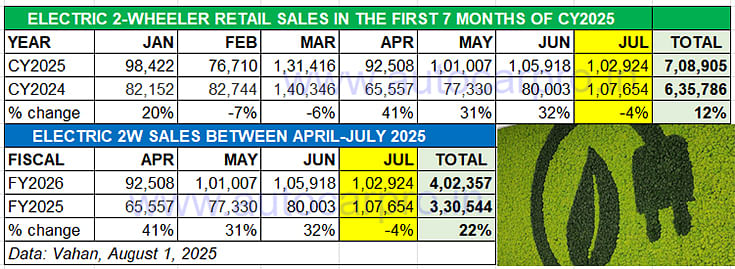

There’s both good and not-so-good news emanating from the seventh month of the current calendar year and the fourth month of fiscal year 2026 for India Electric 2-Wheeler Inc. The good news is that the cumulative seven-month retail sales of 708,905 units are already 62% of CY2024’s record sales of 1.14 million units, with five months left to go in the calendar year. The not-so-good news is that after three straight months of stellar double-digit growth, retail sales in July 2025 are down 4% YoY (July 2024: 107,654 units). This is as per the latest data on the Vahan portal (August 2, 2025).

While the cumulative seven-month calendar year sales are up 12% YoY, retail sales in the first four months of the fiscal year 2026 are up 22%, which is a result of the last three months’ clocking over 100,000 units.

Retail sales, which have crossed 100,000 units for the past three months, could slow down if the impasse of supplies of rare earth magnets is not resolved quickly.

Retail sales, which have crossed 100,000 units for the past three months, could slow down if the impasse of supplies of rare earth magnets is not resolved quickly.

July 2025 saw a total of 102,924 electric scooters, motorcycles and mopeds retailed by 207 companies, of which the Top 10 accounted for 96,720 units or 94% of total sales, leaving the balance to be fought over by the remaining 197 electric 2W manufacturers.

The Top 5 OEMs have each registered five-figure sales last month, with Hero MotoCorp entering this high-performer category for the first time with its best-ever monthly retails which surpassed the 10,000-unit mark for the first time.

The retail sales data reveals that for both the top two large-volume players – TVS Motor Co and Bajaj Auto – demand has slowed down, which is likely due to slower factory output as a result of the ongoing shortage of rare earth magnets originating from China. If the issue remains unresolved, the Indian e-2W industry could be staring at much-reduced production and, resultantly, sales.

Let’s take a closer look at the movers and shakers in July 2025.

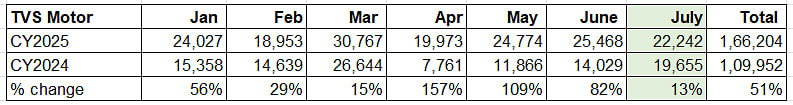

TVS MOTOR CO

TVS MOTOR CO

July 2025: 22,242 units, up 13% YoY / Market share: 22%

July 2024: 19,655 units / Market share: 18%

April-July 2025: 92,457 units, up 73% Once again at the top with 22,242 iQubes sold in July, TVS Motor Co has topped monthly e-2W retail sales for the fourth month in a row. It had topped monthly e-2W retail sales for the very first time in April 2025, and then held onto the crown in May and in June. However, the July numbers, despite being up 13% YoY, are the lowest in the past three months. Nevertheless, the company has a market-leading share of 22% for the month. Cumulative sales for the first four months of FY2026 at 92,457 units are up 73% YoY (April-July 2024: 53,313 units).

Once again at the top with 22,242 iQubes sold in July, TVS Motor Co has topped monthly e-2W retail sales for the fourth month in a row. It had topped monthly e-2W retail sales for the very first time in April 2025, and then held onto the crown in May and in June. However, the July numbers, despite being up 13% YoY, are the lowest in the past three months. Nevertheless, the company has a market-leading share of 22% for the month. Cumulative sales for the first four months of FY2026 at 92,457 units are up 73% YoY (April-July 2024: 53,313 units).

For the first seven months of CY2025, TVS’s 166,204 units, up 51% (January-July 2024: 109,952 units) are already 75% of its record annual sales of 220,813 units in CY2024.

The company has revealed plans to launch a new electric two-wheeler in Q3 FY2026 (September-October 2025). Expect this to happen around the early part of the third quarter with the festive season opening.

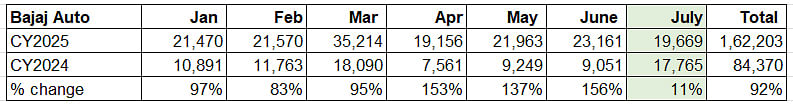

BAJAJ AUTO

BAJAJ AUTO

July 2025: 19,669 units, up 11% YoY / Market share: 19%

July 2024: 17,765 units / Market share: 16.50%

April-July 2025: 84,370 units, up 92% Bajaj Auto, which had topped the monthly e-2W sales in February (21,570 units) and March (35,214 units), has been in the No. 2 slot right since April, what with the TVS iQube selling more than the Bajaj Chetak. In July, the company delivered 19,669 Chetaks, up 11% (July 2024: 17,765 units), which gives it a market share of 19%, improving upon its 16.50% share a year ago. This takes its four-month total to 83,949 units, up 92% (April-July 2024: 43,626 units).

Bajaj Auto, which had topped the monthly e-2W sales in February (21,570 units) and March (35,214 units), has been in the No. 2 slot right since April, what with the TVS iQube selling more than the Bajaj Chetak. In July, the company delivered 19,669 Chetaks, up 11% (July 2024: 17,765 units), which gives it a market share of 19%, improving upon its 16.50% share a year ago. This takes its four-month total to 83,949 units, up 92% (April-July 2024: 43,626 units).

For the January-July 2025 period, the 162,203 Chetaks are a 92% YoY increase (January-July 2024: 84,370 units) and constitute 84% of Bajaj Auto’s record sales of 193,651 units in CY2024.

Bajaj’s gain would have come from the recent launch of the Chetak 3001, the new entry-level variant priced at Rs 99,990 (ex-showroom Bengaluru). While the base 3001 variant costs Rs 99,990 (ex-showroom Bengaluru), the top-end Chetak 3501 has a price sticker of Rs 135,000. The 3001, the most affordable Chetak, slots between the TVS iQube 2.2 kWh and iQube 3.5 kWh at the lower end, and the premium Ather Rizta S at the higher end.

OLA ELECTRIC

OLA ELECTRIC

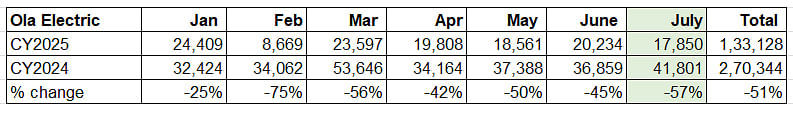

July 2025: 17,850 units, down 57% YoY / Market share: 17%

July 2024: 41,801 units / Market share: 39%

April-July 2025: 76,453 units, down 49% Ola Electric, a strong market leader not so long ago with massive lead every month over its key rivals TVS and Bajaj Auto, is experiencing a tough and competitive market environment. The company, registered retail sales of 17,850 units in July 2025 – this is down 57% YoY on July 2024’s 41,801 units which is among the highest monthly sales Ola has achieved to date.

Ola Electric, a strong market leader not so long ago with massive lead every month over its key rivals TVS and Bajaj Auto, is experiencing a tough and competitive market environment. The company, registered retail sales of 17,850 units in July 2025 – this is down 57% YoY on July 2024’s 41,801 units which is among the highest monthly sales Ola has achieved to date.

As a result, its market share for July 2025 at 17% is hugely down on the year-ago July 2024’s 39 percent.

The company, which sells both e-scooters and electric motorcycles, had last topped the monthly sales chart in January 2025 but since then has lost that spot to Bajaj Auto in February and March 2025, and to TVS in April, May, June and July 2025.

For the first four months of FY2026, Ola has sold 76,451 units – this is down 49% YoY, which translates into 73,759 fewer e-2Ws sold YoY (April-July 2024: 150,212 units). On the calendar year front, the seven-month total of 133,128 units is down 51% on January-July 2024 (270,344 units).

The bulk of Ola’s sales come from the 14-variant S1 e-scooter, which straddles multiple price-points starting from entry level mass mobility through to premium (Rs 65,000 to Rs 170,000). The S1 Pro, equipped with a 4kWh battery, has a claimed 142km range on a single charge and has an ex-showroom price of Rs 154,999.

In May this year, Ola began customer deliveries of its Roadster X electric motorcycle. The company is targeting strong growth with the X, aiming to draw ICE commuter motorcycle buyers. The Ola Roadster X, which develops peak power of 11 kW, top speed of 125kph and has a range of 501km, is claimed to offer “15X lower running cost than comparable ICE models”.

ATHER ENERGY

ATHER ENERGY

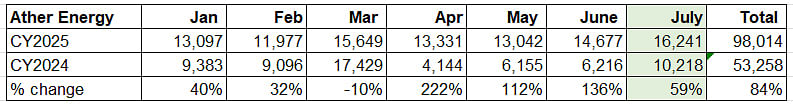

July 2025: 16,241 units, 59% YoY / Market share: 16%

July 2024: 10,218 units / Market share: 10%

April-July 2025: 57,291 units, up 114% Smart electric two-wheeler OEM Ather Energy is currently having a stellar run of the market. In July 2025, it registered retail sales of 16,241 units, a 59% YoY increase (July 2024: 10,218 units). This is its third-best monthly total. The company’s best-ever monthly sales were in the FAME II-ending March 2024 (17,430 units). The second-best monthly sales came in the festive month of October 2024 (16,248 units). This is just seven e-scooters more than in July 2025.

Smart electric two-wheeler OEM Ather Energy is currently having a stellar run of the market. In July 2025, it registered retail sales of 16,241 units, a 59% YoY increase (July 2024: 10,218 units). This is its third-best monthly total. The company’s best-ever monthly sales were in the FAME II-ending March 2024 (17,430 units). The second-best monthly sales came in the festive month of October 2024 (16,248 units). This is just seven e-scooters more than in July 2025.

July’s strong performance gives Ather a 16% share of the 102,924 e-2Ws sold in India last month. And, cumulative sales in the first seven months of this year at 98,014 units are already 78% of its entire CY2024 sales of 126,355 units. If the current pace of sales is maintained, expect Ather Energy to go past the 150,000-unit annual mark for the first time in CY2025.

The flagship Rizta family scooter, which surpassed 100,000 wholesales 13 months after launch in April 2024, remains Ather’s key growth driver and currently contributes over 60% of its sales each month. This is creditable given that the three-variant flagship scooter is a premium product.

On July 1, Ather expanded the Rizta portfolio with the Rizta S equipped with a 3.7kWh battery pack, offering an IDC range of 159km and priced at Rs 137,047 (ex-showroom Delhi).

On July 31, in an effort to rev up demand for the 450S model, Ather launched a new variant powered by a 3.7kWh battery which offers a longer range of 161km on a single charge and priced at Rs 145,999 (ex-showroom Bengaluru). The 450S 3.7kWh has been introduced to bridge the gap between entry-level performance scooters while offering extended range.

Later this month, Ather will reveal its new scooter platform – EL – and concept vehicles at its Community Day 2025. The new EL platform, engineered to be versatile and cost-efficient, will enable Ather to expand its product lineup to cater to a wider range of customer needs. This year’s event will also see the launch of Ather’s next-generation fast chargers, and an upgraded version of its software stack, Ather Stack 7.0. HERO MOTOCORP

HERO MOTOCORP

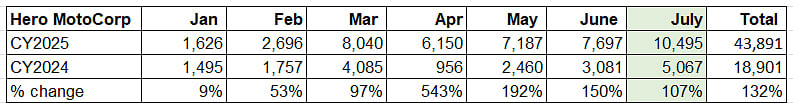

July 2025: 10,495 units, 107% YoY / Market share: 10%

July 2024: 5,067 units / Market share: 5%

April-July 2025: 31,529 units, up 173% Hero MotoCorp has registered its best-ever electric scooter monthly sales in July 2025. The company has delivered 10,495 Vida e-scooters to customers, surpassing the 10,000-unit monthly sales mark for the first time since it entered the electric two-wheeler industry in October 2022.

Hero MotoCorp has registered its best-ever electric scooter monthly sales in July 2025. The company has delivered 10,495 Vida e-scooters to customers, surpassing the 10,000-unit monthly sales mark for the first time since it entered the electric two-wheeler industry in October 2022.

This is a handsome 107% year-on-year increase (July 2024: 5,067 units), beating the company’s previous monthly best of 8,040 Vidas in March 2025 by 2,455 units. This has also helped Hero MotoCorp achieve a monthly 10% market share for the first time, doubling it from the 5% share it had in July 2024.

What’s more, CY2025 is turning out to be a record year for Hero MotoCorp’s EV business. From the 1,626 units sold in January this year to the 10,495 units in July, which is a 545% jump over seven months, Hero MotoCorp is witnessing strong demand led by two new products.

The first of these is the new Vida V2 launched in December 2024. The three-variant Vida 2 is essentially an evolution of the V1 range that Hero MotoCorp began its electric mobility journey around three years ago.

What has strongly accelerated Hero Vida retail sales last month is the launch of the new Vida VX2 on July 1 at an e-2W-rival-worrying prices. In a strategic move designed to draw buyers, Hero MotoCorp slashed prices a week after the VX2’s launch – as per the company website, the VX2 Go now costs Rs 44,990 and the VX2 Plus Rs 57,990 with the BaaS option, which makes them among the most affordable e-scooters in India.

The Vida brand’s stellar performance since March 2025 has meant that cumulative seven-month retails for the year to date at 43,891 units have already surpassed the 43,710 Vida e-scooters sold in CY2024, when Hero MotoCorp had a 4% market share.

For the January-July 2025 period, the company’s e-2W market share stands at 6 percent. Given the current strong pace of monthly sales, and five months to go for CY2025 to end, it can be expected that Hero MotoCorp will get close to or even surpass the 100,000-units annual sales milestone for the first time.

GREAVES ELECTRIC MOBILITY

GREAVES ELECTRIC MOBILITY

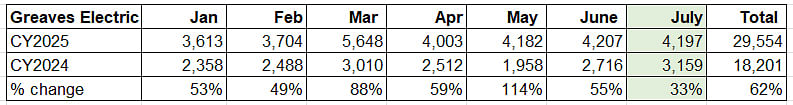

July 2025: 4,197 units, up 33% YoY / Market share: 4%

July 2024: 3,159 units / Market share: 3%

April-July 2025: 16,589 units, up 60% Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton which markets the Ampere brand of e-scooters, registered retails of 4,197 e-scooters in July 2025, which gives it a market share of 4% for the month. While cumulative sales for the first four months of FY2026 at 16,589 units are up 60% YoY, the seven-month calendar year total at 29,554 units marks a 62% YoY increase (January-July 2024: 18,201 units).

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton which markets the Ampere brand of e-scooters, registered retails of 4,197 e-scooters in July 2025, which gives it a market share of 4% for the month. While cumulative sales for the first four months of FY2026 at 16,589 units are up 60% YoY, the seven-month calendar year total at 29,554 units marks a 62% YoY increase (January-July 2024: 18,201 units).

The company has three key e-scooter brands – Nexus (EX and ST), Magnus (Neo and EX) and Reo (80 and Li Plus). While the flagship Nexus remains the best-selling product for GEM and Ampere Vehicles, April saw the company launch the new Ampere Reo 80 at Rs 59,900.

Ranked No. 7 last month is Pur Energy, the Hyderabad-based EV startup incubated from the i-TIC at IIT Hyderabad, remains a regular in the monthly Top 10 e-2W OEM list. In July, the company which has a five-model portfolio sold 1,688 units which gives it a 1.64% share of the market. For the January-July 2025 period, it has clocked retails of 10,860 units.

Bgauss Auto, a Mumbai-based startup spawned by electrical solutions major RR Kabel, is also witnessing strong demand for its two products, the RUV 350 and Max C12. In July, Bgauss sold 1,518 units and its January-July total is 11,191 units.

Another startup which continues to make news is the Bengaluru-based River Mobility, which has a single product – the River Indie. In July 2025, the company sold 1,518 units.

Wrapping up the Top 10 e-2W OEM list for July is Kinetic Green which has three products – the e-Zulu, Zing and the e-Luna moped. The company clocked retails of 1,225 units last month.

ALSO READ:

Exclusive: Hero MotoCorp records best-ever Vida e-2W sales in July