Carmakers’ decision to build up inventory ahead of the festive season is paying off, with passenger vehicle registrations reaching a record 425,000 units as of October 29, according to Vahan data.

The record marks a 27% increase from last year’s daily registration rate in October, with the potential to approach 450,000 units by the month’s end.

This equates to a daily registration rate of 14,732 units in October this year, a 27% increase compared to last October’s daily rate of 11,560 units. Should this rate continue through the remaining two days of October, passenger vehicle registrations are expected to approach 450,000 units. The previous peak for passenger car registrations was 399,112 units in January 2024.

The surge in registrations can be attributed to a unique occurrence this year. The peak festivities of Navratri, Dussehra, Dhanteras, and Diwali, which typically spread across two months, all fell in October this year, creating a concentrated period of high demand.

This year’s peak festivities began on October 3, compared to last year’s on October 15. In the first 27 days of this festive season, starting October 3, passenger car registrations have already reached 415,000 units.

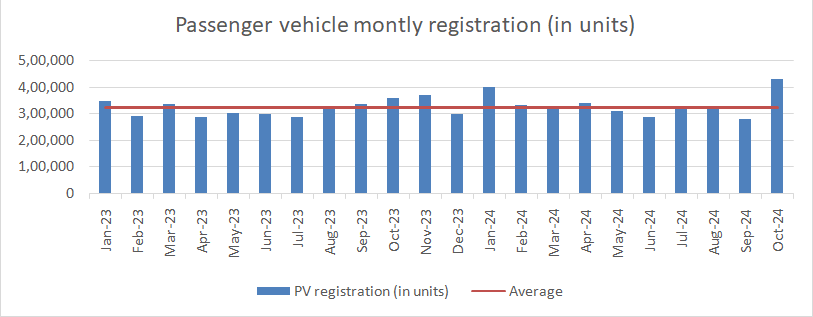

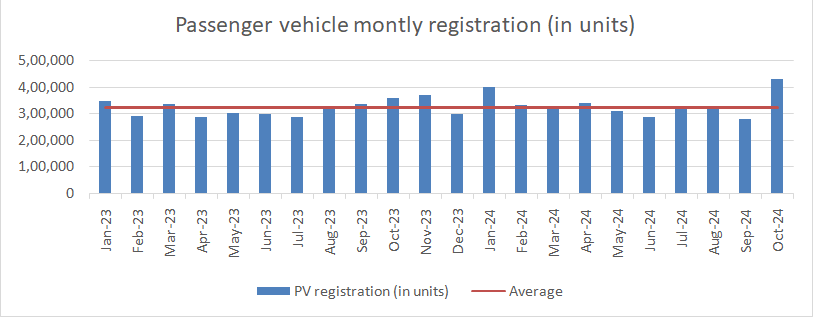

This current figure of 425,000 units encompasses both motor cars and motor cabs listed on the Vahan portal. On average, monthly vehicle registrations in 2024 have been approximately 333,000 units, marking a 5% rise over the previous year’s monthly average and bringing year-to-date registrations to an impressive 3.3 million units. In 2023, total passenger car registrations reached 3.8 million units, with the final two months contributing a notable 0.65 million units.

Unsurprisingly, carmakers are resetting their expectations, anticipating a promising festive season. “This month, we aim to deliver at least 200,000 vehicles and reduce inventory across the network. By month-end, our network inventory should be around 30 days,” stated Partho Banerjee, Senior Executive Officer of Marketing and Sales at Maruti Suzuki, India’s largest carmaker.

In its post-earnings conference call, Maruti Suzuki revealed that festive sales volumes (from Shradh to Diwali) have grown by 14% year-over-year, targeting 3-4% retail volume growth for FY25. Additionally, management highlighted that the rural market outperformed urban areas in the second quarter, with rural growth contrasting a decline in urban market retails year-over-year.

A spokesperson from Tata Motors shared that the festive period has fueled a 30% year-over-year increase in October registrations, positioning this month as Tata Motors’ highest-ever, for registrations. “On Dhanteras, we will deliver over 15,000 vehicles, backed by strong demand across our portfolio, including recent launches,” they remarked.

The spokesperson also said the company has seen strong growth, with a 30% increase in registrations in October compared to the same month previous year.

“As a result, this October, the total registrations for Tata Motors are expected to be the highest ever. On Dhanteras, we will be delivering more than 15,000 vehicles on the back of robust demand for the entire portfolio, including new launches,” the spokesperson added.

Interestingly, the momentum has gathered speed only in the last week, with registration shooting up by over 1 lakh units nationwide.

Sanjay Thakker, Chairman and Executive Director of Landmark Cars, a leading automotive dealer, says the sentiment is positive right now, and the offtake has increased across all brands. “The month of October should be very good, and we hope to sustain this next month. The month started moderately, but there is momentum in the market right now, and the month should end on a healthy note.”

In the first three weeks, from 3rd October to 24th October, passenger vehicle registrations were merely 2%, with 307,000 units registered, compared to the three weeks of the festive period starting with Navratri in 2023.

Inventory levels due for correction

With robust deliveries in the last week, the stock at the dealership is also likely to correct. At the beginning of the festive season, the inventory stood between 750,000 and 800,000 units, equivalent to two and a half months of wholesale volume. For the first time in five months, retail registrations are set to surpass wholesale volumes by 70,000 units, helping the dealerships reduce stock.

This positive trend in registrations is encouraging for the automotive market as it indicates strong demand and healthier inventory levels heading into the festive season.

Gaurav Vangaal, associate director at S&P Global Mobility, says retail sales are set to be the highest ever, which may help ease the pile-up of inventory. “It will be interesting to watch if the momentum continues. Like every year, the current quarter will have a seasonality impact, the real picture will be visible only in the January to March quarter,” added Vangaal.