Elon Musk just made public and material lies aimed at Tesla shareholders. Here’s the proof with the relevant transcript.

Now, let’s see if the SEC still has teeth or if the US has fully entered its scam era under the Trump administration.

Today, Musk made false statements aimed at Tesla shareholders and directly addressed the stock price.

Here’s the video, transcript, and relevant information that proves Musk was lying:

Tesla sales are strong everywhere but Europe

The CEO started the segment by claiming this:

Europe is our weakest market. We are strong everywhere else. Our sales are doing very well at this point. We don’t expect any meaningful sales shortfall.

Tesla’s weakest market is Europe, but sales are not “strong everywhere else.”

We have up-to-date data from China up to last week, and Tesla is having its worst performance in years in the critical EV market:

This is Tesla’s worst quarter start in the last two years based on the insurance registration data. It’s already confirmed that Q1 2025 sales were terrible everywhere, but up-to-date data in Europe and China confirm that Tesla is still struggling in China and Europe.

That’s also despite Tesla offering more incentives and discounts in China than ever. Model 3 and Model Y, representing over 95% of Tesla’s sales in China, are currently offered with 0% financing at Tesla’s cost.

When pressed about Tesla’s sales still being down in Europe, Musk answered:

Yes, that’s true of all manufacturers. There’s no exception. The European market is quite weak.

It’s a bummer that the host didn’t push back on this because it’s a blatant lie.

The European Automobile Manufacturers’ Association (ACEA) released the data a few weeks ago.

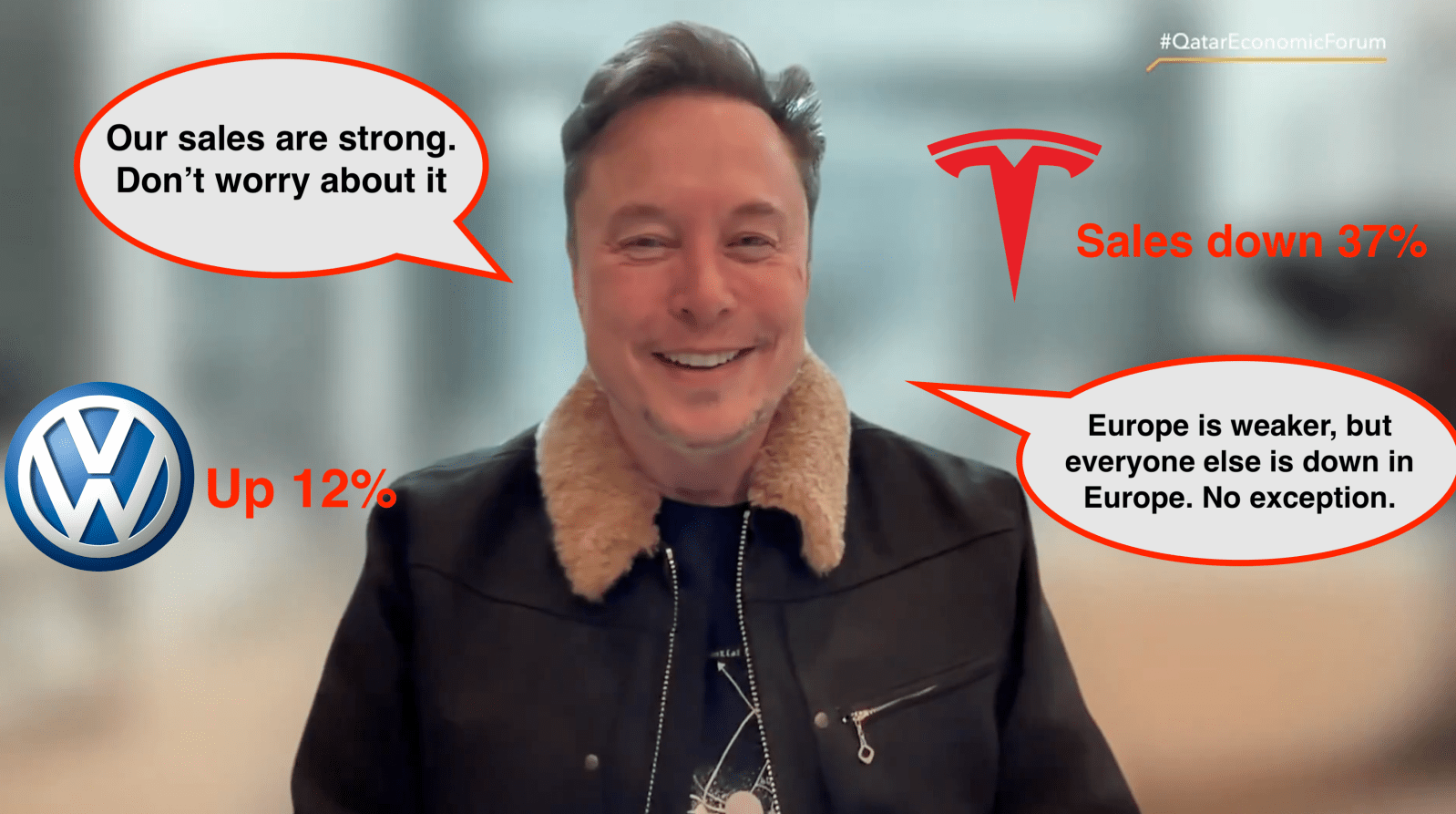

In the EU, EFTA, and the UK, Tesla’s sales were down 37% in Q1 2025. It’s true that other automakers were also down, but not “all manufacturers” and certainly plenty of “exceptions”:

As you can see, the Volkswagen Group was up 5% as a whole and the VW brand itself was more than 12% in the first quarter.

Renault and BMW were also up, as was SAIC.

The lie is even more blatant when you only look at the EV market, where Tesla operates. Battery electric car sales surged almost 24% in Europe in the first quarter, while Tesla’s sales dropped 37%.

Now, this was the last quarter. Maybe Musk could get away by claiming the turnaround is happening now or other automakers are now struggling in Q2.

However, this is also not true based on the latest up-to-date data.

Several European markets report daily vehicle registrations and based on this data, Tesla (left) is tracking way behind the same period last year and about the same as its terrible Q1 2025, while VW (right) is currently significantly outperforming right now compared to the last quarter or the same period in 2024:

This is also true of BMW, Ford, Hyundai-Kia, and several other automakers. So Musk’s claim of no exception is not even remotely true.

The stock market confirms Tesla is doing great

Musk used Tesla’s stock price as some sort of proof of what he is claiming:

Obviously, the stock market recognizes that since we are back now at over $1 trillion market cap. Clearly the market is aware of the situation. It’s already turned around.

This is a misleading statement. The stock price is in no way representative of Tesla’s sales. Musk has admitted that in the past. He said that “Tesla was worth nothing” if it didn’t solve self-driving.

The stock is completely disconnected from Tesla’s vehicle business.

More specifically, Musk is also wrong to claim that the market is “aware of the situation.”

Last quarter, Wall Street analysts were trying to track Tesla’s sales, but they missed badly.

For most of the quarter, Wall Street believed Tesla would deliver more than 400,000 vehicles and only started to update their estimates way down toward the second half of the quarter.

Even then, they still ended up overestimating Tesla’s deliveries by 40,000 units.

Therefore, it’s clear that the market is not well “aware” of Tesla’s current sales levels. The same thing is happening in Q2 2025. The current Wall Street consensus is that Tesla will deliver about 420,000 vehicles in Q2 2025 when the best data available show that Tesla is tracking below Q1 2025, when the automaker delivered 336,000 vehicles.

There’s still a month to go in the quarter, but it’s unlikely that Tesla will be able to accelerate deliveries enough to reach over 400,000 units.

Later on in the segment of the interview embedded above, Musk again referenced the stock price:

Again, you can just look at the stock price. If you want the best inside information, the stock market analysts have that and our stock wouldn’t be trading near all-time highs if things weren’t in good shape. They are fine. Don’t worry about it.

Again, we have clear data that show that “stock market analysts” are terrible at tracking Tesla’s sales, and the stock price is in no way representative of a company’s current performance.

It is simply representative of the demand for Tesla’s stock, which Musk himself admits is linked to Tesla’s autonomous driving effort.

Sales numbers are strong, no problem with demand

When pushed back on the demand front, Musk added:

The sales numbers are strong. And we see no problem with demand.

This is another lie. On top of the previously discussed declining sales, it’s worth mentioning that those declines are compared to 2024, a year when Tesla saw its first full-year decline in sales since starting volume vehicle production a decade ago.

In 2024 and now into 2025, Tesla has throttled down its production capacity to about 60% of its overall capacity due to low demand.

Even with fewer vehicles available, Tesla is now offering record discounts and subsidized financing rates at a great cost to the company – clear indicators of demand problems.

Where is the SEC?

These are clear, verifiable, and material lies aimed at Tesla shareholders. It’s a security violation that the SEC should be going after.

This will be a great test of how corrupt federal agencies are under the Trump administration.

The lies are verifiable right now, but I wouldn’t be surprised if they wait until Tesla reports its official deliveries for Q2 2025.

If they are significantly down versus Q2 2024, as expected, it would be easy to prove that Musk was misleading shareholders with these claims today.

What are the odds on the SEC actually going after this or letting it slide?

FTC: We use income earning auto affiliate links. More.