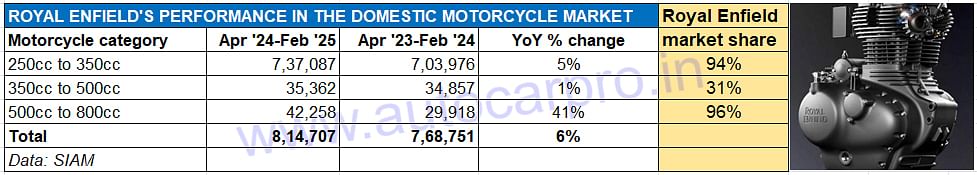

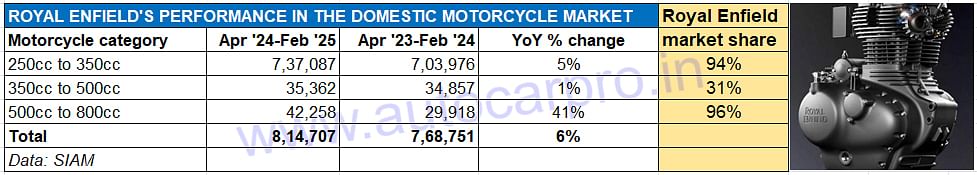

Midsize motorcycle market leader Royal Enfield, which has registered total wholesales of 814,707 units (up 6% YoY) in the first 11 months of FY2025, is set to surpass its record FY2024 sales of 834,795 units (up 13% YoY) in the current fiscal. It is witnessing strong growth in the 500-800cc segment where it has three 650cc motorcycles.

The 650cc twins (Continental GT 650 and Interceptor 650) along with the Super Meteor 650 and Shotgun 650 and the recently launched Bear 650, all powered by the same 648cc engine, have together clocked total wholesales of 42,258 units in the first 11 months of FY2025. This constitutes a robust 41% YoY increase over the 29,918 units sold in the April 2023-February 2024 period.

While the model-wise sales splits are not available, it can be surmised that the Bear 650, with prices starting at Rs 339,000 (ex-showroom Chennai), has helped accelerate demand. The Bear 650 is positioned between the Interceptor and GT Continental at one end and the Shotgun and Super Meteor at the other, all powering 650cc sales for the company.

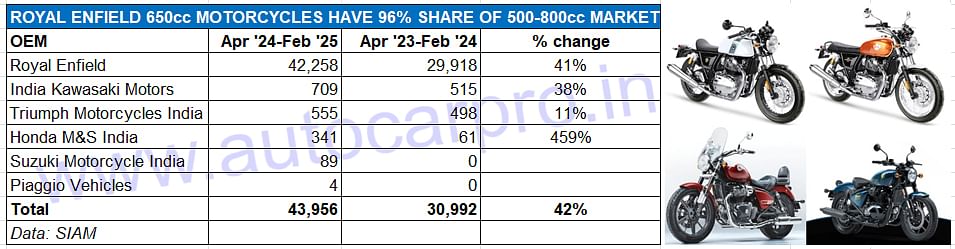

With dispatches of 42,258 units of its 648cc motorcycles in the past 11 months and robust 41% YoY growth, Royal Enfield commands 96% of this sub-segment.

With dispatches of 42,258 units of its 648cc motorcycles in the past 11 months and robust 41% YoY growth, Royal Enfield commands 96% of this sub-segment.

As per the latest SIAM industry wholesales data, for April 2024 to February 2025, the 500-800 motorcycle sub-segment has registered total sales of 43,956 units, up 42% on year-ago dispatches of 30,992 units. Royal Enfield’s 42,258 units give it a hugely commanding 96% share of the market, one which it has maintained since Q1 FY2025.

In its bread-and-butter segment – 350cc bikes – the Chennai-based company has sold 737,087 bikes, up 5% YoY, and has a 94% market share with the next highest being Honda with 38,760 units and a 5% share of this category. In the 350-500cc category, RE has sold 35,362 units, up 1% YoY, and has a 31% market share, below Bajaj Auto which, with 58,626 units has a leading 52% share of the total 1,12,052 units sold in this sub-segment in the past 11 months.

India Kawasaki Motors, with 709 units and 38% YoY growth is ranked second in this category. Kawasaki, which sells the Ninja 650, Versys 650, Vulcan S, Z650, Z650 RS and ZX-6R in this category, continues to see strong demand for the Ninja 650. However, it is learnt that the ZX-6R launched in January 2024 at Rs 11.09 lakh is currently its best-selling product in the current fiscal.

Third on the podium is Triumph Motorcycles India, which retails the Daytona 660, Trident 660, Tiger Sport 660 and the 765cc Street Triple in this bike category. Triumph has registered sales of 555 units, up 11% YoY on the year-ago base of 498 units. While the Street Triple remains its best-seller, demand for the Daytona 660 is rising.

Honda Motorcycle & Scooter India, which relaunched the CB650R and CBR650R in January this year and also retails the XL750, is already seeing strong demand come its way. Its 11-month sales at 341 units are up 459% on a low year-ago base of 61 units. Of this, 137 units have been sold in February 2025 alone, as per the latest SIAM wholesales data.

Suzuki Motorcycles India’s 11-month sales are 89 units, comprising the GSX-8R and V-Strom DL800DE.

ALSO READ:

Royal Enfield sells record 857,378 bikes in CY2024, beats previous best of CY2018