The long-rumored Grab acquisition of Uber’s Southeast Asia business may be official now, but it’s far from complete.

In fact, what should be a celebratory coming-of-age moment for the Southeast Asian local champion is threatening to become nightmarish thanks to persistent regulators, panicky Uber staff and reluctant drivers who are supposed to switch to Grab as part of the arrangement.

The agreed-upon deal sees Uber taking a 27.5 percent stake in Grab and exiting Southeast Asia’s unprofitable market.

Those moves free up Uber resources for use in other geographies where they can be used more effectively. In exchange, Singapore-based Grab gets the operational front of Uber in the region including its ride-hailing business and Uber Eats food delivery service. Meanwhile, most of the 500 employees Uber enlisted across its eight markets in the region and the drivers on its platform now have the option to migrate to Grab.

Grab’s desired outcome was simple: remove the threat of its immediate rival and beef up its business with new hires and drivers. In short, it moves loss-making Grab farther along the path to profitability far more quickly, as CEO Anthony Tan has said.

The two parties proposed a quick Uber exit — with the app scheduled to close on April 9, two weeks after the deal. UberEats would roll into the GrabFood service by the end of May.

For Grab, with hundreds of open vacancies, a key component was the Uber staff acquisition and the migration of Uber passengers and drivers.

Now, one month after the deal, things aren’t going to plan. The whole transaction will take longer than initially imagined — potentially as long as a few months to be settled in full — leaving millions of confused customers stranded on the curb.

One of Grab’s offices in Singapore (Jon Russell/Flickr)

Regulatory concerns

Most obviously, Grab has had a tougher challenge with regulators than it initially anticipated.

Roughly one month after the deal was announced the Uber app remains operational in Singapore, and had been extended for one week in the Philippines, both changes made at the request of anti-trust regulators who sought more time to assess the implications of the deal. A number of other governments in Southeast Asia, including Indonesia and Malaysia, are lining up to weigh in on the merger, too.

Singapore, where Grab is registered, has been the most active.

The Competition and Consumer Commission of Singapore (CCCS) pushed the deadline for the removal of Uber’s app back to May 7 — one month later than originally scheduled — so it could examine the deal. The commission also ordered Grab and Uber to “maintain pre-transaction independent pricing, pricing policies and product options” while it pored over the details.

The CCCS thinks it has “reasonable grounds” to suspect that the deal may run afoul of section 54 of Singapore’s Competition Act regulating against overly dominant monopolies.

These extensions in both Singapore and the Philippines mean additional expenses for Grab, which is paying for costs and helping manage the continuation of Uber’s app in Southeast Asia. Uber has shrugged off any responsibility.

“Uber exited eight markets, including the Philippines, as of Monday. Now, I look after 10 markets, instead of 18. Our funding is gone. Our people are gone. We don’t intend to come back to these markets,” Brooks Entwistle, head of Uber’s Asia Pacific business, told the anti-competition commission in the Philippines earlier this month, according to Rappler.

Keeping Uber open while the deal is scrutinized is undoubtedly a good thing to do, but in this scenario, the service is barely Uber.

For a start it only covers Singapore, and drivers and passengers in the tiny city-state rightly are confused after initially being told Uber’s service would fold. That’s before acknowledging that the Uber app is being financed by Grab — a situation so absurd that Monty Python may want to license the rights.

Both Uber and Grab are guilty of contributing to this current state of uncertainty. In setting out a two-week timeframe for sunsetting the app without consulting with regulators first, the two companies were aggressive and naive at best, or, at worst, recklessly determined to push their deal through without concern for the regulatory bodies whose approval they needed.

A Grab representative told TechCrunch that it contacted CCCS “informally” ahead of the deal, but the CCCS called the deal an “unnotified merger transition.” Neither Grab nor Uber were required by law to contact authorities in Singapore ahead of time, but doing so — or providing a longer timeframe because the planned closure — would clearly have avoided this situation.

Despite the inconvenience and cost, Grab did ultimately get what it wanted since Uber has left the region regardless of regulator demands, as Reuters noted, but other issues remain that should concern the Singapore-based company.

Regulators in Singapore and the Philippines demanded Grab maintain the Uber app for an additional week (Photo by studioEAST/Getty Images)

Uber employees ‘let down’

One critical part of the proposed merger is Grab’s potential ability to pick up an estimated 500 Uber employees in the region. It may be easy to overlook given the wider story of Uber’s global retrenchment, but TechCrunch understands from sources that it was a major focus for Grab.

Not only is Grab keen to fill at least some of the nearly 500 vacancies within the company, but it was particularly eager to avoid a migration of Uber staff moving en masse to direct rivals like Go-Jek in the ride-hailing space or food delivery services Deliveroo and FoodPanda.

Early signs indicate that Grab’s best laid plans are falling apart.

From conversations with over a dozen Uber staff, across various countries and management levels, TechCrunch has heard that many in the workforce are uneasy at the prospect of joining Grab. A number told TechCrunch that they feel that Uber has abandoned them.

The chief concern is that the departing Uber Southeast Asia staff are not in control of their own destiny.

Aside from a small number of employees (estimated at around 50 people), Uber’s Southeast Asian workforce is not permitted to move internally to a different Uber region. Some said they were told that they are forbidden from even applying for other jobs within the company.

The restrictions all but force Uber’s employees to move over to Grab — whether they want to or not. The strong-arming doesn’t end there. Terms for exiting staff also push would-be former Uber staffers into Grab’s orbit, according to details supplied to TechCrunch.

If Grab decides to make an offer that includes a “substantially similar” salary to what they earned at Uber — and it isn’t entirely clear what “substantially similar” means — but the staffer doesn’t want to move over, then they will only receive the minimum statutory severance based on the local laws where they live.

The only way they get a package is if Grab doesn’t want them, and in that case it is the minimum.

Here’s the information bulletin Uber gave its staff on the day the merger was announced:

No one is losing their job today. Everyone who is transitioning to Grab will continue to be an Uber employee until they formally accept an offer, sign a Letter of Employment with Grab and resign from Uber.

If you get a role with Grab, you will not be eligible for any severance.

If you accept a role with Grab and later resign, you will not be eligible for a severance payment.

If Grab makes a substantially similar offer to you and you reject it, you will no longer have a role at Uber so your employment will end and you will be eligible for a severance payment. You will receive the minimum statutory severance based on the local law in your country.

If Grab makes you an offer that is not substantially similar and you reject it, you will be eligible for a severance payment. You will receive a minimum of four months’ base salary plus one minimum month per year of service (e.g. if you have two years of service, you will receive a total of six months severance (four months minimum plus two months based on your service.)

If you resign before receiving an offer from Grab, you will only receive your notice and other statutory entitlements.

If Grab is unable to find a suitable role for you, you will be notified and offered a severance package based on your years of service with Uber. You will receive a minimum of four months’ base salary plus one month per year of service.

As you can see, there is also no exit bonus for Uber’s Southeast Asia people.

That’s a surprise considering that the company offered ‘performance bonuses’ in China and Russia. There, it told people that their hard work and dedication to the cause had been appreciated and critical in striking potentially lucrative exit deals with Didi Chuxing and Yandex, respectively.

Since Uber’s exit from Southeast Asia is a more of a victory than a defeat — its large stake in Grab is set to increase in value over time — it’s no surprise that loyal staff would be disappointed at being shoved out of the door without so much as a tip or acknowledgement of their labor. But, in keeping with Uber’s previous management style, the company seems more adept at making messes, then compensating the folks who have to clean them up.

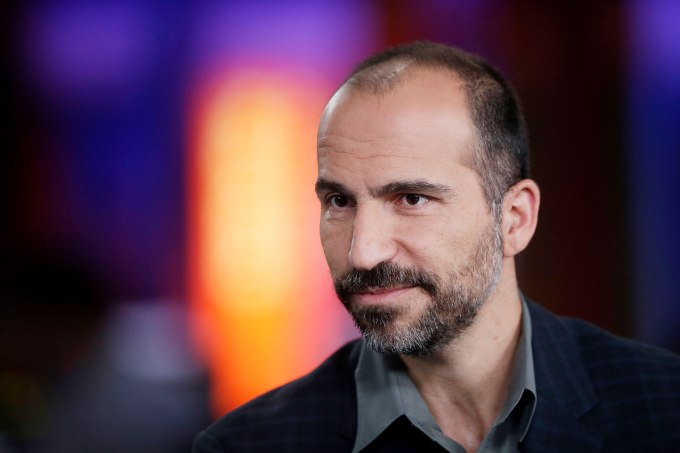

Dara Khosrowshahi has been criticized for not making direct contact with Uber employees in Southeast Asia. (Photographer: Matthew Lloyd/Bloomberg via Getty Images)

On top of all that, Uber CEO Dara Khosrowshahi has yet to make direct contact with the Southeast Asian staff. Several who spoke to TechCrunch were disappointed that they were not part of an internal all-hands video call with Khosrowshahi — which only included Uber’s ‘surviving’ staff in Southeast Asia.

“His arrival was billed as a positive change in culture for Uber, yet he hasn’t bothered to visit the office or even get in touch. Travis Kalanick did both when Uber China was sold to Didi,” one departing Southeast Asia-based Uber employee told TechCrunch.

Much of the discontent seems to center around communication issues.

TechCrunch understands from sources inside Uber that the company is making significant efforts to educate its staff over their options, including potentially allowing those who wish to stay within the company to do so. Uber has dispatched senior management and its head of HR for Asia Pacific and LATAM, Anika Grant, on an ’employee roadshow’ aimed at visiting each Uber Southeast Asia office in person to help staff assess their options in person.

Still, one of the biggest hurdles for both Uber and Grab is also one of the most basic. Simply getting in touch with departing Uber staff is challenging since they were removed from Uber’s system, including the email directory, as soon as the Grab deal was communicated. That’s common security protocol, but setting up and communicating new email address and phones numbers has made maintaining dialogue a challenge.

Those efforts are apparently underway, but most of the Uber employees who spoke to TechCrunch had not yet been contacted by Grab, and, in addition, most were unsure whether and when communication would happen in spite of Grab and Uber’s efforts. One source inside Uber suggested that it could be “months” before all Uber departures have been contacted by Uber or Grab and assessed for a future role at Grab.

Those employees will remain fully paid by Uber during that period, but it’s a long time to wait without updates. Already, though, a nightmare scenario is brewing for Grab.

Recruiters swarm

TechCrunch understands that Go-Jek, which is in the process of launching services in Vietnam, Singapore and the Philippines, is pouring its energies into recruiting Uber’s former staff members and the platform’s drivers in a bid to hit the ground running with its long-awaited regional expansion.

Go-Jek is trying to hire key personnel from Uber’s now-defunct Southeast Asia business

Go-Jek won’t, of course, take all the Uber alums, but these conditions certainly put it in a good position to cherry pick critical new hires to fill out its business outside of Indonesia. Other Grab rivals, including well-funded logistics startup NinjaVan, food delivery companies Deliveroo and FoodPanda, bike-sharing startups, and even the likes of Facebook, WeWork, Google and Netflix are understood to have hastily arranged interviews with Uber’s departing Southeast Asia staff in a bid to suck up new talent.

That’s precisely the scenario that Grab is trying to avoid.

There are also challenges on the driver side transition, too, with many who drove for Uber reluctant or unsure of whether to move over to Grab’s platform.

TechCrunch spoke to nearly a dozen drivers in Singapore, where Uber remains operational, and Thailand and Indonesia, where the service has shuttered.

In Thailand and Singapore, the drivers had already crossed over to Grab, but they complained about the experience. Chiefly that the app is inferior, that they are making less money and that they felt like they had no choice.

Grab has said earlier this month that it has signed up over 75 percent of all Uber drivers in Indonesia, but it doesn’t have data for other markets. No independent figures exist to offer a wider picture on the success of the driver transition so far.

“Drivers tend to feel like pawns when these rideshare giants merge. A lot of drivers have bought into driving for Uber and are comfortable with their experience so the idea of migrating to a new platform can be daunting,” Harry Campbell, who writes about ride-hailing experiences for drivers at The Ride Sharing Guy blog, told TechCrunch.

“One of the nice things about competition, is that it keeps these companies in check when it comes to fighting for drivers and treating them well. There’s a reason why many drivers opted for Uber in the first place,” added Campbell, who recently moderated a Q&A between U.S. drivers and Uber CEO Khosrowshahi.

That’s the opinion of one Uber driver in Singapore, who wrote on his blog that many drivers concerned with earning less with Grab still hope for a “miracle” that sees Uber remain. Added to that concern, TechCrunch reported this week that Go-Jek has held talks with Singapore’s largest taxi operator, ComfortDelGro, with the aim of becoming the firm’s ride-hailing partner. Comfort had previously inked an agreement with Uber.

Finally, customers themselves are having to get used to Grab instead of Uber. Many have been vocal with issues which range subjective claims, such as a perceived inferior experience on Grab, and also more quantifiable concerns that include higher pricing and longer waits for a ride.

On that note, Grab explained that operates a different pricing model. Rather than Uber’s approach of a lower distance-based fare with more emphasis on surge pricing, Grab said it “always maintained a competitive per KM fare with 2.0 surge max.” Uber’s surge could reach 4X, Grab said.

Wtf grab this ride is normally 60b, even with surge pricing this isn’t cool. I think they lied when they said it would be less expensive when Uber left. pic.twitter.com/9aaXlAIyIq

— Ally (@ohmyal) April 15, 2018

I hate how grab can’t provide enough cars for all our commuters. BRING BACK UBER!

— Grace Sison (@mgesison) April 18, 2018

Why is Grab so expensive omg I want uber back

— Peiwen (@Peepeewen) April 20, 2018

Go-Jek’s opportunity

All of these factors give Go-Jek a huge opportunity to step into Uber’s shadow and becoming the Pepsi to Grab’s Coke in Southeast Asia. There’s already a track record of doing so, as recent analysis from the Financial Times suggested.

The paper’s research division surveyed 5,000 consumers across Singapore, Vietnam, Indonesia, Thailand, Malaysia and the Philippines and found that the gap between Grab and Uber’s services is minimal across most countries. The main exception is Indonesia, where GoJek — and its GoCar service — is the dominant player.

That suggests that things could be tighter than first assumed for Grab if it isn’t able to fully capitalize on the Uber acquisition.

With additional reporting and assistance from Jonathan Shieber