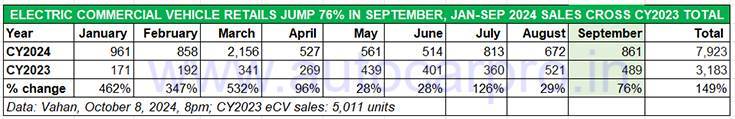

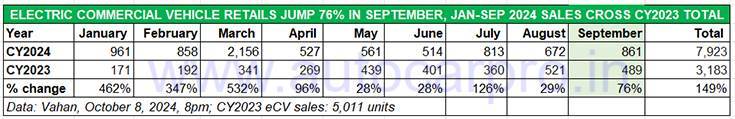

Even as the recently announced two-year PM E-Drive subsidy scheme which, among other incentives, supports purchase of 14,028 electric buses by state transports undertakings and public transport operators, has opened on October 1, 2024, demand for electric commercial vehicles (e-CVs) continues to witness double-digit growth. As per the latest Vahan retail sales data, a total of 861 e-CVs were retailed in September 2024, up 76% year on year (September 2023: 489 e-CVs) and up 28% on August 2024’s 672 units.

The growth trajectory improves on the cumulative nine-month sales front – the January-September 2024 total at 7,923 units is a marked increase of 149% YoY (January-September 2023: 3,183 units). Furthermore, the e-CV industry has already surpassed entire CY2023 sales of 5,011 units and could set a new record of over 10,000 units sold in CY2024.

The CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses. As compared to personal electric mobility in the form of e-two-wheelers and passenger vehicles, the CV industry is where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven every day.

As the monthly sales numbers (see retail sales data table above) shows, the FY2024-ending month of March 2024 witnessed the highest demand – 2,156 e-CVs, followed by January (961 units). Combined retails for the first six months of FY2025 at 3,948 units are up 59% YoY (April-September 2023: 2,479 units). Total e-CV sales in FY2024 were 8,232 units, up 218% on FY2023’s 2,598 units.

As the monthly sales numbers (see retail sales data table above) shows, the FY2024-ending month of March 2024 witnessed the highest demand – 2,156 e-CVs, followed by January (961 units). Combined retails for the first six months of FY2025 at 3,948 units are up 59% YoY (April-September 2023: 2,479 units). Total e-CV sales in FY2024 were 8,232 units, up 218% on FY2023’s 2,598 units.

LIGHT GOODS CARRIER SHARE JUMPS TO 59% OF E-CV MARKET

In terms of e-CV sub-segment-wise share in January-September 2024, light goods carriers have registered strong growth – the 4,689 units are a 233% YoY increase which is reflected in their share of overall e-CV market jumping to 59% from 44% in the year-ago period.

Demand for zero-emission light goods carriers, at 4,689 units, rose 233% YoY in January-September. This segment’s share rose to 59% from 44% a year ago.

Demand for zero-emission light goods carriers, at 4,689 units, rose 233% YoY in January-September. This segment’s share rose to 59% from 44% a year ago.

Demand for electric buses is also on the upswing. In the first nine months of CY2024, a total of 3,071 units were sold, up 108% YoY, albeit their share of the overall market is down to 39% from 46% in January-September 2023.

The third category – electric heavy goods carriers – has seen a 45% decline in sales to 163 units from the 297 units sold in January-September 2023. This has meant their share of the e-CV segment has fallen to 2% from 9% a year ago.

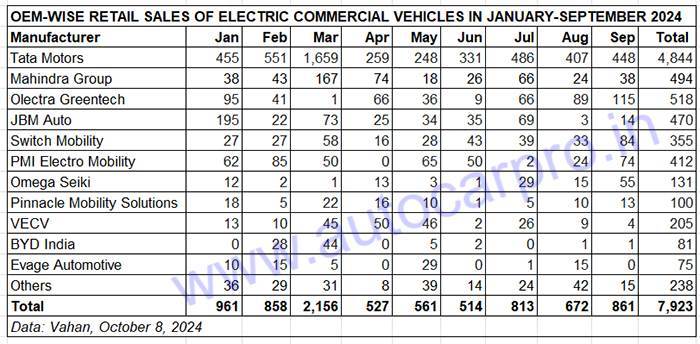

Let’s take a look at how the main players have fared in September 2024 and in the first nine months of this year.

TATA MOTORS’ SHARE AT 61% IN JANUARY-SEPTEMBER 2024

In terms of OEM retails which constitutes combined sales tally of goods carriers and passenger-transporting buses, Tata Motors is the strong e-CV market leader with 448 units in September (comprising 271 light goods carriers and 177 e-buses) and 4,844 units in January-September 2024 (comprising 1,235 buses). This performance gives Tata Motors a market share of 52% in September and 61% in January-September.

Of the total 4,844 e-CVs sold, light goods carriers account for 3,609 units for 74.50% while e-buses (1,235 units) account for the balance 25.50 percent. The strong numbers for e-LCVs/SCVs can be attributed to the launch of the new Ace EV 1000 small mini-truck in May this year. This zero-emission SCV offers a higher rated payload of one tonne and a certified range of 161km on a single charge. Targeted at last-mile mobility providers, the newest variant of the Ace EV has been developed to address evolving needs of sectors like FMCG, beverages, paints and lubricants, and dairy.

Olectra Greentech has sold a total of 518 e-CVs including 502 buses in the January-September 2024 period.

The electric bus-only JBM Auto has sold a total of 470 units in the first nine months of 2024, which gives it a current market share of 15% in the e-bus market and 6% in the overall e-CV market.

Switch Mobility, the electric commercial vehicle arm of Ashok Leyland has sold a total of 355 e-CVs in the first nine months of 2024 comprising 184 light goods carriers and 171 e-buses.

ALSO READ:

Electric car and SUV sales in September lowest in 19 months: 5,733 units

Electric 2W sales jump 40% in September, Bajaj Chetak outsells TVS iQube, Ola share falls to 27%

Bajaj Auto sells 5,000 electric 3Ws for the first time in September, market share rises to 8%