Commerce and Industry Minister Piyush Goyal has set a formidable target for India’s auto component industry: achieving $100 billion in exports by 2030. An examination of the industry’s current position and growth trends by Rubix Data Sciences has now found that this goal is very much within the realm of possibility.

The industry’s growth is driven by three key factors: a booming domestic automotive sector, rising export demand, and government initiatives promoting local manufacturing and technological advancements.

The report provides detailed trade statistics showing steady growth. India’s auto component exports stood at $21.2 billion in FY2024, having grown at a 10% CAGR since FY2020.

A detailed breakdown of export categories reveals the industry’s diversification. Drive transmission and steering components dominate the export basket, contributing $7.3 billion or 34% of total exports. Engine components form the second-largest category at $4.1 billion, representing 19% of exports. The electrical and electronics segment contributes $2.5 billion, accounting for 12% of the total.

In addition, suspension and braking parts generate $2.4 billion in exports, while body, chassis, and BIW components closely follow at $2.3 billion, each representing 11% of exports. Interior components, excluding electronics, account for $1.2 billion or 6% of exports. The remaining share comprises consumables, rubber components, and cooling systems.

Shradha Suri Marwah, president of the Automotive Component Manufacturers Association, highlights the resilience shown by the autocomponent industry in the face of an overall slowdown in exports and global markets. “Apart from increase in vehicle production, higher value addition from the component sector has led to growth in the auto components sector… while overall merchandise exports from India witnessed degrowth in FY24, auto components exports have grown despite geopolitical challenges and increase in logistics costs,” she noted.

India’s Global Market

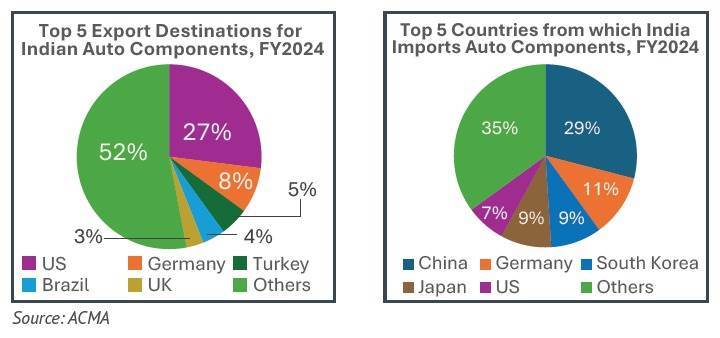

The Rubix report outlines India’s export market concentration, with the top five destinations accounting for 48% of total auto component exports. The United States emerges as the leading market, commanding a 27% share, while Germany accounts for 8%. Turkey, Brazil, and the UK each represent smaller but significant shares at 4%, 3%, and 3% respectively.

The report identifies several interconnected factors driving supply chain shifts toward India. These include the lingering effects of pandemic-induced chip shortages, ongoing tensions from the US-China trade war, disruptions from the Russia-Ukraine conflict, and impacts of the Israel-Palestine crisis. This combination of factors has contributed to a significant production shift away from Europe and China towards Southeast Asia and India, resulting in India recording a trade surplus of $300 million in FY2024.

The industry is faced with several emerging opportunities, particularly in metal casting and forgings, according to the report. The closure of several European metal-casting and forging plants due to economic viability issues has created a market gap that Indian manufacturers are well-positioned to fill. India’s competitive advantages in labor and raw material costs, combined with strong technical expertise, make it an attractive alternative for these services in global supply chains.

The Challenges

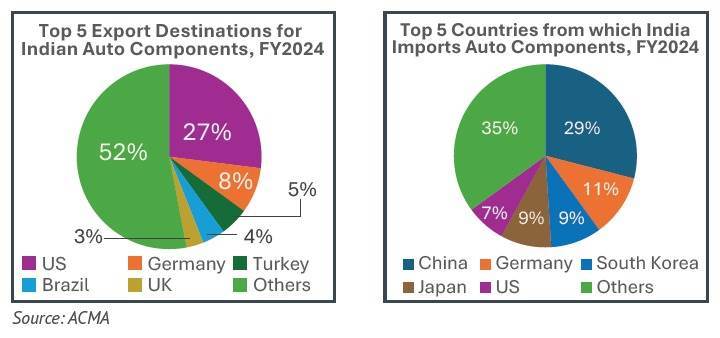

However, Rubix identifies significant challenges regarding China’s dominance in the EV supply chain. China’s control of approximately 75% of global battery production capacity and over 50% contribution to global EV production presents a formidable competitive challenge. While the China+1 strategy has benefited India, the report notes that the country hasn’t yet seen significant investments directly diverted from China. Instead, India’s gains have come from companies seeking to de-risk their operations by increasing their Indian sourcing.

Another challenge is the Red Sea crisis. This crucial maritime route, which handles nearly 30% of global shipping container traffic, is experiencing substantial disruption due to attacks by Yemen-based Houthi militants on shipping vessels. The resulting vessel rerouting has led to port congestion, creating a cascade of challenges for Indian automakers. These include extended production cycles, market delivery delays, inventory accumulation, and increased pressure on working capital.

Steps Needed

The key requirement to support export growth is, unsurprisingly, continued investment into research and development and technology. To this end, notes the report, auto component makers are planning substantial investments of $2.5-3.0 billion in FY2025, primarily focusing on technology upgrades and modernisation. This investment surge is driven by OEMs’ push to localise supply chains.

The government too is doing its bit. The Production-Linked Incentive (PLI) scheme has seen its allocation increase to Rs 3,500 crore in Budget 2024-25. As of March 2024, the scheme has approved 18 auto companies under the Champion OEM category and 67 companies under the Component Champion category.

Outlook

The Automotive Component Manufacturers Association expects the industry to grow at 7%–10% in FY2025, based on steady vehicle production, a strong aftermarket, government initiatives, and expanding export activities. The report indicates that Indian auto component manufacturers are receiving an unprecedented volume of export orders and are expanding their capacities to meet rising global demand.

However, achieving the $100 billion export target will require addressing key challenges including technological upgradation, supply chain resilience, and competition from established global players, particularly in the EV component space. The success of this ambitious target will depend on the industry’s ability to capitalize on global supply chain shifts while building robust domestic manufacturing capabilities.