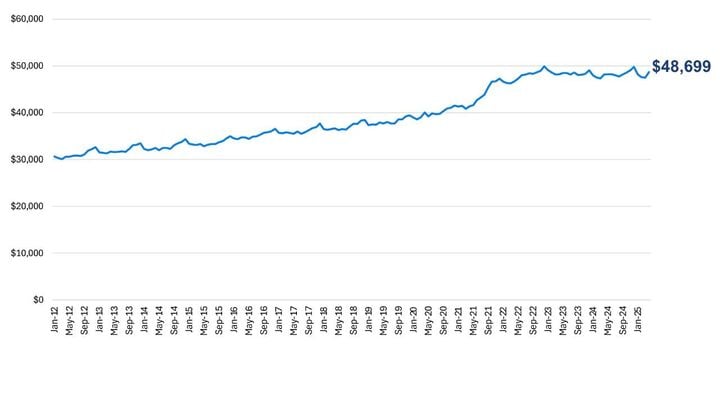

Since April 2023, as new-vehicle inventory recovered from the COVID-era shortage, new-vehicle prices have been mostly flat year over year.

Graphic: Cox Automotive

New-vehicle ATP increased in April to $48,699, a sharp 2.5% month-over-month bump, according to Kelley Blue Book report released May 12.

April typically delivers a monthly increase of 1.1%. In the past decade, only April 2020 produced a larger month-over-month increase, at 2.7%.

Other Key takeaways from the April report include:

- New-vehicle prices in April were higher year over year by 1.1%, an increase below long-term averages but higher than in recent months. Over the long term, new-vehicle prices typically rise more than 3% year over year, according to Kelley Blue Book estimates. Since April 2023, however, as new-vehicle inventory recovered from the COVID-era shortage, new-vehicle prices have been mostly flat year over year.

- The new-vehicle sales pace in April was 17.3 million. The sales pace was lower than March but the strongest April since 2021. Amid the buying frenzy, new-vehicle sales incentives fell to 6.7% of ATP, down from 7% in March and at the lowest point since the summer of 2024. Before April, the six-month average was 7.4% of ATP.

- The Compact SUV segment, one of the most popular segments and highly exposed to new import tariffs, saw vehicle prices that were mostly flat monthly and year over year at $36,416. Incentives and discounts declined in April to 7.8% of ATP, down from 8.2% in March. Since April 2024, incentives in the Compact SUV segment have averaged 9.1% of ATP. Similarly, April transaction prices held mostly steady monthly in the subcompact SUV segment, but incentives also declined.

- Among core volume brands, the results in April were mixed. Audi, Land Rover and Volvo saw higher ATPs and lower incentives than March. Three General Motors brands – Cadillac, Chevrolet and GMC – also posted higher ATPs, with little change to incentives. Buick saw lower prices and higher incentives in April. Acura and BMW also held prices lower and increased incentive spending compared to March.

- Sales of Porsche and Land Rover models accelerated in April, as both brands face higher future costs since 100% of their respective vehicles are imported. ATPs for Porsche led the industry last month at above $114,000, with Land Rover just behind at $113,000. April was the best sales month in 2025 for both brands, pushing the overall industry ATP higher.

- In April, Ford advertised heavily on a message of “holding prices steady” and celebrated its “built in America” leadership. Ford’s brand prices and incentives in April mainly were unchanged compared to March, according to Kelley Blue Book data. One standout: The popular, Mexico-built Maverick pickup truck saw lower prices in April, and incentive spending increased to an all-time high of 6.6% of ATP. Sales were strong: A record 20,183 were sold in April.

“Ever since President Trump announced auto tariffs 47 days ago, the cost of new cars has steadily climbed,” said Erin Keaing, an executive analyst with Cox Automotive, in a news release. “Although there was a surge in shopping and sales early on, the manufacturer’s suggested retail prices haven’t budged. The pricing landscape varies depending on the automaker, car segment, and specific models – some are cutting incentives, others are in high demand, and the supply isn’t evenly distributed across the board.”

Electric Vehicle Prices Reach Highest Point of Year in April, Incentive Decline Further

The Kelley Blue Book team initially estimates new EV prices in April to be $59,255, higher year over year by 3.7% and higher than March by 0.2%. The March EV ATP was revised lower to $59,132.

EV incentives declined for the second consecutive month in April, dropping to 11.6% of ATP. EV incentives peaked in November 2024 at 13.9% of ATP.

In May, market-leader Tesla sold more than 45,000 EVs, the brand’s best month of 2025, thanks mostly to sales of the freshened Model Y. Tesla’s average ATP increased month over month and year over year in April, reaching $56,120, although Cybertruck, at one point the best-selling product transacting over $100,000, had an ATP of $89,247. Sales of Cybertruck fell below 2,000 units for the first time in a year.

New EV sales were lower month over month by nearly 6%, according to initial estimates from Kelley Blue Book. Year-to-date EV sales in 2025 are higher by 5.4%.

Originally posted on Automotive Fleet