Bajaj Auto has been exhibiting weakness in its domestic shipments, with July marking yet another month of weak performance. Dealer shipments in July fell by a significant 18% year-over-year, with volumes dropping to 139,279 units compared to 168,847 units in July 2024. This marks an acceleration from June 2025’s already concerning 16% YoY decline (149,317 units vs 177,207 in June 2024), signaling deepening challenges in the domestic market.

The July shipment figure is particularly concerning as it falls below even the weakest retail sales month of 2025, indicating either significant inventory correction at the dealer level or sharply reduced demand expectations.

The sequential decline from June to July 2025 adds another layer of concern. Domestic dealer shipments fell 6.7% month-on-month, from 149,317 units in June to 139,279 units in July. This sequential drop is particularly worrying given that July typically sees seasonal improvement in two-wheeler demand.

More telling is the relationship between dealer shipments and retail sales. In June 2025, while Bajaj’s retail sales stood at 156,360 units, dealer shipments were already 4.7% lower at 149,317 units – suggesting dealers were already becoming cautious about inventory buildup. This gap has likely widened further in July.

Shipments Below Recent Sales Trends

The July 2025 dealer shipment figure of 139,279 units represents a substantial drop from Bajaj’s retail sales performance throughout 2025. When compared to retail sales in January 2025 of 173,754 units, July shipments are down 19.8%. Even against February’s relatively weak retail performance of 153,631 units, July shipments remain 9.3% lower. The gap widens further when compared to stronger months like May 2025, where retail sales reached 184,831 units, making July shipments 24.6% lower.

Bajaj’s year-to-date domestic performance for April-July 2025 shows an 11% decline compared to the same period in 2024, with volumes falling from 751,344 units to 668,623 units. The deterioration from a 9% YTD decline in April-June to 11% in April-July indicates the weakness is intensifying rather than stabilizing.

Exports

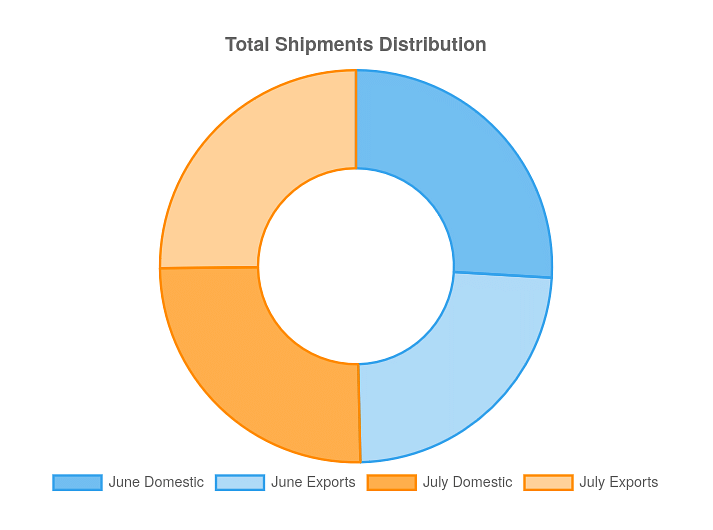

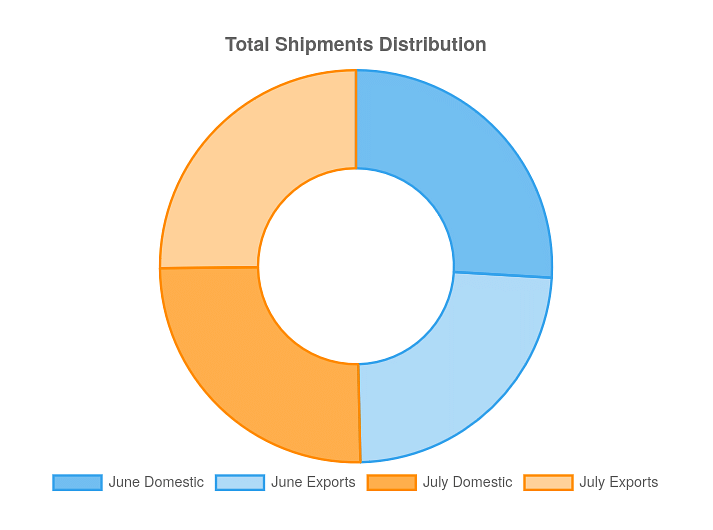

In stark contrast to the domestic market struggles, Bajaj Auto’s export performance continues to surge. The shift in business mix is dramatic. In June 2025, exports of 149,167 units nearly matched domestic shipments of 149,317 units. By July 2025, exports at 156,968 units exceeded domestic shipments of 139,279 units by 17,689 units.

July 2025 exports grew an impressive 22% year-over-year, up from 128,694 units in July 2024. The month-on-month export growth of 5.2% from June to July further underscores the divergent trajectories of Bajaj’s domestic and international businesses.

The year-to-date export figures reinforce this positive trend, with a 16% growth in the April-July 2025 period (576,415 units) compared to the same period in 2024 (497,114 units).

Strategic Implications

The accelerating divergence between domestic and export performance, now reaching a critical juncture where exports exceed domestic shipments, raises fundamental questions about Bajaj Auto’s domestic market strategy.

The progression from retail sales exceeding dealer shipments in June to the sharp sequential decline in July suggests dealers are actively reducing inventory, anticipating continued weak demand.

With domestic shipments declining at an accelerating pace while competitors maintain stronger positions, Bajaj’s market share loss appears to be structural rather than cyclical. The company risks losing relevance in key domestic segments as it cedes ground to rivals.

The crossover point where exports now exceed domestic shipments marks a fundamental shift in Bajaj’s business model. While this demonstrates international competitiveness, it also highlights the company’s diminishing relevance in its home market and increasing vulnerability to global economic cycles and currency fluctuations.