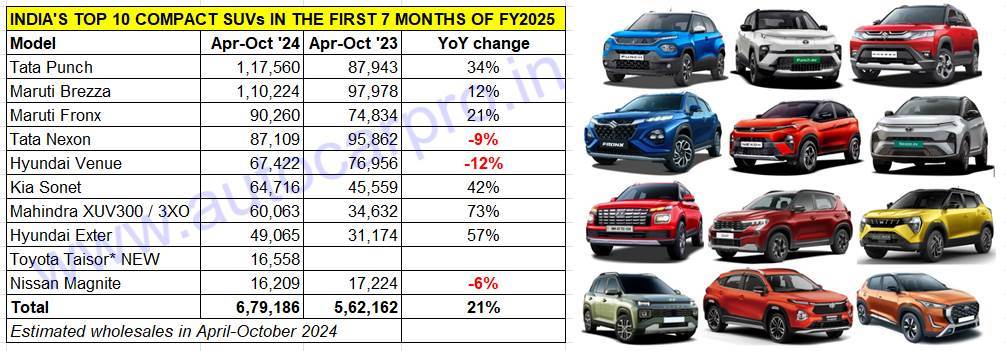

Small is big in the Indian SUV market, if one goes by the sales of the compact SUV models. In the first seven months of FY2025, this extremely popular sub-segment of the utility vehicle industry clocked wholesales of an estimated 796,575 units in April-October 2024 (up 13% YoY). This constitutes 51% of the total UVs sold (15,69,297 units) and translates into every second SUV sold being a compact (less than 4,000mm-long) model.

At present, of the total 70-odd UVs and over 870 variants in the market, compact SUVs account for 14 models and 280 variants. Of these 14 models, seven compact SUVs are part of the Top 10 SUVs list for the April-October 2024 period, clearly indicating their domination of the segment. Let’s take a closer look at India’s 10 best-selling compact SUVs in the April-October 2024 period.

Surging demand sees 7 of the Top 10 compact SUVs register strong double-digit growth. However, sales of the Nexon, Venue and Magnite have fallen.

Surging demand sees 7 of the Top 10 compact SUVs register strong double-digit growth. However, sales of the Nexon, Venue and Magnite have fallen.

No. 1 – Tata Punch: 117,560 units, up 34% YoY

The Tata Punch, India’s third best-selling SUV in FY2024 (169,844 units, up 27%) after the Tata Nexon and the Maruti Brezza, is leading the Top 10 SUVs table in FY2025 at present. In fact, it opened this fiscal year with a new monthly high of 19,158 units in April 2024, which is the second highest monthly stat for any SUV in FY2025 to date after the Marui Brezza’s 19,190 units in August 2024.

The Punch, which is available with petrol, CNG and electric powerplants, has clocked total dispatches of 117,560 units between April and October, which constitutes robust 34% YoY growth (April-October 2023: 87,943 units). Not only has the Punch outsold its sibling, the Nexon – India’s best-selling SUV in FY2024, FY2023 and FY2022 – for the past 10 months, but it has also aced the Bharat NCAP crash test with a top five-star rating. The Punch’s sales in the fiscal to date give it a 48% share of Tata Motors’ total SUV dispatches of 242,948 units. In June 2024, the Punch hit the 400,000 sales milestone, becoming the fastest SUV model to do so in 33 months since its launch in October 2018.

No. 2 – Maruti Brezza: 110,024 units, up 12% YoY

The third SUV in the Top 10 chart with six-figure wholesales is the Maruti Brezza compact SUV. Between April and October, the Brezza has registered cumulative sales of 110,024 units, up 12% YoY (April-October 2023: 97,978 units), opening the fiscal year with 17,113 units in April and hitting a best-ever monthly figure of 19,190 units in August.

The Brezza had missed out on the No. 1 SUV title in FY2024 by a whisker – just 2,032 units – to the Tata Nexon but, as can be seen in the current fiscal, it is hard on the heels of its podium partners: the Punch and the Creta. Total cumulative sales since launch of the Brezza, which drove past the million-units milestone in December 2023, are 1.16 million units.

No. 3 – Maruti Fronx: 90,260 units, up 21% YoY

Ranked fifth on the Top 10 SUV listing is the Maruti Fronx compact SUV with 90,260 units, which gives it a 22% share of Maruti Suzuki’s UV sales of 414,309 units between April and October. FY2024 saw Maruti Suzuki launch three all-new Nexa models – Fronx, Jimny and the Invicto. Of these three, the Fronx has been the most successful.

In September, the Baleno-based Maruti Fronx became the second premium SUV from the Nexa channel, after the Grand Vitara, to achieve 200,000-unit wholesales in the domestic market. Having clocked 100,000 sales in just 10 months after launch in April 2023, the next 100,000 Fronx compact SUVs have been sold in a scant seven months. And, as in FY2024, it remains ahead of the eighth-ranked Grand Vitara midsize SUV in the first seven months of FY2025.

No. 4 – Tata Nexon: 87,109 units, down 9% YoY

The Tata Nexon compact SUV, which was India’s best-selling SUV for three straight years in FY2024, FY2023 and FY2022, is clearly feeling the heat of the revved-up competition as well as from its own sibling, the Punch. The Nexon has dropped five ranks to be at No. 6 position now.

At 87,109 units, the Nexon’s sales in the first seven months of FY2025 are down by 9% YoY (April-October 2023: 95,862 units). The Nexon, sold in petrol, diesel and electric avatars, is slated to get CNG power later this fiscal. Will the Nexon numbers stage a recovery later this fiscal and in 2025? We’ll have to wait and see but it just might be that the competition has, by then, taken an unsurmountable lead.

No. 5 – Hyundai Venue: 67,422 units, down 12% YoY

The Hyundai Venue, the first compact SUV from Hyundai Motor India, is the third model after the Tata Nexon and Maruti Grand Vitara in this Top 10 SUVs list to register a cumulative sales decline in the first seven months of FY2025. At 67,422 units, the Venue’s wholesales are down 12% YoY (April-October 2023: 76,956 units) which translates into 9,534 fewer units than in the year-ago period.

Demand for the Venue seems to have slowed down in the wake of the rollout of the Exter, Hyundai’s second compact SUV launched a year ago. The Exter has sold 49,065 units in the first seven months of FY2025. Launched in May 2019, the Hyundai Venue recently drove past cumulative sales of 600,000 units in the Indian market.

No. 6 – Kia Sonet: 64,716 units, up 42% YoY

The penultimate SUV in this Top 10 listing is the Kia Sonet compact SUV with 64,716 units, which is stellar 42% YoY increase (April-October 2023: 45,559 units). Launched in January 2024, the new Sonet compact SUV, which is equipped with plenty of features and also ADAS, has emerged as Kia India’s highest-selling model.

The Sonet has outsold its sibling, the Seltos midsize SUV for 10 straight months this year and, along with the Carens MPV, has helped propel demand for the Korean brand. In the first seven months of FY2025, Kia has sold a total of 150,074 units, which gives the Sonet a strong share of 43 percent.

No. 7 – Mahindra XUV300/3XO: 60,063 units, up 73%

Wrapping up the Top 10 SUVs for the first seven months of FY2025 is the Mahindra XUV 300 / 3XO. The compact SUV’s cumulative sales at 32,501 units, are a handsome 73% YoY increase (April-October 2023: 34,632 units). This translates into an additional 25,431 units, the second highest increase in terms of additional units YoY amongst the Top 10 SUVs in this list after the 29,617 additional Tata Punch dispatched.

In April, M&M launched the new 3XO – the facelifted version of the XUV300, which has given a fresh charge to sales. The youngest Mahindra in town has been priced aggressively from Rs 749,000 – the XUV 3XO aims to be the new disrupter in the booming compact SUV market which is why M&M is eyeing the top rank in the sub-compact SUV segment in the next three years. With the Mahindra 3XO acing the Bharat NCAP crash test with a top five-star rating recently, expect demand for this compact SUV to further accelerate.

No. 8 – Hyundai Exter: 49,065 units, up 57%

The entry-SUV category within the sub-four-metre-SUV segment is witnessing strong demand and the Exter’s aggressive pricing strategy has paid off. It is estimated that between 20,000-22,000 entry SUVs are sold each month and the Exter has made it mark there. The Exter, which is Hyundai’s second compact SUV after the Venue, was launched in July 2023 and crossed the 100,000 sales milestone in August 2024. Till end-October, the Exter has clocked total sales of 120,294 units.

July 2024 saw Hyundai introduce two new variants. The first was the Exter Knight Special Edition, which features styling updates inside and out, to mark the Exter’s first anniversary. Then, on July 14, the company launched the Exter dual-cylinder CNG at Rs 850,000, the first Hyundai CNG model to get dual-cylinder technology which deploys two smaller CNG cylinders instead of one large unit that occupies most of the boot space.

No. 9 – Toyota Urban Cruiser Taisor: 16,558 units

Toyota Kirloskar Motor (TKM)’s strategic move to re-enter India’s booming compact SUV market with the Urban Cruiser Taisor in April 2024 is paying off. The Taisor has already become a key contributor to TKM, which is well set at to record 300,000-unit sales for the first time in a fiscal year. Between April and October this year, the Taisor has registered wholesales of 16,558 units, and accounts for 11% of TKM’s UV sales of 147,351 units. What’s more, in its first six months of sales, it has already entered the Top 10 list.

The youngest of the four rebadged models (Glanza, Hyryder, Rumion, Taisor) in TKM’s portfolio, the Urban Cruiser Taisor is also the most affordable Toyota SUV – and also the smallest – in India with an aggressive starting pricing of Rs 773,500 (ex-showroom) for the base E MT variant.

The Taisor is powered by 1.2-litre, four-cylinder naturally aspirated petrol and 1.0-litre, three-cylinder turbo-petrol engines. The former develops 90hp and 113 Nm of torque, and can be had with either a 5-speed manual transmission or an AMT. The turbo-petrol engine (100hp/148 Nm) is available with a 5-speed manual and a 6-speed torque converter automatic. There is also a CNG option with claimed fuel efficiency of 28.5 km/kg.

No. 10 – Nissan Magnite: 16,209 units

Wrapping up the Top 10 compact SUV listing is the Nissan Magnite which, with 16,209 units, is down 6% on its year-ago dispatches of 17,224 units. In an effort to drive up demand, Nissan Motor India launched the facelifted Magnite on October 4, priced at Rs 599,000. This mid-life freshened-up model gets some styling updates and a few new features. The powertrains remain the same – the 72hp, 96Nm, 1.0-litre NA petrol and 100hp, 160Nm engine options. A 5-speed manual gearbox is standard across both. Nissan claims a fuel efficiency of 20kpl with the manual and 17.4kpl for the CVT turbo variants.

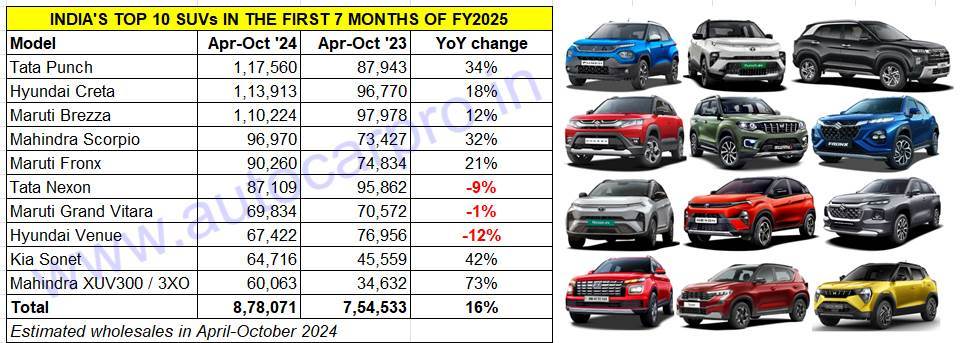

COMPACT SUVs RULE THE TOP 10 SUVs CHART

Compact SUVs continue to rule over midsize SUVs, maintaining their grip on the market. This segment, which registered sales of over a million units in FY2024 and a 25% share of the record 2.52 million UV dispatches in India, has seen total dispatches of an estimated 796,575 units in April-October 2024 (up 13% YoY). This constitutes 51% of the total UVs sold (15,69,297 units) and translates into every second SUV sold being a compact (less than 4,000mm-long) model.

India’s Top 10 best-selling utility vehicles listed below together add up to 878,071 units (up 16% YoY) comprising 597,354 compact SUVs and 280,717 midsize SUVs, which makes for a 68:32 percent ratio in favour of compact SUVs. Small, as they say, can often be big. . .