- UK commercial vehicle manufacturing falls -3.9% in October, but still records second-best monthly performance since 2008.

- Production for exports drops -11.6%, while domestic demand grows by 11.9%.

- Year to date output up 6.9% to 105,834 units – a 16-year high.

- News comes as industry calls for urgent action on market regulation and business costs.

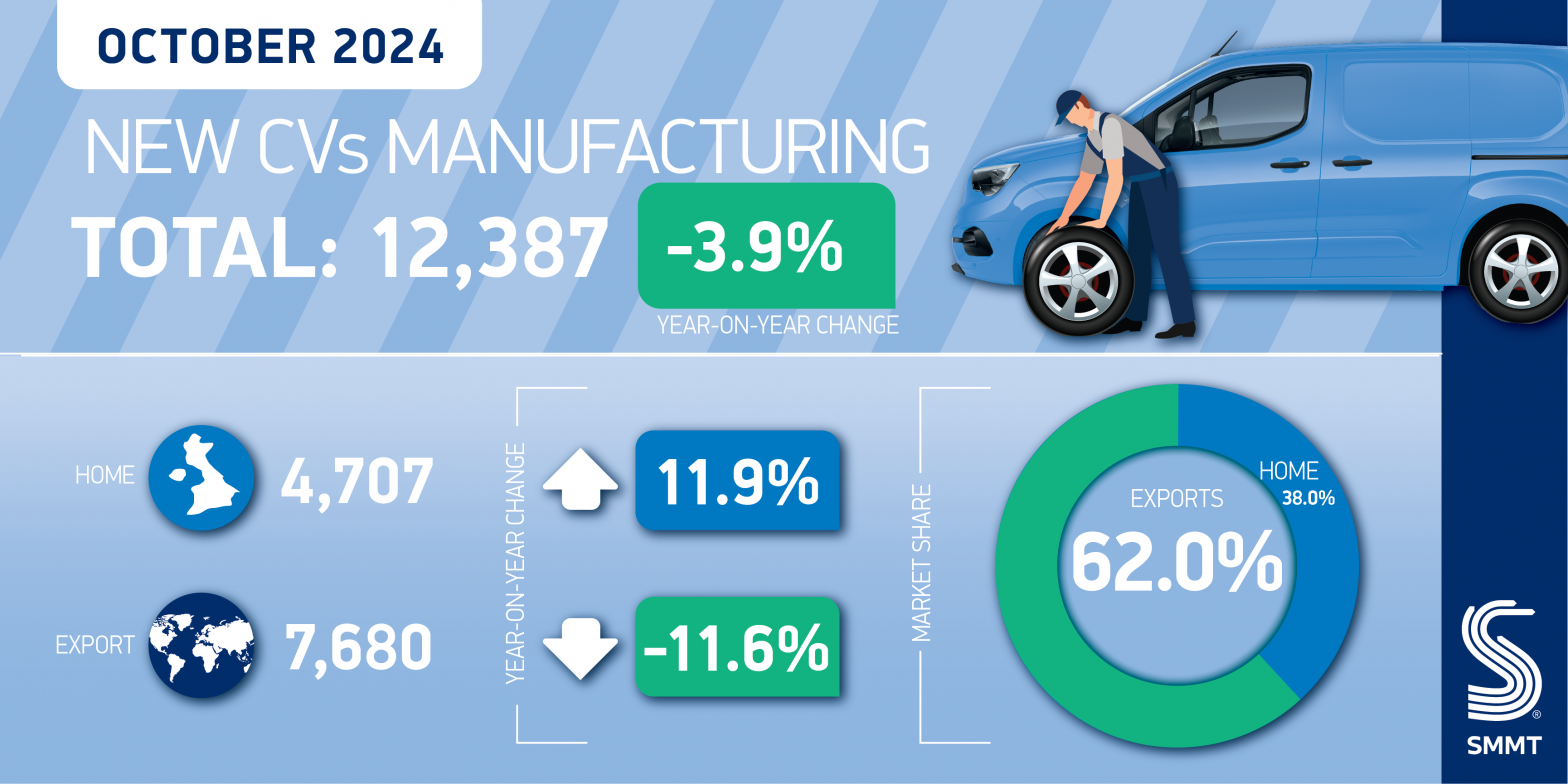

UK commercial vehicle (CV) manufacturing fell by -3.9% in October following September’s return to growth, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The decline is set against a high performing October 2023 when production volumes jumped 47.5%, making it the month’s highest output since 2008.1 This October came a close second, however, with 12,387 vans, buses, trucks, coaches and taxis rolling out of factory gates, just 503 fewer vehicles than last year.

Exports continued to dominate output with more than three in five vehicles built destined for overseas markets in the month, although shipments declined by -11.6% to 7,680 units. The EU remained the UK’s biggest international market, with 97.9% of exports heading to the bloc.2 Output for the domestic market, meanwhile, grew by 11.9% to 4,707 units.

In the year to date, CV manufacturing is up 6.9% to 105,834 units – an uplift of 6,803 on the same period in 2023 and representing the best first 10 months for 16 years.3 Exports recorded double-digit growth, increasing 11.4% to 69,342 units, while output for the UK saw a modest fall of -0.8% to 36,492 – a difference of just 299 units.

Mike Hawes, SMMT Chief Executive, said,

Despite the concerning recent announcements, UK commercial vehicle manufacturers continue to demonstrate resilience, with the sector achieving its strongest 10-month performance since 2008, despite a slight dip in October. Fluctuations in monthly output are inevitable, however, reflecting the realignment of plants and production processes to deliver next generation zero emission vans, trucks and buses. Sustained success will hinge on preserving the sector’s global competitiveness, so we must foster the conditions necessary to attract investment which include affordable energy costs, support for the skills transition and robust domestic demand for electrified commercial vehicles that meet operator needs and the targets set out in the UK’s ambitious mandate regulation.

Given recent announcements, ensuring the UK remains a globally competitive location for advanced vehicle manufacturing requires an industrial and trade strategy that works for the sector and, crucially, creates a healthy domestic market given vehicle makers build close to where they sell. Government must work in partnership with industry to deliver market regulations that support consumers and industry, as well as measures to address the UK’s high cost of energy, and trade deals built on free and fair trade.

Notes to editors

1 October 2008 production: 13,106 units

2 European CV export figures, October 2024: 7,518 units

3 UK CV production, Jan-Oct, 2008: 185,641 units