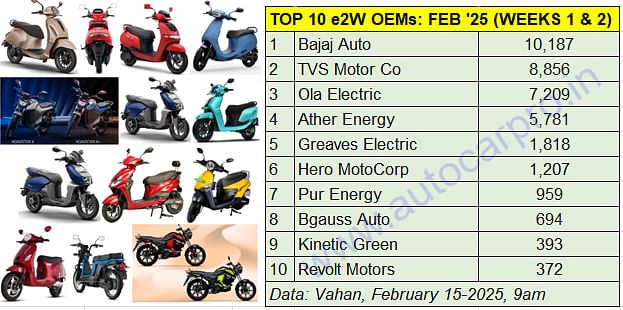

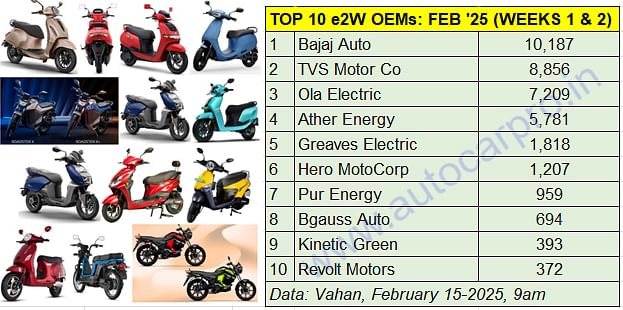

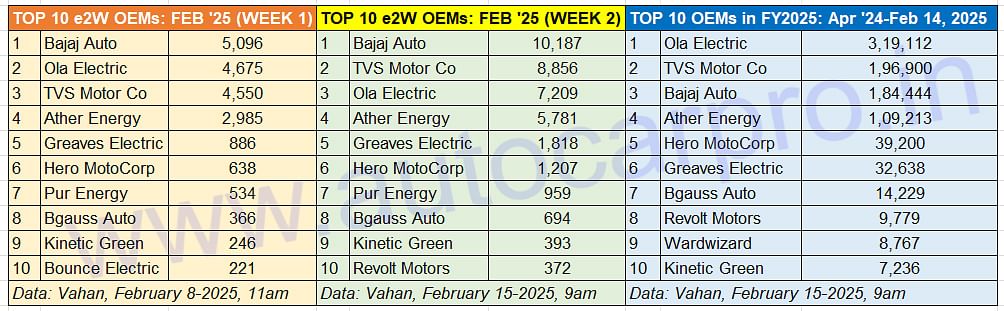

With the first two weeks of February coming to a close with Valentine’s Day on the 14th, a quick look at the Vahan website reveals that 39,735 electric two-wheelers have been sold across India, up 9.66% month on month (January 1-14, 2025: 36,234 units). Of this number, the Top 10 OEMs account for 37,476 units, or 94% of total retails.

Having sold 5,096 Chetaks in Week 1, Bajaj Auto sold another 5,091 units to clock total retails of 10,187 units from February 1-14. TVS with 8,856 units has moved up to No. 2 rank in Week 2.

Having sold 5,096 Chetaks in Week 1, Bajaj Auto sold another 5,091 units to clock total retails of 10,187 units from February 1-14. TVS with 8,856 units has moved up to No. 2 rank in Week 2.

On the cumulative sales front, Ola Electric tops with retails of 319,112 units which gives it a current market share of 32.50% of the 981,807 electric two-wheelers sold in India between April 1, 2024 and February 14, 2025.

On the cumulative sales front, Ola Electric tops with retails of 319,112 units which gives it a current market share of 32.50% of the 981,807 electric two-wheelers sold in India between April 1, 2024 and February 14, 2025.

February Week 1 topper Bajaj Auto continues to maintain its lead in Week 2 (February 8-14). Having sold 5,096 Chetaks in Week 1, the Pune-based auto maker sold another 5,091 units to wrap up Week 2 with 10,187 units, which gives it a lead of 1,331 units over TVS Motor Co. Bajaj Auto, which won the best-selling e2W OEM title for the first time in December 2024, was ranked No. 3 in January 2025 after Ola Electric and TVS Motor Co. Bajaj Auto is benefiting from the launch of the Chetak 35 Series e-scooters in the form of the mid-spec 3502 and top-spec 3501 variants, which deliver a claimed higher range of 153km per charge, TFT display with integrated maps, Bluetooth connectivity and screen mirroring, faster charging and best-in-class 35-litre boot space.

Bajaj Auto’s cumulative 10-and-half-months’ retails in FY2025 are 184,444 units, which gives it a 19% share of total retails of 981,807 e2Ws to date in the current fiscal. In FY2024, the Chetak manufacturer had sold a total of 106,431 units for an 11% market share and was ranked fourth behind Ather Energy.

TVS Motor Co, which was ranked third in Week 1, has moved up to No. 2 in Week 2. TVS sold 3,819 e2Ws in Week 2 which gives it a total of 8,856 units and a 1,647-unit lead over Ola Electric. While these should comprise mainly the iQube e-scooter, the company has recently begun deliveries of the TVS X, its flagship electric scooter first unveiled in December 2023 and priced at Rs 250,000 (ex-showroom Delhi).

For the fiscal to date cumulative sales, TVS Motor Co is the No. 2 OEM after Ola Electric (319,112 units) with 196,900 iQubes and a 20% market share. In FY2024, TVS had sold 182,933 units for a 19% market share.

Ola Electric, which regained its market leader title in January 2025 from Bajaj Auto and was ranked No. 2 in February Week 1 is now down to No. 3 in Week 2, as per the latest Vahan data. After Week 1 sales of 4,675 units, Ola added another 2,534 units in Week 2, which gives it a February 1-14 total of 7,209 units. The company, in end-January, launched the its third-generation S1 portfolio comprising four models – S1 X, S1 X+, S1 Pro and the new flagship S1 Pro+ – with prices start at Rs 80,000 and going up to Rs 170,000 for the S1 Pro+. The S1 Pro+, equipped with a 5.3 kWh battery, claims a top speed of 141kph and an industry-topping range of 320km on a single charge. A more affordable 4 kWh variant is also available. Ola EV sales should get a fillip in the months ahead, following the launch of the Roadster X, its first electric motorcycle whose deliveries are slated to commence in mid-March 2025.

On the cumulative sales front, Ola Electric remains the market leader. The company, which had sold 326,428 e-scooters in FY2024 and topped the market with a 35% share, has retailed 319,112 units which gives it a current market share of 32.50% of the total 981,807 electric two-wheelers sold in India between April 1, 2024 and February 14, 2025.

Ather Energy maintains its No. 4 rank with 5,791 units, having sold 2,806 units in Week 2. Its flagship product is the Rizta family e-scooter launched in April 2024 at a starting price of Rs 110,000 (Rizta S) through to Rs 165,000 (Rizta Z 3.7 with ProPack). The Rizta is witnessing growing customer acceptance. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. Ather’s cumulative sales in the fiscal year to date are 109,213 units, which gives it an 11% share of total retails. In FY2024, the smart e-scooter OEM had sold 108,870 units.

Greaves Electric Mobility also maintains its No. 5 rank. Having sold 886 units in the first week of February 2025, GEM added another 932 units to arrive at total sales of 1,818 e-scooters. The company’s sales are mainly driven by the Nexus and Magnus Neo e-scooters. While the flagship Nexus family EV has a top speed of 93kph and a certified range of 136km per charge, the Magnus Neo, which is an updated version of the Ampere Magnus, has an over-100km range.

Hero MotoCorp at No. 6 position has clocked total sales of 1,207 Vida e-scooters sold between February 1-14. The new Vida V2, which has expanded the company’s portfolio, is available in three variants: Lite (Rs 96,000), Plus (Rs 115,000) and Pro (Rs 135,000). The most affordable V2 Lite is an entirely new variant and comes with a small 2.2kWh battery pack that has a claimed 94km IDC range. It also has a lower 69kph top speed compared to the Plus and Pro variants, which have top speeds of 85kph and 90kph, respectively. Only two riding modes are available on the V2 Lite – Ride and Eco – but the rest of the feature-set is very similar to the other two, including the 7-inch touchscreen TFT display.

Pur Energy, with 959 units, is seventh on the Top 10 list of e2W OEMs. The company currently sells three e-scooters and two -motorcycles: ePluto 7G Max, ePluto 7G, E-Trance Neo+, ecoDrft 350 and eTryst X.

At No. 8 is Bgauss Auto with 694 units. The EV arm of electrical solutions major RR Kabel, Bgauss has sold 14,229 units in the current fiscal year. Its portfolio comprises the RUV 30 and 350i EX which, with its 2.3 kWH battery, delivers an ARAI-certified range of 105km on a single charge, and the BG C12i powered by a 3.2 kWh lithium-ion battery and giving a top speed of 60kph. Bgauss Auto’s total sales in FY2025 till February 14 are 14,229 units.

Kinetic Green Energy, whose e2W portfolio comprises of the e-Zulu, Zoom, Flex and Zing e-scooter and the e-Luna moped, is at No. 9 position with 393 units. In the fiscal to date, the company has sold 7,236 units, compared to FY2024 when it was ranked 12th with 9,703 units.

Fourteen days remains for February 2025 to come to a close. Will there will be a change in the Top 10 e2W rankings for the month? Stay plugged in for the latest updates on this zero-emission segment of India EV Inc.