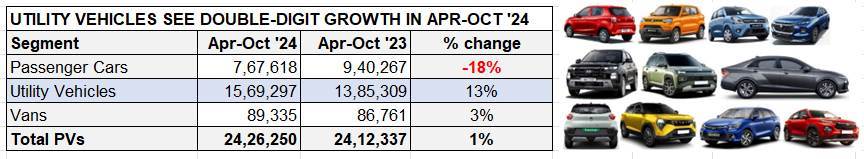

If the Indian passenger vehicle industry, which has registered wholesales of an estimated 2.42 million units (up 1% YoY) has managed to stay out of negative territory in the first seven months of FY2025, then it’s thanks to the sustained double-digit growth of the utility vehicle segment. At 1.56 million units, the UV segment, which comprises SUVs and MPVs, has posted YoY growth of 13% and accounted for 65% of total passenger vehicle dispatches in the April-October 2024 period. This is a considerable increase from the 57% share UVs had in April-October 2023.

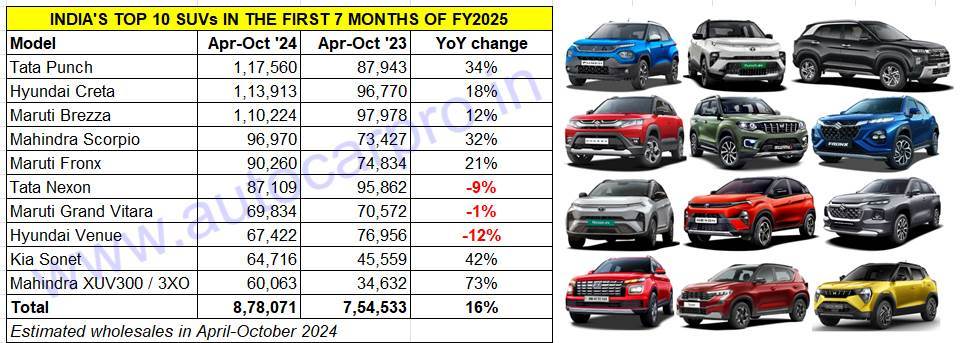

SIAM’s PV member companies have around 70 UV models and over 870 variants in the market. Of these, some are far more popular than the others and are part of the monthly Top 10 models, with the majority being compact SUVs. Let’s take a closer look at India’s 10 best-selling SUVs in the April-July 2024 period.

SIAM’s PV member companies have around 70 UV models and over 870 variants in the market. Of these, some are far more popular than the others and are part of the monthly Top 10 models, with the majority being compact SUVs. Let’s take a closer look at India’s 10 best-selling SUVs in the April-July 2024 period.

SUV No. 1 – Tata Punch: 117,560 units, up 34% YoY

The Tata Punch, India’s third best-selling SUV in FY2024 (169,844 units, up 27%) after the Tata Nexon and the Maruti Brezza, is leading the Top 10 SUVs table in FY2025 at present. In fact, it opened this fiscal year with a new monthly high of 19,158 units in April 2024, which is the second highest monthly stat for any SUV in FY2025 to date after the Marui Brezza’s 19,190 units in August 2024.

The Punch, which is available with petrol, CNG and electric powerplants, has clocked total dispatches of 117,560 units between April and October, which constitutes robust 34% YoY growth (April-October 2023: 87,943 units). Not only has the Punch outsold its sibling, the Nexon – India’s best-selling SUV in FY2024, FY2023 and FY2022 – for the past 10 months, but it has also aced the Bharat NCAP crash test with a top five-star rating. The Punch’s sales in the fiscal to date give it a 48% share of Tata Motors’ total SUV dispatches of 242,948 units. In June 2024, the Punch hit the 400,000 sales milestone, becoming the fastest SUV model to do so in 33 months since its launch in October 2018.

SUV No. 2 – Hyundai Creta: 113,913 units, up 18% YoY

Just 3,647 units behind the Tata Punch is the Hyundai Creta. India’s best-selling midsize SUV and the No. 4 UV in FY2024 has raced into No. 2 position in the first seven months of FY2025. The 113,913 units, which comprise 47% of Hyundai Motor India’s total UV sales of 241,282 units, make for 18% YoY growth. The Creta received a sales booster in January 2024 with the launch of the MY2024 facelifted Creta, which has helped accelerate demand for the popular model.

In October 2024, the new Creta clocked its highest-ever monthly dispatches yet – 17,497 units – which shows Hyundai ensured its showrooms were not found wanting for delivery in the festive season. The rapid pace of demand for the model has meant that the new Creta cruised to 100,000-unit sales in just six months. This makes it the fastest in its segment to hit the 100,000 milestone and in half the time the Maruti Grand Vitara took. From January 2024 to October 2024, the Creta has clocked wholesales of 158,859 units.

SUV No. 3 – Maruti Brezza: 110,024 units, up 12% YoY

The third SUV in the Top 10 chart with six-figure wholesales is the Maruti Brezza compact SUV. Between April and October, the Brezza has registered cumulative sales of 110,024 units, up 12% YoY (April-October 2023: 97,978 units), opening the fiscal year with 17,113 units in April and hitting a best-ever monthly figure of 19,190 units in August.

The Brezza had missed out on the No. 1 SUV title in FY2024 by a whisker – just 2,032 units – to the Tata Nexon but, as can be seen in the current fiscal, it is hard on the heels of its podium partners: the Punch and the Creta. Total cumulative sales since launch of the Brezza, which drove past the million-units milestone in December 2023, are 1.16 million units.

SUV No. 4 – Mahindra Scorpio N / Scorpio Classic: 96,970 units, up 32% YoY

Mahindra is firing on all cylinders in FY2025 and is well set to achieve 500,000 unit sales for the first time in a fiscal. At 314,714 units in April-October 2024, the SUV maker has already achieved 68% of its record wholesales of 459,877 units in FY2024. Leading the charge are the Scorpio twins with 96,970 units, followed by the XUV 3XO (60,063), Bolero (56,381 units), XUV700 (53,927 units), Thar and Thar Roxx (42,726 units), XUV400 (4,531 units) and the Marazzo (114 units).

Mahindra’s best-selling UV continues to be the Scorpio in the form of the popular Scorpio N and the Scorpio Classic. The Scorpio – No. 6 in FY2024 – is currently ranked fourth with 96,970 units, up 32% on year-ago dispatches of 73,427 units, which constitutes 31% of M&M’s total SUV sales of 314,714 units (up 22% YoY). In terms of fuel-wise sales split, the diesel-engine Scorpios have sold 89,210 units while the petrol-powered siblings sold 7,760 units. Clearly, the consumer verdict is in overwhelming favour of diesel which comprises 92% of the sales. Between the Scorpio N and the Classic, demand is understood to be sizeably more for the Scorpio N.

SUV No. 5 – Maruti Fronx: 90,260 units, up 21% YoY

Ranked fifth on the Top 10 SUV listing is the Maruti Fronx compact SUV with 90,260 units, which gives it a 22% share of Maruti Suzuki’s UV sales of 414,309 units between April and October. FY2024 saw Maruti Suzuki launch three all-new Nexa models – Fronx, Jimny and the Invicto. Of these three, the Fronx has been the most successful.

In September, the Baleno-based Maruti Fronx became the second premium SUV from the Nexa channel, after the Grand Vitara, to achieve 200,000-unit wholesales in the domestic market. Having clocked 100,000 sales in just 10 months after launch in April 2023, the next 100,000 Fronx compact SUVs have been sold in a scant seven months. And, as in FY2024, it remains ahead of the eighth-ranked Grand Vitara midsize SUV in the first seven months of FY2025.

SUV No. 6 – Tata Nexon: 87,109 units, down 9% YoY

The Tata Nexon compact SUV, which was India’s best-selling SUV for three straight years in FY2024, FY2023 and FY2022, is clearly feeling the heat of the revved-up competition as well as from its own sibling, the Punch. The Nexon has dropped five ranks to be at No. 6 position now.

At 87,109 units, the Nexon’s sales in the first seven months of FY2025 are down by 9% YoY (April-October 2023: 95,862 units). The Nexon, sold in petrol, diesel and electric avatars, is slated to get CNG power later this fiscal. Will the Nexon numbers stage a recovery later this fiscal and in 2025? We’ll have to wait and see but it just might be that the competition has, by then, taken an unsurmountable lead.

SUV No. 7 – Maruti Grand Vitara: 69,834 units, down 1% YoY

The Maruti Grand Vitara, which continues to be a key contributor to Maruti Suzuki’s premium Nexa sales channel, has registered total wholesales of 69,834 units in the April-October 2024 period, down marginally by 1% on its year-ago sales of 70,572 units.

Maruti Suzuki India’s flagship model remains popular with SUV buyers with its fuel-efficient hybrid system, clever packaging and interior quality but seems to be feeling the heat of new competition. In early July 12024, this premium Nexa model, which was the fastest midsize SUV to hit the 100,000 sales in 12 months, raced past the 200,000 milestone in 22 months.

SUV No. 8 – Hyundai Venue: 67,422 units, down 12% YoY

The Hyundai Venue, the first compact SUV from Hyundai Motor India, is the third model after the Tata Nexon and Maruti Grand Vitara in this Top 10 SUVs list to register a cumulative sales decline in the first seven months of FY2025. At 67,422 units, the Venue’s wholesales are down 12% YoY (April-October 2023: 76,956 units) which translates into 9,534 fewer units than in the year-ago period.

Demand for the Venue seems to have slowed down in the wake of the rollout of the Exter, Hyundai’s second compact SUV launched a year ago. The Exter has sold 49,065 units in the first seven months of FY2025. Launched in May 2019, the Hyundai Venue recently drove past cumulative sales of 600,000 units in the Indian market.

SUV No. 9 – Kia Sonet: 64,716 units, up 42% YoY

The penultimate SUV in this Top 10 listing is the Kia Sonet compact SUV with 64,716 units, which is stellar 42% YoY increase (April-October 2023: 45,559 units). Launched in January 2024, the new Sonet compact SUV, which is equipped with plenty of features and also ADAS, has emerged as Kia India’s highest-selling model.

The Sonet has outsold its sibling, the Seltos midsize SUV for 10 straight months this year and, along with the Carens MPV, has helped propel demand for the Korean brand. In the first seven months of FY2025, Kia has sold a total of 150,074 units, which gives the Sonet a strong share of 43 percent.

SUV No. 10 – Mahindra XUV300/3XO: 60,063 units, up 73%

Wrapping up the Top 10 SUVs for the first seven months of FY2025 is the Mahindra XUV 300 / 3XO. The compact SUV’s cumulative sales at 32,501 units, are a handsome 73% YoY increase (April-October 2023: 34,632 units). This translates into an additional 25,431 units, the second highest increase in terms of additional units YoY amongst the Top 10 SUVs in this list after the 29,617 additional Tata Punch dispatched.

In April, M&M launched the new 3XO – the facelifted version of the XUV300, which has given a fresh charge to sales. The youngest Mahindra in town has been priced aggressively from Rs 749,000 – the XUV 3XO aims to be the new disrupter in the booming compact SUV market which is why M&M is eyeing the top rank in the sub-compact SUV segment in the next three years. With the Mahindra 3XO acing the Bharat NCAP crash test with a top five-star rating recently, expect demand for this compact SUV to further accelerate.

COMPACT SUVs RULE THE TOP 10 CHART

Compact SUVs continue to rule over midsize SUVs, maintaining their grip on the market. This segment, which registered sales of over a million units in FY2024 and a 25% share of the record 2.52 million UV dispatches in India, has seen total dispatches of an estimated 796,575 units in April-October 2024 (up 13% YoY). This constitutes 51% of the total UVs sold (15,69,297 units) and translates into every second SUV sold being a compact (less than 4,000mm-long) model.

The Top 10 best-selling models listed above together add up to 878,071 units (up 16% YoY) comprising 597,354 compact SUVs and 280,717 midsize SUVs, which makes for a 68:32 percent ratio in favour of compact SUVs. Small, as they say, can often be big. . .

ALSO READ: CNG car and SUV sales jump 67% to highest level in October: 99,967 units

Mahindra Thar tops 200,000 sales, new Thar Roxx accelerates demand

Toyota Hyryder sales cross 100,000 units, midsize SUV turns best-selling rebadged model