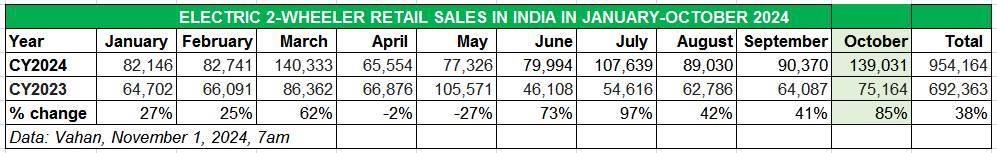

Festive October turned out to be an electrifying month for manufacturers of electric two-wheelers. At 139,031 units, retail sales in October 2024, which ushered in the 32-day festive season across India, registered handsome 85% year-on-year growth (October 2023: 75,164 units).

October 2024’s retails of 139,031 units are the e2W industry’s second-best monthly performance after the FAME II-ending March 2024 (140,333 units).

October 2024’s retails of 139,031 units are the e2W industry’s second-best monthly performance after the FAME II-ending March 2024 (140,333 units).

With the new PM E-Drive Scheme kicking in from October 1, despite the reduced subsidy and the buyer-friendly festive season schemes and attractive deals offered by e-two-wheeler OEMs as also availability of customised financing, retail sales were the second-highest in this calendar year to date, after the FAME II subsidy-ending month of March 2024 (140,333 units).

The PM E-Drive Scheme has an outlay of Rs 10,900 crore over a two-year period with subsidy / demand incentives worth Rs 3,679 crore aimed at supporting 24.79 lakh e-two-wheelers, 316,000 e-three-wheelers, and 14,028 electric buses. Passenger vehicles have been left out of the ambit of the PM E-Drive Scheme which runs from October 1, 2024 through to March 31, 2026.

The electric two-wheeler segment is the biggest volume driver of the EV industry in India. In October, it accounted for 64% of total India EV Inc’s volumes of 217,621 units, as per data published on the government of India’s Vahan website (as of November 1, 7am).

Let’s take a closer look at each of the top six players, who are the movers and shakers of the e-two-wheeler industry.

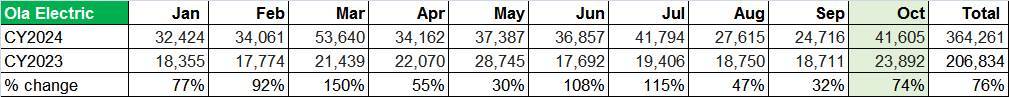

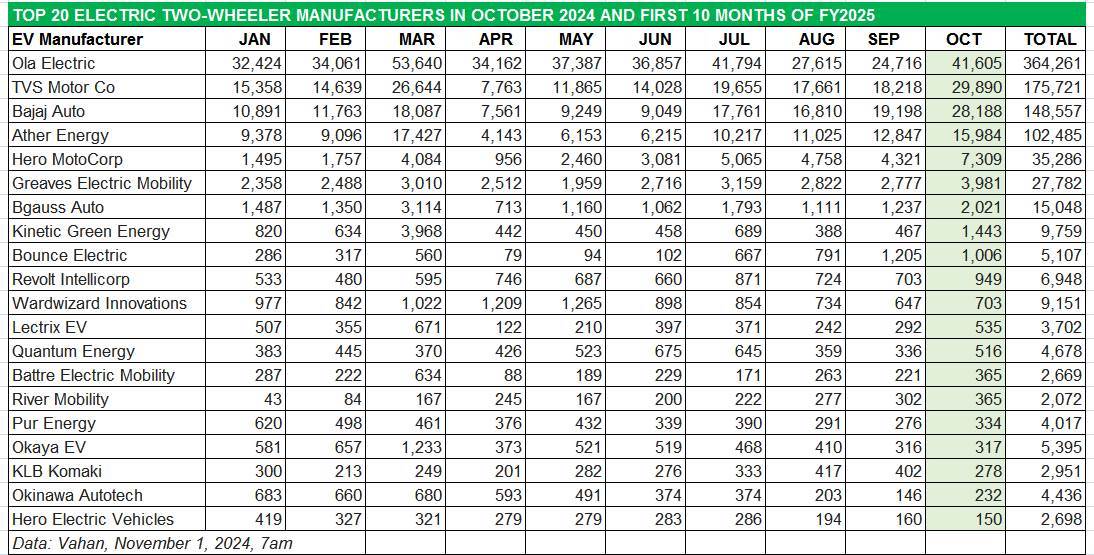

OLA ELECTRIC – October 2024: 41,605 units, up 74% YoY

OLA ELECTRIC – October 2024: 41,605 units, up 74% YoY

Market share: October 2024 – 30% / October 2023 market share: 17%

Jan-Oct 2024: 364,261 units, up 76% YoY (Jan-Oct 2023: 206,834 units), CY2023: 267,376 units

Ola Electric will be heaving a sigh of relief – after two torrid months of low sales of below 28,000 units (August: 27,615 and September: 24,716) which reduced its market share to less than 30%, the company has sold 41,605 units in October 2024. This is a month-on-month increase of 68% and a YoY growth of 74 percent. The company has also surpassed its entire CY2024 retails of 267,376 units and has sold an additional 96,885 units till end-October.

Ola had opened CY2024 with 32,424 units (up 77%) in January, hit a high of 53,640 units in March (up 150%) and maintained stellar month-on-month growth right from April through to July until the sharp drop in August and September. Ola’s sales decline in August and September were attributed to be related a large number of customer complaints about service deficiencies. However, following the recently listed company’s assurance that it had addressed 99.1% of the complaints to the satisfaction of its customers through its redressal mechanism, sales have revived in October.

As a result, Ola’s market share which was at 27% in September – down by 11 percentage points from the 38% it commanded in March 2024 and July 2024 – has regained momentum in October with 30% market share. In terms of cumulative sales, Ola remains well ahead of the competition – its January-October 2024 sales (364,261 units, up 76% YoY) give it an overall market share of 38%, up from 30% a year ago.

In September, Ola became the first Indian EV OEM to surpass 300,000 unit sales in a calendar year.

In an effort to address service issues, Ola Electric has announced a Network Partner programme aimed at being logistically closer to its customers. As per a September 26 tweet by CEO Bhavish Aggarwal, 625 partners are already in place. This will be expanded to 1,000 by the festive season and to 10,000 by end-2025.

Ola Electric’s mass-market S1 X portfolio is available in three battery configurations (2 kWh, 3 kWh, and 4 kWh), and priced at Rs 69,999, Rs 84,999, and Rs 99,999, respectively. The company has also recently revised the prices of its S1 Pro, S1 Air, and S1 X+ to Rs 129,999, Rs 1,04,999, and Rs 89,999, respectively.

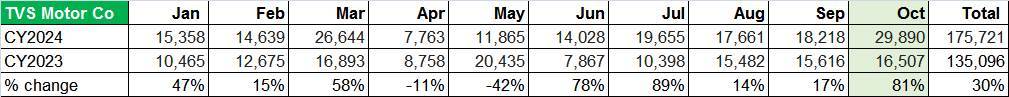

TVS MOTOR CO – October 2024: 29,890 units, up 81% YoY

TVS MOTOR CO – October 2024: 29,890 units, up 81% YoY

Market share: October 2024 – 21% / October 2023 – 11.75%

Jan-Oct 2024: 175,721 units, up 30% YoY (Jan-Oct 2023: 135,096 units), CY2023: 166,581 units

Stung by Bajaj Auto taking the No. 2 spot in September, TVS Motor Co has fought back and regained the second position on the e-two-wheeler podium in October. With retail sales of 29,890 units, the iQube manufacturer has registered strong 81% YoY growth (October 2023: 16,507 units) and gets a market share of 21% for last month. For the first 10 months of this year, TVS has a market share of 18.41 percent.

Like Bajaj Auto, TVS Motor too dispatched the highest number of iQubes to its dealers in October – 28,564 units and the move has paid off because its October retails are its highest monthly numbers yet.

The intense battle between these two legacy OEMs continues – in CY2023, TVS had sold a total of 166,581 iQubes – 94,641 units more than Bajaj Auto’s 71,940 Chetaks. That huge gap is now stands sizeably reduced in the current calendar year – to 27,164 units.

The TVS iQube is available with three battery options – 2.2 kWh, 3.4 kWh and 5.1 kWh and according to the company the entire portfolio is getting a good market response. The base variant with a 2.2kWh battery has a 75km real-world range and a charging time of 2 hours from 0-80% with a 950W charger. This base variant is currently the most affordable iQube at Rs 94,999. This model along with the 3.4 kWh iQube get a 5-inch TFT display with tow and theft alerts and turn-by-turn navigation.

The iQube ST line-up has also expanded to include variants with two capacities – 3.4kWh and 5.1kWh. The iQube ST 3.4 variant (Rs 155,555) has a claimed real-world range of 100km. The range-topping ST 5.1 variant has the largest battery capacity of any Indian electric scooter and TVS claims a real-world range of 150km on a single charge. The iQube ST 5.1 also has a higher 82kph top speed, and the claimed charging time is 4 hours and 18 minutes from 0 to 80 percent. The ST 5.1 gets all the same features as the ST 3.4, but at Rs 185,373, it’s the most expensive model in the line-up.

Manufacturing capacity is not a constraint and TVS is geared up to handle a spurt in demand. In a recent analyst conference call on October 23, K N Radhakrishnan, CEO, TVS Motor Co, said: “The TVS iQube is a great product and the customers are happy. We are very systematically building the capacity on manufacturing. We have enough capacity. And even whenever we want to increase the capacity, it’s a question of about 3 months.”

The company is also strategically expanding the iQube dealer network. According to the TVS Motor Co CEO, “We have now all about 750. We are also now increasing that very systematically month after month on a number of dealerships in India.”

The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025 and is readying new product launches in the remaining five months of FY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.

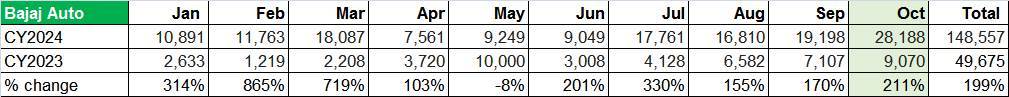

BAJAJ AUTO – October 2024: 28,188 units, up 211% YoY

Market share: October 2024 – 20% / October 2023 – 6.46%

Jan-Oct 2024: 148,557 units, up 199% YoY (Jan-Oct 2023: 49,675 units), CY2023: 71,940 units

Bajaj Auto continues to reap rich dividends in the e-scooter market. The company, which dispatched a record monthly high of 28,517 Chetaks in September to its dealers across India ahead of the festive season kicking in, has sold 28,188 Chetaks in October 2024, up 211% YoY (October 2023: 9,070 units). Like TVS, this is Bajaj Auto’s best monthly score yet.

Bajaj Auto, whose Chetak has a starting price of Rs 95,998 (ex-showroom Bengaluru) for the Chetak 2903 and rising to Rs 127,244 for the Chetak 3201 and Rs 128,744 for the Chetak 3201 SE, is also upping the ante to achieve even faster sales traction. On September 4, the company launched the Chetak Blue 3202 at Rs 115,000 (ex-showroom, Bengaluru). The Blue 3202 is the renamed Urbane variant with new cells that give it more range while still having the same battery capacity.

Marketing initiatives like the recent partnership with Kendriya Police Kalyan Bhandar (KPKB) to offer the Chetak 2903 to KPKB beneficiaries across India are helping drive demand. As part of this tie-up, Chetak Experience Centres across India are now authorised to sell the Chetak 2903 to KPKB beneficiaries at special rates. The KPKB serves the needs of the Central Armed Police Forces, which includes the BSF, CRPF, CISF, ITBP, SSB and Assam Rifles. The benefits also extend to various Central Police Organizations such as the IB, BPRD, and NCRB among others.

In September 2024, Bajaj with 19,198 units had gone ahead of longstanding No. 2 OEM, TVS Motor Co (18,218 units) but TVS has regained traction and its second rank in October with 29,890 units. This means the Bajaj Chetak has a 20% market share in October and 15.56% for the first 10 months of this year. Bajaj Auto’s cumulative sales of 148,557 units in January-October 2024 are up nearly 200% on year-ago retails of 49,675 units. This means Bajaj Auto has sold an additional 98,882 Chetaks in January-October 2024 period compared to the year-ago period. This stellar 10-month performance sees the company leave its entire CY2023 sales of 71,940 far behind.

Bajaj Auto’s YoY speedy rate of growth compared to TVS is helping it to close the gap with the longstanding No. 2 e2W OEM. This is a result of surging consumer demand, ramped-up production of nearly 20,000 units per month and an expanded Chetak retail sales network.

In early August, Bajaj Auto launched the Chetak 3201 special edition EV sold only on Amazon, priced at Rs 129,000 (ex-showroom, Bengaluru), with a 136km range which is higher than the top-spec Chetak Premium.

The Chetak 2901, launched in early June at Rs 95,998, is the most affordable of the Chetak line-up and nearly Rs 51,000 cheaper than the top-end variant. The Chetak 2901, which shares its 2.9kWh battery with the mid-spec Chetak Urbane, has successfully taken the battle right into the rivals’ camp – TVS iQube, Ather Rizta S and Ola S1 Air. And the move is playing true with just what Bajaj Auto management planned. ATHER ENERGY – October 2024: 15,984 units, up 88% YoY

ATHER ENERGY – October 2024: 15,984 units, up 88% YoY

Market share: October 2024 – 11.49% / October 2023 – 6%

Jan-Oct 2024: 102,485 units, up 15% YoY (Jan-Oct 2023: 88,839 units), CY2023: 104,734 units

Smart e-scooter maker Ather Energy maintains its No. 4 rank with 15,984 units in October, up 88% YoY (October 2023: 8,484 units). The company registered its best monthly sales in March (17,427 units) but slid to 4,143 units in April. Since then, Ather retails has risen month on month right till October. October retails give the Hosur-based OEM a market share of 11.49% compared to 6% a year ago.

Smart e-scooter maker Ather Energy maintains its No. 4 rank with 15,984 units in October, up 88% YoY (October 2023: 8,484 units). The company registered its best monthly sales in March (17,427 units) but slid to 4,143 units in April. Since then, Ather retails has risen month on month right till October. October retails give the Hosur-based OEM a market share of 11.49% compared to 6% a year ago.

Cumulative January-October 2024 retails at 102,485 units are up 15% YoY (January-October 2023: 88,839 units), which gives it a market share of 11% of e2W Inc’s total retails of 954,144 units till end-October.

The Rizta family e-scooter (pictured above) launched in April at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z) is witnessing growing customer acceptance. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty.

HERO MOTOCORP – October 2024: 7,309 units, up 227% YoY

HERO MOTOCORP – October 2024: 7,309 units, up 227% YoY

Market share: October 2024 – 5.25% / October 2023 – 1.37%

Jan-Oct 2024: 35,286 units, up 443% YoY (Jan-Oct 2023: 6,496 units), CY2023: 11,141 units The world’s largest two-wheeler manufacturer and the last of the big legacy players to enter the EV market is seeing demand pick up for its Vida brand of e-scooters. The company, which hit its best-ever monthly retails of 7,309 units in October 2024, clocked 443% YoY growth on a low year-ago base of 1,937 units. The strong performance is seen in the increased market share to 5% from 1% in October 2023.

The world’s largest two-wheeler manufacturer and the last of the big legacy players to enter the EV market is seeing demand pick up for its Vida brand of e-scooters. The company, which hit its best-ever monthly retails of 7,309 units in October 2024, clocked 443% YoY growth on a low year-ago base of 1,937 units. The strong performance is seen in the increased market share to 5% from 1% in October 2023.

Hero MotoCorp has started scaling up brand presence for Vida and its network now stands at 203 touchpoints comprising 180 dealers across 116 cities. The company, which has the V1 Plus and V1 Pro EVs, plans to expand its portfolio – within the mid- and affordable segment – within FY2025. And it already has around 2,500 charging stations in collaboration with Ather Energy, in which Hero MotoCorp is an early investor.

Like all the leading EV OEMs, Hero MotoCorp too is focusing on reducing product cost. In an earnings conference call on August 14, Niranjan Gupta, CEO, Hero MotoCorp said: “We are working very aggressively, and on the powertrain side, to bring the costs down by technological improvements, by localization, obviously, by bringing scale. You will see that benefit coming out into our further launches as well. You’ll see affordable products coming out later this year.”

Market share: October 2024 – 3% / October 2023 – 3%

Jan-Oct 2024: 27,782 units, up 67% YoY (Jan-Oct 2023: 16,650 units), CY2023: 16,650 units

Greaves Electric Mobility (GEM), the fifth-ranked OEM in this list, sold 3,981 e-scooters in October 2024, down 5% YoY (October 2023: 4,184 units). GEM launched its new Ampere Nexus e-scooter on April 30. GEM’s cumulative 10-month sales at 27,782 units are a 67% increase over the 16,650 units in the January-October 2023 period. Its October 2024 and first 10 months of CY2024 market shares are identical at 3 percent.

Greaves Electric Mobility (GEM), the fifth-ranked OEM in this list, sold 3,981 e-scooters in October 2024, down 5% YoY (October 2023: 4,184 units). GEM launched its new Ampere Nexus e-scooter on April 30. GEM’s cumulative 10-month sales at 27,782 units are a 67% increase over the 16,650 units in the January-October 2023 period. Its October 2024 and first 10 months of CY2024 market shares are identical at 3 percent.

Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

Greaves Electric Mobility, like the other five OEMs above it, is also focussing on cost optimisation. In a Q1 FY2025 earnings call on August 13, executive director and CEO K Vijaya Kumar said: “We have been able to make considerable inroads in terms of our costing of key components and products on one side. The other side is broadly we have looked at our cost, sort of a cost rationalization wherein we are getting closer to building our efficiencies much higher than where we were.”

INDIA E2W INC NEEDS JUST 45,856 UNITS MORE TO HIT A MILLION UNITS IN CY2024

As accurately predicted in our sales analysis for September 2024, India Electric 2W Inc has surpassed the industry’s record annual CY2023 retails of 848,003 units in the first 10 months of CY2024 itself as also the forecast of over 100,000 sales in festive October.

The gains are seen in the strong sales for the top six EV OEMs – this six-pack has each surpassed its entire CY2023 sales in the January-October 2024 period. While Ola Electric with 364,261 units has crossed its CY2023 sales of 267,376 units, TVS Motor Co has, with 175,721 iQubes sold, surpassed its CY2023 retails of 166,581 units. Bajaj Auto, which clocked sales of 148,557 units in the first 10 months of this year, has achieved 106% more sales than the 71,940 Chetaks it sold in entire CY2023. Ather Energy, with 102,485 units in January-October 2024, needs just 2,249 units more to better its CY2023 total of 104,734 units – which it will in the first few days of November. Hero MotoCorp, which has sold 35,286 Vida e-scooters between January-September 2024, has also beaten its CY2023 score of 11,141 units. And Greaves Electric Mobility, with 27,782 units, has also surpassed its CY2023 tally of 24,043 units.

The combined sales of these top six OEMs add up to 126,957 units in October and account for 91% of the industry sales. For the first 10 months of this year, their cumulative retail sales are 828,039 units or 87% of India 2W EV Inc sales. Of these six, the first four are the biggies with six-figure sales.

At the end of October 2024, cumulative 10-month retails at 954,144 units are just 45,856 units shy of the million-units sales mark which the e2W wheeler industry will achieve for sure in November itself and mark the first time that the million milestone will have been achieved in this segment. Given that the e2W segment is the biggest volume driver for the EV industry, it remains to be seen just how close India EV Inc gets to the 2-million EVs mark.