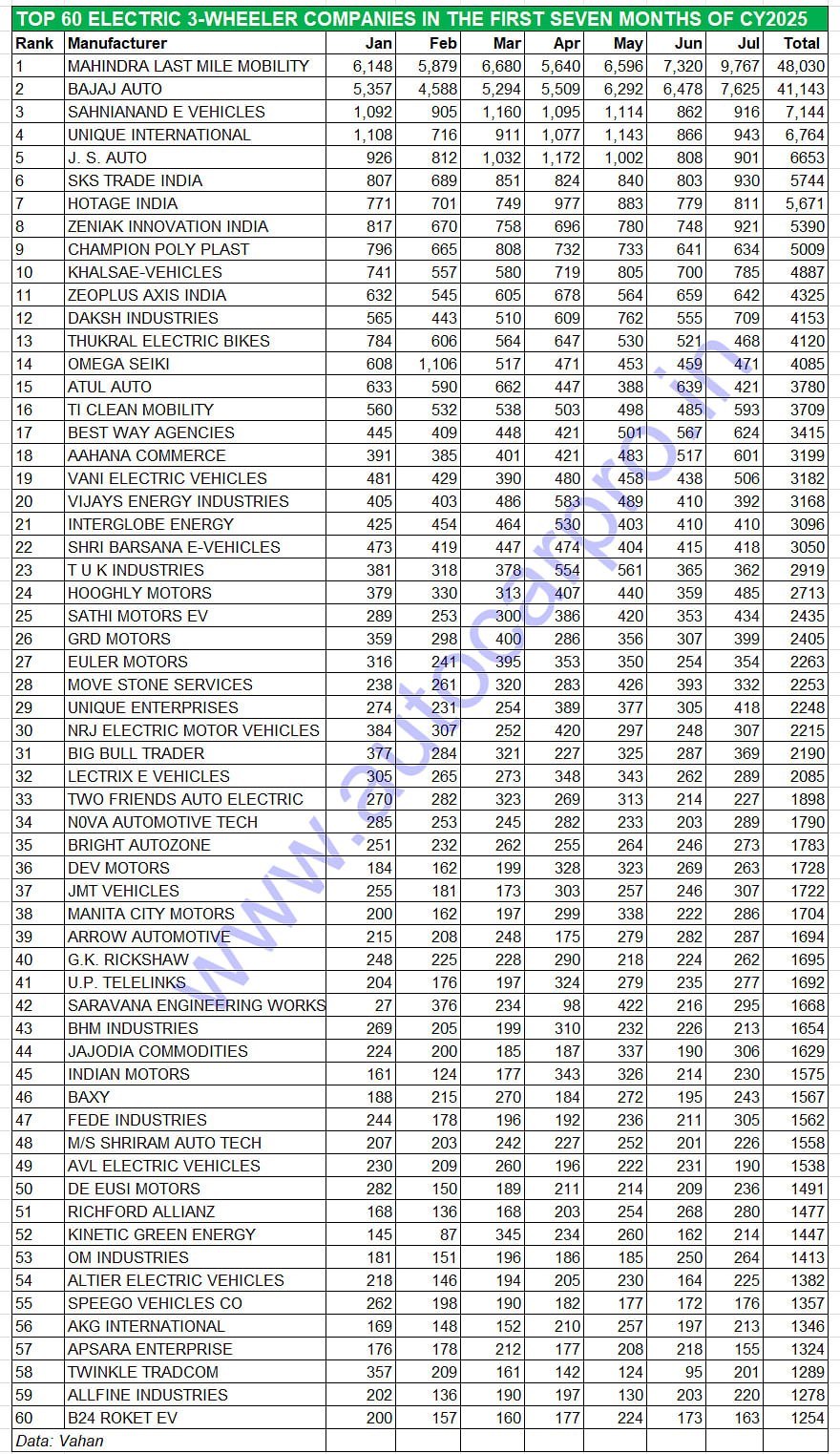

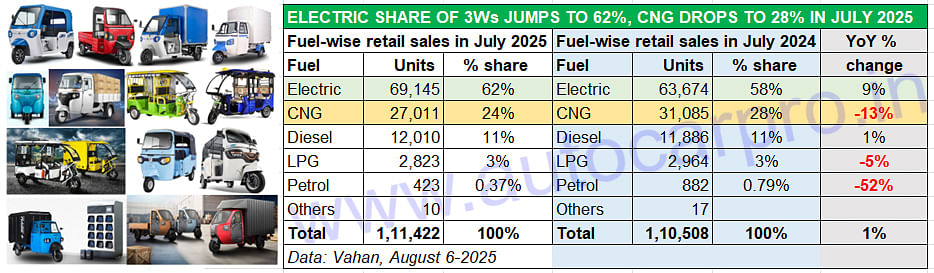

The march of the electric three-wheeler industry, which continues to see the highest level of transition from ICE to zero-emission mobility, is reflected in the July 2025 retail sales numbers. With 69,145 units and 9% YoY growth (July 2024: 63,674 units), India e-3W Inc has registered its best-ever monthly sales yet, beating the previous best of 66,014 units in May 2025. What’s more, the fuel-wise sales numbers reveal that the e-3W industry continues to eat into the share of their CNG-powered cousins.

The electric 3W segment’s best-ever monthly sales in July and 9% growth have given the category a 62% market share – an additional 4% – while that of CNG 3Ws has dropped to 24% from 28% a year ago.

The electric 3W segment’s best-ever monthly sales in July and 9% growth have given the category a 62% market share – an additional 4% – while that of CNG 3Ws has dropped to 24% from 28% a year ago.

Of the total 111,422 three-wheelers across all powertrains (electric, CNG, diesel, LPG and petrol) sold in India (other than Telangana for which Vahan does not provide the retail data) in July 2025, electric three-wheelers account for the bulk of them – 62% – clearly establishing their stranglehold over this vehicle segment. Furthermore, it is also the one to register the highest YoY growth (see data table above). The 9% YoY growth in sales has given it an additional 4% market share, increasing from the 58% it had in July 2024.

In comparison, CNG three-wheelers have lost exactly the same level of market share that EVs have gained: 4 percent. July 2025 saw 27,011 CNG units, down 13% YoY (July 2024: 31,085 units), being delivered to customers. This translates into 4,074 fewer sales YoY. Among the impediments to better market performance for CNG three-wheelers is the recent price hikes of this fuel which increase the total cost of vehicle ownership, which is critical in this vehicle category which caters to both passenger and cargo transport.

Meanwhile, diesel 3W sales, at 12,010 units, were up marginally by 1% YoY to 12,010 units. This sees it maintain the same 11% market share it had in July 2024. LPG-fuelled 3W sales (2,823 units) wer down 5% YoY but the 3% market share remains unchanged. And only 423 petrol-engined 3Ws were sold last month, down 52% YoY, which is understandable given the wallet-busting cost of this fossil fuel.

With five months left to go in CY2025, expect the e-3W industry to surpass the record 691,301 units it sold in CY2024.

With five months left to go in CY2025, expect the e-3W industry to surpass the record 691,301 units it sold in CY2024.

ELECTRIC 3Ws HEADED FOR RECORD SALES OF OVER 700,000 UNITS CY2025

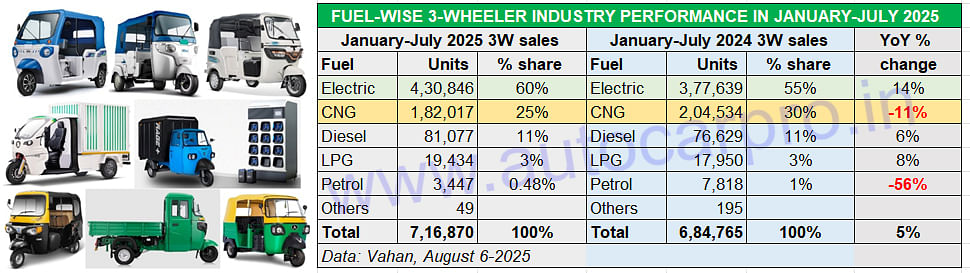

Given the continuing strong momentum of sales in the past seven months, it can be surmised that electric 3W OEMs are headed for record sales this calendar year. The 430,846 units sold between January and July and strong 14% YoY growth (January-July 2024: 377,639 units), are already 62% of India e-3W Inc’s record retails of 691,301 units.

Average monthly sales for the year to date are 61,549 units, compared to 53,948 units in the year-ago period. With five months left to go in CY2025, which includes the upcoming festive season, an improving rural India market as well as sustained demand in the urban last-mile mobility market, expect the e-3W industry to easily clock more than the 260,455 units required to surpass CY2024 sales. It could go on to achieve the 700,000 milestone for the first time in a calendar year.