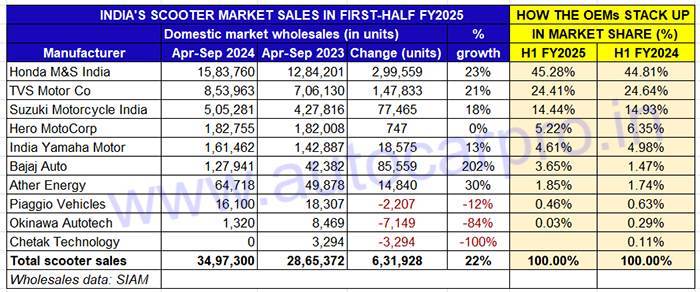

Honda Motorcycle & Scooter India’s (HMSI) dominance of the scooter market continues unabated. With 1.58 million units of the 110cc and 125cc Activa scooters dispatched to its dealers across the country in the first six months of FY2025, HMSI has clocked strong 23% YoY growth on a high year-ago base. This sees the company increase its market share to 45.28% from 44.81% a year ago. In FY2024, HMSI had sold a total of 25,30,667 Activas – its H1 FY2024 total is already 62% of that total albeit that’s much below the 3.15 million Activas sold in FY2018 or 3 million sold in FY2019.

Of the three two-wheeler segments, in terms of YoY growth per se, the scooter segment (3.49 million units) has posted the highest increase of 22%, followed by motorcycles (6.40 million units, up 13%) and mopeds (259,793 units, up 16%). As a result, the scooter segment’s share of overall two-wheeler sales in the April-September 2024 period stands at 34.40%, up from 33% in H1 FY2024. And growth has come to all but two of the nine scooter manufacturers and SIAM members.

TVS Motor Co, the longstanding No. 2 scooter OEM, dispatched 853,963 units in April-September 2024, up 21% YoY (similar to its Q1 FY2025 growth rate). The dispatches comprise 730,990 units of the flagship Jupiter and NTorq scooters (up 21%) and 122,973 units of the electric iQube (up 28%). TVS’ market share is marginally down to 24.41% from 24.64% in H1 FY2024.

TVS Motor Co, the longstanding No. 2 scooter OEM, dispatched 853,963 units in April-September 2024, up 21% YoY (similar to its Q1 FY2025 growth rate). The dispatches comprise 730,990 units of the flagship Jupiter and NTorq scooters (up 21%) and 122,973 units of the electric iQube (up 28%). TVS’ market share is marginally down to 24.41% from 24.64% in H1 FY2024.

Suzuki Motorcycle India is the only other OEM to have sold over half-a-million scooters in H1 FY2025. The company dispatched 505,281 units to post 18% YoY growth and currently has a market share of 14.44 percent. The company, which sells the 125cc Access, Avenis and Burgman, would have seen strong demand for the Access 125 which remains a popular buy.

Hero MotoCorp, with 182,755 units in April-September 2024, sees flat sales (H1 FY2024: 182,008). The sales comprise 156,220 IC-engined scooters (Pleasure+, Maestro Edge and Destini 125 – down 11% YoY) and 26,535 Hero Vida electric scooters. Had it not been for the 357% YoY increase in Vida sales albeit on a low year-ago base (H1 FY2024: 5,800), Hero MotoCorp’s overall scooter numbers would have been in the red.

India Yamaha Motor, which retails three scooters – the 125cc Ray and Fascino, and 155cc Aerox – sold a total of 161,462 units, up 13% YoY between April and September this year. While combined Ray and Fascino sales at 138,350 units rose 9%, Yamaha also sold 10,854 units of the Aerox, an increase of 139% YoY. On April 14, the company had launched the keyless ignition Aerox Version S at Rs 151,000, which indicates the company has benefited from the new launch

Bajaj Auto, which was ranked seventh a year ago, moves up one place to sixth. The company, whose sole scooter is the electric Chetak, had a strong opening quarter in FY2025 with 40,854 Chetaks sold, up 96% YoY (April-June 2023: 20,834 units). Now, in the first-half of the current fiscal year, six-month Chetak sales at 1,11,241 units are a strong 162% YoY increase (H1 FY2024: 42,382 units).

What’s more, in September, just ahead of the festive season opening on October 3 with Navratri and going on to Diwali in November, Bajaj dispatched 28,517 Chetaks – its highest monthly wholesales yet. This is the third straight month of over 21,000 sales after July (21,064) and August 21,756). In June this year, the zero-emission Bajaj two-wheeler surpassed the cumulative 200,000 sales milestone, with the last 100,000 units being sold in just eight months. With this performance, Bajaj Auto has more than doubled its scooter market share to 3.65% from 1.47% in H1 FY2024.

Ather Energy, the other all-electric scooter maker in the fray in positive territory, clocked wholesales of 64,718 units, up 30% YoY. Ather’s share in the overall scooter market is now 1.85%, up from the 1.74% it had a year ago.

How will demand shape up for the scooter and the overall two-wheeler industry in the months to come? From the looks of it, there should be good growth to be had, kicking off with the ongoing festive season. The revival of demand from rural India, new model availability as well as an uptick in urban consumer buying augur well for this segment.

ALSO READ:

Honda Activa sales cross 10 million units in South India, last 5 million in 7 years