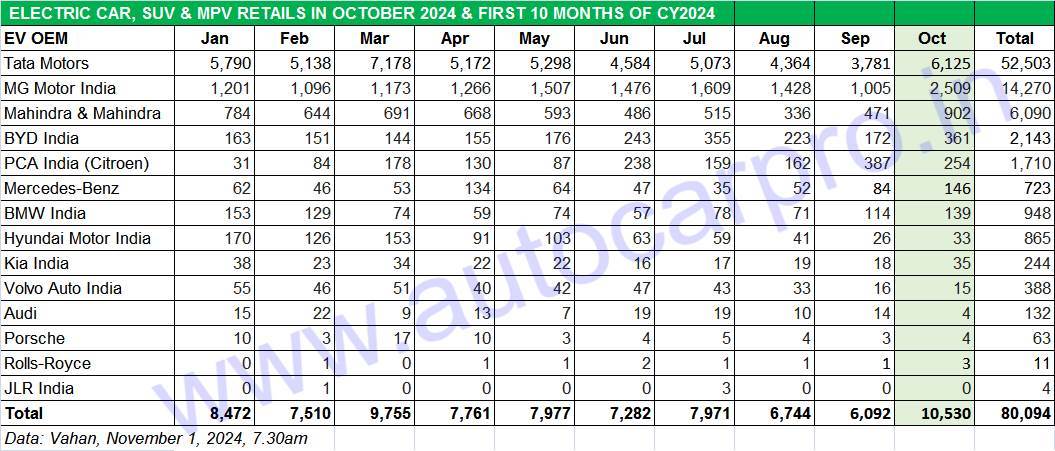

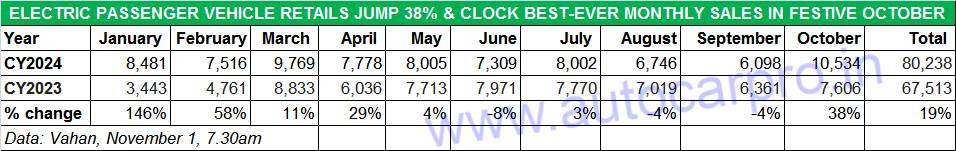

Here’s a good reason why automakers, both electric and ICE, bank on India’s festive season to deliver the goods. After a dismal September, when retail sales of electric cars, SUVs and MPVs fell to a 17-month low of 6,098 units, electric passenger vehicle manufacturers have plenty of reason to celebrate the festive season and Diwali – retail sales of e-PVs at 10,534 units in October 2024 are up 38% year on year (October 2023: 7,606 units), as per the latest data from Vahan as of November 1 (7.30am). This makes October 2024 the best in monthly retails, beating the FAME II subsidy-ending month of March 2024 (9,769 units) but also sets India PV Inc on pace to go past CY2023’s total sales of 82,561 units early in November 2024.

The Vahan-sourced retail sales data table above reveals that October’s five-figure retails of 10,534 electric passenger vehicles are a sizeable 73% month-on-month increase over September’s 6,094 units, proof that e-PV OEMs’ discounted festive season offers have clicked in a big way. This, even as e-PVs have been kept out of the two-year PM E-Drive Scheme, which kicked in from October 1, 2024.

The Vahan-sourced retail sales data table above reveals that October’s five-figure retails of 10,534 electric passenger vehicles are a sizeable 73% month-on-month increase over September’s 6,094 units, proof that e-PV OEMs’ discounted festive season offers have clicked in a big way. This, even as e-PVs have been kept out of the two-year PM E-Drive Scheme, which kicked in from October 1, 2024.

CY2024 had opened with strong sales of 8,481 units (up 146% YoY), dropped 11% month on month to 7,516 units in February but went on to scale a high of 9,769 EVs in the FY2024-ending month of March. Now, after a six-month gap, the industry has hit a high note and how.

Tata Motors sells 6,125 EVs in October

Tata Motors sells 6,125 EVs in October

Tata Motors, the bellwether and market leader of the electric passenger vehicle segment, sold 6,125 EVs in October 2024, up 9.53%% on its October 2023’s 5,592 units and improving upon September 2024’s 3,778 units by 62 percent. The company has the largest e-PV portfolio in India comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV. This gives the company an e-PV market share of 58% in October and 65% (52,503 units of India ePV Inc’s 80,238 EVs) for the cumulative January-October 2024 period – both are down on Tata Motors’ year-ago market shares – 73% in October 2023 and 74% for January-October 2023 (49,823 Tata EVs of total India e-PV sales of 67,513 units).

What would have helped Tata Motors in October is its sizeable price cuts on its EV range other than the new Curvv EV. Ahead of the festive season beginning, on September 10, Tata Motors slashed prices of its EV range – the Nexon EV (by Rs 300,000), Punch EV (by 120,000) and the Tiago EV (by Rs 40,000) for a limited period up to October 31, 2024. The company is also offering six months of free charging at any of the over 5,500 Tata Power charging points across the country, as a value add.

Tata Motors has, in the first 10 months of CY2024, retailed 52,503 EVs, which is an increase of 5% YoY (January-October 2023: 49,823 EVs). With two months left for 2024 to come to a close, Tata Motors has achieved 87% of its estimated CY2023 sales of 60,006 units.

Windsor EV adds tailwinds to JSW MG Motor’s sales

Windsor EV adds tailwinds to JSW MG Motor’s sales

JSW MG Motor India, which retails the ZS EV, Comet EV and Windsor EV, sold a record 2,509 units in October, up 166% on year-ago sales of 944 units and up 150% month-on-month on September 2024 (1,005 units), which were its lowest in the first 10 months of CY2024. October’s performance gives JSW MG a market share of 24%. Cumulative 10-month retails of 14,270 units have crossed the company’s entire CY2023 total of 9,523 units.

On September 11, MG Motor India launched its third EV – the MG Windsor EV – priced at Rs 13.49 lakh (ex-showroom). Billed as India’s first intelligent Crossover Utility Vehicle (CUV), the Windsor EV combines features of both a sedan and an SUV.

On October 26, JSW MG Motor India delivered 101 MG Windsor EVs in Bengaluru and followed this up two days later on the festive day of Dhanteras with over a hundred EVs in a single day in Delhi-NCR. The recently launched Windsor EV first passenger EV in India to garner 15,176 bookings within 24 hours of booking.

MG Motor India has recently introduced an innovative Battery-as-a-Service (BaaS) program for its EVs. According to the OEM, this flexible ownership program eliminates the upfront cost of the battery, enabling customers to pay only for its usage. This subscription model lowers the per-kilometre expense significantly reducing the initial acquisition cost to ensure an economical ownership experience. Under BaaS, the Windsor is available at Rs 999,000 + battery rental @ Rs3.5/km, MG Comet EV starts at Rs 499,000 + battery rental at Rs2.5/km and the MG ZS EV is offered at Rs 13.99 Lakh + battery rental at Rs 4.5/km.

The company is also upping the ante on the sales network front by expanding to Tier 3 and Tier 4 cities as well as rural markets across India. There are plans to set up 100 new touchpoints by the end of 2024, and setting up 520 touchpoints in 270 cities by the end of March 2025.

Mahindra XUV400 retails scale a new monthly high

Mahindra XUV400 retails scale a new monthly high

October was a good month for Mahindra & Mahindra because its sole EV – the XUV400 – sold a total of 902 units, the best performance in the year to date. The company’s best monthly sales were in April 2023 (537 units). The EV has been available with discounts of over Rs 200,000 for over a year now, and according to Autocar India, some units, most likely from the MY2023 production batches, are being offered with discounts of up to a whopping Rs 440,000. Expect these to have contributed to M&M’s strong performance in October this year.

This gives the company an 8.56% market share for October and a 7.58% share for the January-October 2024 period with total sales of 6,090 – up 101% YoY (January-October 2023: 3,031 units). M&M had sold 4,267 XUV400s in CY2023.

M&M, which will have added manufacturing capacity of around 100,000 units for its upcoming Born Electric vehicles by end-March 2025, plans to invest Rs 12,000 crore towards its EV programme. It has announced 4-5 new models on the INGLO platform, which will have key components from the Volkswagen Group.

BYD revs up its act

BYD revs up its act

BYD India, which sells the all-electric Atto 3 SUV, Seal sedan and more recently the new eMAX 7 MPV maintains its No. 4 EV OEM position. In October 2024, BYD sold 361 EVs, up 110% on September 2024’s 172 units but blow July 2024’s 355 units. Last month’s strong sales takes the Chinese EV OEM’s cumulative 10-month sales to 2,143 units, 131 EVs more than its entire CY2023 retails of 2,012 units.

After hitting best-ever monthly sales of 387 units in September 2024, PCA Motors (Citroen India) sold 254 units in October. The company, which retails the e-C3, the electric avatar of the C3 hatchback, is seeing growing demand particularly from EV fleet operators.

The Citroen eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, should see increased sales momentum later this year. Between March and June 2024, the e-C3 has received bulk orders for over 7,000 units from Blusmart, OHM E Logistics and Cab-E. By end-October, PCA Motors with 1,710 units has already achieved 88% of its CY2023 sales of 1,949 units.

The Citroen eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, should see increased sales momentum later this year. Between March and June 2024, the e-C3 has received bulk orders for over 7,000 units from Blusmart, OHM E Logistics and Cab-E. By end-October, PCA Motors with 1,710 units has already achieved 88% of its CY2023 sales of 1,949 units.

The two Korean carmakers in India – Hyundai and Kia – have together sold a total of 68 EVs in October. Hyundai Motor India, which has discontinued the Kona in India, and had clocked three-figure sales in January-March 2004, has seen sales slow down substantially since then. In October, only 33 Ioniq 5 EVs were delivered to customers. Hyundai’s cumulative January-October 2024 sales at 865 units are down 34% YoY (January-October 2023: 1,314 units). Hyundai had sold a total of 1,608 EVs in CY2023.

STRONG GROWTH FOR LUXURY EV RETAILS: 311 UNITS, UP 39% IN OCTOBER, 2,269 EVs IN FIRST 10 MONTHS, UP 24%

STRONG GROWTH FOR LUXURY EV RETAILS: 311 UNITS, UP 39% IN OCTOBER, 2,269 EVs IN FIRST 10 MONTHS, UP 24%

As per Vahan retail sales data, deliveries of luxury electric cars, sedans and SUVs rose strongly by 39% YoY in October 2024 to 311 units (October 2023: 224 units). The cumulative 10-month January-October 2024 retails also reflect stellar 24% YoY growth – the 2,269 units constitute an additional 438 EVs over the 1,831 units sold in the year-ago period.

With two months left in CY2024, cumulative luxury electric PV retails from seven OEMs, at 2,269 units, are 375 units shy of their CY2023 total of 2,644 units.

BMW India, which is the luxury EV market leader in the first 10 months of 2024 (948 units), sold 139 units in October, up 48% YoY, but sees Mercedes-Benz India with 146 units go ahead last month. BMW India has a luxury EV market share of 45% in October and 42% (948 units) for the first 10 months of this year.

Mercedes-Benz India sold 146 EVs in October 2024 – this is its best monthly retail sales in the year, after April’s 134 units, and give it a 47% share of the market. Its combined January-October 2024 sales (723 EVs) are up 96% YoY (January-October 2023: 369 EVs) and give it a 32% share of the luxury EV market in the year to date. Importantly, for the German carmaker, it has raced past its CY2023 total of 516 units.

While luxury EVs accounted for 3% of the overall ePV market in October, their share of the India electric car and SUV market in the first 10 months of this year was the same at 2.83 percent.

All said and done, at a cumulative 80,238 units sold in the January-October 2024 period, the Indian electric passenger vehicle industry will surpass its entire CY2023’s retails of around 82,500 units very soon.