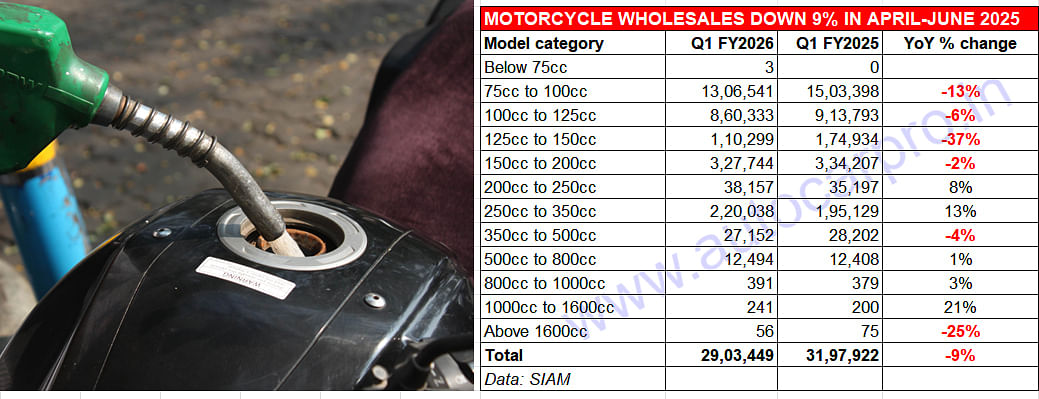

After clocking wholesales of 12.25 million units and 5.1% YoY growth in FY2025, which contributed to the overall Indian two-wheeler segment’s 19.60 million units and 9.1% growth over FY2024, motorcycles, which are the volume drivers for the two-wheeler market which includes scooters and mopeds, has had a poor start to FY2026 with a sharp 9.2% YoY decline in sales in the first quarter of the current fiscal. SIAM attributes this to inventory correction across the segment.

Nevertheless, the 2.90 million motorcycles dispatched to showrooms in April-June 2025 (Q1 FY2025: 3.19 million units) were the key reason for dragging down the overall two-wheeler segment’s performance of 4.67 million units (down 6.2% YoY) in Q1 FY2026. While scooter wholesales at 1.66 million units were down marginally (-0.2%), demand for mopeds was down 11% at 109,361 units.

The fuel-sipping entry level 75-100cc and 100-125cc bike categories, which accounted for 2.16 million units in Q1 FY2026 were down 10% on year-ago dispatches of 2.59 million units.

The fuel-sipping entry level 75-100cc and 100-125cc bike categories, which accounted for 2.16 million units in Q1 FY2026 were down 10% on year-ago dispatches of 2.59 million units.

A quick look at the motorcycle segment categories reveals plenty of red ink. Of the 12 sub-segments, six of them – with the top four being the volume providers – have registered a YoY sales decline.

The fuel-sipping commuter 75-100cc bike category with 13,06,541 units is down by 13% YoY, having sold 196,857 fewer units. While Hero MotoCorp (10,91,460 units / HF Deluxe, Passion, Splendor) is down 8.63% YoY, Bajaj Auto (94,618 units / CT100, Platina) is down 24% and Honda Motorcycle & Scooter India with 49,318 units of the Livo and Shine is down 55% YoY.

The 100-125cc category, with 860,333 factory dispatches, is down 6% YoY (Q1 FY2025: 913,793 units). The rate of decline would have been higher if it weren’t for a good performance by Honda, which leads this category with sales of 432,580 units of the Shine, up 11% (Q1 FY2025: 387,832 units). However, both the No. 2 and No. 3 players here saw their numbers decline – Bajaj Auto (211,559 units, down 6% / Pulsar and Freedom CNG) and Hero MotoCorp (1,10,282 units , down 39% / Glamour, Splendor, Xtreme 125R).

The 125-150cc category sees the highest rate of sales decline: down 37% YoY at 110,299 units (Q1 FY2025: 174,934 units). Leader Bajaj Auto with 47,054 units of the Pulsar is down sharply by 44% YoY. Second-ranked Yamaha with 37,228 FZs sold is down by 7% and Honda, with 26,017 units of the CB Unicorn 150 down by 49 percent YoY.

Compared to these three categories, the 150-200cc motorcycle sub-segment has witnessed the lowest rate of decline – down 2% at 327,744 units – which is the result of a growing number of commuter bike buyers upgrading to the executive commuter bike category. The main beneficiary of this is TVS Motor Co with its Apache RTR Series – RTR 160, RTR 160 4V, RTR 180 and RTR 200. With sale of 136,118 Apaches, up 13%, TVS commands a 41% share of this bike category. No. 2 Bajaj Auto (74,431 units) comprising the Bajaj Pulsar, Avenger, and KTM) witnessed a 14% YoY increase in bike dispatches. At No. 3 in this category is Honda, with 68,546 units (up 15%) with the likely best-seller being the SP 160.

India Yamaha, with 36,467 units of the MT 15 and R15, is down sharply by 48% YoY (Q1 FY2025: 69,945 units). The MT 15 typically outsells the R15.

Hero MotoCorp, with 8,834 units of the XPulse 200 and Xtreme, is down 41% YoY (Q1 FY2025: 15,137 units) and Suzuki Motorcycle India, with 3,022 Gixxers down by 10% (Q1 FY2025: 3,371 units).

The 200-250cc category has registered sale of 38,157 units, up 8% YoY (Q1 FY2025: 35,197 units). This growth can be attributed to the strong demand for the TVS Ronin which, with 14,530 units (up 157%), accounts for 38% of this sub-segment’s sales in the first quarter. This puts the TVS Ronin at No. 2 after the clutch of Bajaj bikes (Pulsar, Dominar, Avenger, Husqvarna and KTM) which have sold 21,513 units, down 17% YoY.

The 250-350cc category has done well – the 220,038 units are up 13% YoY and that’s thanks to the market leader Royal Enfield selling 208,659 bikes, up 14% YoY, and commanding 95% of the category sales, up from the 94% it had in Q1 FY2025.

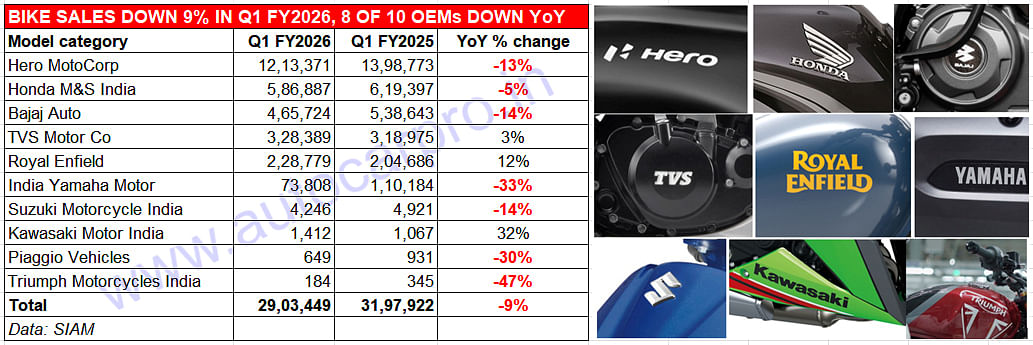

Seven of the 10 bike-making OEMs have witnessed a YoY decline in wholesales in the first quarter of FY2026, with the Top 3 feeling the heat of slowing sales of entry-level commuter motorcycles.

Seven of the 10 bike-making OEMs have witnessed a YoY decline in wholesales in the first quarter of FY2026, with the Top 3 feeling the heat of slowing sales of entry-level commuter motorcycles.

Will Q2 FY2026 (July-September 2025) prove better for the motorcycle industry. According to SIAM, “The overall industry outlook remains cautiously optimistic. While the challenges from Q1 may continue to linger in the near term, several positive macroeconomic and seasonal indicators could support a gradual recovery.”

These include the upcoming festive season, which typically serves as a demand driver, particularly for passenger vehicles and two-wheelers, while the above-normal monsoon is likely to aid rural income recovery, which is especially important for two-wheelers and entry-level vehicles that rely heavily on rural demand. Furthermore, the RBI’s cumulative repo rate cuts of 100 basis points over the past six months are expected to gradually ease borrowing costs which could positively impact the auto sector by improving affordability and boosting consumer sentiment in the coming months.

ALSO READ: Honda scooter market share drops to 39%, TVS’ rises to 29% in Q1 FY2026

Legacy e-2W OEMs keep startups at bay, capture 58% share in first-half CY2025