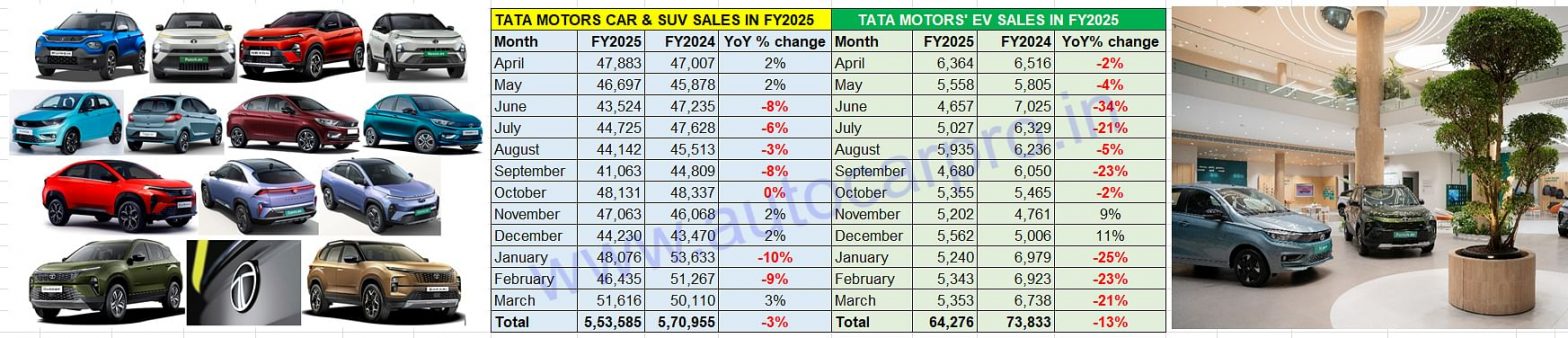

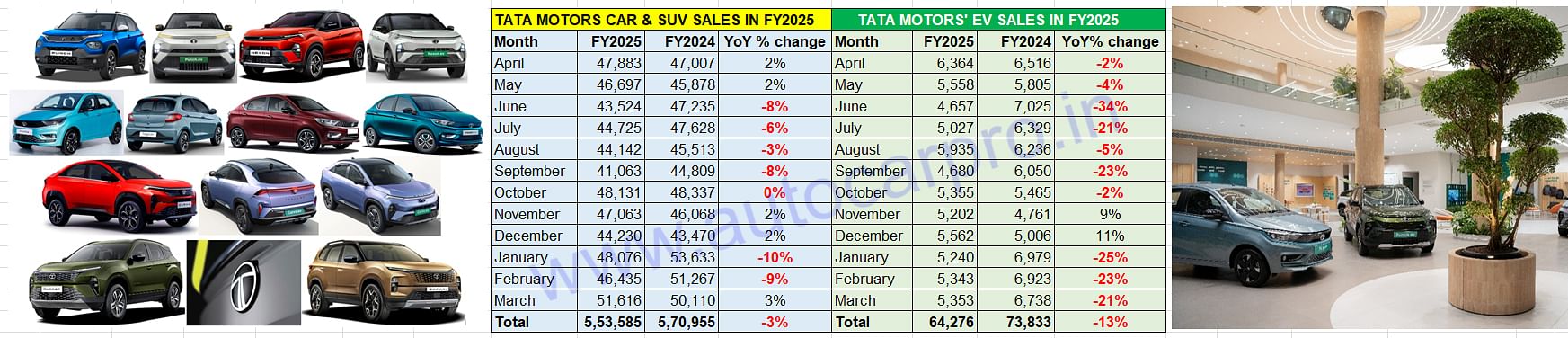

Tata Motors has reported total wholesales of 553,585 passenger vehicles in FY2025, down 3% on its record FY2024 sales. This, nevertheless, ensures that the company retains its No. 1 PV OEM status, ahead of a hard-charging Mahindra & Mahindra which, with 551,487 SUVs sold, was just 2,098 vehicles behind Tata Motors.

As per SIAM wholesales numbers, Tata Motors was the No. 3 passenger vehicle OEM in FY2024 (582,915 units), FY2023 (544,391 units) as well as FY2022 (373,138 units) and FY2021 (224,109 units).

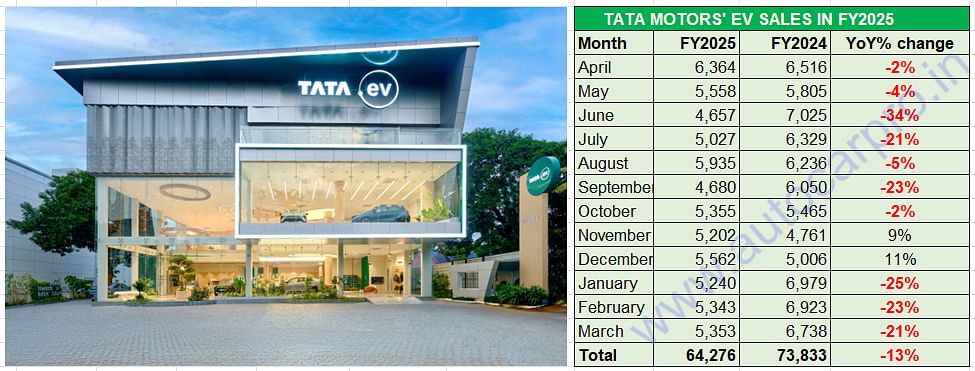

For Tata Motors, the difference between its FY2025 and FY2024 performance is that its overall passenger vehicle wholesales have been dragged down by the marked 13% decline in demand for its EVs, which have been impacted by the increased competition and product choice in the marketplace. The company, which retails eight passenger vehicles – Altroz, Tigor, Tiago, Nexon, Punch, Harrier, the Safari and the Curvv – in the domestic market, has been under pressure in most of the past 12 months.

According to Tata Motors, the Tata Punch, which was leading the UV market in the first 11 months of the fiscal, is the No. 1 SUV in FY2025.

Tata Motors’ overall passenger vehicle wholesales were dragged down by the decline in demand for its EVs, which have been impacted by the increased competition and product choice in the market.

Tata Motors’ overall passenger vehicle wholesales were dragged down by the decline in demand for its EVs, which have been impacted by the increased competition and product choice in the market.

As the 12-month wholesales data (see passenger vehicle and EV sales data above) reveals, the company’s performance in the current fiscal has been impacted considerably. Of the four quarters, three saw a sales decline. And EV sales were down in 10 of the past 12 months.

Q1 FY2025’s (April-June 2024) dispatches of 138,104 PVs were down 1% YoY and Q2 (July-September 2024) at 129,930 units were down 6% YoY. Sales returned to the black in Q3 (October-December 2024) at 139,424 units, up 1%, as a result of demand picking up in the festival months of October and November last year. In Q4 FY2025 (146,127 units), sales dropped 6% on Q4 FY2024’s 155,010 units.

EV wholesales were down for 10 of the 12 months in FY2025.

EV wholesales were down for 10 of the 12 months in FY2025.

GOOD ON THE CNG FRONT BUT EVs DRAG OVERALL NUMBERS DOWN

Tata Motors has done well on the CNG front – it was the No 2 after Maruti Suzuki for most of FY2025 in CNG-powered car and SUV sales. The company, which had first introduced its innovative twin-CNG-cylinder technology in the Altroz hatchback, has now standardised the technology in its entire CNG line-up which comprises the Tiago CNG, Punch CNG, Altroz CNG, Tigor CNG and the Nexon CNG launched in September 2024. In fact, in CY2024, with retail sales of 115,432 vehicles, the company increased its CNG share to 16 percent.

Tata Motors’ accelerated growth over the past few years has been a result of its first-mover advantage in the electric vehicle market, where it once had an over 70% market share albeit that has dropped to around 65 percent. Of the mainstream PV OEMs, the company continues to have the largest e-PV portfolio in India comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV.

Tata Motors’ cumulative 12-month EV wholesales at 64,276 units are down 13% YoY (FY2024: 73,833 EVs), having seen 10 months of sales decline in the current fiscal. November and December 2024 were the only months where it registered EV sales growth. This makes it amply clear that the marked decline in EV sales has dragged Tata’s overall PV sales numbers and also resulted in reduced EV penetration level.

In FY2025, Tata Motors’ EV penetration level stands at 11.61% compared to 13% in FY2024. The company’s share of the electric PV market, which was not too long ago upwards of 75%, has been continually reducing, reflecting the heightened competition from rival EV OEMs and increased product choice for buyers. JSW MG Motor India has eaten into Tata Motors’ EV sales, following the launch of the Windsor EV and sale of 15,753 units in five months.

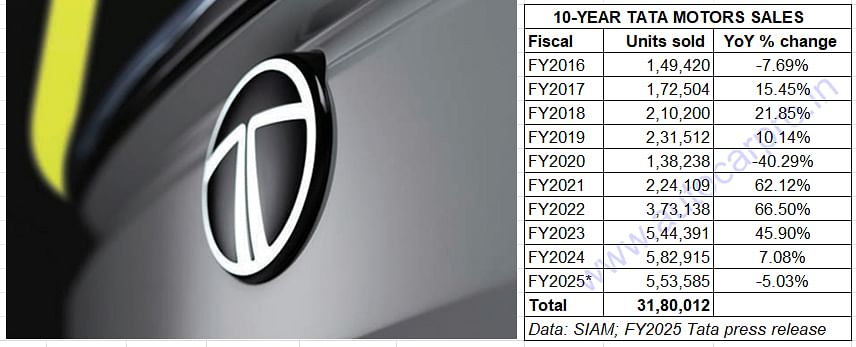

TATA MOTORS PV SALES DECLINE AFTER FOUR YEARS OF GROWTH

TATA MOTORS PV SALES DECLINE AFTER FOUR YEARS OF GROWTH

As the 10-year sales data table below depicts, Tata Motors FY2025 sales decline marks the first year of sales falling after four years of sustained and strong growth. Demand had hit a low of 138,328 vehicles in the Covid-impact FY2020 but picked up smartly by 62% in FY2021 (224,109 units).

The next three two fiscals saw the company register particularly strong numbers – 66% growth and 373,138 PVs in FY2022 and 544,391 units and 46% growth in FY2023, which was the first time Tata drove past the half-a-million milestone. FY2024 in comparison was far more subdued and now FY2025 has delivered total wholesales of 553,585 PVs, down 3% year on year.

In his comments on the company’s performance in FY2025, Shailesh Chandra, Managing Director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said: “Amidst a challenging year marked by fluctuating demand, Tata Motors Passenger Vehicles achieved wholesales of 556,263 units, including 64,726 units of EVs. We led the industry in SUV growth and outpaced it in CNG sales, recording over 50% YoY growth. Across various segments of the PV industry, the Punch emerged as the top choice for private buyers to become India’s No. 1 SUV in FY2025. Our latest launches and updates — Curvv, Nexon CNG, and Tiago — received an enthusiastic response, resonating strongly with customers. We achieved two key milestones in FY2025, as we surpassed 6 million cumulative sales for PVs, and 200,000 cumulative sales for EVs.”

He added, “Looking ahead, overall demand growth will be shaped by macroeconomic factors such as consumption growth, inflation, infrastructure spending and global geopolitics. However, industry momentum is expected to be driven by continued innovation in line with evolving customer preferences. SUVs, CNG, and EVs will remain key growth drivers, fueling the industry’s expansion.”