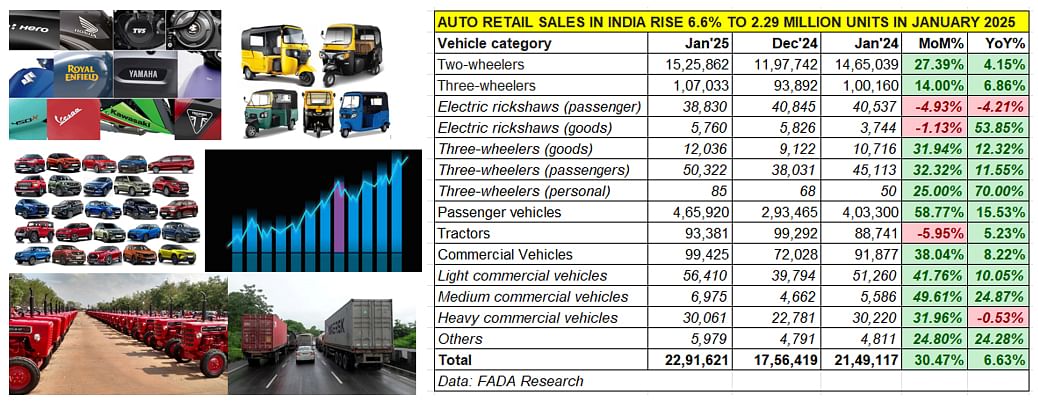

India Auto Inc sold a total of 2.29 million vehicles in January 2025, up 6.6% YoY (January 2024: 2.14 million units) as per the retail sales data released by Federation of Automobile Dealers Association (FADA). Importantly, there is growth across all segments including tractors. While retail sales of two-wheelers at 1.52 million units were up 4.15%, three-wheeler sales (107,033 units) rose by nearly 7%, passenger vehicles (465,920 units) by 15.53%, commercial vehicles (99,425 units) by 8.22% and the tractor segment (93,381 units) by 5.23 percent. Clearly, the performance in the opening month of the new year augurs well for the current fiscal as well as for CY2025.

Retail sales, which constitute the real-world customer deliveries across the country, present a more accurate scenario than the wholesales data which essentially are vehicle dispatches to OEM dealers.

As FADA’s detailed data statistics reveal, all segments other than the two sub-segments of electric passenger rickshaws and heavy commercial vehicles have posted year-on-year growth. Commenting on the auto industry’s performance, FADA president C S Vigneshwar said: “The auto retail sector kicked off 2025 on a promising note, aligning with FADA’s earlier survey projections that expected January to range from flat to moderately positive. Overall retail sales posted a robust 6.6% YoY growth, reinforcing the industry’s optimistic start. Our observations indicate that each vehicle category witnessed positive momentum, pointing toward sustained consumer confidence and steady market recovery.” Let’s take a closer look at each segment.

As FADA’s detailed data statistics reveal, all segments other than the two sub-segments of electric passenger rickshaws and heavy commercial vehicles have posted year-on-year growth. Commenting on the auto industry’s performance, FADA president C S Vigneshwar said: “The auto retail sector kicked off 2025 on a promising note, aligning with FADA’s earlier survey projections that expected January to range from flat to moderately positive. Overall retail sales posted a robust 6.6% YoY growth, reinforcing the industry’s optimistic start. Our observations indicate that each vehicle category witnessed positive momentum, pointing toward sustained consumer confidence and steady market recovery.” Let’s take a closer look at each segment.

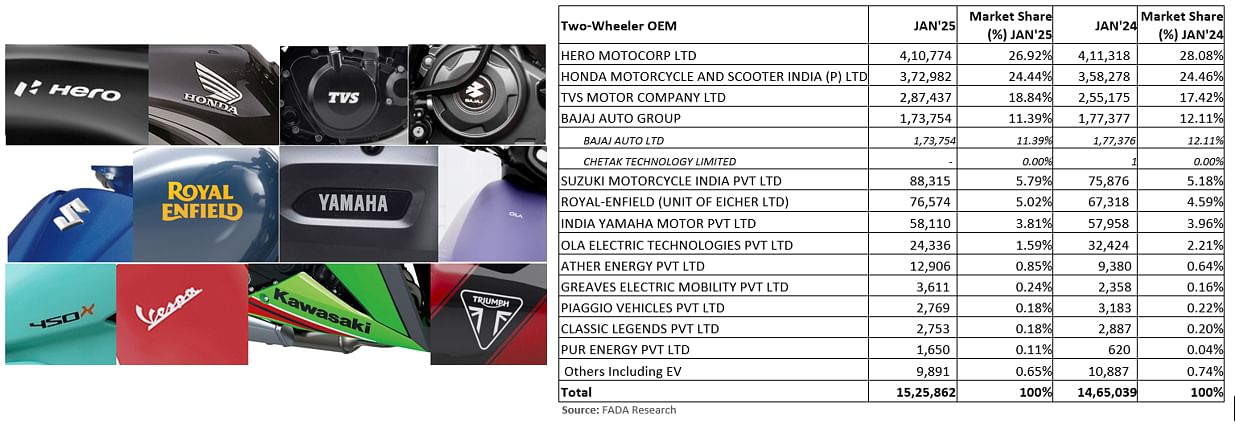

TWO-WHEELERS: 15,25,862 units, up 4.15% YoY

This is the biggest volume segment and accounted for 66% of India Auto Inc’s sales last month. The 4.15% YoY increase at 1.52 million units is a sign of better times to come. Demand has bounced back for both motorcycles and scooters and the results are there to see – January 2025 witnessed additional sales of 328,120 units over January 2024.

According to FADA, January 2025’s healthy two-wheeler numbers are a result of a host of new model launches, demand from the ongoing marriage season across India, as also enhanced financing options. Also, urban sales outpaced rural India sales on a YoY basis, growing by 4.54% compared to 3.85 percent in January 2024.

The combined sales of the top four OEMs – Hero MotoCorp, Honda Motorcycle & Scooter India, and TVS Motor Co – at 12,44,947 units account for 81% of the two-wheeler industry’s sales, leaving the remaining 19% for the other players. While market leader Hero MotoCorp sold 410,774 units which makes for flat sales (-0.13% YoY), arch rival Honda posted 4% growth at 372,982 units and TVS clocked a 12% YoY increase with 287,437 units. Bajaj Auto, with 173,754 units, saw a 2% YoY decline.

Suzuki Motorcycle India did well to sell 88,315 units, up 16%, as did midsize motorcycle leader Royal Enfield with 76,574 units, up 14 percent. Yamaha, the third Japanese OEM, sold 58,110 units which is flat sales. Eighth rank goes to Ola Electric, which wrested back the No. 1 EV OEM title in January 2025 with 24,336 e-scooters, a month after it had lost the title to Bajaj Auto in December 2024. Ather Energy and Greaves Electric Mobility, the two other pure-electric OEMs, sold 12,906 and 3,611 e-scooters respectively.

While the prognosis, based on the January sales, for the two-wheeler segment in the coming months looks good, according to FADA, rural liquidity issues, rising interest rates and overall market uncertainty could prove to be challenges to speedier growth.

PASSENGER VEHICLES: 465,920 units, up 15.53% YoY

When India’s value conscious passenger vehicle buyers purchase an additional 172,455 units over the corresponding month in the previous year, it can only translate into robust growth. That’s just what happened in January 2025 with total car and SUV-MPV retails of 465,920 units, up 15.53% YoY (January 2024: 293,465 units).

FADA Research’s comprehensive OEM-wise sales data reveals that PV market leader Maruti Suzuki India sold 211,074 vehicles – this is an additional 35,585 units over January 2024’s 175,489 units and helps it increase its market share to 45.30% from 43.51 percent.

Hyundai Motor India, with 59,858 units, has posted 13% YoY growth while Tata Motors witnessed flat sales at 53,884 units (-0.40% YoY). Tata Motors is the only one among the top six players to see decline, albeit a marginal one, which is probably a result of its overall sales being dragged down by a sizeable drop in its EV retails.

Mahindra & Mahindra, which is riding a wave of surging demand for most of its SUVs, sold 51,914 units in January 2025, up 20% YoY. This performance sees its market share rise to 11.14% from 10.70% a year ago. Toyota Kirloskar Motor too is on a roll, benefiting from demand for its SUVs and MPVs as also for its rebadged models. With sales of 28,907 units last month, Toyota has notched stellar growth of 35% with a result increase in market share to 6.20% from 5.32% a year ago. Kia India, ranked sixth amongst the PV OEMs, sold 22,169 units, a 13% YoY increase.

FADA points out that some of the spike in sales last month can be attributed to consumers deferring their December purchases into January to benefit from the ‘CY2025 model year’ advantage. While the PV share of urban markets inched up from 60.8% to 61.8%, rural India actually posted a higher YoY growth –18.57% vs urban’s 13.72%. Many dealers have noted improved demand but also pointed out that last year’s heavy discounting has helped clear older models and shift registrations. Inventory levels in the PV segment have improved, dropping by around five days to 50–55 days, suggesting improved supply-demand balance albeit still warranting further monitoring. THREE-WHEELERS: 107,033 units, up 4.15% YoY

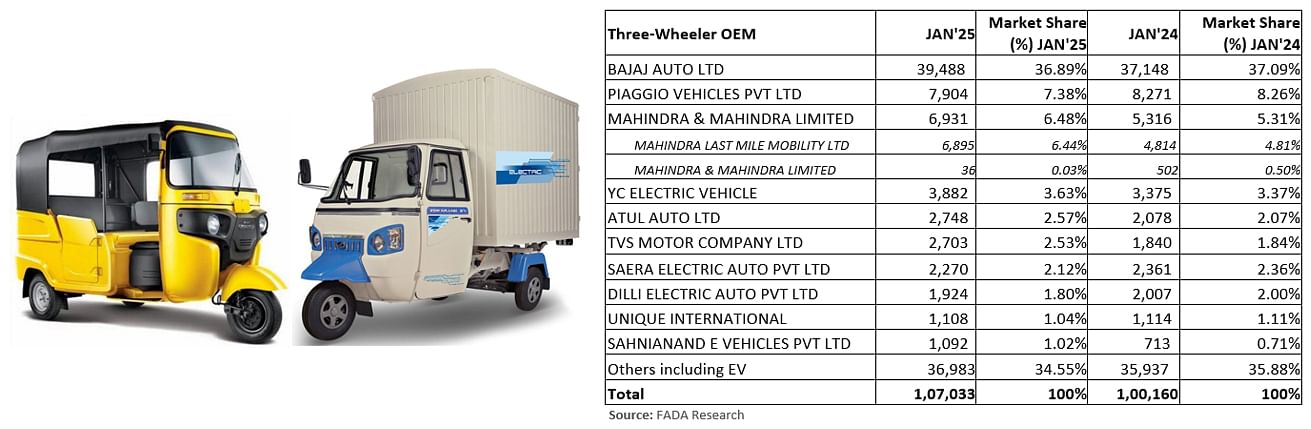

THREE-WHEELERS: 107,033 units, up 4.15% YoY

The three-wheeler segment registered total retails of 107,033 units, up 6.86% YoY (January 2024: 93,892 units), of which 89,152 units or 83% comprised passenger models, with cargo models contributing 17,796 units or 17 percent.

Market leader Bajaj Auto sold 39,488 units in January 2025, up 6%, maintaining its vice-like grip on this segment with a market share of 37 percent. Of this, 5,352 units were electric three-wheelers which gives the company an EV penetration level of 13.55 percent.

Piaggio Vehicles, which clocked retails of 7,904 units, saw its January 2025 numbers down 4% YoY which results in its market share reducing to 7.38% from 8.26% a year ago.

Mahindra & Mahindra is ranked third with 6,931 units, comprising mainly EVs. This constitutes strong 30% YoY growth which sees its market share rise to 6.48% from 5.31% in January 2024.

This segment, which sees the fastest level of transition from ICE to EVs, is set to see new action in the form of TVS lMotor Co launching its electric three-wheeler the King EV Max last month.

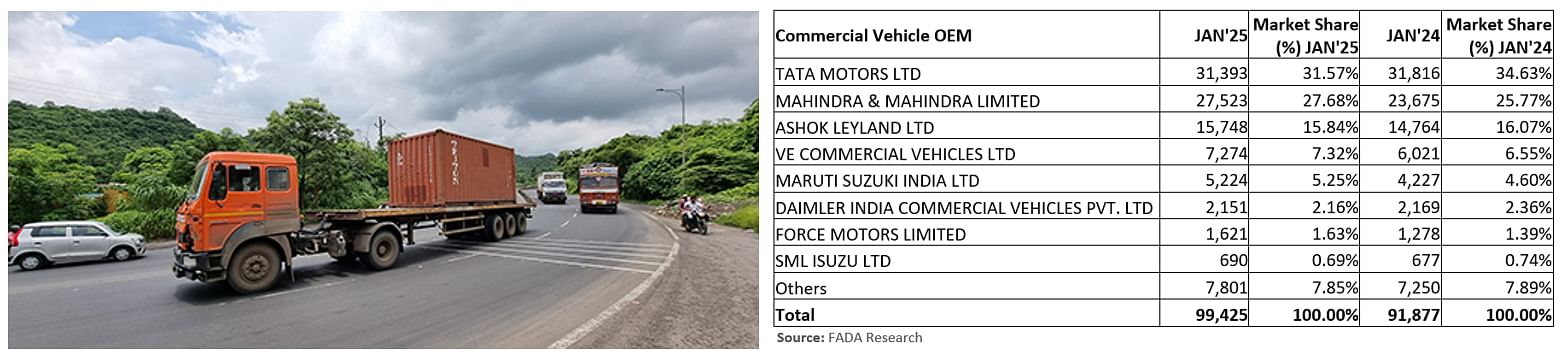

COMMERCIAL VEHICLES: 99,425 units, up 8.22% YoY

COMMERCIAL VEHICLES: 99,425 units, up 8.22% YoY

Strong demand for commercial vehicles, across both the light and medium CV sub-segments, helped propel overall segment sales to 99,425 units, up 8.22% YoY (January 2024: 72,028 units). According to FADA, the share of urban markets rose from 50.1% to 51.2% share and outpaced rural growth (9.51% vs. 6.89%). Put this down to the growing demand from the e-commerce industry in urban India as well as higher freight rates and buoyant passenger carrier demand.

Nevertheless, many dealers cited low cash flow, strict financing policies and sluggish industries (like cement and coal) as major hurdles. Sentiments in rural regions remained notably subdued, compounded by limited new products. Overall, the sector shows cautious optimism but faces persistent headwinds, highlights FADA in its CV commentary for last month.

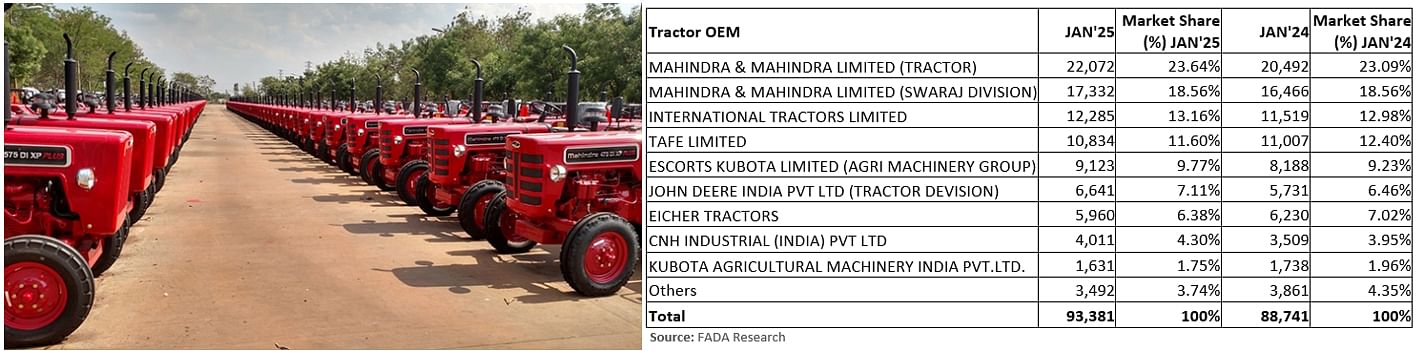

TRACTORS: 93,381 units, up 5.23% YoY

TRACTORS: 93,381 units, up 5.23% YoY

The tractor and farm equipment segment was in growth mode in January 2025 with sales of 93,381 units, an improvement of 5.23% on its year-ago retails. Mahindra & Mahindra along with its Swaraj Tractors accounted for 39,404 units, up 6.61% over year-ago sales of 36,958 units. This gives it a market share of 42.2% compared to 41.65% in January 2024.

International Tractors (Sonalika) also did well, clocking sales of 17,332 units, up 5% YoY. TAFE Ltd with 1,834 units saw a marginal decline of 1.57 percent. As the OEM-wise stats reveals, Escorts Kubota, John Deere India and CNH Industrial posted YoY growth while Eicher Tractors saw a decline.

WHAT’S THE NEAR-TERM OUTLOOK FOR INDIA AUTO RETAILS?

A good start to a new year always offers the promise of better sales to come in the days and months ahead. According to the findings of FADA’s latest dealer survey, 46% anticipate growth in February, while 43% expect sales to stay flat and 11% foresee a dip. This blend of sentiments underscores the industry’s complex landscape, points out the apex dealer association, where bright spots are tempered by ongoing challenges.

What will give a fillip to sales in the penultimate month of FY2025 is the continuing marriage season, fresh product launches and strategic promotional activities. Furthermore, improved inventory management, better financing options from select lenders and backlogged orders in certain segments (such as commercial vehicles) offer the promise of improved numbers. With supportive policies and a post-Union Budget lift in consumer sentiment, many believe February could see a stable or slightly elevated sales curve.

At the end of the first 10 months of FY2025, total retails are 22 million units (2,20,78,161 units), up 8.38% YoY. This translates into 90% of FY2024’s total retails of 2,45,30,334 or 24.53 million vehicles across segments already being achieved. Given the current market momentum, the industry will surely sell the 2.45 million vehicles needed to surpass FY2024’s retails in February and March. The question that remains is, by how much will India Auto Inc exceed the 25 million sales mark this fiscal.