After spearheading oil’s rally

last summer, diesel markets have gotten even tighter.

The cold winter in the U.S., strong global economic growth and refineries increasingly processing lighter crude oil have all contributed to the steady draw-down of diesel stockpiles the world over. All of that, along with the longer-term fillip of new shipping regulations, is helping to counter the

potential for curbed use of the fuel following the so-called “diesel-gate” scandal. Here are five charts that show how diesel has become one of the most bullish corners of the oil market.

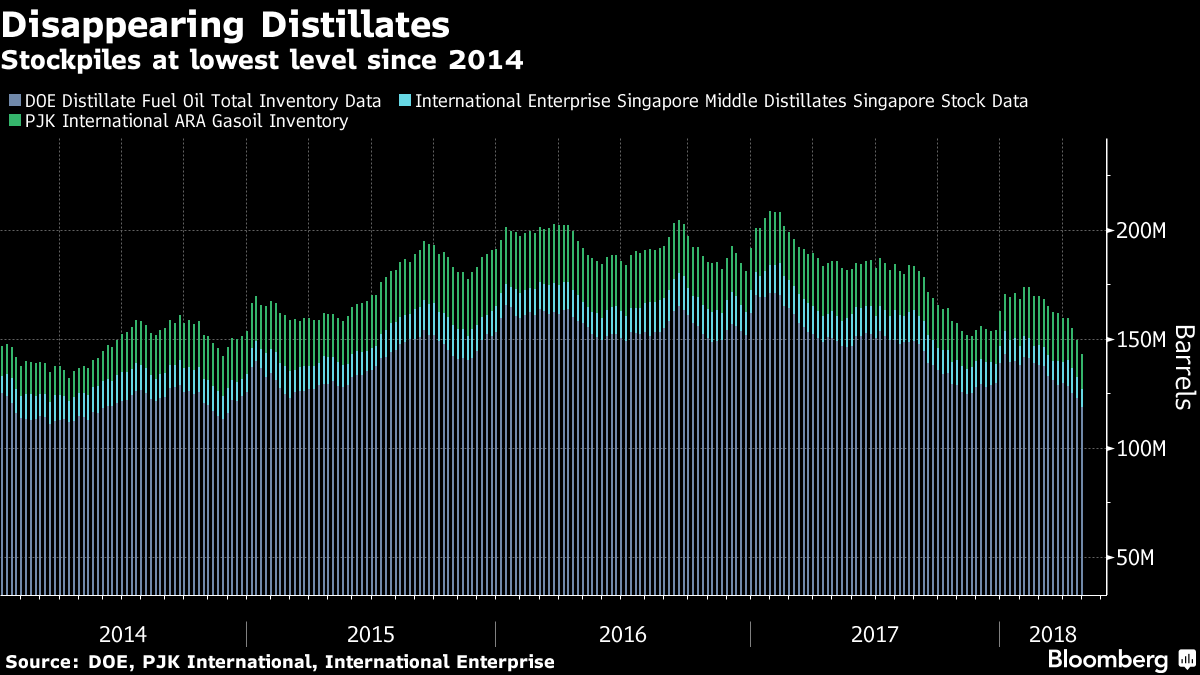

1. Diesel Draws

Distillate inventories globally have fallen to their lowest level since 2014. That’s been spurred by declines in U.S. stockpiles for 11 of the last 12 weeks, while those in Singapore have fallen for the last four weeks. In Europe, supplies have contracted for the last eight weeks. A series of cold snaps in the U.S. and strong global economic figures underpinned demand for distillates, said Warren Patterson, a commodities strategist at ING Bank NV. “In the U.S. it’s week after week, we continue to see that draw-down. There’s no stopping it.”

2. More Than Seasonal Slump

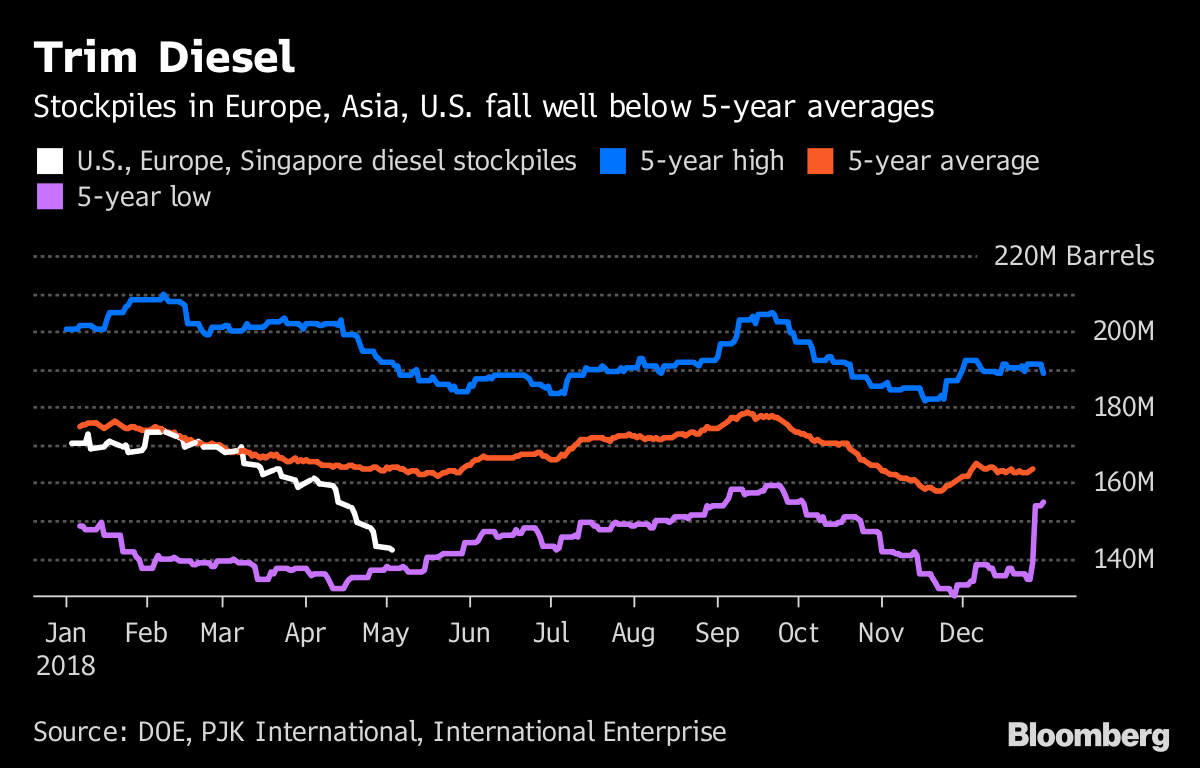

In the three major regions, stockpiles from the middle of the barrel are near the lowest level for the time of year for any of the last five years. That suggests that despite booming crude futures prices, demand for products made from that oil is yet to be impacted, according to consultancy Energy Aspects Ltd. That’s also showing up in freight volumes, and the number of miles driven by industrial vehicles, according to the researcher.

Trim Diesel

Stockpiles in Europe, Asia, U.S. fall well below 5-year averages

Source: DOE, PJK International, International Enterprise

3. See the Light

There’s more to those sliding stockpiles than insatiable demand. The oil being consumed by refineries in the U.S. is

lighter than at any other time in the last three decades. That means that as inventories are being eroded, refineries aren’t producing as much distillate to replenish those stockpiles. “At the moment we are clearly somewhat diesel starved,” JBC Energy analyst Michael Dei Michei, said by email. “What you usually get is relatively more kerosene and a little less gasoil as the crude slate gets lighter.”

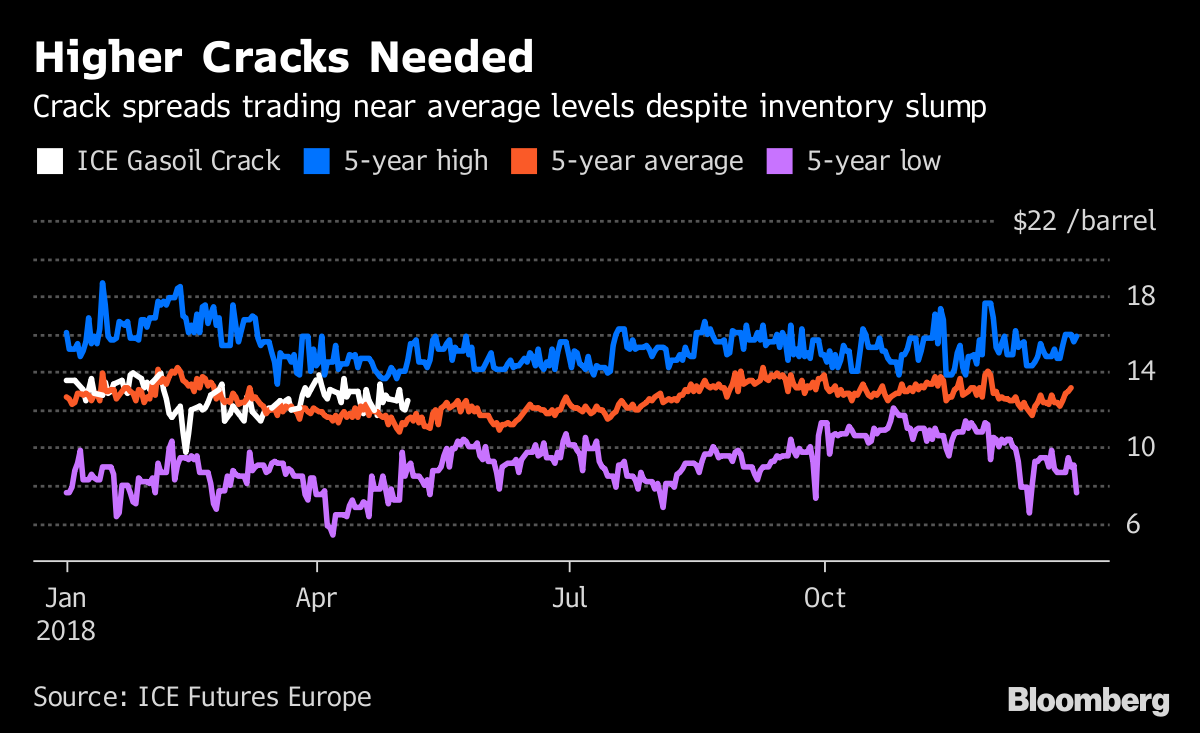

4. Price Premium

Still, given the recent slump in stockpiles, there’s a risk that inventories won’t rise sufficiently before consumption climbs even higher in the autumn, Commerzbank AG analysts including Carsten Fritsch wrote in a report. For the time being, gasoil cracks in Europe, the U.S. and Asia are all trading near their five-year averages, limiting the incentives for refineries to churn out more diesel. “Clearly, higher crack spreads are needed to give refineries a greater incentive to produce middle distillates,” Fritsch said.

Higher Cracks Needed

Crack spreads trading near average levels despite inventory slump

Source: ICE Futures Europe

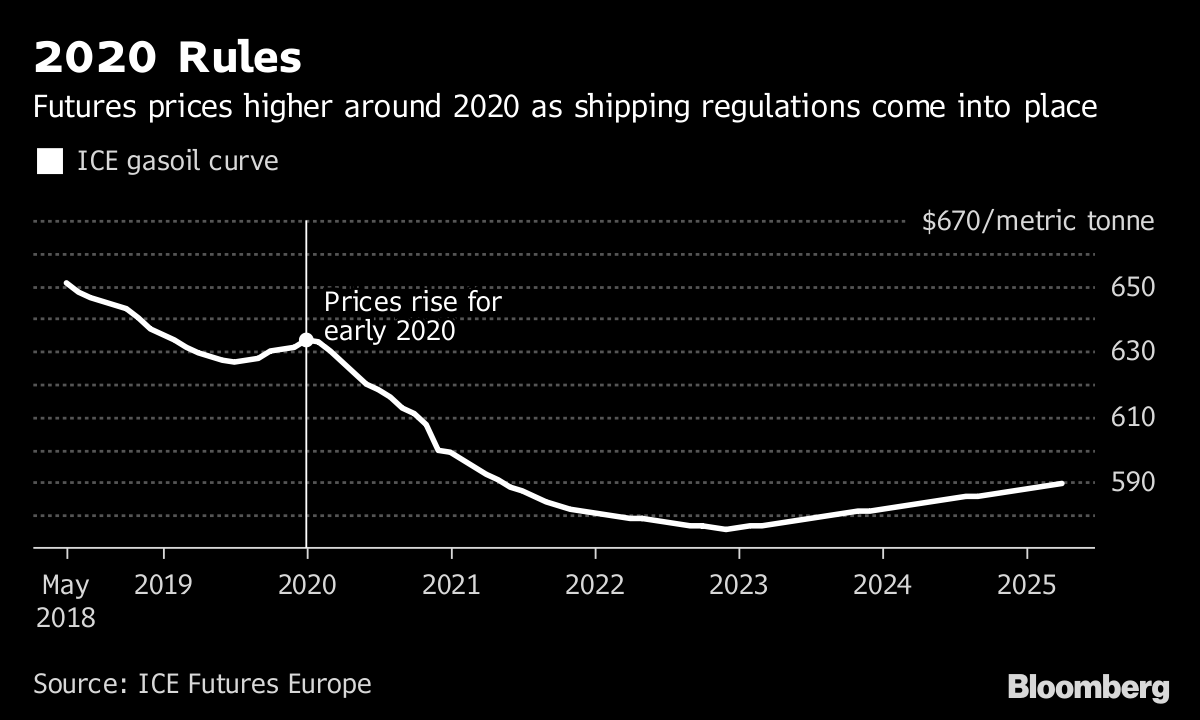

5. IMO Support

Look further down the line and there may be more support coming.

Regulations on shipping emissions due in 2020 have been buoying oil product prices along U.S. and European diesel curves. The measures to restrict sulfur emissions are expected to boost demand for compliant middle distillate products, including diesel. “It’s meant to be the most bearish part of the barrel,” ING’s Patterson said. “Everyone was talking about falling diesel car sales, but longer-term the outlook is a lot more positive on diesel given the IMO changes coming.”

2020 Rules

Futures prices higher around 2020 as shipping regulations come into place

Source: ICE Futures Europe

— With assistance by Laura Blewitt, and Rachel Graham