In hindsight, Elon Musk’s statement at the beginning of Tesla Inc.’s latest earnings call that “We’re going to go as long as there are good questions to answer” sounds less like encouragement and more like a warning.

As you may have heard, the CEO decided the “good questions” from analysts ran out in about half an hour. Luckily, he had teed up a retail investor via YouTube to ask questions — at least 10 of them — much more to his liking, thereby avoiding an awkward silence.

This earnings call was, in short,

bonkers. But it was also kind of perfect.

Tesla’s calls have always been special. That may have something to do with Musk’s personality. It definitely has something to do with the sorts of questions that get asked; Morgan Stanley’s Adam Jonas, in particular, sometimes likes to steer the conversation toward Musk’s extra-terrestrial pursuits, and he didn’t disappoint on Wednesday evening.

But I think the real thing that makes the calls special is their inherent uselessness. The latest one was merely the apotheosis of this.

It’s all about contrasts. The questions that kicked off the call were — Jonas’s SpaceX-Big Data line of inquiry aside — almost exclusively about the interplay of Tesla’s Model 3 production problems, profit margins, and spending. Musk eventually lost patience with this “dry” line of interrogation.

The questions posed over YouTube were quite different. Here’s my summary of them:

How are Tesla’s plans for its (forthcoming) shared autonomous vehicles going?

Sub-question: When will the robo-taxis show up?

Where will Tesla build the (forthcoming) Model Y crossover vehicle, given factory constraints?

Will Tesla require a breakthrough in battery technology for the (forthcoming) Semi truck?

Will Tesla amp up its Superchargers? Because Porsche is talking about some cool stuff.

Will Tesla let other car brands use the Superchargers?

Sub-question: Why even open up the Superchargers? Because they are a strategic moat.

NB: Musk thinks moats are “lame;” innovation is what matters.

How will Tesla price electricity from the (forthcoming) Megachargers?

How could Tesla change the overall trucking market with its (forthcoming) trucks?

How is Tesla prioritizing residential and utility-scale demand in its energy business?

This is not to dismiss those questions; the one about factory space was particularly useful. Still, you may have noticed a theme. While analysts obsessed about how Tesla will pay for this year’s plans (and setbacks), these questions erred on the expansive side, peering somewhat further into the future.

This captures things perfectly. Even with Tesla’s stock having sold off Thursday morning, the company is still valued at about $48 billion (not including debt). In the absence of positive cash flow, that rests to a large degree on some theoretical terminal value, as some dry analyst might put it. More prosaically, it rests on the belief Musk will remake the global transportation and energy markets through sheer innovation and technical brilliance — as reflected in many of those YouTube questions.

In contrast, the analysts’ questions represent the doubts. How does one actually get to that bright, lucrative future (without massive dilution) if the company is burning $1 billion a quarter, has $2.7 billion in the bank and is still struggling to build its key product?

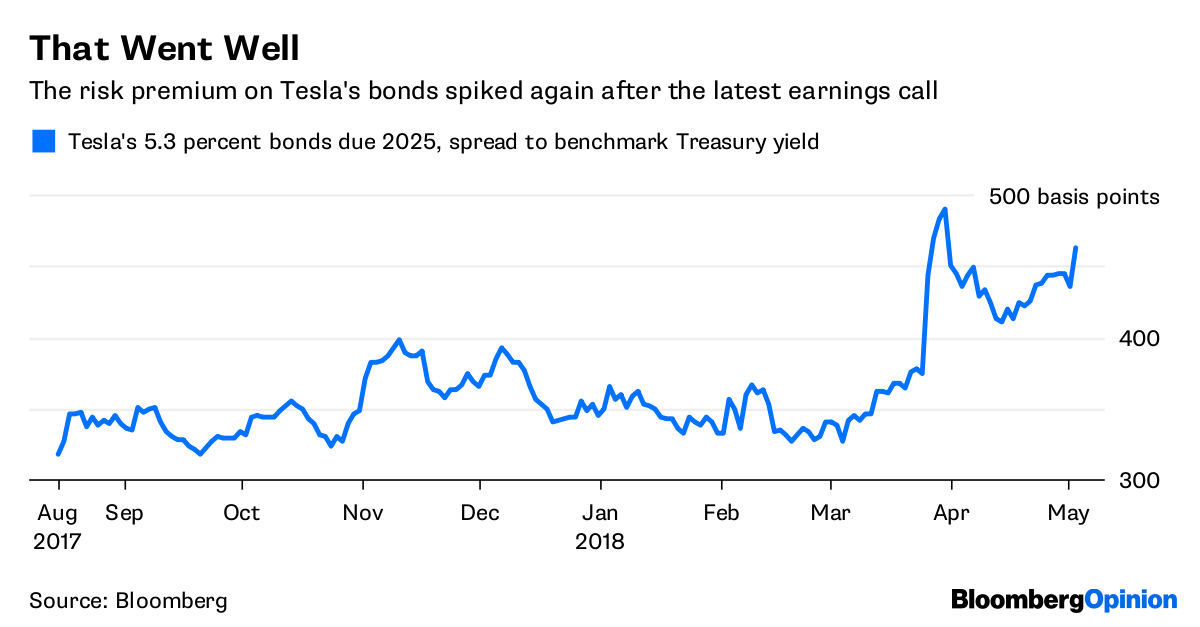

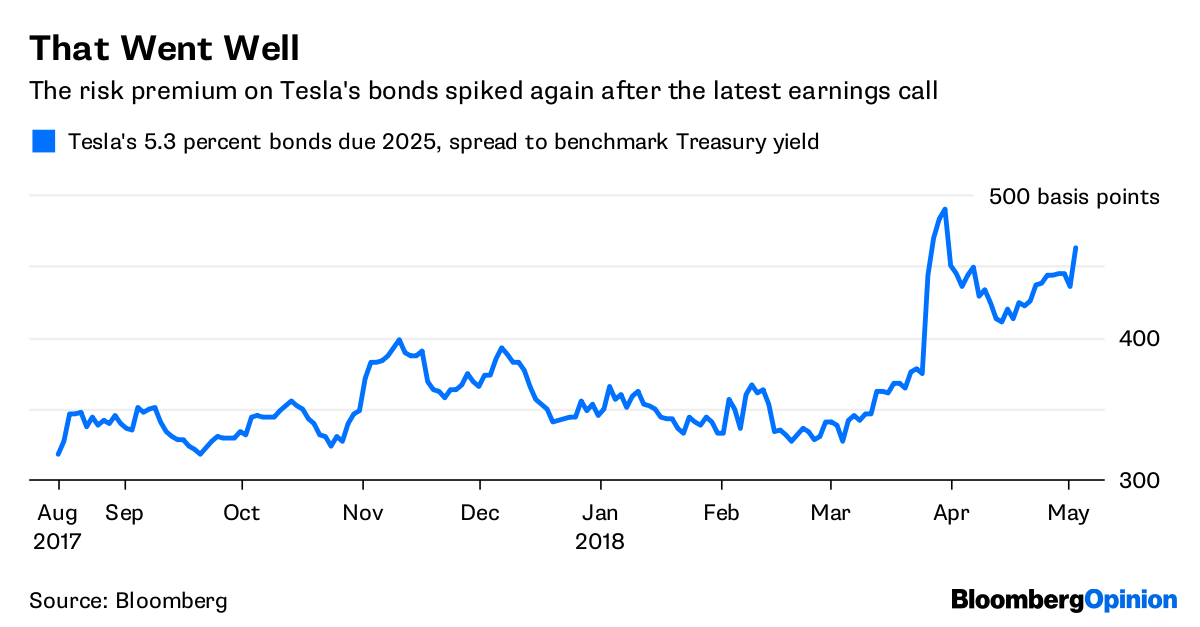

That Went Well

The risk premium on Tesla’s bonds spiked again after the latest earnings call

Source: Bloomberg

The contrast — one set of eyes fixed on the top line of the P&L, others on the balance sheet — has always been there. It just hasn’t really mattered that much. Hence, the quarterly calls have been largely useless in the sense that, even when questions are posed about the nuts and bolts of Tesla’s finances, the vision thing dominates. If you believe in Musk, then you are by definition taking a long-term view, and what happened in the past three months is mostly irrelevant. The abrupt switch to the YouTube channel just made this more overt.

In a different timeline, Tesla might have been an unlisted unicorn like Uber Technologies Inc. As I wrote

here a couple of years ago, being private would have allowed Tesla to not merely forgo the indignity of spending four hours a year answering questions. It may also have moderated — not, I want to make clear, negated — the company’s ambition and spending by removing the impetus to be ever more expansive.

As it is, Tesla is a listed company that remains dependent on external funding. Moody’s, which cut Tesla’s credit rating in late March, reiterated on Thursday morning that a $2 billion capital raise is likely needed, despite the company’s claims to the contrary.

Bulls may counter that the giant market cap is, in itself, a shield against such concerns. But that’s circular logic: The valuation is merely the manifestation of their underlying belief in Musk prevailing, come what may.

While Tesla projects healthier finances later this year, its

track record on guidance is poor, and disbelief can be just as contagious as belief when it comes to capricious markets. For now, Tesla still needs others for its funding — at least some of whom tend to ask questions that only get drier as the debts get bigger.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Liam Denning at ldenning1@bloomberg.net

To contact the editor responsible for this story:

Mark Gongloff at mgongloff1@bloomberg.net

Go to Source