Amid slowing growth in FY-25 due to a high base, the personal mobility demand in the first half of the festive season has remained the slowest since Covid.

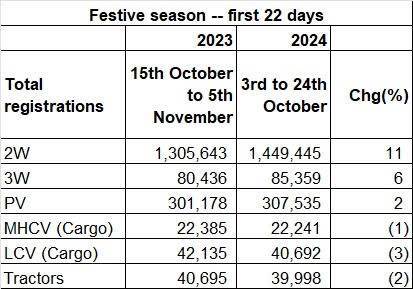

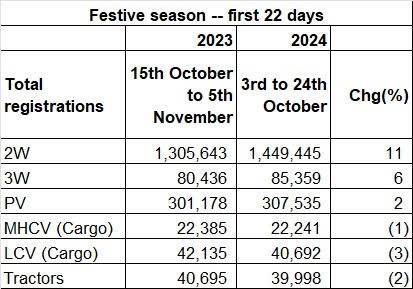

Despite the key festivities and attractive offers, the registration of new vehicles in the personal mobility segment, including two-wheelers and passenger cars, increased by 11% and 2% in the first 24 days of the festival starting on October 3, compared to last year’s 24 days period.

According to Vahan’s data, about 14.49 lakh units of two-wheelers were registered 3.07 lakh for passenger cars. The registration data for the first 24 days represents approximately 50-60% of total festival sales from last year.

Compared with festival volume data from the past three years, the current growth in the personal mobility segment shows a significant slowdown. Two-wheeler registration volumes grew by 29% and 21% during the last two festival periods, a 42-day period starting after Shraadh, while the passenger car segment grew by 37% and 10% during the same periods.

The 42-day festival period accounts for about 15% of total annual vehicle registrations, with an even higher share in the two-wheeler segment.

Among all vehicle categories, the two-wheeler segment showed the highest registration volume growth during the festival period, followed by three-wheelers at 6% and passenger cars at 2%.

The notable outlier in this period is the tractor and LCV segment, which experienced a 2% and 3% decline in registrations, respectively, with 39,998 units and 40692 units in the same order.

Regarding overall monthly registrations, two-wheeler registrations dropped by 8% to 1.2 million units in September, marking the first decline in 10 months. Passenger vehicle registrations also fell by 17% to 2.8 lakh units during the same period. September was the second consecutive month of decline in passenger vehicle registrations, a trend not seen in nearly 28 months.

However, the tractor segment saw a 17% year-on-year growth, with 57,137 units registered, after experiencing declines for four consecutive months.

Kumar Rakesh, Analyst – IT & Auto of BNP Paribas India , in his review of festive season sales, said, “Based on the historical progression of the festive season, if the current trend continues, the y-y growth during this year’s festive season is trending to be 10% for 2Ws, 11% for Mopeds, 1% for PVs, 11% for 3Ws and -4% for Tractors. (based on the registration Vahan data.”

Interestingly, according to the BNP Paribas analysis, the demand for electric and CNG vehicles continued outperforming the internal combustion engine, albeit on a low base.

Rakesh Sharma, executive director of Bajaj Auto, told media after the Q2 earnings call that the ongoing festival season has failed to bring joy to the motorcycle industry, with growth in sales volumes not meeting expectations.

According to Sharma, the overall increase in motorcycle sales during the full festival season is expected to be limited to 5%.

The exact reason for such muted growth is unclear, Sharma said but noted that disruptions caused by delayed monsoons, assembly elections in some states, and unrest in the northeast, which is a good two-wheeler market, could be probable reasons.

C S Vigneshwar, president of the Federation of Automobile Dealers Association, said the dealers had witnessed “fantastic footfalls and inquiries” during the Navratri and Dussehra periods, and retail sales are up 10% yearly.

“We are hopeful for an even stronger finish to the festive season as we go along,” Vigneshwar added, without commenting on the exact growth rate, “No comments on the exact figures, but we believe it will be good.”

Some brands like Hyundai have managed to buck the trend.

Tarun Garg, the whole time Director & Chief Operating Officer at Hyundai Motor India told Autocar Professional

The Navratri and Dussehra periods have started on a very positive note for HMIL. We witnessed an all-India growth of 37% in Vahan Registrations from 1st October to 17th October 2024 over the same period last month. As regards the Onam period, i.e. 17th August to 30th September 2024, we observed a double-digit growth in retail sales over the same period last year in Kerala state.