The India-UK Free Trade Agreement (FTA) has explicitly excluded battery, hybrid and hydrogen-powered passenger cars priced under £40,000 (approximately Rs 44 lakh) from any import duty cuts, a move aimed at shielding the domestic manufacturers. The basic customs duty on these cars will remain 70%.

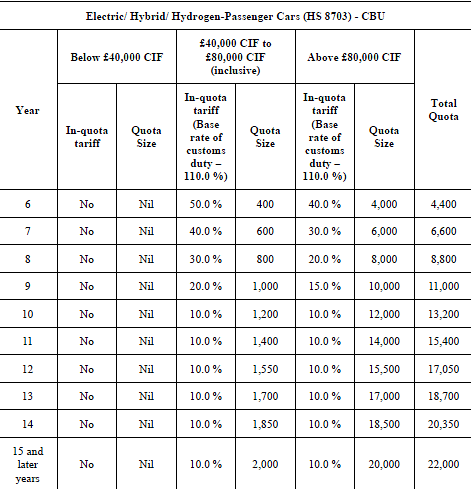

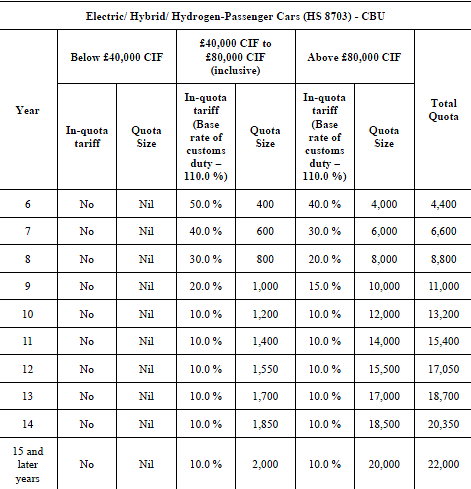

There will be no import duty concessions for any of these alternative fuel vehicles during the first six years of the FTA, even for those priced above £40,000.

However, from the sixth year, vehicles priced above £40,000 will see gradual reduction in duties within a import volume threshold. Vehicles in this price segment currently has a basic customs duty of 110%.

The vehicles priced between £40,000 and £80,000 will qualify for a 50% concessional duty rate in the sixth year of FTA, which will further decrease to 10% by the tenth year.

These reduced rates are tied to a specific quota, beginning at 400 units in the sixth year and expanding to 2,000 units annually by the fifteenth year.

For alternative fuel vehicles priced above £80,000, import duties will be cut to 40% in the sixth year, with an initial quota of 4,000 units.

The duty will then progressively drop to 10% in the year when the import volume reaches 12,000 units. By the fifteenth year, this 10% duty quota will expand to 20,000 units annually.

(TO BE UPDATED)