Tesla’s insurance products are currently unsustainable, according to a new report that shows the company is losing money insuring its own cars.

Tesla vehicles have long had a reputation for being expensive to insure.

The automaker tried to address the situation on multiple fronts. It launched its own “collision centers” to try to control repair costs, and it also introduced its own insurance products.

Tesla claims that no other insurer knows more about its technology and its owners than Tesla does, so the automaker should be able to offer more precise products.

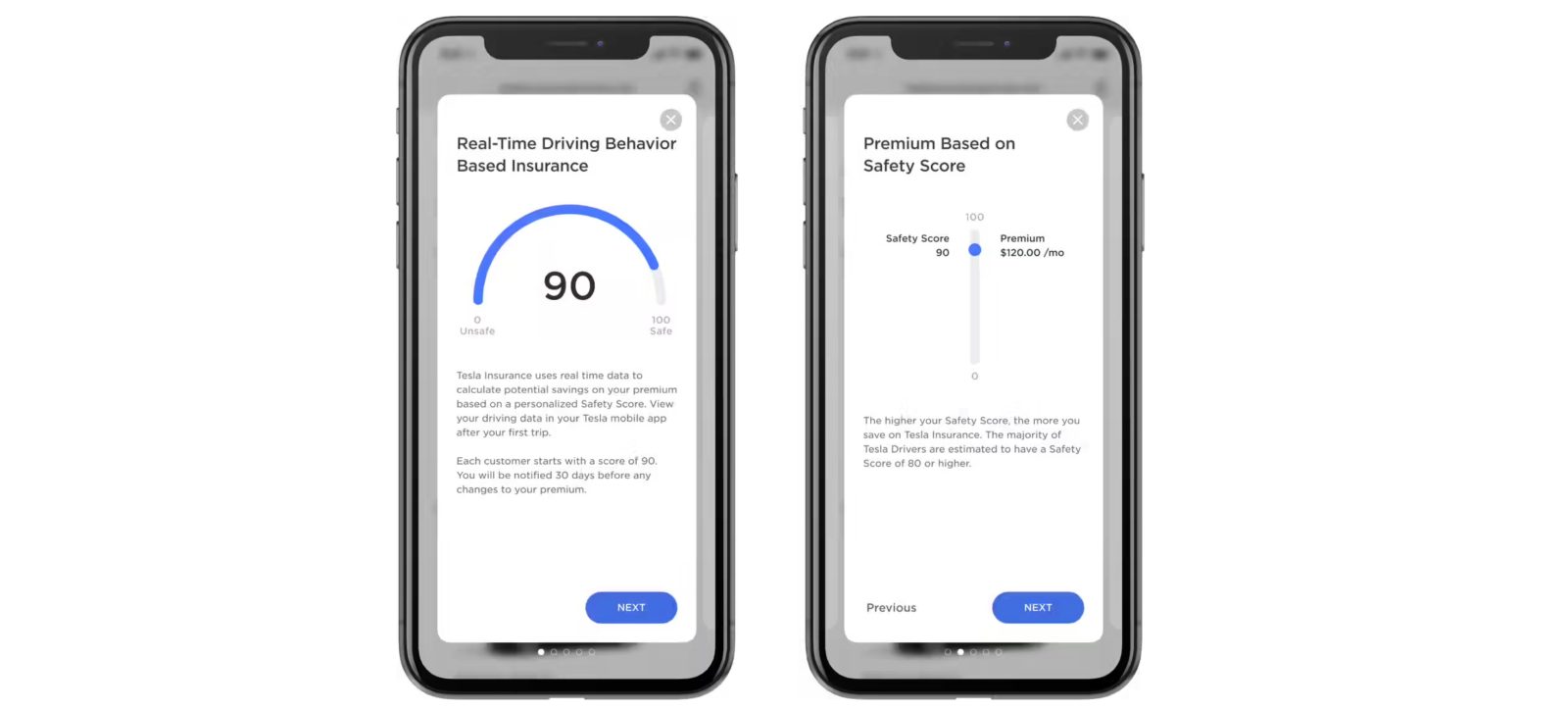

For the last few years, Tesla has been offering its own car insurance in some US states. The automaker utilizes its capacity to collect real-time driving data from its vehicles to create what it calls a “Safety Score. ” This score is based on how and when drivers drive, and the company increases or decreases their monthly premium accordingly.

The use of Tesla’s ADAS systems, Autopilot and Supervised Full Self-Driving, can also affect premiums.

Tesla owners have been reporting mixed results when trying to obtain lower quotes from Tesla compared to other insurers.

Now, data from S&P Global points to Tesla Insurance having significant problems:

An insurance company’s loss ratio is a key metric, as it represents the percentage of premiums paid out to customers. The higher it is, the more likely an insurer is likely to lose money.

Based on S&P Global’s latest data, Tesla’s was at 92.5% in 2023. This means that Tesla Insurance paid out 92.5 cents in claims for every dollar it collected in premiums.

After accounting for overhead costs, it means that Tesla was likely losing money on its insurance products.

In recent months, data suggests that insurance is becoming more expensive for Tesla vehicles in 2025.

Electrek’s Take

This is quite interesting, as it directly contradicts Tesla’s claim that its vehicles are involved in crashes at a significantly lower rate than other vehicles and are relatively inexpensive to repair.

Neither of those claims can be true if insurance premiums are expensive.

If it were the case, insurance costs on Tesla vehicles would be going down, and Tesla would be making money with its insurance products.

Now, S&P claims that even the latter is not valid.

FTC: We use income earning auto affiliate links. More.