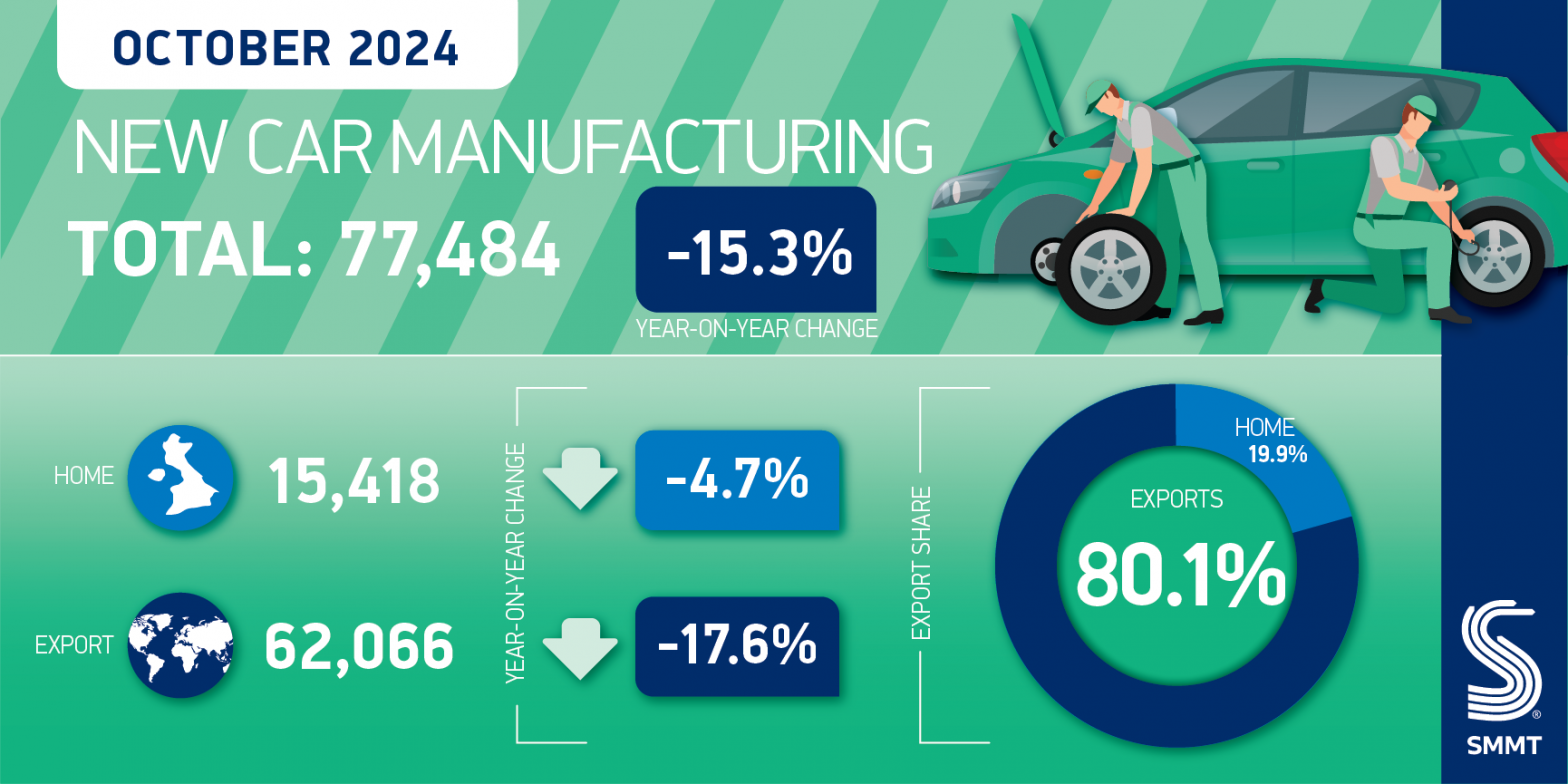

- British car production down -15.3% in October with 77,484 units rolling off factory lines.

- Output for home and export markets declines -4.7% and -17.6% respectively.

- Latest production outlook downgrades expectations as new car markets in UK and overseas stall.

- News comes as industry calls for urgent action with weak EV demand and unsustainable business costs undermining UK manufacturing.

UK car manufacturing output fell -15.3% in October, the eighth consecutive month of decline, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 77,484 units left factory gates, 14,037 fewer than in the same month last year, with plants continuing their retooling to enable production of the next generation of zero emission vehicles.

24,719 battery electric, plug-in hybrid and hybrid electric cars were made, representing almost a third (31.9%) of output, despite a volume decline of -32.6%. Since January, UK car makers have now turned out a combined 239,773 electrified vehicles, with 71.8% of them exported to global markets.

Overall, volumes for both domestic and export markets declined in October, down -4.7% and -17.6% respectively, with eight-in-10 cars shipped abroad and more than half of these (32,170 units) heading into the EU, although total volumes fell by -34.6%. Exports to the next largest market, the US, meanwhile, surged 96.2% to 14,584 units, thanks to increasing shipments of the UK’s luxury and premium models.

In the year to date, UK car production has now slipped -10.8% to 670,346 units, due primarily to falling exports. While production for the UK is up 5.3% to 159,125 units, exports are down -14.8% to 511,221 units, equivalent to 89,095 fewer cars being shipped overseas in the first ten months.

Manufacturers announced more than £20 billion worth of investment last year to drive their transition to EV production, a massive sum demonstrating the industry’s commitment to net zero.1 With weak new car markets in the UK and EU, the latter up just 0.7% from January-October, however, the latest independent production outlook has downgraded expectations for UK car and light van production.2 It anticipates factories turning out some 911,000 vehicles this year, and 839,000 in 2025, around a third less than the near 1.4 million cars and light vans made in 2019 pre-Covid.3

If planned UK zero emission model launches stay on track and consumer demand improves, there is potential to get above one million units in 2028. If not, output would remain below one million units until 2030, and in a worst-case scenario drop to fewer than 750,000 should plants close and others have reduced model lineups, which would have a devastating effect on the sector, jobs and economic growth.

The news follows a series of announcements by manufacturers and suppliers, in the UK and Europe, reflecting challenging market conditions and a slowdown in the transition to electrification. Ensuring the UK remains a globally competitive location for advanced vehicle manufacturing, therefore, requires an industrial and trade strategy that works for the sector and, in addition, a healthy domestic market, given car makers build close to where they sell. Government must work in partnership with industry to deliver market regulations that support consumers and industry, including measures to address the UK’s high cost of energy and the signing of trade deals built on free and fair trade.

Mike Hawes, SMMT Chief Executive, said,

These are deeply concerning times for the automotive industry, with massive investments in plants and new zero emission products under intense pressure. Slowdowns in the global market – especially for EVs – are impacting production output, with the situation in the UK particularly acute given we have arguably the toughest targets and most accelerated timeline but without the consumer incentives necessary to drive demand. The cost of stimulating that demand and complying with those targets is huge and, as we are seeing, unsustainable. Urgent action is therefore needed and we will work with government on its rapid review of the regulation and the development of an ambitious and comprehensive Industrial Strategy to assure our competitiveness.

Notes to editors

1 SMMT calculations based on publicly announced investment commitments, public and private, in UK automotive production and R&D 2023 from brands including but not limited to: MINI, JLR, Tata and Nissan

2 ACEA figures – https://www.acea.auto/pc-registrations/new-car-registrations-1-1-in-october-2024-year-to-date-battery-electric-sales-4-9/

3 Based on independent production outlook produced by AutoAnalysis in November – cars and light vans only