The report, the first in a quarterly series from the B2B technology provider for car rental operations, highlights several key trends shaping the industry, from booking patterns to payment preferences.

Graphic: CarTrawler

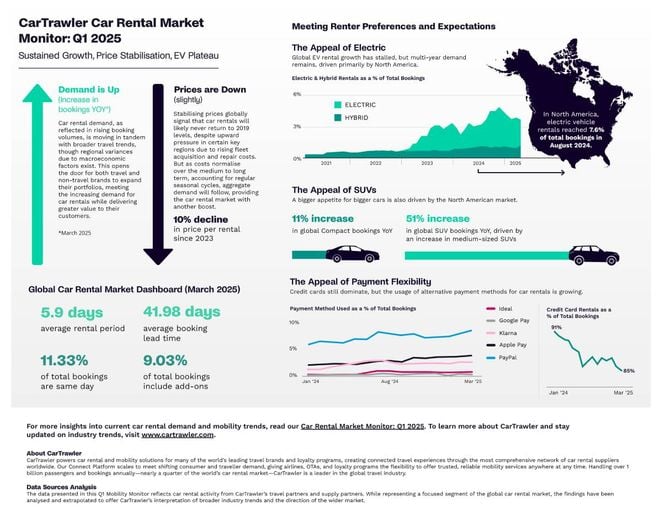

CarTrawler has released its Car Rental Market Monitor for the first quarter of 2025, revealing a sector that thrives even against well-publicized headwinds.

The report, the first in a quarterly series from the B2B technology provider for car rental operations, highlights several key trends shaping the industry, from booking patterns to payment preferences.

Car Rental Demand Remains Strong Despite Economic Pressures

The global car rental market is showing resilience amid economic challenges. Total bookings have grown since January 2023 and continue to rise into 2025, with March bookings up year-over-year. This trend defies inflation rates in North America and Europe, supply chain issues, and U.S. tariff uncertainty.

While booking volumes follow seasonal patterns, peaking in the summer months and dipping around winter holidays, the overall trend remains net positive. This growth mirrors the broader travel industry’s recovery, suggesting that consumers view car rental as integral to their travel experience.

Prices Have Stabilized but Remain Above Pre-Pandemic Levels

After a period of volatility, rental prices appear more stable across major markets. Average rental prices have decreased steadily from $347 per booking in March 2023 to about $291 in March 2025. This trend is consistent across regions, including Europe and the UK.

However, prices fluctuate by season, with peak rates during the high-demand summer vacation months of June and July. Notably, demand for premium categories is rising, with “luxury” rentals increasing by 81% between March 2024 and March 2025 and SUVs experiencing a 51% volume increase over the same period.

EV Rental Growth Has Plateaued

The electric vehicle rental segment also shows interesting trends. While EV bookings have increased over time, growing from a mere 0.6% of total rentals in January 2023 to 4% by March 2025, they peaked at 5% during late 2024.

Even as EV adoption levels off, the sustained demand for this vehicle type among renters indicates that travel brands and rental suppliers should not ignore that EVs remain a relevant offering in the mobility mix.

Regionally, North America leads in electric demand at 5% of total rental sales, following an impressive 8% during the summer of 2024. Meanwhile, hybrid vehicles show stronger adoption in European and UK markets, representing 1.6% and 1.4% of bookings, respectively.

Booking Windows Are Shortening

Consumer booking behavior is changing in favor of greater flexibility. The average lead time between booking and travel has decreased from 49.54 days in January 2024 to 41.98 days in March 2025. This suggests travelers are making decisions closer to their departure dates.

Same-day bookings also reflect this trend toward immediacy, with rates of 12% in January 2024, rising to 16% in December 2024, before settling at 11% in March 2025. These patterns highlight a growing consumer preference for flexible and spontaneous travel planning.

Gavin Sweeney, chief revenue officer of Car Trawler, brings expertise in commercial strategy and performance, trading, data science, and revenue management. He has held senior roles at CarTrawler, including director of trading and head of business performance, and has worked at Paddy Power Betfair and Ireland’s Department of Finance.

Photo: CarTrawler

Alternative Payments Are Rising

Payment preferences are shifting away from traditional methods. Credit card dominance has declined from 90% of global bookings in March 2024 to 85% by March 2025, with regional variations highlighting different adoption rates.

Globally, PayPay, and Apple Pay top the list of non-card payment methods used when booking a rental car. In total, alternative payments now account for nearly 15% of all transactions processed through the CarTrawler platform.

Industry Outlook Remains Positive

From this data, the car rental market is poised to enter the second half of 2025 in a position of strength. While specific economic challenges are undeniable, consumer demand remains healthy, with clear preferences emerging for flexibility, immediacy, and digital convenience. Companies that respond to these preferences will likely see continued success as the industry adapts to changing consumer expectations.