The Indian automotive sector witnessed a remarkable surge in retail sales during October 2024, with overall vehicle sales jumping 32% year-over-year, driven by the convergence of major festivals and strong rural demand. According to data released by the Federation of Automobile Dealers Associations (FADA), total vehicle retail sales reached 28,32,944 units in October 2024, compared to 21,43,929 units in the same month last year.

Festival Power and Rural Momentum

The coincidence of both Navratri and Diwali falling in October 2024 created a perfect storm for auto sales, as these festivals traditionally account for 30-35% of annual auto sales. FADA President C S Vigneshwar noted that dealers entered this crucial period with all-time high inventory levels, and the market response didn’t disappoint.

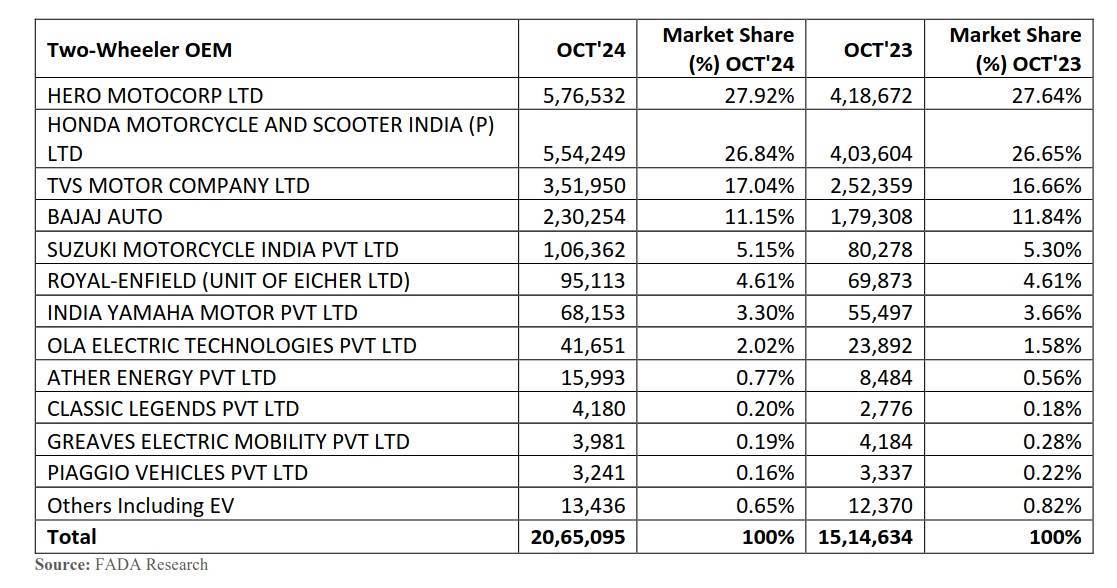

Two-wheeler sales, often considered a barometer of rural economic health, recorded an impressive 36% year-over-year growth, with 20,65,095 units sold in October. The segment also witnessed a substantial month-on-month growth of 71%. Hero MotoCorp maintained its market leadership with a 27.92% share, followed closely by Honda Motorcycle and Scooter India at 26.84% and TVS Motor Company at 17.04%.

The strong performance in the two-wheeler segment was attributed to multiple factors, including attractive festive schemes, new model launches, and improved vehicle availability. The rural market played a pivotal role, boosted by favorable monsoons and positive crop expectations. The government’s announcement of increased Minimum Support Price (MSP) for Rabi crops further enhanced market sentiment.

Passenger Vehicles: Growth Amid Inventory Concerns

The passenger vehicle (PV) segment registered a robust 32% year-over-year growth, with sales reaching 4,83,159 units. Maruti Suzuki continued to dominate the market with a 41.33% share, followed by Hyundai Motor India at 14.07% and Tata Motors at 13.46%. The segment saw particularly strong demand for SUVs and new model launches.

However, despite the strong sales performance, FADA raised concerns about high inventory levels in the PV segment. Dealer inventory remains elevated at 75-80 days of stock, despite a slight reduction of five days. This oversupply situation might lead to continued substantial discounts through the end of the calendar year.

Commercial Vehicles Show Modest Growth

The commercial vehicle (CV) segment recorded a modest 6% year-over-year growth, with sales of 97,411 units. Tata Motors led the segment with a 31.37% market share, followed by Mahindra & Mahindra at 28.51%. The growth was supported by agricultural demand and bulk purchases for container movements, though challenges such as sluggish construction activities and increased vehicle prices affected overall performance.

Three-Wheeler and Tractor Performance

Three-wheeler sales grew by 11.45% year-over-year to 1,22,846 units, with Bajaj Auto maintaining its leadership with a 39.06% market share. The tractor segment showed a modest 3.08% growth, reaching 64,433 units, reflecting the positive agricultural sentiment in rural areas.

Urban-Rural Divide

The data revealed interesting trends in the urban-rural divide across segments. In the two-wheeler segment, rural areas accounted for 55.5% of sales, while urban areas contributed 44.5%. The passenger vehicle segment showed a contrasting pattern, with urban areas dominating at 61% of sales. This split highlights the different dynamics driving various vehicle segments across India’s geographic spectrum.

Future Outlook: Wedding Season Optimism

Looking ahead, the automotive sector appears poised for continued strong performance through the end of 2024. An estimated 4.8 million weddings scheduled nationwide in November and December 2024 are expected to drive additional demand, particularly in the two-wheeler and passenger vehicle segments.

However, dealers remain cautious about certain challenges. The high inventory levels in the passenger vehicle segment continue to be a concern, and there are apprehensions about potential slowdowns caused by customers postponing purchases in anticipation of better year-end discounts.

FADA’s dealer sentiment survey revealed mixed expectations for November 2024, with 37.15% of dealers expecting growth, 39.69% expecting flat sales, and 23.16% anticipating a decline. The survey also showed that 48.35% of dealers reported good liquidity conditions, while 38.93% reported neutral conditions.

Motor vehicle road tax collections for October 2024 reached Rs 9,707 crore, showing a significant 33.4% increase year-over-year and a 63.2% jump month-on-month, further confirming the robust sales performance during the festive period.

As the sector moves into the wedding season, the industry remains optimistic about near-term growth prospects while maintaining a cautious approach to inventory management and market dynamics. The combination of positive rural sentiment, good crop yields, and the upcoming wedding season suggests continued momentum in the automotive retail sector, though careful navigation of potential challenges will be crucial for sustained growth.