Tata Motors and Iveco Group have announced a definitive agreement to combine their commercial vehicle (CV) businesses in a landmark €3.8 billion all-cash deal. The acquisition will be executed through a voluntary tender offer for all common shares of Iveco Group (post-separation of its defence business), marking a strategic move to create a global leader in the commercial mobility space.

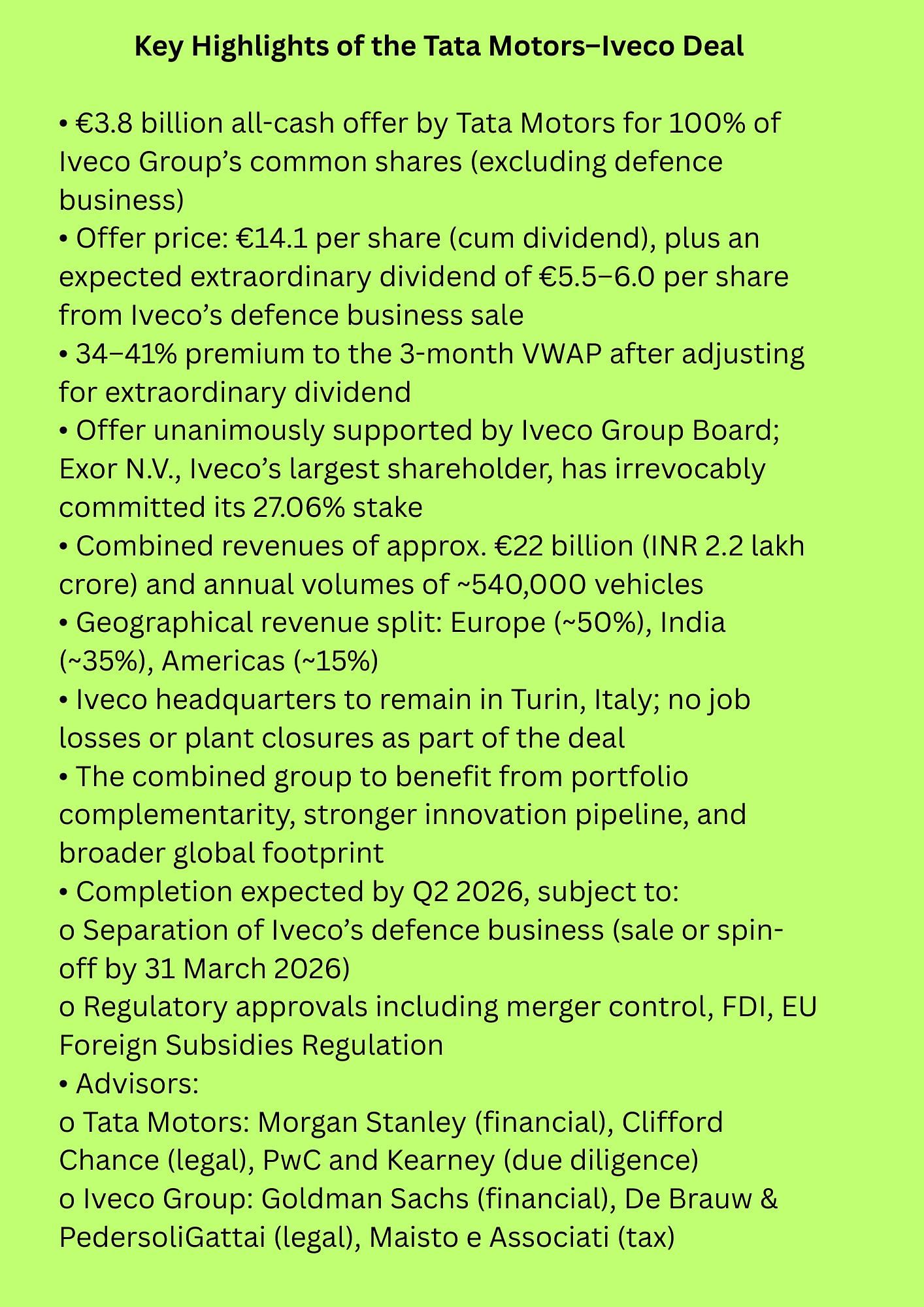

The offer will be made by TML CV Holdings PTE Ltd or a Dutch-incorporated entity wholly owned by Tata Motors. The offer price of €14.1 per share (cum dividend, excluding any payout from the defence divestment) represents a 34–41% premium, adjusted for an estimated €5.5–6.0/share extraordinary dividend from the sale of Iveco’s defence unit (valued at €1.7 billion EV).

The deal is conditional upon the completion of Iveco’s defence business separation by 31 March 2026, with the public offer expected to close in Q2 2026. Regulatory approvals including merger control, foreign investment clearances, and EU Foreign Subsidies Regulation will also be required.

Strong Board and Shareholder Backing

The Iveco Board has unanimously recommended the offer, deeming it in the best interests of shareholders and stakeholders. Major shareholder Exor N.V., holding 27.06% of shares and 43.11% of voting rights, has irrevocably committed to tender its stake and support the transaction.

Post-transaction, Iveco will be delisted from Euronext Milan and operate as a wholly owned subsidiary of Tata Motors. The combined entity will retain Iveco’s headquarters in Turin, its brands, and its industrial footprint across Europe.

A Global Commercial Vehicle Champion

Together, Tata Motors’ CV business and Iveco Group will form a €22 billion revenue entity (~INR 2.2 lakh crore), with combined sales of over 540,000 units annually. Revenue split will be approximately 50% from Europe, 35% from India, and 15% from the Americas, along with strong positions in Asia and Africa.

“This is a logical next step following the demerger of Tata Motors’ CV business. It allows the combined group to compete globally with dual strategic home markets in India and Europe,” said Natarajan Chandrasekaran, Chairman, Tata Motors.

Strategic Fit and Shared Vision

The companies see strong complementarity in product portfolios, manufacturing assets, and geographic footprint—with minimal overlap. Iveco’s powertrain business FPT Industrial, Tata’s reach in India and Asia, and combined R&D strengths are expected to drive growth in zero-emission mobility and sustainable transport solutions.

“We’re unlocking operational excellence and future-ready innovation,” said Girish Wagh, Executive Director, Tata Motors. Iveco CEO Olof Persson added: “Joining forces will accelerate our innovation in zero-emission transport and broaden our customer reach.”

Deal Safeguards and Employee Commitments

Tata Motors has agreed to a set of non-financial covenants valid for two years post-settlement, including no job cuts or plant closures as a direct consequence of the deal. The transaction ensures protection of employee rights, long-term strategy continuity, and the integrity of Iveco’s brands and operations.

The offer is fully financed with commitments from Morgan Stanley and MUFG. Advisors include Goldman Sachs (Iveco), Morgan Stanley (Tata), Clifford Chance, and others.