The telematics penetration rate across the car rental fleets in North America and Europe is expected to grow from 40% at the end of 2023 to 75% in 2028.

Graphic: Berg Insight

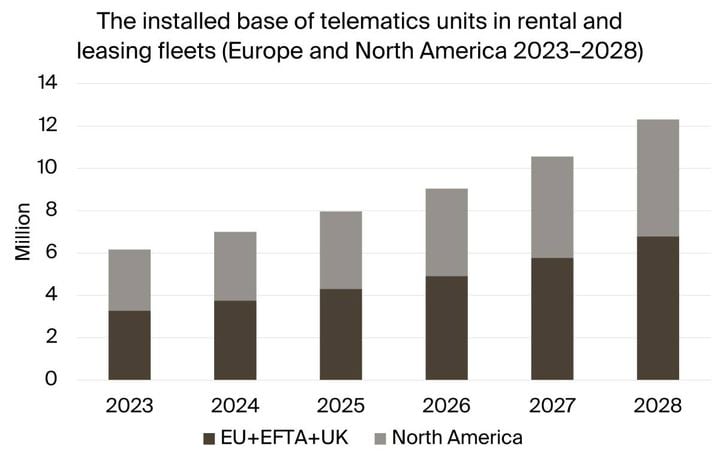

The installed base of active telematics systems in North America and Europe’s car rental and leasing market reached 6.2 million at the end of 2023, according to a new market research report from the IoT analyst firm Berg Insight released Dec. 19.

The total active installed base across the two regions’ car rental and leasing fleets is forecasted to reach 12.3 million by 2028, growing at a compound annual growth rate (CAGR) of 14.8%.

The telematics penetration rate across the car rental fleets in North America and Europe is expected to grow from 40% at the end of 2023 to 75% in 2028. The telematics penetration rate in the total population of leasing vehicles in the two regions reached 36% at year-end 2023 and is expected to reach 60% by 2028.

Three factors are driving the telematics uptake:

- Requirements for fleets to increase fleet usage and decrease the carbon footprint

- Emergence of new mobility services

- General automotive electrification trend

OEM telematics have intensified over the years, allowing rental and leasing operators to avoid telematics hardware installations.

“All leading rental and leasing operators have deployed telematics solutions to some extent, some more than others”, said Erica Rickard, IoT Analyst at Berg Insight, in a news release. “Several players aim to connect all or many of their vehicles in the coming years and strategic partnerships between mobility operators, telematics service providers, and OEMs have also been established.”

Several categories of telematics applications are used today in car rental and leasing.

“The main benefits of deploying rental and leasing cars with telematics solutions include improved control over assets, optimized fleet usage, and enhanced customer experience,” Rickard added.

Fleet managers are interested in tracking their vehicles’ location and monitoring vehicle status to prevent fraud, theft, and mistreatment. Telematics solutions enable rental and leasing fleet managers to reduce operational costs and potentially lower insurance premiums.

“Telematics technology may also enable new business models and services such as digital and contactless car rental and carsharing experiences,” Rickard said. Rental and leasing companies can also use telematics to provide sustainability reporting by monitoring CO2 emissions and driver behavior.

Telematics Market Overview

The telematics value chain spans multiple industries including a large ecosystem of companies, such as hardware specialists, software specialists, and end-to-end solution providers.

Examples of leading telematics companies in the rental and leasing market include: Geotab, Targa Telematics, OCTO Telematics, CalAmp, and Webfleet. Additional notable telematics service providers in the rental and leasing telematics market include Powerfleet, Munic, MySmartObject, Connected Cars, RentalMatics, and Guidepoint Systems.

The market also consists of telematics specialists who are only or mainly active in the rental and leasing space, offering solutions for digital access or vehicle fleet management. These companies include: Fourth Tier, Zubie, HQ Rental Software, Kirrk and TSD Mobility Solutions. Some carsharing telematics providers, including Invers, Vulog, OpenFleet, WeGo Carsharing, Convadis and Atom Mobility, also target rental and leasing companies.

Rickard concluded, “Telematics data integration between automotive OEMs and rental and leasing companies has become increasingly common. It is anticipated that the involvement of automotive OEMs will accelerate in the rental and leasing telematics industry in the coming years.”

Berg Insight is a dedicated M2M/IoT market research firm based in Sweden. It specializes in all major machine-to-machine/IoT verticals, such as fleet management, car telematics, smart metering, smart homes, mHealth, and industrial M2M. It has provided analytical services to 1500 clients in 72 countries on six continents.

Download report brochure: Telematics for Rental and Leasing Fleets