The festive month of October 2024 which had Navratri, Durga Puja and Dussehra in the lead to Diwali on November 1, saw demand for CNG-powered passenger vehicles (hatchbacks, sedans, SUVs and MPVs) achieve their highest monthly sales in India.

Retail sales of CNG-powered passenger vehicles in October were a handsome 67% YoY increase but missed out on the 100,000-mark by a whisker: 33 units.

Retail sales of CNG-powered passenger vehicles in October were a handsome 67% YoY increase but missed out on the 100,000-mark by a whisker: 33 units.

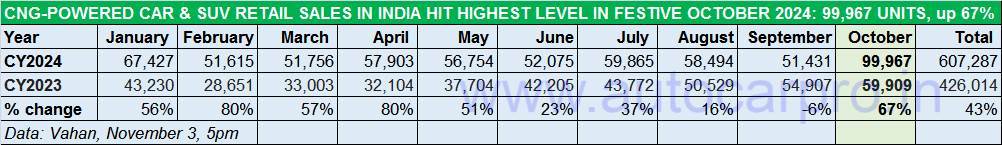

As per the latest Vahan data (as of November 3, 2024), at 99,967 units, retail sales of CNG-powered passenger vehicles were a handsome 67% year-on-year increase (October 2023: 59,909 units), missing the 100,000 mark by a whisker: 33 units. The incremental YoY sales translate into an additional 40,058 units sold last month compared to the year-ago period. The CNG PV industry’s previous monthly best was January 2024’s 67,427 units.

This mega performance in October has resulted in the combined sales of India’s four CNG PV manufacturers in the January-October 2024 period registering a total of 607,287 units, an increase of 43% YoY (January-October 2023: 426,014 units). With two months left to go for 2024 to come to an end, expect the CNG PV industry to set a new annual retails sales benchmark of over 700,000 units, which will be a 32% YoY increase.

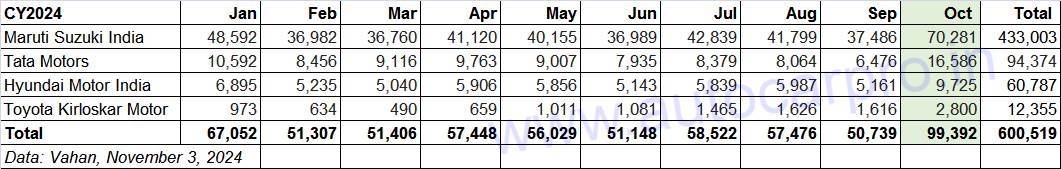

While CNG PV market leader Maruti Suzuki, with over 12 models, has a vice-like grip and a 72% share, it is Tata Motors and Toyota which have witnessed an increase in their CNG market shares in the first 10 months of this year.

While CNG PV market leader Maruti Suzuki, with over 12 models, has a vice-like grip and a 72% share, it is Tata Motors and Toyota which have witnessed an increase in their CNG market shares in the first 10 months of this year.

MARUTI WITH VICE-LIKE GRIP ON CNG MARKET TARGETS 600,000 SALES IN FY2025

MARUTI WITH VICE-LIKE GRIP ON CNG MARKET TARGETS 600,000 SALES IN FY2025

Passenger vehicle market leader Maruti Suzuki, the pioneer in the factory-fitted CNG PV segment in India since 2010 when it rolled out the Wagon R CNG, has the largest portfolio of 13 CNG models comprising the Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Wagon R, XL6, Fronx and more recently the CNG avatar of the fourth-generation Swift. Only the Jimny, Ignis and Invicto are not part of its CNG stable. Understandably, with such a wide model spread, the company has a vice-like grip on the market.

Maruti Suzuki, which completely pulled out of the diesel car market in April 2020, has seen the vacuum being filled by the consumer demand for its CNG models. As per Vahan data, Maruti Suzuki India has sold and delivered a total of 433,003 CNG PVs in the first 10 months of this year, with October 2024’s 70,281 units being its highest monthly sales yet. Of the total 13,93,001 passenger vehicles the company sold between January and October 2024, CNG-powered PVs account for a 31% share.

As of September 1, 2023, Maruti Suzuki had a strong order book of nearly 165,000 units spanning all its CNG models, with the most popular ones being the Ertiga MPV, Brezza compact SUV and the Dzire sedan. The company has outlined an ambitious sales target over 600,000 CNG PVs in FY2025, which translates into 38% YoY growth over its FY2024’s 434,122 units, and around 11,000 units more than the entire PV industry’s retails of 589,996 CNG cars and SUVs last fiscal. In the first seven months of FY2025 (April-October 2024), Maruti Suzuki has registered retail sales of 310,669 units.

With strong customer demand for many of its CNG models, Maruti Suzuki has ramped up production and model availability is good at present, compared to a few months ago.

Tata Motors has standardised its innovative twin-CNG-cylinder technology across its CNG line-up that comprises the Tigor, Tiago, Altroz and Punch.

Tata Motors has standardised its innovative twin-CNG-cylinder technology across its CNG line-up that comprises the Tigor, Tiago, Altroz and Punch.

TATA MOTORS’ CNG PV MARKET SHARE RISES TO 16%

Tata Motors, the No. 3 PV OEM in overall sales after Maruti Suzuki and Hyundai Motor India, is the No. 2 in CNG-powered car and SUV sales. The company, which had first introduced its innovative twin-CNG-cylinder technology in the Tata Altroz hatchback, has now standardised the technology in its entire CNG line-up which comprises the Tiago CNG, Punch CNG, Altroz CNG and Tigor CNG.

One of the Tata CNG models’ USPs is the seamless shift between CNG and petrol mode as a result of a single ECU while maintaining higher fuel efficiency. What’s more, they enable vehicle start directly in the CNG mode.

Like Maruti Suzuki, Tata Motors too has hit a monthly best of 16,586 CNG PVs in October, which takes its January-October 2024 total of 94,374 units, up 104% YoY (January-October 2023: 46,330 units). This translates into its CNG PVs having a 21% share of the total 444,085 PVs (petrol, diesel, electric and CNG) retailed in the first 10 months of CY2024, as per Vahan data.

This also means that Tata Motors, which had sold a total of 83,482 CNG cars and SUVs in FY2024, has gone past that figure in the first seven months of FY2025. Its April-August 2024 retails of 42,984 units (up 131%) make it well placed at this stage of the fiscal to cross the 100,000 CNG PV sales milestone for the first time in FY2025.

Tata Motors, which entered the CNG market with the Tiago hatchback and Tigor sedan in January 2022, has gone on to hugely benefit from the rollout of new CNG models like the Tata Punch CNG compact SUV , which was Tata Motors’ response to the introduction of the Hyundai Exter CNG compact SUV. In early February 2024, Tata Motors launched the Tiago and Tigor CNG AMT which has added more ‘ammo’ to the CNG portfolio. Having confirmed plans to introduce the Nexon CNG, showcased at the Bharat Mobility Expo in January, it is set to launch the greener Nexon anytime soon. That’s not all. Tata Motors could also be looking to introduce a CNG variant of the recently launched Curvv SUV-coupe, adding to the petrol, diesel and electric powertrains.

In July, the Exter compact SUV became the first Hyundai CNG model to get dual-cylinder technology. The Aura CNG and Grand i10 Nios CNG have a similar layout.

In July, the Exter compact SUV became the first Hyundai CNG model to get dual-cylinder technology. The Aura CNG and Grand i10 Nios CNG have a similar layout.

HYUNDAI SELLS 9,725 UNITS IN OCTOBER, 60,787 UNITS IN JANUARY-OCTOBER

Like Maruti Suzuki and Tata Motors, Hyundai Motor India too has notched its best-ever monthly CNG PV retails in October 2024: 9,725 units. For the first 10 months of this year, Hyundai’s cumulative retails at 60,787 units are up 19% YoY (January-October 2023: 51,285 units). In terms of CNG PV market share, Hyundai currently has 10.12% compared to 12.12% in January-October 2023, possibly as a result of the advance of Tata Motors and Toyota which seem to have eaten into its market share.

Hyundai Motor India, which currently has three CNG models – Aura, Grand i10 Nios and Exter – is looking to rev up sales and has recently launched the base variant of the Aura – Hy-CNG E – at Rs 748,600, powered by a 1.2-litre Bi-Fuel engine, advanced safety features and fuel efficiency of 28.4 km/kg.

Having introduced a dual-cylinder CNG setup in the Exter compact SUV, in July, Hyundai launched the Grand i10 Nios hatchback with the same layout. The Hyundai Nios CNG dual-cylinder version is available in the two mid-spec Magna and Sportz variants and priced between Rs 775,000 lakh and Rs 830,000.

TOYOTA’S CNG PASSENGER VEHICLE SALES JUMP 109% IN JANUARY-OCTOBER

TOYOTA’S CNG PASSENGER VEHICLE SALES JUMP 109% IN JANUARY-OCTOBER

Toyota Kirloskar Motor, which is currently witnessing strong demand for its range of cars, SUVs and MPVs, is also faring very well on the CNG PV retail front. The 2,800 CNG-powered passenger vehicles it sold in October are its monthly best yet.

The company, which has recently expanded its CNG passenger vehicle portfolio to four models with the Taisor joining the Glanza hatchback, Urban Cruiser Hyryder and the Rumion MPV, has sold 12,355 units in the past 10 months, up 109% YoY (January-October 2023: 5,918 units).

ALSO READ:

Maruti, Hyundai, Tata, Toyota: CNG strategies explained