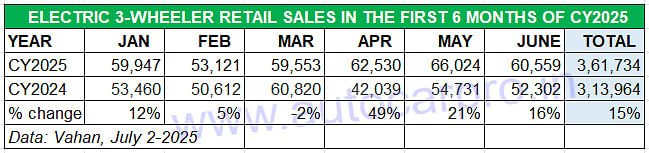

Like the electric two-wheeler industry, which at halfway stage in the current calendar year, is set to achieve record sales in CY2025, unless hampered by the slowdown in the rare earth magnets supply chain, the electric three-wheeler industry too is poised to set a new sales benchmark this year. Between January 1 and June 30, a total of 361,734 units have been retailed, as per the data on the Vahan portal. This marks 15% year-on-year growth (January-June 2024: 313,964 units) and is 52% of CY2024’s record sales of 691,302 units.

If India e-3W Inc maintains the same growth trajectory in H2 CY2025, then it could achieve the 700,000 sales milestone for the first time this year.

If India e-3W Inc maintains the same growth trajectory in H2 CY2025, then it could achieve the 700,000 sales milestone for the first time this year.

If e-3W OEMs maintain the same level of growth displayed in the past six months, or exceed given the festival season later this year, then it can be surmised that India e-3W Inc will go on to surpass the 700,000-units retail sales milestone for the first time in CY2025.

ELECTRIC 3-WHEELERS EAT INTO CNG 3W MARKET

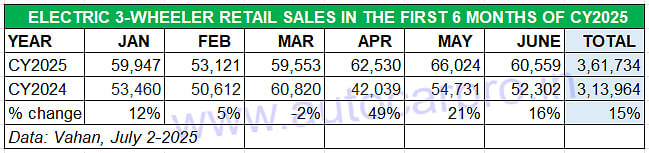

Of the total 605,493 three-wheelers sold in India (other than Telangana for which Vahan does not provide the retail data) in H1 CY2025, electric three-wheelers account for the bulk of them – 60% – clearly establishing their stranglehold over this vehicle segment. Furthermore, it is also the one to register the highest YoY growth (see data table above). The 15% YoY increase in sales has given it an additional 5% market share, increasing from the 55% it had in H1 CY2024 and thereby taken away sales from the CNG market.

Of the total 605,493 3Ws sold in India in the past six months, e-3Ws registered 15% growth and grew their market share to 60 percent. In comparison, with their sales down 11% to 155,022 units, CNG 3W market share has dropped by 5% year on year.

Of the total 605,493 3Ws sold in India in the past six months, e-3Ws registered 15% growth and grew their market share to 60 percent. In comparison, with their sales down 11% to 155,022 units, CNG 3W market share has dropped by 5% year on year.

In comparison, sales of CNG-powered 3Ws (155,022 units) were down 11% YoY (H1 CY2024: 173,469 units). This translates into 18,627 fewer units sold, with one of the sales impediments being the recent price hikes of this fuel which increase the total cost of vehicle ownership, which is critical in this segment. Diesel 3W sales, at 69,063 units, rose 7% YoY while LPG-fuelled 3Ws (16,622 units) increased by 11 percent. And only 2,987 petrol-engined 3Ws, down 57% YoY, were sold in the last six months.

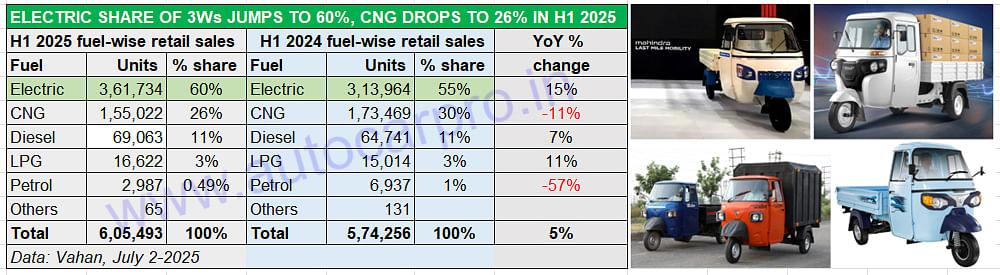

The scenario in the e-3W industry is akin to the e-2W industry, where a shakeout is underway between the legacy OEMs and a host of startups. The Top 15 e-3W OEMs list for H1 CY2025 has four legacy players – Mahindra & Mahindra, Bajaj Auto, Piaggio Vehicles and recent entrant TVS Motor Co – which between them have sold 84,754 units which makes for a 23% market share. Electric 3W market leader Mahindra Last Mile Mobility (38,262 units, 10.57% share) is followed by Bajaj Auto (33,521 units, 9.26% share), Piaggio Vehicles (ranked No. 6 with 7,357 units, 2% share) and TVS Motor Co (ranked 11th with 1.55% share).

The remaining 276,970 units sold in H1 FY2025 are split between 569 others players, which reflects the intense competition is this segment of the EV industry. Let’s take a closer look at the top five OEMs which have sold more than 10,000 units each in the first half of this year.

After the first six months of CY2025, electric three-wheelers have contributed 34% to India EV Inc’s total sales of 10,47,498 EVs across all segments. The two-wheeler segment, with 605,355 units, has the largest share of 58% albeit e-3Ws have the highest level of ICE users transitioning to e-mobility.

MLMM, which was the first of the legacy players to enter the e-3W market, has the largest portfolio and has sold over 221,000 units since CY2016.

MLMM, which was the first of the legacy players to enter the e-3W market, has the largest portfolio and has sold over 221,000 units since CY2016.

MAHINDRA LAST MILE MOBILITY

January-June 2025: 38,262 units, up 29% YoY

E3W market share: 10.57%

Mahindra Last Mile Mobility (MLMM), which was the first of the legacy OEMs to enter the field of electric mobility nearly a decade ago, continues to maintain its grip on the market. MLMM has, between January-June 2025, retailed a total of 38,262 units, up 29% YoY (H1 CY2024: 29,668 units), which gives it a market-leading share of 10.57 percent. This total is 56% of the company’s sales of 68,099 units (up 25% YoY) in CY2024, its best-ever annual sales to date.

June 2025 retails of 7,320 units is the second-highest monthly sales for MLMM after October 2024 (7,479 units) and ahead of November 2024 (7,134 units).

Between CY2016 and H1 CY2025, MLMM has sold a total of 221,874 electric 3Ws, with 76,693 units sold in the past 12 months. Between CY2022 and H1 FY22025, when the e-3W industry has seen stellar growth, M&M has sold a total of 190,465 units.

MLMM has the largest e-3W portfolio in the industry comprising the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains.

The Treo, Treo Plus and e-Alfa Plus are passenger-transporting models, the last being an e-rickshaw. While the Treo is powered by a 7.4 kWh lithium-ion battery which delivers an ARAI-certified range of 110km, the Treo Plus with a 10.24 kWh battery can travel 150km per charge. Both have a similar 55kph top speed with driver and three passengers. The E-Alfa Plus e-rickshaw has a 100km range with driver and 4 passengers.

There are three cargo-transporting models – the e-Alfa Cargo (310kg payload / 95km range), the Zor Grand (400kg payload / 90km range) and Treo Zor (500kg payload / 80km range) – designed for multiple operations.

According to the company, electrification in the L5 category has touched ~31% in Q1 FY2026, up from less than 8% in FY2023, and one enabled by Mahindra’s flagship 3W EVs like the Treo Auto and Zor Grand.

For Bajaj Auto, its June 2025 retail sales of 6,478 units are its best-ever monthly retails, going ahead of its previous best of October 2024 (6,313 units). Cumulative sales since June 2023 have touched 80,000 units.

For Bajaj Auto, its June 2025 retail sales of 6,478 units are its best-ever monthly retails, going ahead of its previous best of October 2024 (6,313 units). Cumulative sales since June 2023 have touched 80,000 units.

BAJAJ AUTO

January-June 2025: 33,521 units, up 168% YoY

E3W market share: 9.26%

Bajaj Auto, which has clocked retail sales of 33,521 units in the first six months of this year, has registered 168% YoY growth (H1 CY2024: 12,499 units). June 2025’s sales of 6,478 units are its best-ever monthly retails, going ahead of its previous best of October 2024 (6,313 units) and November 2024 (6,128 units), both being festival season months when vehicle buying typically picks up in India.

With this performance in H1 CY2025, Bajaj Auto, which is India’s No. 1 ICE 3W manufacturer and exporter, currently has a 9.26% market share. The 33,521 units are 80% of its entire CY2024 sales of 41,904 units. Between June 2023, when it entered the e-3W market and end-June 2025, Bajaj Auto has sold a total of 80,000 units as per Vahan data.

Bajaj Auto plugged into this segment with two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 – which are being replaced by the GoGo e3W brand launched in February 2025 and aimed to redefine last-mile mobility, for both passenger and cargo operations. Key highlights are a best-in-class range of 248km, a 5-year /120,000km battery warranty, and first-in-class tech features like auto hazard and anti-roll detection. There are two GoGo models for passenger transport (P70s and P50s) and three variants (P5009, P5012 and P7012). While the P5009 has a 9 kWH battery, the P5012 and P7012 are equipped with a 12 kWh unit.

Meanwhile, the company, which had previously said that it was set to roll out its first e-rickshaw in July seems to have deferred the launch to sometime in the second quarter of FY2026 (July-September 2025).

YC Electric five models on sale – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations.

YC Electric five models on sale – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations.

YC ELECTRIC

January-June 2025: 21,057 units, up 5% YoY

E3W market share: 6%

In third place is YC Electric which has five models on sale – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. YC Electric has done well to sell 21,057 units, up 5% YoY (H1 CY2024: 20,121 units).

January 2025 (3,880 units) was its best month in the first-half and June 2025 (3,303 units) its lowest. This gives the company a market share of 5.82% and third rank. While it remains a podium player, YC, which was the longstanding No. 2 e-three-wheeler OEM, lost its position to a hard-charging Bajaj Auto in FY2025.

Along with its Mayuri brand of e-rickshaws, Saera Auto also sells an L5 range of electric three-wheelers for passenger and cargo transport.

Along with its Mayuri brand of e-rickshaws, Saera Auto also sells an L5 range of electric three-wheelers for passenger and cargo transport.

SAERA AUTO

January-June 2025: 12,382 units, down 9% YoY

E3W market share: 3.42%

Like a number of other e-rickshaw players, Saera Auto too has been impacted by the advance of legacy OEMs in the e-3W industry. In H1 CY2025, the company clocked cumulative retails of 12,382 units, down 9% (H1 CY2024: 13,550 units). This sees its market share reduce to 3.42% from 4.31% a year ago.

Saera Electric Auto, the manufacturer of the Mayuri brand of electric rickshaws, has all of nine models in the market. Based in the industrial hub of Bhiwadi, Rajasthan, it is the leading supplier of e-rickshaw loader models like the Mayuri E-Cart Loader. Saera Auto also sells its L5 range of electric three-wheelers, built in association with the Telangana-based Keto Motors for passenger and cargo transportation.

The company has three manufacturing plants. While the Bhiwadi plant has a production capacity of 24,000 units per annum, the Bawal (Haryana) plant has a 36,000 units per annum capacity. And the third facility at Kosi in Uttar Pradesh has recently commenced production.

Halfway into CY2025, Dilli Electric has achieved 43% of its CY2024 sales.

Halfway into CY2025, Dilli Electric has achieved 43% of its CY2024 sales.

DILLI ELECTRIC AUTO

January-June 2025: 10,535 units, down 12% YoY

E3W market share: 2.91%

In fifth place is Dilli Electric Auto with 10,535 units, which is 12% down on its year-ago sales of 11,976 units. This Haryana-based company manufactures electric rickshaws (CityLife brand), a category which is now under pressure as legacy players like MLMM and Bajaj Auto target sales with better-built, safer products. Dilli Electric had sold 24,207 units in FY2025, down 7% YoY (FY2024: 26,163 units). Halfway into CY2025, it has achieved 43% of its CY2024 sales.

SEVEN OEMS SELL OVER 5,000 UNITS EACH

The Top 12 OEMs also contain seven e-3W manufacturers which have each sold over 5,000 units. Piaggio Vehicles, ranked No. 6, has sold 7,357 units albeit its sales are down 32% YoY (H1 CY2024: 10,808 units) which give it a 2% market share. Energy Electric Vehicles (6,289 units, up 4%), Mini Metro (6,229 units, down 11%), and Sahnianand E-Vehicles (6,228 units, up 49%) are three OEMs keeping company in the 6,200-odd range. JS Auto (5,753 units, up 9%), recent entrant TVS Motor Co (5,624 units) and Unique International (5,281 units, down 21%) are the Nos 10-12 player.

Murugappa Group company TI Green Mobility (Montra Electric), which entered the market in July 2023, is also fast climbing up the ranks. The company, which sells the Super Auto passenger model and has recently launched the Super Cargo variant, has sold 3,116 units in H1 CY2025, up 25% YoY. This gives it a 0.86% market share and No. 24 rank.

Compared to the electric two-wheeler market which has only a few legacy players (TVS, Bajaj Auto, Hero MotoCorp, Honda Motorcycle & Scooter India, and recent entrant Suzuki India), the electric 3W industry has eight – Mahindra & Mahindra, Kinetic Group, Atul Auto, Piaggio Vehicles, Omega Seiki, Bajaj Auto, Murugappa Group and TVS Motor Co. Other than these well-established legacy OEMs, the e-3W segment is currently populated by several small and medium enterprises, many of them manufacturing electric rickshaws.

The shakeout in the overall e-3W market is clearly underway with buyers preferring to buy better-built models from well-established legacy OEMs, which have a much stronger marketing, sales and service network as well as financial capabilities. This is also evident in the fact that of the Top 30 OEMs (see data table below), 13 of these MSMEs have registered YoY sales declines in the first half of this year.

ALSO READ: Murugappa Group’s Montra Electric sells over 10,000 3-wheelers, enters cargo market

ALSO READ: Murugappa Group’s Montra Electric sells over 10,000 3-wheelers, enters cargo market

India beats China again to be world’s largest electric 3W market

Electric 3W industry scales new high in FY2025 but misses 700,000 milestone by 900 units