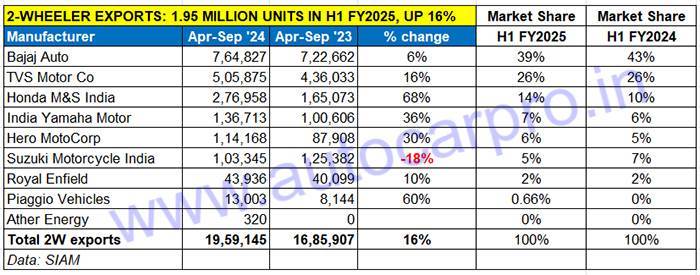

The Indian two-wheeler industry, which comprises motorcycles, scooters and mopeds, is currently witnessing a good run, both in the domestic and export markets. In the domestic market, between April and September 2024, 1,01,64,980 units – or a little over 10 million units – were dispatched to dealers across the country, registering strong 16.31% YoY growth (H1 FY2024: 87,39,406 units). 2W Inc is also doing well on the export front – in first-half FY2025, total overseas shipments from nine OEMs were 19,59,145 units – an additional 273,328 two-wheelers – resulting in a 16% YoY increase (H1 FY2024: 16,85,907 units)

While motorcycle exports at 16,41,804 units (up 15.60%) account for 84% of total exports till end-July 2024, scooter shipments at 314,533 units are up 19% YoY (April-September 2024: 264,955 units).

Bajaj Auto remains the undisputed No.1 two-wheeler exporter, with overseas dispatches of 764,827 units (up 6% YoY) and comprise 764,825 motorcycles (up 6%) and two Chetak electric scooters. This gives Bajaj Auto an export market share of 39%, slightly down from 40% in Q1 FY2025 and four percentage points down from the 43% it had in H1 FY2024.

Bajaj Auto is betting big on Brazil to be amongst its top three global markets.

Bajaj Auto is betting big on Brazil to be amongst its top three global markets.

In the entry-level up to 110cc fuel-efficient motorcycle category, the company’s exports were down 26% to 249,367 units, reflecting the distress in some key African markets. Export demand for Bajaj bikes though improves as the cubic capacity grows higher. The 110-125cc category fared much better – 185,134 units, up 43% YoY. The 125-150cc category saw exports of 115,052 units, up 47 percent. Dispatches in the 150-200cc category (Husqvarna, KTM, Pulsar) at were up 12% at 125,050 units. Next up is the 200-250cc segment where 48,019 units were exported, up 27 percent. And, with exports of made-in-Inda Triumph motorcycles kicking off in Q1, demand in the 350-500cc category in April-September 2024 rose strongly by 46% to 42,203 units.

Bajaj Auto is betting big on Brazil to be amongst its top three global markets. In June 2024, Bajaj Brazil had commissioned its new plant in Manaus Free Trade Zone, Brazil, with an annual capacity of 20,000 units on a single-shift basis and rolling out motorcycles under the ‘Dominar’ brand.

TVS Motor Co, the longstanding No. 2 exporter, dispatched over half-a-million two-wheelers, up 16% YoY, which gives it an export market share of 26% in H1 FY2025, the same as in H1 FY2024. The shipments comprised 448,238 motorcycles (up 20%), 54,829 scooters (down 14%) and 2,808 mopeds (up 293%). TVS currently sells its two-wheelers in over 80 countries in key markets across Asia, Africa and Latin America.

In the past year, the company has strategically entered new markets like Nepal, Vietnam, and France. And it has also begun exporting the made-in-Hosur BMW CE 02 electric scooter as well as its own iQube electric scooter. In the last six months, TVS’ EV exports are 4,085 units comprising the CE 02 and the TVS iQube (to ASEAN and Asian markets).

In the past year, the company has strategically entered new markets like Nepal, Vietnam, and France. And it has also begun exporting the made-in-Hosur BMW CE 02 electric scooter as well as its own iQube electric scooter. In the last six months, TVS’ EV exports are 4,085 units comprising the CE 02 and the TVS iQube (to ASEAN and Asian markets).

On October 17, TVS launched the five-geared HLX 125 commuter motorcycle in Kenya. Exported since 2014, the TVS HLX has seen strong buying in rural and urban regions across Asia, Africa, the Middle East and LATAM.

Honda Motorcycle & Scooter India, which is currently making strong moves in the domestic market and hard on the heels of market leader Hero MotoCorp, exported 276,958 two-wheelers, up 14% YoY. This comprised 172,290 scooters, which is a strong 65% increase YoY, and 1,04,668 motorcycles, up 72% YoY. This strong performance has resulted in HMSI’s export market share growing to 14% from 10% a year ago, making it the OEM with the highest percentage of increase in the past six months.

Honda is working on a strategic export growth programme. On April 18, HMSI inaugurated a state-of-the-art engine assembly line at its Global Resource Factory in Manesar, Gurugram (Haryana), with a focus on CKD (Completely Knocked Down) exports. The new assembly line has a manufacturing managing of 600 engines a day and can produce engines for models ranging from 110cc to 300cc, catering to diverse needs and preferences of Honda customers globally.

India Yamaha Motor, which was ranked fifth in Q1 FY2025, has moved to No. 4, ahead of Hero MotoCorp with 136,713 units, up 36% YoY. The bulk of its exports comprised bikes – 1,02,989 units, up 23 percent. The key volume contributors were the FZ and SZ (57,860, up 38%) Crux (24,670, up 52%). Export demand for Yamaha scooters doubled – the 33,724 units in H1 FY2025 were up 100% YoY and comprised 33,544 Fascino and Ray and 180 Aerox.

Hero MotoCorp, the world’s largest two-wheeler manufacturer and the domestic market leader, is upping the ante on its global manufacturing footprint. The company, which entered the growing Southeast Asian market by commencing operations in the Philippines on August 1, 2024, plans to now bring Brazil into its ambit.

In an investor presentation in July, Hero MotoCorp confirmed that operations will start in Brazil in Q4 FY2024 (January-March 2025). In May this year, the company had said it had plans to set up a new wholly owned subsidiary in Brazil, to manufacture and distribute two-wheelers, including parts and accessories. The Brazilian operations is most likely to be named ‘Hero MotoCorp do Brasil Ltd’, with investment in phases

The company is witnessing demand rise for its exports – the 114,168 units in April-September represent a 30% YoY increase and comprises 99,174 bikes (up 40%) and 14,994 scooters (down 14%). The company now has three overseas assembly plants – in Bangladesh (150,000 units per annum), Colombia (80,000 per annum), Nepal (75,000 units per annum) and the Philippines (150,000 units per annum).

Suzuki Motorcycle India is the sole OEM to see a decline in its export – 103,345 units, down 18%, with its performance dragged down by the 45% YoY decline in scooter dispatches (29,868 units). Suzuki motorcycle shipments at 73,477 units were up marginally by 4% YoY. This performance has meant that its export market share is down to 5% from 7% a year ago.

Royal Enfield dispatched a total of 43,936 bikes in the first six months of FY2025, up 2% YoY. RE’s line-up includes the Hunter 350 roadster, Meteor 350, Super Meteor 650 cruiser, Interceptor 650 and Continental GT 650 twins, Shotgun 650, the all-new Himalayan adventure tourer, the Scram 411 ADV Crossover, and the Bullet 350 and Classic 350. Along with its two production facilities at Oragadam and Vallam Vadagal, near Chennai. Royal Enfield also has five modern CKD assembly facilities in Nepal, Brazil, Thailand, Argentina and Colombia.

FY2025 EXPORT GROWTH OUTLOOK: OPTIMISTIC

What is heartening is that the reviving two-wheeler export growth story is benefiting all the major OEMs, which augurs well for India Two-Wheeler Inc. Strong domestic sales can only add tailwind to that growth trajectory.

Judicious management of both domestic and export market sales help inventory management as well as capacity utilisation. Bajaj Auto, TVS and Honda have each recorded smart export growth in the first half of FY2025 and with demand picking up in key global markets, it is expected things can only get better in the months to come. The icing on the export ‘cake’ is that the profit margins are often better on the made-in-India products.

ALSO READ: Maruti Suzuki takes huge lead in car, SUV exports in H1 FY2025, Volkswagen is the new No. 3

Vehicle exports from India rise 14% in H1 FY2025, SUVs, 2-wheelers and CVs drive revival