdued market environment.

The big news is of Honda Motorcycle & Scooter India outselling market leader Hero MotoCorp. While Honda sold 334,034 units, Hero MotoCorp registered sales of 271,465 units. This puts HMSI in the market leadership position for September 2024 with a 27.73% share (up from 26.57% a year ago) compared to Hero MotoCorp which, whose share for the month has dropped to 22.24% versus 26.76% in September 2023. Nevertheless, with aggressive marketing in the festive season, Hero MotoCorp is expected to achieve strong numbers in October and beyond.

TVS Motor Co, with 221,257 units, too has increased its market share to 18.37% from 17.43% in September 2023 albeit its sales last month are down 3.54% YoY (September 2023: 229,381 units). Bajaj Auto, which hit the EV news headlines for its Chetak e-scooter having outsold TVS Motor Co’ iQube in September, clocked retails of 141,668 units last month, down 5.34% YoY.

Suzuki Motorcycle India sold 74,287 two-wheelers, 450 more than it did a year ago, a performance similar to India Yamaha Motor which, with 50,065 units, sold 426 units more in September 2024.

Meanwhile, Royal Enfield with 57,504 units last month saw its retails decline 10% YoY (September 2023: 64,159 units).

3-WHEELERS: 106,524 units, up 0.66% YoY, up 0.99% MoM

3-WHEELERS: 106,524 units, up 0.66% YoY, up 0.99% MoM

Bajaj Auto retains firm grip on market with 35% share, Piaggio and Mahindra maintain podium positions

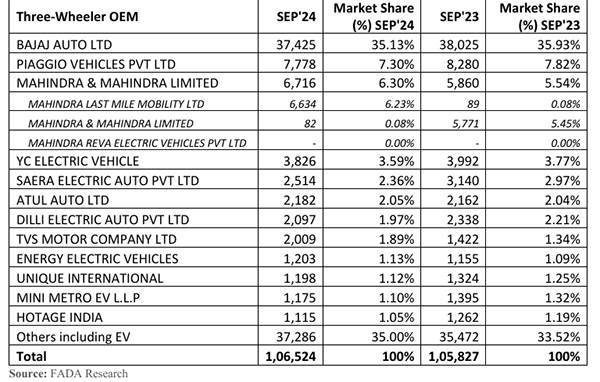

The three-wheeler segment, with 106,524 units, saw flat sales (up 0.66% YoY and 0.99% MoM) in September, marginally improving upon August’s 105,478 units and July’s 103,782 units. The sector continues to benefit from the surging demand for electric models, which now account for every second three-wheeler sold in the country.

According to FADA president C S Vigneshwar, “Three-wheeler sales showed marginal growth of 0.99% MoM and 0.66% YoY, driven by positive customer engagement and increasing demand for e-rickshaw options. However, overall demand remained subdued as many customers deferred purchases in anticipation of the upcoming festive season and heavy rains impacted walk-ins and sales activity.”

September 2024 retails, nevertheless, are the second highest in the year to date after July (110,497), August (105,478), January (97,675), February (94,918), March (105,222), April (80,105), May (98,265) and June (94,321). Bajaj Auto, with 37,425 units maintains its strong grip on the 3W market with a 35% share. The company, which entered the electric 3W market only 16 months ago, registered its best-ever e3W retails in September, selling over 5,000 units for the first time in a month.

Piaggio Vehicles sold 7,378 units – 502 fewer than in September 2023 – comprising a mix of diesel, CNG and electric powertrains. This gives it a market share of 7.30%, down from the 7.82% it had in September 2023.

Mahindra & Mahindra, the leader in the e-3W market, sold a total of 6,716 units across multiple powertrains, which gives it a market share of 6.30%, improving on the 5.54% of September 2023.

The OEM table below also reveals a number of electric three-wheeler makers, all of which are among the Top 30 electric three-wheeler OEMs in September 2024 and the first nine months of CY2024.

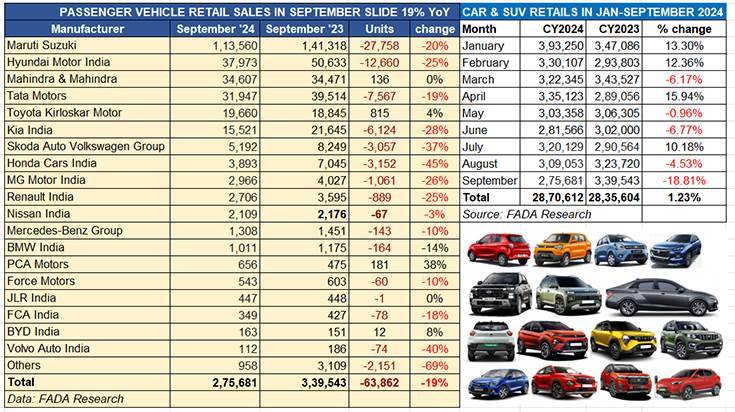

PASSENGER VEHICLES: 275,681 units, down 18.81% YoY, down 10.80% MoM

September sales lowest in the past nine months. FADA continues to red-flag high inventory levels of 80-85 days, which are equivalent to 790,000 vehicles worth Rs 79,000 crore.

The plenty of red ink indicative of a sales decline for the bulk of the passenger vehicle manufacturers tell the story of the sharp fall in September 2024 retails for this segment. Of the five vehicle segments, the passenger vehicle segment has registered the highest level of sales decline – down 19% YoY – with retail sales of 275,681 units, which translates into 63,862 fewer hatchbacks, sedans, SUVs and MPV sold than the 339,543 units sold in September 2023. Month on month too, the decline is sharp – down 10.8% on August 2024’s 309,053 units. Not surprisingly, last month’s sales are the lowest in the first nine months of CY2024.

According to the FADA president, this signals an alarming trend of declining consumer demand and deteriorating market sentiment. He said, “Seasonal factors such as Shraddh and Pitrapaksha, coupled with heavy rainfall and a sluggish economy, have exacerbated the situation, leaving dealers with historically high inventory levels of 80-85 days — equivalent to 790,000 vehicles worth Rs 79,000 crore.”

He added, “Given the critical festive season around the corner, FADA urges OEMs to take immediate corrective measures to avoid a financial setback. FADA also calls on the Reserve Bank of India to issue an advisory to banks, mandating stricter channel funding policies based only on Dealer consent and on actual collateral, to prevent dealers from facing additional financial pressure due to unsold stock. This is the final opportunity for PV OEMs to recalibrate and support market recovery before it’s too late!”

COMMERCIAL VEHICLES: 74,324 units, down 10.45% YoY, up 1.46% MoM

COMMERCIAL VEHICLES: 74,324 units, down 10.45% YoY, up 1.46% MoM

Subdued buying results in mixed-bag performance, MCVs sole category to see growth

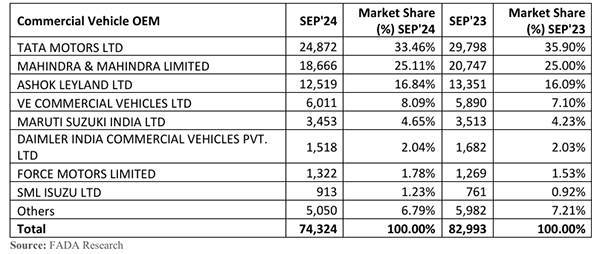

The commercial vehicle segment, considered as the barometer of the economy, registered retail sales of 74,324 units in September 2024, improving upon August’s 73,253 units but down 10.45% on year-ago sales of 82,993 units.

Vehicle sub-segment-wise, Light CVs with 41,715 units (down 12% YoY), accounted for 56% of total CV industry sales, followed by Heavy CVs with 22,941 units (down 12%) and a 31% share. Medium CVs was the sole category on growth road – the 6,090 units gave it a 4% YoY increase.

According to FADA, this was reflective of a “mixed performance. While there was positive sentiment and marginal growth in regions supported by infrastructure projects, overall demand remained weak due to low government spending, extended monsoon delays and seasonal challenges. Despite some improvement in fleet purchases, the market conditions remain subdued.”

The company-wise sales data table reveals that the each of the top three OEMs – Tata Motors, Mahindra & Mahindra, and Ashok Leyland – posted YoY declines. Tata Motors, which sold 24,872 units last month, was down 16.53% on its year-ago retails. Mahindra & Mahindra, which leads in the small pickup category, clocked sales of 18,666 units, down 10% YoY (September 2023: 20,747 units). And Ashok Leyland, with 12,519 units, posted a YoY decline of 6.23% (September 2023: 13,351 units). Fourth-ranked VE Commercial Vehicles though was in positive territory – its 6,011 units were an increase of 2% over year-ago sales.

TRACTORS: 62,542 units, up 14.69% YoY, down 4.48% MoM

All tractor makers farm growth in September – Mahindra as well as International Tractors record 15% YoY sales increase

The bountiful monsoon season across most parts of the country, along with favourable agricultural conditions and improved crop yields, have helped drive rural demand for tractors. So much so, that all nine manufacturers registered YoY sales increases. In September, a total of 62,542 tractors were sold, up 14.69% YoY (September 2023: 54,529 units) albeit 4.48% down on August’s 65,478 units.

Market leader Mahindra & Mahindra (through Mahindra Tractors and Swaraj Tractors) sold a total of 25,773 units last month, registering 15% YoY growth. International Tractors, which manufactures and sells the Sonalika brand of tractors, clocked sales of 8,116 units, posting similar 15% growth.

TAFE International, with 7,285 tractors sold, posted an increase of 6% YoY.

FADA maintains ‘cautiously optimistic’ near-term outlook

FADA maintains ‘cautiously optimistic’ near-term outlook

As it has been for the past few months, dealer body FADA remains cautiously optimistic about retail sales in the near-term, as both Navratri and Diwali fall in the same month, creating strong expectations for a surge in vehicle sales.

In its statement, FADA said: “With healthy water levels in reservoirs and improved crop yields supporting rural demand, the festive season is expected to drive a substantial boost in two-wheelers, passenger vehicle and tractor sales with new launches been planned for the month. However, the passenger vehicle segment faces a critical situation due to high inventory levels at dealerships. If sales do not pick up as expected in October, dealers could face significant financial pressure from unsold stock piling up in their warehouses.”

It added, “While dealers and OEMs are betting on robust festive sales, especially in rural markets where positive cash flow and better agricultural conditions are expected to spur demand, the outcome remains uncertain. A successful October is essential to clear out excess inventory and set a positive growth trajectory for the remainder of FY2025.”

With rising customer inquiries and optimistic dealer sentiment, the growth outlook leans towards optimism, says FADA but high stakes and dependency on October’s performance warrant a cautious approach. If the anticipated festive sales do not materialise, FADA could shift the outlook to pessimistic, putting dealers as well as OEMs in a difficult position heading into 2025.