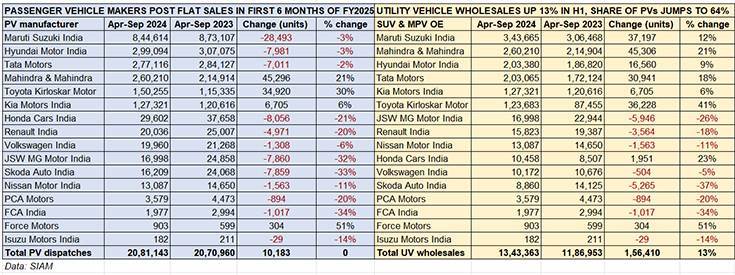

The overall passenger vehicle (PV) segment which comprises hatchbacks, sedans and utility vehicles, as expected, has registered flat wholesales of just 0.5% in the April-September 2024 period. As per the PV OEM dispatch data released by industry body SIAM, all 16 OEMs dispatched a total of 20,81,143 units, just 10,183 units more than they did in the year-ago six-month period.

While the April-June 2024 quarter saw sales of 10,26,006 units, up 3% YoY, the July-September 2024 quarter saw dispatches of 10,55,137 PVs, down 1.8% YoY, clearly indicating the slowdown in the past three months as a result of tepid consumer demand and high levels of inventory at dealers, which OEMs continue to rationalise, and disruption due to heavy rain in different parts of the country.

As it had in August, dealer body FADA, in early September, had red-flagged the high inventory levels in the passenger vehicle industry stating that stock days had stretched to 70-75 days and there was inventory totalling 780,000 vehicles, valued at Rs 77,800 crore. FADA, in its statement, had urged “banks and NBFCs to intervene and immediately control funding to dealers with excessive inventory. Dealers must also act swiftly to stop taking on additional stock to protect their financial health. OEMs, too, must recalibrate their supply strategies without delay, or the industry faces a potential crisis from this inventory overload. If this aggressive push of excess stock continues unchecked, the auto retail ecosystem could face severe disruption.”

At halfway stage in FY2025, PV sales at 20,81,143 units (up 0.5%) are 49% of FY2024’s record 42,18,746 units. In comparison, UV dispatches at 13,43,363 units (up 13.2%) are already 53% of the record 25,20,691 units sold in FY2024.

At halfway stage in FY2025, PV sales at 20,81,143 units (up 0.5%) are 49% of FY2024’s record 42,18,746 units. In comparison, UV dispatches at 13,43,363 units (up 13.2%) are already 53% of the record 25,20,691 units sold in FY2024.

UV share of PV sales scales a new high: 64% vs 57% in H1 FY2024

The H1 FY2025 wholesales PV data table for 16 manufacturers shows plenty of red ink, with 12 registering a year-on-year sales decline including the top three – Maruti Suzuki (844,614 units, down 3%), Hyundai Motor India (299,094 units, down 3%) and Tata Motors (277,116 units, down 2%). Mahindra & Mahindra (260,210 units, up 21%), Toyota Kirloskar Motor (150,255 units, up 30%), Kia India (127,321 units, up 6%) and Force Motors (903 units, up 51%) are the four OEMs to post YoY growth.

Of the three sub-segments, passenger car and sedan dispatches continue to be down – the 660,098 units in H1 FY2025 are down 18.5% YoY while vans, at 77,682 units, were up 5.3% YoY. Utility vehicles (SUVs and MPVs) remain the bulwark of the overall PV segment and help buffer the slowdown in demand for cars and sedans.

Total wholesales of utility vehicles (UVs) at 13,43,363 units are up 12.2% YoY (H1 FY2023: 11,86,953 UVs), which translates into 156,410 additional UVs being dispatched between April and September 2024 over the year-ago period.

Maruti Suzuki India maintains its UV leadership in H1 FY2025 with 343,665 units, up 12% and dispatches of an additional 37,197 units. This gives it a UV market share of 25% compared to 26% in H1 FY2024.

Mahindra & Mahindra, which is riding a wave of demand for its SUVs, dispatched 260,210 units for register 21% YoY growth. At an additional 45,306 units over H1 FY2024’s 214,904 units, M&M is the biggest gainer. Its H1 FY2025 UV market share stands at 19% compared to 18% a year ago.

Hyundai Motor India, with 203,380 UVs, posted a 9% YoY increase and has a market share of 15% in H1 FY2025 vs 16% in H1 FY2024.

Just 315 UVs behind Hyundai, Tata Motors’ wholesales of 203,065 units are up 18% YoY and has a current UV market share of 15% compared to 14.50% a year ago.

Toyota Kirloskar Motor, which is also seeing robust demand for its SUVs and MPVs, clocked wholesales of 123,683 units, up 41% YoY. This performance sees Toyota’s UV market share rise to 9.20% from 7.36% in H1 FY2024.

Kia India, with 127,321 units, posted 6% YoY growth and has a current market share of 9.47% compared to 10.16% a year ago.

The top six OEMs have dispatched a total of 12,61,324 UVs to their dealers across India between April-September 2024, which gives them a 94% share of the UV market, leaving the balance 6% to the other 10 players.

At halfway stage in the current fiscal year, PV sales at 20,81,143 units (up 0.5% YoY) are 49% of FY2024’s record 42,18,746 PVs (up 8.4% YoY). In comparison, UV dispatches at 13,43,363 units (up 13.2% YoY) are already 53% of the record 25,20,691 UVs sold in FY2024, when the UV share of overall PV wholesales was 60 percent.

ALSO READ: September retail sales lowest in 9 months and down 9%, OEMs target festive October to revive demand