With electric two-wheeler retail sales hitting a high note in the first six months of FY2025 at nearly 800,000 units (up 31% YoY), and the 32-day festive season in India having opened on October 2, both TVS Motor Co and Bajaj Auto are targeting strong retail sales this month and also in November, which opens with the festival of lights – Diwali – and should see robust retail sales.

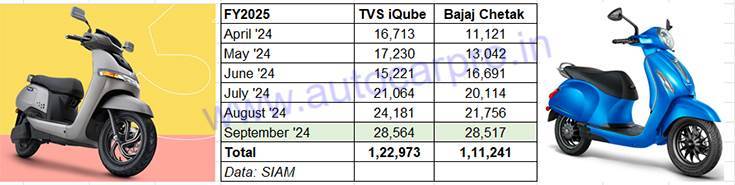

To ensure that their showrooms are well stocked, both OEMs have registered their highest monthly dispatches of electric scooters in September – both dispatching over 28,000 units (wholesales) to their dealers across India. While TVS Motor Co has dispatched 28,564 iQubes, bettering its previous monthly best of 24,181 units in August 2024, Bajaj Auto has sent out 28,517 Chetaks, improving upon its August 2024 score of 21,756 units.

Both OEMs, which are the No. 2 and No. 3 players in the electric two-wheeler industry after Ola Electric, have also scaled a new high for first-half fiscal sales. While TVS’s 122,973 iQubes in April-September 2024 are an increase of 28% YoY (H1 FY2024: 96,071 units), Bajaj Auto, with 111,241 Chetaks in H1 FY2025 has registered YoY growth of 162% (H1 FY2024: 42,382 units).

While TVS’ 122,973 iQubes in H1 FY2025 are up 28% YoY (H1 FY2024: 96,071 units), Bajaj Auto, with 111,241 Chetaks has registered YoY growth of 162% (H1 FY2024: 42,382 units).

While TVS’ 122,973 iQubes in H1 FY2025 are up 28% YoY (H1 FY2024: 96,071 units), Bajaj Auto, with 111,241 Chetaks has registered YoY growth of 162% (H1 FY2024: 42,382 units).

In an effort to accelerate demand for its iQube, on October 9, TVS announced a cashback offer enabling consumer benefits of up to Rs 30,000 across select states in India. This offer is open until October 31, 2024. The zero-emission, five-variant TVS iQube has a starting price of Rs 89,999 (ex-showroom Maharashtra).

Meanwhile, Bajaj Auto, whose Chetak has a starting price of Rs 95,998 (ex-showroom Bengaluru) for the Chetak 2903 and rising to Rs 127,244 for the Chetak 3201 and Rs 128,744 for the Chetak 3201 SE, is also upping the ante to achieve even faster sales traction. On September 4, the company launched the Chetak Blue 3202 at Rs 115,000 (ex-showroom, Bengaluru). The Blue 3202 is the renamed Urbane variant with new cells that give it more range while still having the same battery capacity.

In mid-September, Bajaj Auto announced its partnership with Kendriya Police Kalyan Bhandar (KPKB) to offer the Chetak 2903 to KPKB beneficiaries across India. As part of this tie-up, Chetak Experience Centres across India are now authorised to sell the Chetak 2903 to KPKB beneficiaries at special rates. The KPKB serves the needs of the Central Armed Police Forces, which includes the BSF, CRPF, CISF, ITBP, SSB and Assam Rifles. The benefits also extend to various Central Police Organizations such as the IB, BPRD, and NCRB among others.

INTENSE LEADERSHIP BATTLE UNDERWAY: TVS iQUBE CROSSES 400,000 WHOLESALES

The battle between these two-wheeler legacy players for supremacy in the EV market has grown even more intense in the first six months of FY2025. The wholesales (dispatches to dealers) gap between them at the end of September, for the April-September 2024 period, is 11,732 units. In FY2024, at end-March 2024, the two OEMs were separated by 74,194 units, both having hit their all-time highs – TVS with 189,896 iQubes and Bajaj with 115,702 Chetaks.

While the wholesales gap between the iQube and Chetak is 11,732 units in H1 FY2025, the retail sales difference stands at 9,116 units.

While the wholesales gap between the iQube and Chetak is 11,732 units in H1 FY2025, the retail sales difference stands at 9,116 units.

On the retail front, the sales gap for the first six months of FY2025 stands at 9,116 units. While TVS had delivered 88,151 iQubes to buyers, the Bajaj Chetak has gone home to 79,035 units. Both are well below market leader Ola, which has retailed 197,432 units between April and September 2024.

In the current fiscal, TVS and Bajaj Auto, which entered the Indian electric two-wheeler industry in the same month (January 2020), have both registered new cumulative sales milestones for their electric scooters. Both the legacy players are making their presence felt in a field teeming with EV start-ups. Ather Energy, the Bengaluru-based smart e-scooter maker, has clocked 64,718 wholesales in H1 FY2025, up 30% YoY (H1 FY2024: 49,878 units). Hero MotoCorp, the third legacy OEM after TVS and Bajaj, has posted wholesales of 26,535 units in April-September 2024 – 20,735 units more than the 5,800 Vidas it sold in H1 FY2024.

In terms of cumulative sales, the TVS iQube maintains a huge lead over the Bajaj Chetak. Both EVs were launched in the same month: January 2020.

In terms of cumulative sales, the TVS iQube maintains a huge lead over the Bajaj Chetak. Both EVs were launched in the same month: January 2020.

Cumulative wholesales-wise from launch in January 2020 through till end-September 2024, the TVS iQube (421,419 units) maintains a huge lead of 148,422 units over Bajaj Auto (272,997 units) as a result of the big sales difference in FY2023 and FY2024 (see data table above). However, the Chetak is setting a fast pace since the past year. In June 2024, the Chetak (16,691 units) even went ahead of the iQube (15,221 units) and also in August.

In the process, TVS Motor Co has become the first legacy OEM to cross 400,000 EV sales in India. While the TVS iQube surpassed the 300,000-units mark in early April 2024, the 400,000-unit wholesales milestone has been crossed in early September, which means the last 100,000 units have come in just around six months. On the marketing network front, TVS Motor Co currently has around 750 dealers and sub-dealers spanning over 450 cities across India.

Bajaj Auto topped the 200,000 milestone in June 2024, with the last 100,000 Chetaks sold in just eight months. At present, the Chetak is 27,003 units shy of the 300,000 mark, which it should achieve by end-October 2024.

What is giving the Chetak new verve in the market is the ramped-up production and a growing dealer network, which is to be expanded from its existing presence in over 170 cities and 250 touchpoints to around 1,000 by September 2024. What’s more, Bajaj Auto is also soon to further up the ante with the launch of a new mass-market e-scooter under the Chetak brand umbrella.

With stiff petrol prices and most Indian states offering incentives to accelerate electric mobility, both the Bajaj Chetak and TVS iQube should continue to see robust demand in the coming months. Ola Electric remains the e-two-wheeler market leader but in an expanding marketplace with new products, what ticks the boxes for both TVS and Bajaj is their strong brand image, reliable aftersales support and an expanding product and market strategy.

ALSO READ: Top 5 two-wheeler OEMs target festive fervour, dispatch 1.85 million units to dealers in September

Two-wheeler sales hit 10 million units in H1 FY2025 after six years, scooters up 22%, bikes by 13%