Read by: 100 Industry Professionals

In the third quarter of 2024, the Indian automotive sector experienced significant growth, recording 32 deals worth USD 1.9 billion across mergers and acquisitions (M&A), private equity (PE), initial public offerings (IPO), and qualified institutional placements (QIP), according to a Grant Thornton report. This represents the highest quarterly activity since Q4 2021 and a 30% increase in deal values from Q2 2024, signaling renewed investor confidence.

M&A activity

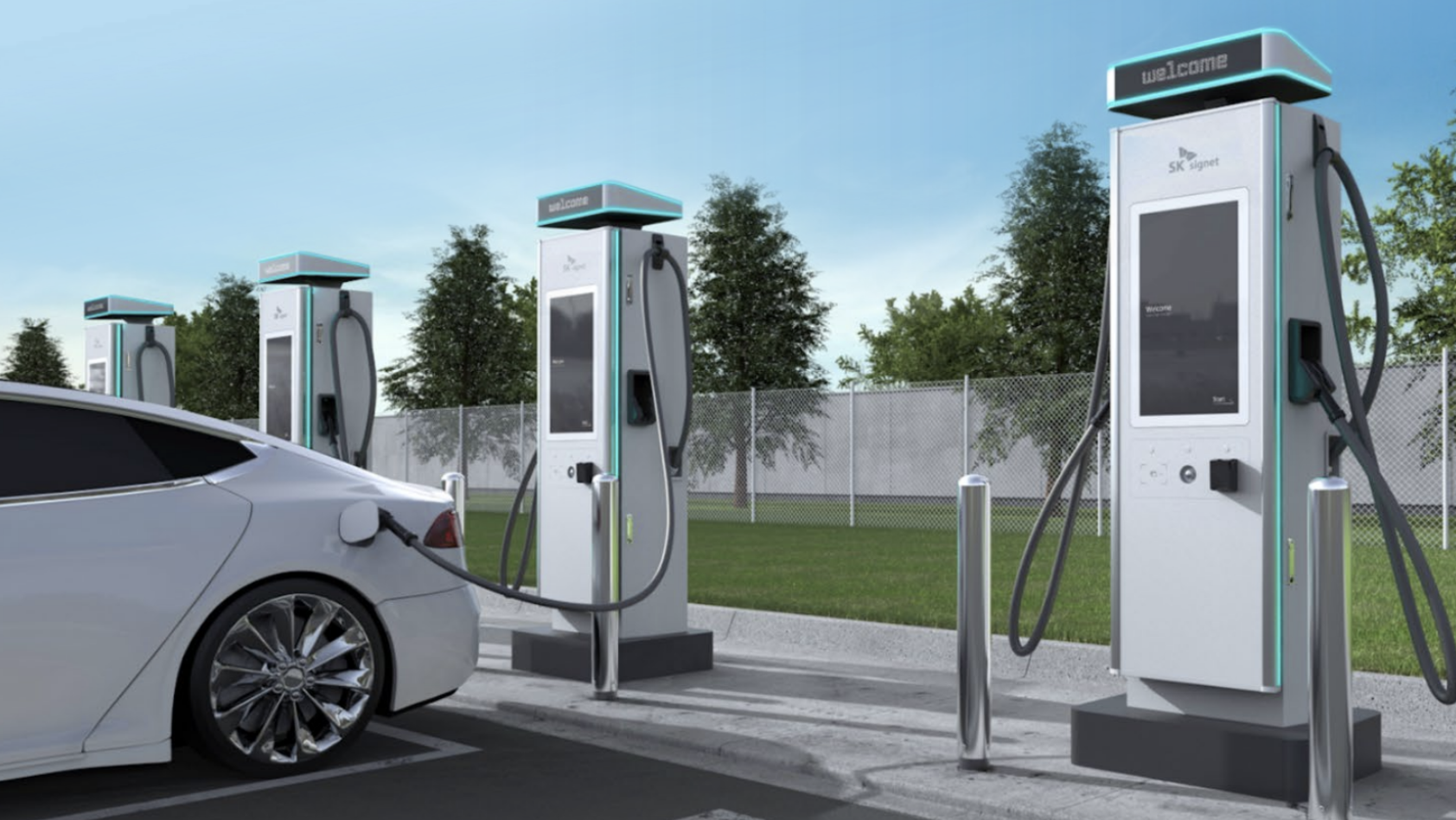

The M&A activity saw a notable rebound with 6 deals valued at USD 74 million, marking a 20% increase in volume and a 30% rise in value compared to Q2 2024. A major M&A deal of the quarter was Exicom Tele-Systems Ltd‘s USD 30 million acquisition of charging technology company Tritium Pty Ltd.

“With government support through the PM E- DRIVE scheme and the industry’s focus on alternative fuel technologies, we expect increased global PE investments and partnerships, positioning India as a leading export hub for electric and smart mobility solutions,” said Saket Mehra, Partner, Grant Thornton Bharat.

PE and VC

The PE and VC landscape grew significantly, with 22 deals worth USD 542 million, reflecting a 30% increase in value from the previous quarter. The EV and Mobility-as-a-Service (MaaS) subsectors led this growth with 17 deals totaling USD 518 million. WestBridge Capital’s USD 200 million investment in Rapido was among the high-value deals, and the average deal size increased to USD 25 million, indicating growing investor confidence.

Global players like Carlyle are also eyeing India’s automotive sector, developing USD 400 million platforms to acquire and merge mid-market companies specializing in EV technologies.

IPO and QIP

The IPO and QIP landscape in Q3 2024 also saw increased activity with two IPOs worth USD 768 million and two QIPs raising USD 470 million. Notably, Rapido and Ather Energy became unicorns, and Ola Electric’s multi-million-dollar IPO provided a significant boost to the sector.