This story was delivered to Business Insider Intelligence Transportation & Logistics Briefing subscribers hours before it appeared on Business Insider. To be the first to know, please click here.

Chinese ride-hailing giant Didi Chuxing is nearing an agreement with Volkswagen (VW) to deploy a “purpose-built” fleet of VW vehicles in its home country, according to The Wall Street Journal.

BI Intelligence

As part of the joint venture, the German carmaker would provide around 100,000 vehicles, electric and autonomous vehicle technology, and manage the fleet.

Didi, meanwhile, would give its customers access to this fleet, but interestingly not through its current mobile application, according to the Journal, suggesting the firms might be co-developing a separate mobile app for an autonomous ride-hailing service. VW would own 40% of the joint venture, which could be officially announced as soon as next week, and will have the option to acquire an additional 10% stake at a yet to be determined future date.

The deal would help Didi quickly scale up its autonomous driving technologies and maximize their revenue-generating potential. The ride-hailing behemoth — it counts over 400 million users — has been working on autonomous driving technologies for at least the last two years, and appears poised to finalize a technology stack sometime in 2019. That will, in all likelihood, make the ride-hailing behemoth the second entrant into the Chinese autonomous technology and mobility space after search titan Baidu, which plans to start mass producing autonomous cars later this year.

Though the firm likely wouldn’t have had a difficult time finding domestic carmaker to place its technologies into vehicles, working with VW gives Didi a massive fleet that it can use to launch a commercial service at scale throughout China. Additionally, using the German company’s self-driving and electric vehicle technology could allow Didi quicken the pace of its own self-driving tech development, though it’s unlikely it will be able to leapfrog Baidu and its partners.

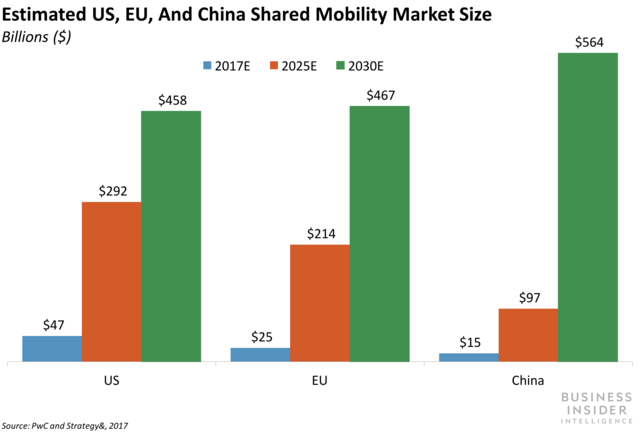

Volkswagen, meanwhile, stands to deepen its footprint in the world’s largest auto market. China is already the world’s largest auto market by vehicle sales, according to McKinsey’s estimates, and will only become a larger opportunity for carmakers and tech firms in the years ahead. While China’s mobility services market was smaller than the US’ last year, it will climb to $564 billion by 2030, dwarfing the latter market by $100 billion, according to Strategy&.

VW isn’t new to China at all — it established its first joint venture in the country back in 1984, carved out another in 1991, and is now the second-largest foreign automaker in China by vehicle sales after GM. However, working with Didi would give VW the ability to tap into the ride-hailing firm’s massive user base and maximize the uptime of this new vehicle fleet through rides to consumers, enabling it to capitalize on the growth in mobility services expected to hit China in the years ahead.

If successful, the joint venture could give other Western carmakers a roadmap to cash in on the massive opportunity in China. The world’s second-largest economy is notoriously difficult for Western companies to tap into, largely because they need to attract partners to establish a joint venture.

Amazon and Google, notably, are both locked out of China, affording JD.com, Alibaba, and Baidu a tight grip on the country’s e-commerce and search markets, respectively. So, if VW can generate a substantial sum of revenue from this joint venture, it’s likely other Western carmakers will at least explore pursuing the same strategy.

The self-driving car is no longer a futuristic fantasy. Consumers can already buy vehicles that, within a few years time, will get software updates enabling them to hit the road without the need for a driver.

This autonomous revolution will upend the automotive sector and disrupt huge swaths of the economy, while radically improving energy efficiency and changing the way people approach transport around the world.

Automakers and tech companies are racing to develop the technology that will power self-driving cars in the coming years. That tech is advancing, but leaves observers with a bigger question: will consumers trust driverless car tech, and will they want to use autonomous cars?

Peter Newman, research analyst for Business Insider Intelligence, Business Insider’s premium research service, has compiled a detailed report on self-driving cars that:

Sizes the current and future self-driving car market, forecasting shipments and projecting installed base.

Explains the current state of technology, regulation, and consumer perception.

Analyzes how the development of autonomous cars will impact employment and the economy.

To get the full report, subscribe to an All-Access pass to Business Insider Intelligence and gain immediate access to this report and more than 250 other expertly researched reports. As an added bonus, you’ll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

You can also purchase and download the full report from our research store.