When a vehicle segment’s top two manufacturers, along with a new entrant which is also a legacy player, achieve their highest monthly sales, it is imperative that their volumes will make a difference. That’s just the scenario in the electric three-wheeler market in July 2025.

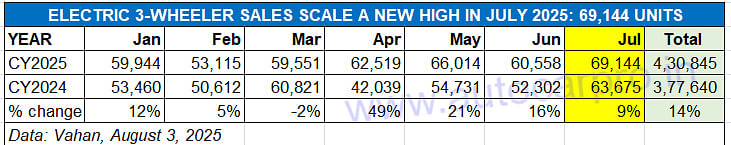

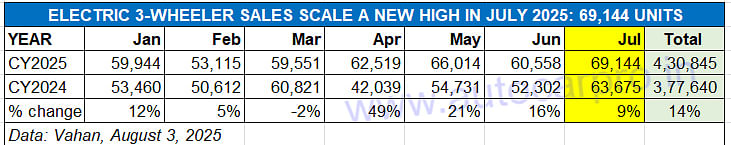

At 69,144 units and 9% YoY growth (July 2024: 63,675 units), India e-3W Inc has registered its best-ever monthly retail sales yet, beating the previous best of 66,014 units in May 2025 (see data table below).

India e-3W Inc has delivered 430,845 units in the first seven months of 2025, which is 62% of last year’s record sales of 691,302 units.

India e-3W Inc has delivered 430,845 units in the first seven months of 2025, which is 62% of last year’s record sales of 691,302 units.

Maharashtra-based e-3W market leader Mahindra Last Mile Mobility and Bajaj Auto, which have been sparring at the top for the past year or so, have both notched their best-ever monthly retails while South India-based TVS Motor Co, which entered the e-3W market only last year, has quickly moved into fourth place, creditable in a field of nearly 600 players.

For the e-3W industry per se, CY2025 is turning out to be quite a year and, seven months down, places it in position to achieve best-ever calendar year sales. The cumulative January-July sales of 430,845 units are a 14% YoY increase (Jan-July 2024: 377,640 units). This translates into an additional 53,205 units and is already 62% of the record 691,302 units sold in CY2024.

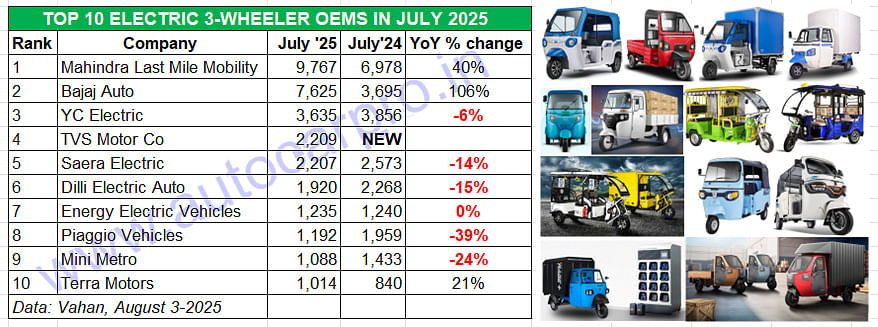

With 31,892 units between them, these Top 10 e-3W companies account for 46% of the record 69,144 units the industry has sold in July 2025.

With 31,892 units between them, these Top 10 e-3W companies account for 46% of the record 69,144 units the industry has sold in July 2025.

MLMM sold a record 9,767 units in July, up 40% YoY. This gives it a 14% market share, up from the 11% it had a year ago.

MLMM sold a record 9,767 units in July, up 40% YoY. This gives it a 14% market share, up from the 11% it had a year ago.

Mahindra Last Mile Mobility (MLMM), the first of the legacy OEMs to enter the field of electric mobility nearly a decade ago, has the largest e-3W portfolio comprising the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus and e-Alfa Cargo, maintains its grip on the market. MLMM has sold a record 9,767 units in July.

This is a strong 40% YoY increase (July 2024: 6,978 units), which gives it a 14% market share, up from the 11% a year ago. July 2025 numbers beat the previous best of October 2024 (7,479 units). The two other months when MLMM surpassed 7,000 units were June 2025 (7,320 units) and November 2024 (7,134 units).

MLMM has clocked cumulative seven-month sales at 48,030 units, which give it a market share of 11 percent. While it opened the year with 6,148 units in January, there was a marginal dip in February (5,879 units), a rise again in March (6,680 units), and a dip again in April (5,640 units). However, since the past three months, demand has risen month on month: May (6,596 units), June (7,320 units) and July (9,767 units).

Bajaj Auto’s best-ever monthly retail sales of 7,625 units in July are a 106% YoY increase and see its market share nearly double to 11% from 6% a year ago.

Bajaj Auto’s best-ever monthly retail sales of 7,625 units in July are a 106% YoY increase and see its market share nearly double to 11% from 6% a year ago.

Bajaj Auto, India’s market leader in IC-engined three-wheelers and also the No. 1 3W exporter, has also registered its best-ever monthly retail sales in July 2025. The 7,625 units are a 106% YoY jump (July 2024: 3,695 units) and sees its monthly market share nearly double to 11% from 6% in July 2024.

Bajaj Auto began this year with 5,357 units in January, which fell 14% month on month (MoM) to 4,588 units in February. Since then though, it’s been five straight months of MoM growth – March (5,294 units), April (5,509 units), May (6,292 units), June (6,478 units) and July (7,625 units).

Bajaj Auto, had entered the e-3W market in June 2023 with two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 – which are now replaced by the GoGo e3W brand launched in February 2025 and aimed to redefine last-mile mobility, for both passenger and cargo operations. Key GoGO product highlights are a best-in-class range of 248km, a 5-year /120,000km battery warranty, and first-in-class tech features like auto hazard and anti-roll detection. There are two GoGo models for passenger transport (P70s and P50s) and three variants (P5009, P5012 and P7012). While the P5009 has a 9 kWH battery, the P5012 and P7012 are equipped with a 12kWh unit.

The company’s seven-month cumulative sales in the year to date at 41,143 units gives it a market share of 9.54 percent. In CY2024, Bajaj Auto had sold a total of 41,904 e-3Ws, which means it is just 761 units behind that score at this stage and will set a new high from August onwards.

Meanwhile, the company, which had previously said that it was set to roll out its first e-rickshaw in July seems to have deferred the launch to sometime in the second quarter of FY2026 (July-September 2025).

YC Electric sold 3,635 units, down 6% YoY which sees its market share reduce to 5% from the 6% it had in July 2024.

YC Electric sold 3,635 units, down 6% YoY which sees its market share reduce to 5% from the 6% it had in July 2024.

Ranked third among the Top 10 OEMs for July 2025 is YC Electric, with 3,635 units which is a 6% decline on its July 2024 sales of 3,856 units. This gives the company a July market share of 5%, down from the 6% it had a year ago. The company has five models on sale – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. YC Electric’s cumulative seven-month sales are 24,62 units.

January 2025 (3,880 units) has been its best month in the year to date and June 2025 (3,304 units) its lowest. While it remains a podium player, YC, which was the longstanding No. 2 e-three-wheeler OEM, lost its position to a hard-charging Bajaj Auto in FY2025.

In July, TVS sold 2,209 units to capture a 3% market share and fourth rank among 600 players. Not bad for a company which entered the e-3W market only recently.

In July, TVS sold 2,209 units to capture a 3% market share and fourth rank among 600 players. Not bad for a company which entered the e-3W market only recently.

TVS Motor Co, the latest legacy ICE three-wheeler OEM to enter the electric three-wheeler market, has already made a mark. The Chennai-based auto major, which has been the No. 1 electric 2W OEM for the past four months, is the third legacy player along with Mahindra and Bajaj Auto to achieve best-ever monthly sales.

In July, TVS sold 2,209 units and gets a 3% market share. Not bad for a company which entered the e-3W market only recently. Starting the year with just 133 units in January, sales have risen month on month: February (309 units), March (738 units), April (1,207 units), May (1,583 units), June (1,685 units), July (2,209 units). It’s early days yet for the TVS King EV Max and the zero-emission 3W is currently available in only a few states including Uttar Pradesh, Bihar, Jammu & Kashmir, Delhi and Bengal.

Along with its Mayuri brand of e-rickshaws, Saera Auto also sells an L5 range of electric three-wheelers for passenger and cargo transport.

Along with its Mayuri brand of e-rickshaws, Saera Auto also sells an L5 range of electric three-wheelers for passenger and cargo transport.

Saera Electric Auto, which makes the Mayuri brand of electric rickshaws, is ranked fifth in the Top 10 list with sales of 2,207 units, down 14% YoY (July 2024: 2,573 units). This sees its market share reduce to 3% from 4% a year ago. Like a number of other e-rickshaw players, Saera Auto too has been impacted by the advance of legacy OEMs in the e-3W industry. Based in the industrial hub of Bhiwadi, Rajasthan, Saera Auto has nine models and is the leading supplier of e-rickshaw loader models like the Mayuri E-Cart Loader. Saera Auto also sells its L5 range of electric three-wheelers, built in association with the Telangana-based Keto Motors for passenger and cargo transportation.

Dilli Electric Auto sold 1,920 units in July, down 15% YoY. This Haryana-based company manufactures electric rickshaws (CityLife brand), a category which is now under pressure as legacy players like MLMM, Bajaj Auto and now TVS target sales with better-built, safer products.

There are four other OEMs which have sold over 1,000 units each in July 2025 – Energy EV (1,235 units), Piaggio Vehicles (1,192 units), Mini Metro (1,088 units) and Terra Motors (1,014 units).

E3W INDUSTRY SHAKEOUT UNDERWAY AS LEGACY PLAYERS DRAW BUYERS

Compared to the electric two-wheeler market which has only a few legacy players (TVS, Bajaj Auto, Hero MotoCorp, Honda Motorcycle & Scooter India, and recent entrant Suzuki India), the electric 3W industry has eight – Mahindra & Mahindra, Kinetic Group, Atul Auto, Piaggio Vehicles, Omega Seiki, Bajaj Auto, Murugappa Group and TVS Motor Co. Other than these well-established legacy OEMs, the e-3W segment is currently populated by a large number of small and medium enterprises, many of them manufacturing electric rickshaws.

The shakeout in the overall e-3W market is clearly underway with buyers preferring to buy better-built models from well-established legacy OEMs, which have a much stronger marketing, sales and service network as well as financial capabilities. This is also evident in the fact that of the Top 10 OEMs in July 2025, four of these MSMEs have registered YoY sales declines and one has witnessed flat sales.

ALSO READ: Electric car and SUV sales cross 90,000 in 7 months of 2025, hit record 15,423 units in July

Electric 2W sales cross 700,000 in first seven months of 2025