Rural India continued to demonstrate its market strength in October 2024, posting growth in key two-wheeler and passenger vehicle categories, despite the festival season traditionally driving stronger urban sales.

The latest data from the Federation of Automobile Dealers Associations (FADA) also reveals interesting shifts in the urban-rural dynamics of India’s auto retail market.

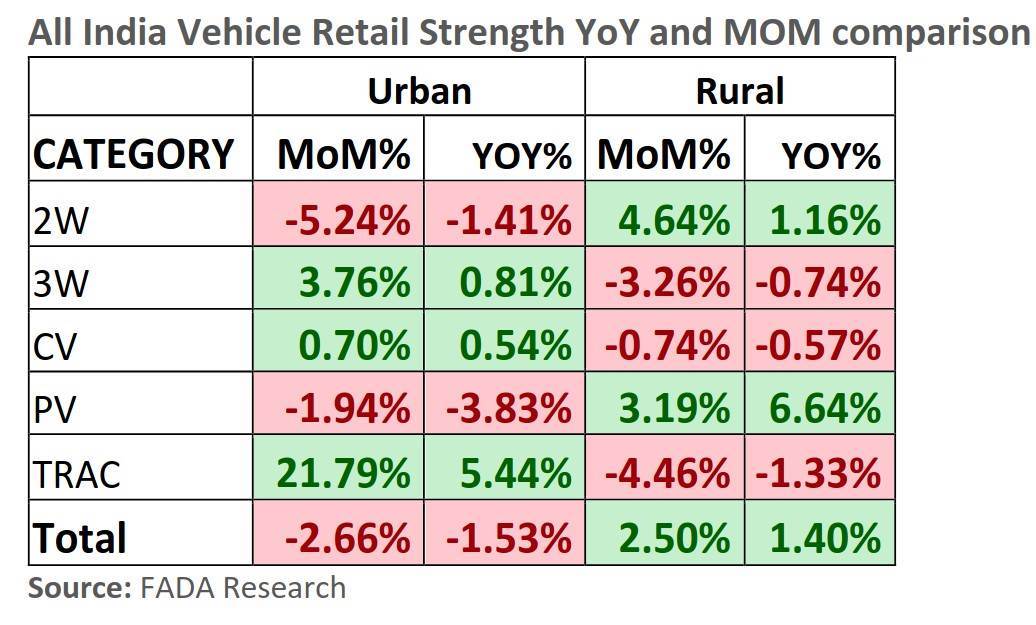

In October, auto sales in urban areas were down 2.7% month on month and 1.5% year on year. In contrast, rural sales were up 2.5% on the month and 1.4% on the year in October 2024.

This was because, in urban areas, two critical segments — two-wheelers and passenger vehicles — showed month-over-month and year-over-year declines in October. Month on month, urban two-wheeler sales were down by a sharp 5.24% and passenger vehicles fell by 1.94%. Year over year, two-wheeler sales fell 1.4% in October, while passenger vehicle saless fell 3.8%.

As for the rural market, both these categories registered growth. Two-wheeler sales grew by 4.64% month on month in rural areas, while passenger vehicle sales increased by 3.19%. On a year-on-year basis, two-wheeler sales were up 1.2% and PVs were up by a strong, 6.6% in rural areas in October.

The trends, however, were different for other categories such as CVs, tractors and three-wheelers, where urban sales outperformed rural sales in October.

In tractors, rural sales declined by 4.46%, but jumped 21.79% in urban areas, possibly indicating increasing mechanization in peri-urban agriculture.

Looking at year-to-date performance (April to October 2024), rural markets have shown stronger growth across most segments compared to urban areas. While urban centers saw a 2% decline overall, rural areas registered a 1.73% growth, with particularly strong performance in three-wheelers (5.96% growth) and passenger vehicles (5.31% growth).

Interestingly, cumulative sales are down across all segments in urban areas, led by tractors (-9.4%) and three-wheelers (-6.0%). The lowest decline (-0.9%) was seen in CVs.

“The rural market once again played a leading role in driving growth, particularly in the 2W and PV segments,” FADA noted in its release.

The association highlighted that the government’s announcement of increased Minimum Support Price (MSP) for Rabi crops further boosted rural market sentiments.

Relative Contribution

The FADA numbers also gave a glimpse into the changing contributions of the two markets to different auto segment sales.

The overall market split for October stood at 47.2% urban and 52.8% rural, maintaining rural India’s position as the larger market for automobile retail. This represents a slight shift from September’s 48.4% urban and 51.6% rural split, indicating rural India’s growing importance in the country’s automotive market.

Two-wheelers, the largest segment by volume, saw rural areas maintain their leadership with a 55.5% share of sales in October 2024, compared to 44.5% in urban areas. This was an improvement from September when rural areas commanded on a 53.1% share. The year-to-date trend shows rural areas consistently accounting for over 55% of two-wheeler sales, underlining the segment’s strong rural dependency.

Passenger vehicles present a contrasting picture, with urban areas maintaining their traditional dominance. Urban centers accounted for 61% of passenger vehicle sales in October 2024, though this represented a slight decline from September’s 62.2% in keeping with the weakness seen in October. Rural areas increased their share to 39% in October, up from 37.8% in September.

The commercial vehicle segment showed a near-equal split, with urban areas holding a slight edge at 51.6% compared to rural’s 48.4% in October. This balanced distribution represents a marginal increase in urban share from September’s 51.2%, possibly driven by festival season logistics demand in cities.

Three-wheelers, crucial for last-mile connectivity, saw urban areas command 48.2% of sales compared to rural’s 51.8% in October. This marks a shift from September when rural areas had a more pronounced lead with 53.6% share.

These trends suggest that while urban India remains crucial for premium segments and new technology adoption, rural India continues to be the backbone of volume growth in the Indian automotive market. The data also indicates that rural demand remains resilient, supported by positive agricultural indicators and government policies, even as urban markets show more volatility in response to short-term factors like festivals and promotional campaigns.