October 2024 was a mega month for the Indian electric two-wheeler industry, what with retail sales rocketing 85% year on year to over 139,000 units (October 2023: 75,164 units). As a result of buoyant festive season demand and attractive OEM discounts, e-two-wheeler retail sales hit their second-best monthly performance, narrowly missing March’s 140,333 units. The electric two-wheeler segment is the biggest volume driver of the EV industry in India. In October, it accounted for 64% of total India EV Inc’s volumes of 217,621 units.

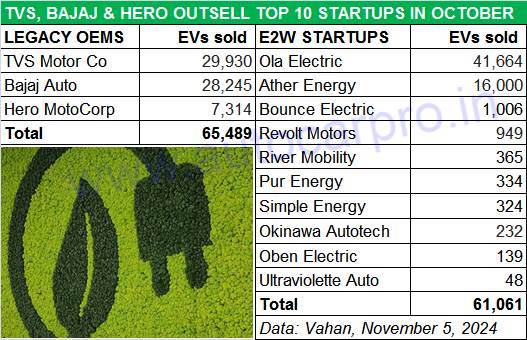

TVS, Bajaj Auto and Hero MotoCorp with combned sales of 65,489 e-scooters sold 4,428 EVs more than the Top 10 e2W startups in October 2024.

TVS, Bajaj Auto and Hero MotoCorp with combned sales of 65,489 e-scooters sold 4,428 EVs more than the Top 10 e2W startups in October 2024.

While Autocar Professional’s comprehensive e-two-wheeler industry retail sales analysis of the October 2024 and January-October 2024 is a deep dive into the market performance of the Top 6 OEMs – Ola Electric, TVS Motor Co, Bajaj Auto, Ather Energy, Hero MotoCorp and Greaves Electric Mobility, last month also saw the three legacy ICE OEMS (TVS, Bajaj and Hero MotoCorp) which have forayed into electric vehicles outsell the Top 10 EV startups in India.

All three legacy OEMs, which had ensured that their showrooms across India were well stocked for the festive season with best-ever monthly dispatches in September, registered their best-ever monthly retail sales in the festive month of October. TVS Motor Co sold 29,930 iQubes last month, regaining its lead over a hard-charging Bajaj Auto (28,245 Chetaks) which had outsold it in September, and Hero MotoCorp sold 7,314 Vida e-scooters. Club all these three companies’ sales and you get 65,489 units, which is 4,428 EVs more than the combined total of the Top 10 e-two-wheeler startups in India: 61,061 units.

Of the total 139,031 e-two-wheelers sold in October 2024, TVS (21% market share), Bajaj Auto (20% market share) and Hero MotoCorp (5% market share) have a combined market share of 47% with their cumulative 65,489 units compared to 44% for the Top 10 e2W OEMs, with the remaining 9% market share being fought for by the rest of the field – 196 players. In October, Vahan retail sales data reflected all of 209 e-wheeler manufacturers in India.

Ola Electric, which had a torrid August and September, though remains the No. 1 e-two-wheeler OEM and bounced back with 41,664 units in October, its third-highest monthly score after the 53,640 units in March 2024 and 41,794 units in July 2024. While Ola, with 30% market share, accounts for the bulk of the Top 10 Startups’ sales, Bengaluru-based Ather Energy, which clocked best-ever monthly retails of 16,000 units in October, has an 11.50% market share. The remaining eight start-ups – Bounce Electric, Revolt Motors, River Mobility, Pur Energy, Simple Energy, Okinawa Autotech and Oben Electric – account for 3,397 units and 5.56% market share. Revolt Motors (949 e-motorcycles) and Simple Energy (324 e-scooters) both registered their best-ever monthly sales yet.

Not very long ago, it was felt that EV startups on two wheels, with their perceived absence of legacy issues, IT technology prowess, venture capital investments and the ability to burn cash to get a foothold in the market, would stamp their dominance on this segment of zero-emission mobility. However, TVS, Bajaj Auto and Hero MotoCorp, the three legacy ICE OEMs which have diversified and plugged into e-mobility, are proving to be a resilient lot and are giving the two-wheeler startup world a run for their money and more. These three companies, which have a strong R&D setup and component supplier base, are clearly benefiting from their growing localisation levels, introduction of new variants, brand power and the marketing strength that comes from a large dealer network spread across the country.

ALSO READ: EV sales in India surge 55% to best-ever 217,000 units in October

Electric cars and SUVs race to best-ever monthly sales of 10,500 units in festive October