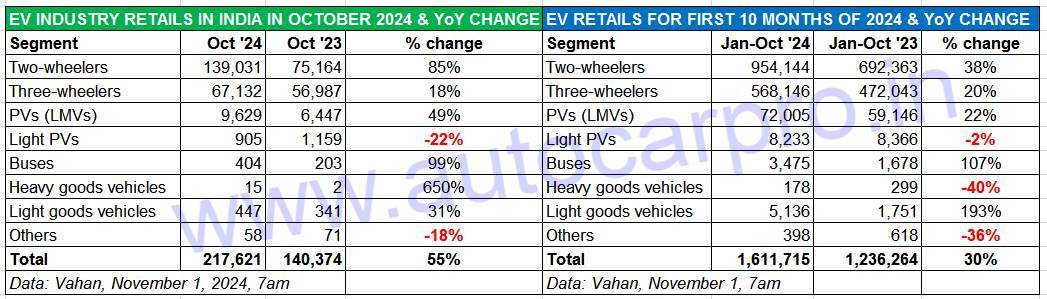

October has been an electrifying month for the Indian electric vehicle (EV) industry. The 32-day festive season, which opened with Navratri on October 3, continued with Dassera and accelerates with Diwali on November 1, has registered record monthly retail sales of 217,621 units in October 2024, up 55% YoY (October 2023: 140,374 units). This is India EV Inc’s best-ever monthly retail sales performance after March 2024’s 213,062 units, when the FAME II subsidy scheme came to an end.

What has driven the momentum in October 2024 is that all the EV sub-segments – two- and three-wheelers, passenger vehicles and commercial vehicles (light goods carriers, heavy goods carriers and buses) have registered year-on-year growth.

Compared to October 2023, an additional 77,247 EVs were sold in October 2024. And cumulative January-October 2024 retails at 1.61 million units are up 30% year on year.

Compared to October 2023, an additional 77,247 EVs were sold in October 2024. And cumulative January-October 2024 retails at 1.61 million units are up 30% year on year.

As the Vahan-sourced monthly retail sales data reveals (see data table above), much of the credit for October’s big-ticket sales go to the biggest volume segment – electric two-wheelers. At 139,031 units sold and stellar 85% YoY growth, October 2024 has turned out to be the e-two-wheeler industry’s second-best month this year after March 2024 (140,333 units). On the cumulative first 10-months’ front, total retails of 954,144 units constitutes 38% YoY growth (January-October 2023: 692,363 units), which means the e2W industry is just 45,856 units shy of the million-units sales mark for this calendar year, which will be achieved for sure in November itself and will mark the first time that the million milestone will have been achieved in this segment. Given that the e2W segment is the biggest volume driver for the EV industry, it remains to be seen just how close India EV Inc gets to the 2-million EVs mark.

Adding to the momentum is the electric three-wheeler segment, which continues to witness the fastest transition to EVs with every second unit sold in India being a zero-emission model. This segment, which comprises of passenger-transporting rickshaws and cargo-delivering models, registered total sales of 67,132 units in October 2024, up 18% YoY (October 2023: 56,987 units). While Mahindra Last Mile Mobility remains the longstanding market leader, Bajaj Auto, which entered this segment in June 2023, is the new challenger to the throne. Between January and October 2024, a total of 568,146 units have been sold, up 20% YoY over the 472,043 units in the year-ago period.

After a dismal September, when retail sales of electric cars, SUVs and MPVs fell to a 17-month low of 6,098 units, electric passenger vehicle manufacturers have plenty of reason to celebrate the festive season and Diwali – retail sales of e-PVs at 10,534 units in October 2024 are up 38% year on year (October 2023: 7,606 units), as per the latest data from Vahan as of November 1 (7.30am). This makes October 2024 best in monthly retails, beating the FAME II subsidy-ending month of March 2024 (9,769 units) but also sets India PV Inc on pace to go past CY2023’s total sales of 82,561 units early in November 2024.

The electric commercial vehicle segment too witnessed pick up – a total of 866 e-CVs were retailed in October, up 59% YoY (October 2023: 546 units). And the growth is there for all three sub-segments – buses: 404 units, up 99% YoY, light goods vehicles (447 units, up 31%) and heavy goods vehicles (15 units, up 650%).

EV penetration increases to 7.71% from 6.47% a year ago

The pace of retails has picked up in the second half of this year. In the first-half of CY2024, with 896,529 units, the EV industry had clocked 58% of CY2023’s record 1.53 million sales. Now, at 1.61 million units sold in the first 10 months of the year, EV sales in India have already set a new record and there’s November and December still left to be counted.

As per the comprehensive retail sales data on the government of India’s Vahan website, the 16,11,715 EVs sold between January-October 2024 account for 7.61% of the total 21.15 million (2,11,59,092 units) vehicles sold across all segments and petrol, diesel, CNG, LPG and electric powered vehicles. This reflects an increase over the 6.47% EV penetration level in January-October 2023 – 12,36,264 EVs to 19.10 million automobiles (1,91,03,049 units).

The two- and three-wheeler segments (15,22,290 units) together account for an overwhelming 94% of total EV sales in India in January-October 2024 – while e-two-wheelers (954,144 units) have the major share of 59.20%, e-three-wheelers (568,146 units) have contributed to 35.25% of the sales in the first 10 months of 2024. While electric cars and SUVs, with 80,238 units, account for a 5% share, electric buses, heavy and light goods carriers at 8,789 units account for a 0.54% share.

EV-OLUTION OF THE INDIAN ELECTRIC VEHICLE INDUSTRY

India, which is the third-largest automobile market in the world, is among the global markets which are aggressively driving awareness and adoption of EVs as a countermeasure to its serious air pollution problem. As is known, India is home to 14 of the 20 most polluted cities in the world. By 2030, the government has targeted EVs to account for 70% of commercial vehicle sales, 30% of passenger vehicles, 40% of buses and 80% of two-wheelers and three-wheelers.

The past four-odd years have shown how India EV Inc has evolved when it comes to the overall electric mobility ecosystem. From the growing number of new EVs being launched, the enhanced level of R&D, significant investment from component manufacturers in making EV parts and creating a robust supply chain, gradual expansion of EV charging infrastructure through to exclusive EV retail showrooms from OEMs and both the Central and most State governments rolling out EV-friendly policies for EV manufacturing as well as EV buyers, the EV market dynamic is here to stay in India.

The initial cost of an EV compared to a conventional internal combustion engine remains 25-30% higher mainly due to the battery cost but as technology evolves, localization levels increase and OEMs benefit from economies of scale, EV costs are bound to rationalise and EV-ICE vehicle price parity could be foreseen in the not-so-long-term future in India.

What’s more, e-mobility is no longer an urban India phenomenon and has now spread to town and country as scores of vehicle users recognize the wallet-friendly nature of EVs while also contributing to eco-mobility.

Nevertheless, what India EV Inc is confident about is the growing adoption of electric mobility by both individual buyers and also industry, along with the considerable potential of exports of both made-in-India EVs and EV components.

ALSO READ:

World EV Day Special: Will EV sales in India hit 2 million units in FY2025?