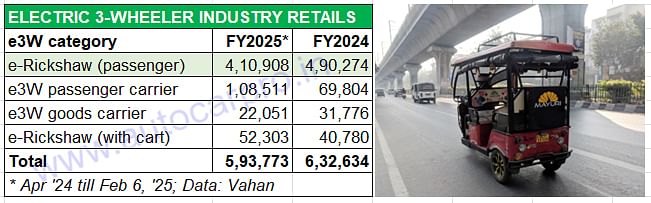

In FY2024, the electric three-wheeler market clocked record retail sales of 632,634 units, up 57% YoY. Of this, the largest share belonged to the e-rickshaw (passenger) category – 490,274 units or a 77% of total e3W sales. It’s the same scenario in January 2025. Of the 59,930 e3Ws retailed, the e-rickshaw (passenger) sub-segment accounted for 38,819 units or 65 percent. As per Vahan data (as of February 6, 2025), there were all of 424 players battling for a slice of this market. There are only three legacy OEMs amongst them – Mahindra & Mahindra, Atul Auto and Kinetic Green Energy.

Of the 593,773 e-3Ws retailed in the fiscal year to date, the e-rickshaw paseenger market (410,908 units) accounts for a 69% share.

Of the 593,773 e-3Ws retailed in the fiscal year to date, the e-rickshaw paseenger market (410,908 units) accounts for a 69% share.

In the current fiscal, from April 2024 till February 6, 2025, a total of 410,908 e-rickshaws (passenger) have been sold, which translates into 84% of FY2024 sales being achieved ad two months’ retails yet to be counted. If the current sales momentum is maintained in February and March 2025, this segment could hit the 500,000 or half-a-million mark for the first time in a fiscal year.

Bajaj Auto, which entered the e3W market in June 2023, has been slowly climbing the ladder-board with its RE E-Tec 9.0 passenger and Maxima XL Cargo E-Tec 12.0 models. In CY2023, Bajaj Auto was ranked 28th in a field of nearly 500 players in this segment of zero-emission mobility. In FY2024, the company rose to No. 13, having sold 10,886 units in 10 months. Mahindra Last Mile Mobility was the No. 1 in FY2024 with over 60,000 units and a 10% market share, followed by YC Electric Vehicles and Saera Electric.

YC Electric, Saera Auto and Dilli Electric Auto are the curren market leaders in this segment, which has just three to four ICE-legacy OEMs including Mahindra Last Mile Mobility, Atul Auto and Kinetic Green Energy.

YC Electric, Saera Auto and Dilli Electric Auto are the curren market leaders in this segment, which has just three to four ICE-legacy OEMs including Mahindra Last Mile Mobility, Atul Auto and Kinetic Green Energy.

In January 2025, the e-rickshaw (passenger) category registered retail sales of 38,819 units, down 4% YoY (January 2024: 40,511 units). YC Electric with 3,458 units topped the monthly chart with a 9% share, followed by Saera Electric Auto (2,030 units, 5% share) and Dilli Electric Auto (1,426 units, 3.67% share). The rest of the Top 15 players including MLMM (see data table below) have sold less than a thousand units each.

Encouraged by its strong success in a relatively short span of time in the electric three-wheeler (passenger and cargo) segment since its market entry in June 2023, Bajaj Auto is now plotting an encore in the electric rickshaw (passenger) market. The Pune-based auto major plans to unveil and launch its first e-rickshaw (passenger) by the end of FY2025 or early April.

BAJAJ DEVELOPING LARGE E-RICKSHAW WITH PASSENGER-CUM-CARGO APPLICATION

Speaking in a recent analyst call following the announcement of its Q3 FY2025 results, Rakesh Sharma, Executive Director, Bajaj Auto said: “We expect to launch the e-rick by the end of the FY2025 fiscal. It’s a sizeable opportunity. We don’t sell anything in it. Almost 50% of three-wheeled mobility is in the e-rick space, which is in north and east, little parts of west. Almost 45,000 e-ricks are retailed every month. And they come in various shapes and sizes. It’s a very fragmented market.

A lot of it is import dependent. A lot of it is substandard product. But it’s a very good format for certain use cases. So, the demand is there. And by introducing our e-rick, we hope to organize this market and bring in fresh new business for us.”

He added, “We are going to introduce a variant, which is larger sized and which will allow more passengers and passengers-plus-cargo kind of application. We found that in the core urban areas, a smaller vehicle is preferred. But as you start to go into the suburban areas or the mofussil, smaller town areas, we find that a larger body vehicle requirement is there. We already have a larger body vehicle in the ICE format. But now we are going to put it also in the E format.

It is very important to ensure the performance of the product because there will be more passengers, more cargo sitting on it. So, things like its gradability, the kind of heights it can climb and the loads it can carry had to be really worked out. Those tests have been done. And we are very excited about the introduction of this product. This will happen in this quarter which should then give us a good play into many geographies where our market share is relatively lower.”

STRONG DOUBLE-DIGIT GROWTH IN PASSENGER E-RICKSHAW MARKET

What must have proved alluring to Bajaj Auto to expand into e-rickshaws (passenger) is the market size and the high double-digit growth this sub-segment has been registering. After the first 10 months of FY2025, retails of 410,908 units are already 84% of FY2024’s 490,274 units (see data table below). And FY2024’s sales were a handsome 41% jump over FY2023’s 348,342 units.

The market leader in the current fiscal’s first 10 months is YC Electric with 34,480 units (7% share), followed by Saera Electric Auto with 22,012 units (4.50% share). Mahindra Last Mile Mobility is some distance away with 8,403 units and among the handful of legacy OEMs in a field of over 500 players, most of them from the unorganised sector. Reason enough for Bajaj Auto to feel it can make a difference with a product that pushes the electric-rickshaw envelope for passengers as well as cargo transport across multiple fronts including comfort and safety.

ALSO READ: Bajaj Auto is No. 1 electric 3W cargo OEM in January, Mahindra leads in FY2025

January e3W passenger sales: Mahindra and Bajaj Auto separated by just 125 units