The construction equipment (CE) market faced severe headwinds in July 2025, with retail volumes plummeting 33.28% year-on-year to just 3,509 units, marking the steepest decline among all vehicle categories tracked by FADA.

The sharp month-on-month contraction of 59% from June’s 8,558 units highlights the sector’s struggle with infrastructure demand weakness and supply chain disruptions.

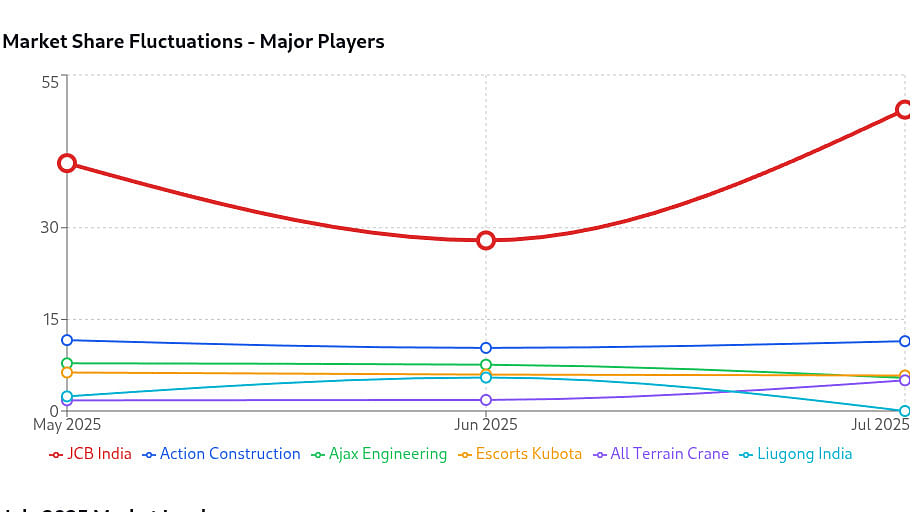

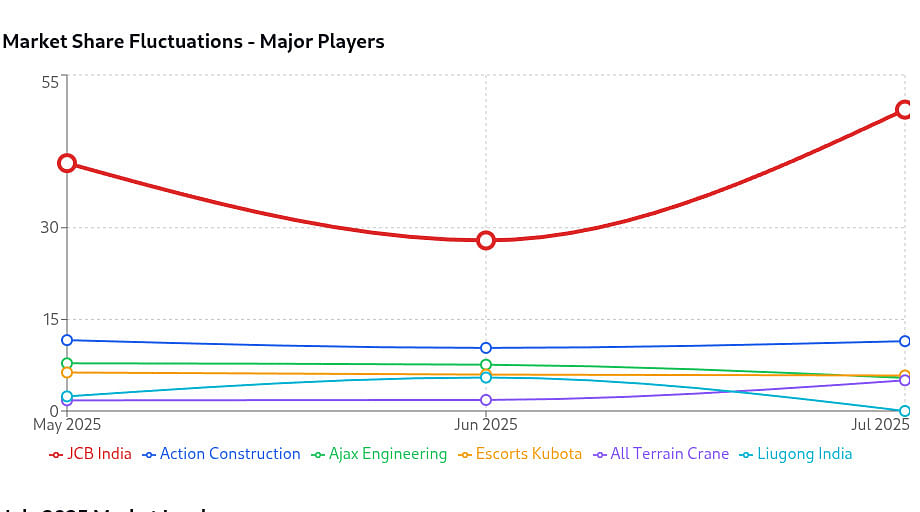

JCB India Limited has paradoxically strengthened its market leadership amid the overall downturn, capturing 49.33% market share in July compared to 40.57% in May and 27.92% in June. This represents a dramatic consolidation of market position, with JCB selling 1,731 units in July despite the challenging environment.

The construction equipment sector’s volatility stands in stark contrast to other agricultural-linked segments. While tractors surged 10.96% YoY in July, benefiting from rural recovery and monsoon tailwinds, CE continues to grapple with muted infrastructure demand and project delays.

Market Consolidation Accelerates

Action Construction Equipment, the second-largest player, saw its market share decline to 11.43% in July from 11.60% in May, though it maintained relatively stable positioning. The company’s ability to retain double-digit market share amid sector-wide challenges demonstrates resilience in its product strategy.

Action Construction Equipment, the second-largest player, saw its market share decline to 11.43% in July from 11.60% in May, though it maintained relatively stable positioning. The company’s ability to retain double-digit market share amid sector-wide challenges demonstrates resilience in its product strategy.

Escorts Kubota’s construction equipment division faced significant pressure, with its market share dropping to 5.81% in July from 6.30% in May, reflecting broader challenges in the mid-segment equipment category.

Ajax Engineering showed mixed performance, declining from 7.81% share in May to 5.41% in July, indicating pressure on specialized equipment demand as infrastructure projects face delays.

A notable development has been the emergence of All Terrain Crane as a significant player, jumping to 5.02% market share in July from 1.74% in May, suggesting specific demand strength in the crane and heavy lifting segment despite overall market weakness.

Infrastructure Headwinds Persist

The construction equipment market’s struggles reflect broader infrastructure challenges plaguing the Indian economy. FADA’s analysis points to “muted infrastructure demand” and “project delays” as key factors constraining the sector.

C.S. Vigneshwar, FADA President, noted that while “robust government capital expenditure through June-August targeting roads, railways, metros and green-energy projects” was expected to underpin CV and CE segments, the reality has been more challenging.

Supply chain constraints have compounded demand issues. “Challenges in securing rare-earth materials have stalled component production, further constraining supply and retail volumes,” according to FADA’s assessment.

Urban-Rural Divide Evident

The construction equipment sector’s urban bias has become a liability during this period of rural economic recovery. Unlike tractors, which benefit from enhanced agricultural subsidies and favorable monsoon conditions, CE remains tied to urban infrastructure cycles that are currently subdued.

Urban areas account for 47.5% of CE sales in July, significantly higher than tractors’ 19.1% urban share, making the sector more vulnerable to urban economic sentiment and infrastructure spending cycles.

Mixed Outlook Amid Policy Support

Despite current challenges, there are pockets of optimism. The government’s robust capital expenditure focus on infrastructure projects, particularly in roads, railways, and green energy, could provide support in the coming months.

However, external factors pose additional risks. The U.S. tariff measures and resulting market volatility could further impact business confidence and infrastructure investment decisions.

Dealer sentiment in the CE sector remains cautious, with many pointing to inventory management challenges and delayed project approvals as ongoing concerns. The sector’s recovery appears contingent on a revival in infrastructure spending and resolution of supply chain bottlenecks.

The construction equipment market’s performance in July highlights the sector’s vulnerability to infrastructure cycles and its dependence on government capital expenditure programs, making policy coordination crucial for recovery.